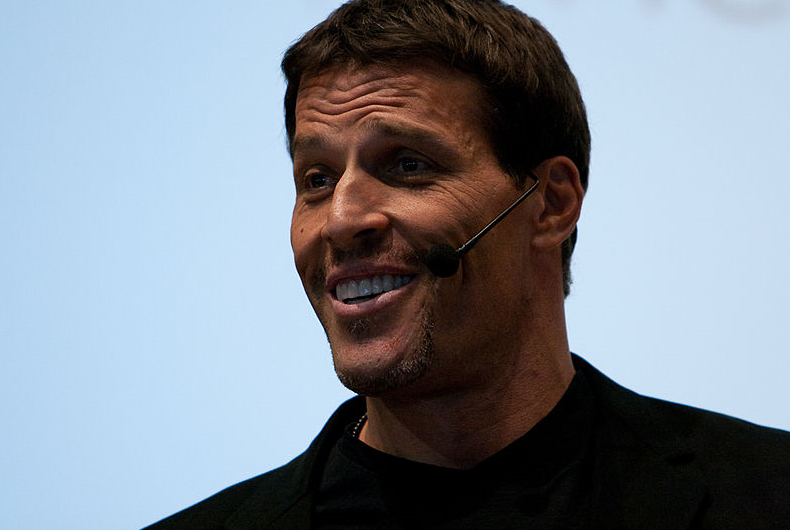

We have no idea why motivational speaker Tony Robbins is commenting on your 401K investments, but he's actually saying some pretty smart things. Namely, avoid the high fees.

In this CNBC article, Mr. Robbins explains "the more you pay in fees, the less money you have for retirement." Yahtzee, Mr. Robbins! Avoiding high fees is half the battle. Robbins goes on to say "You don't have to become a genius; you just have to understand what to avoid, as well as what to do." More brilliant advice from Tony Robbins, but unfortunately this time it's a little vague. However, we're going to help you out Tony with a specific example.

One of the most costly things an investor can ever do is roll over an old 401K plan to an Individual Retirement Account (IRA) with a full-service stock broker. Why? Because many brokers will take 5% of your hard-earned money upfront, and then they'll waste another 1-2% every year thereafter on totally unnecessary fees. Investors can avoid this expensive nonsense by rolling the 401K money over to an IRA with a discount broker. You can get the same investment exposures with far lower fees by opening an IRA with TD Ameritrade, eTrade or Scottrade, for example.

Honestly, it breaks our collective heart when we hear about the engineer or corporate office worker that moves their retirement account to a full service broker and loses a huge chunk of their life savings before they even realize what's going on. Or if you're just starting out as a new investor, there is really no need to work with a full-service broker. Just open that discount brokerage account, and make the investments on your own. As Tony says "You don't have to become a genius; you just have to understand what to avoid, as well as what to do." For example, check out our "Lazy Person" ETF strategy offered via "Blue Harbinger Stocks" for starters.

Regardless, thank you motivational speaker Tony Robbins for shedding a little more light on the expensive perils of investing via the status quo. Be smart and prosper.