The main focus of this week’s Blue Harbinger Weekly is an attractive Master Limited Partnership investment opportunity that currently pays big monthly distributions that amount to approximately 12% per year. We review the merits of this MLP in detail, and discuss why income-focused investors may want to consider adding it to their diversified long-term portfolio (and no it’s not Plains All American). Additionally, we briefly review three of our value stocks that recently reported earnings and have been performing particularly well over the last month (and why we expect them to continue performing well going forward).

Williams Partners

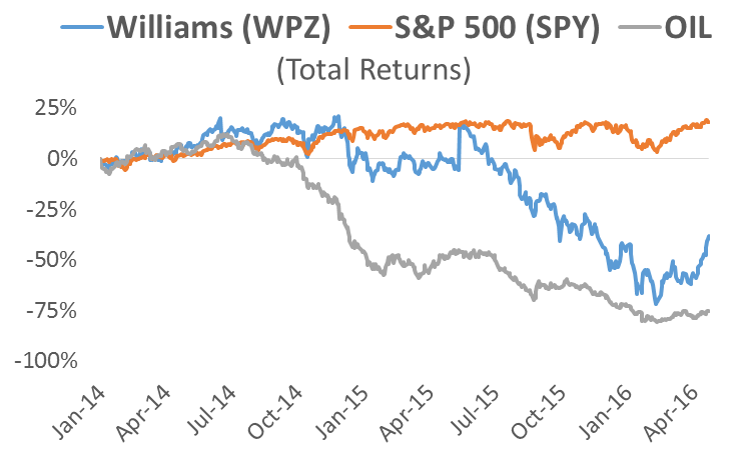

Williams Partners (WPZ) is a high-yield (11.8%) Master Limited Partnership (MLP) that has declined more than 50% since the second half of 2014. It trades for less than its book value, and a basic distribution discount model suggests the market has already priced in zero growth and a significant distribution cut. We believe the market has overreacted to the challenges Williams faces (e.g. low energy prices, counterparty credit/default risk, management reorganization, and rising interest rates), under-reacted to the value it creates (e.g. energy price agnostic fee business, the value of its assets, and its future growth potential), and it could be a valuable addition to the higher risk portion of a diversified, income-focused, investment portfolio.

Overview

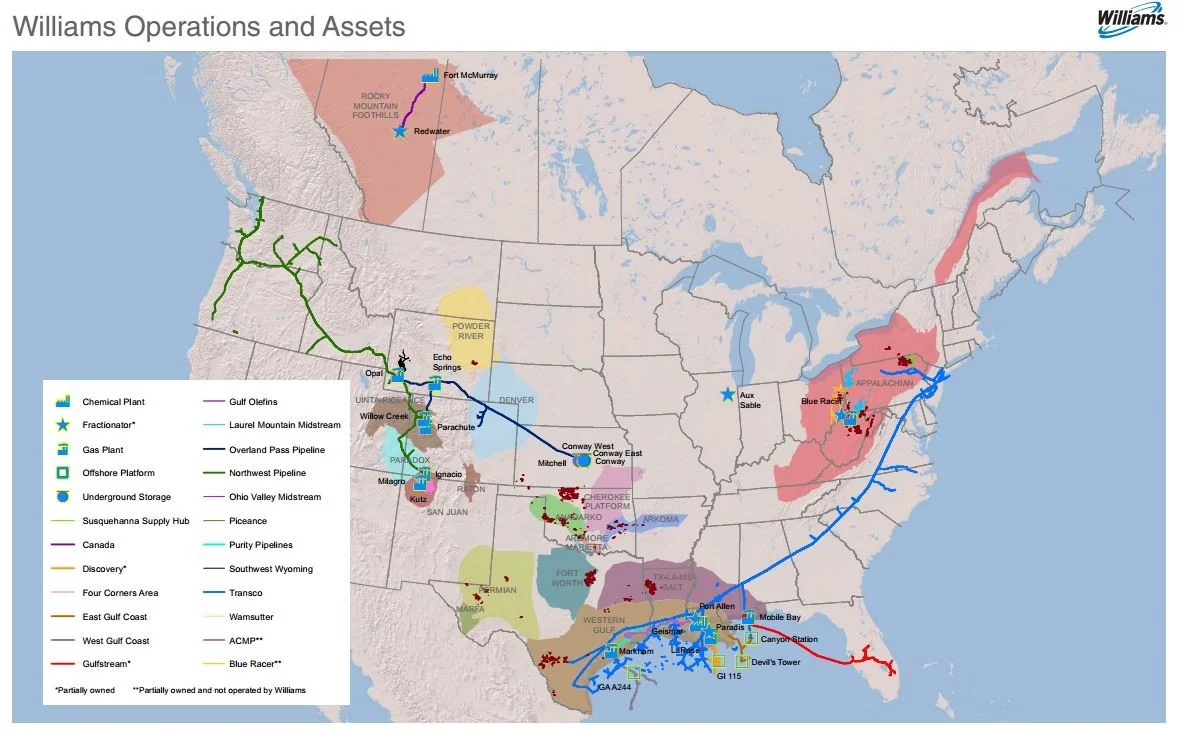

Williams is publicly traded MLP that connects North American resource plays to growing markets for natural gas and olefins. Williams’ operations reach from the Gulf of Mexico to the Canadian oil sands.

MLPs in general have sold off dramatically since energy prices began to decline in the second half of 2014. Not only do MLPs have varying degrees of direct exposure to energy prices, but they are also exposed to growing credit/default risks related to their energy industry counterparties. For example, cheap oil has already bankrupted more than 50 American producers, and more bankruptcies are expected. To make matters worse, fears related to rising interest rates have created additional headwinds for high-yield MLPs because it makes capital even more expensive and because investors may begin to find attractive yields elsewhere.

As the above chart shows, Williams sold off right along with other MLPs, but we believe this is somewhat inappropriate for a variety of reasons. First, more than 90% of WPZ revenues are fee based (investor presentation, p. 6). Fee-based revenues are less exposed to the volatility of energy prices, and this gives Williams an advantage over many of its peers.

Secondly, Williams’ assets have value. If the company were to simply liquidate itself, the assets left over would be worth more than its current market price. And this doesn’t even take into consideration Williams future earnings potential (more on valuation later).

Third, Williams has the ability to grow. For example, Williams Transco system happens to run near the Marcellus Shale basin in Pennsylvania, and this has allowed Williams to add infrastructure to accommodate expansion in the area; this is a source of growth envied by other MLPs. Also, Williams recently merged with Access Midstream which increases growth opportunities.

Fourth, Williams has opportunities to improve operational efficiency following the Access Midstream merger. Additionally, Williams can further improve efficiency following the merger between Williams companies and Entergy Transfer which is expected to be completed during the first half of 2016 (this is also a source of risk, more on the risk later).

Dividend History

As the following chart shows, Williams has a strong history of paying and increasing its dividend.

And even though the dividend hasn’t been increased lately, it hasn’t been cut. In 2015, it’s distributable cash coverage ratio was less than one (0.99x) which is a good thing (and it was as high as 1.39x if you count the one time IDR waver from Williams Companies (investor presentation, p.2)). Further, the coverage ratio should improve as new assets under construction are completed. For example, the Canadian Offgass Processing CNRL-Horizon project is expected in-service in the early part of 2016, and the Kodiak and Gunflint tiebacks are expected in the first half of 2016 (investor presentation, p.4).

What is Williams Worth?

We believe Plains is worth significantly more than its current $17.7 billion market cap. As mentioned previously, Williams book value of $22.9 billion ($47.9 billion in assets minus $25.0 billion in liabilities) is already more than its market cap, and it gives the company zero credit for its future earnings power. And considering the company s generating over $1 billion in EBITDA per quarter (investor presentation, p.2), the $17.7 billion market value is a little ridiculous (it’s way too low).

Another way to look at Williams’ value is to discount its distribution payments by its cost of equity. Specifically, Williams paid out $2.686 billion in distributions in 2015, and its cost of equity is only around 9.2% (we assume a beta of 1.03 [Google Finance], a risk free rate of 1.8% [10-year treasury], and an expected long-term return on the market of 9%). If we assume a 0% growth rate then Williams is worth $29.2 billion or approximately 60% more than its current market value. Viewed differently, Williams would have to cut its distribution by approximately 40% to warrant its current market price, a d we don’t believe a dividend cut that large (or one at all) is happening giving Williams distribution coverage ratio and growth projects as mentioned above. Additionally, Morningstar just reaffirmed Williams' BBB investment grade credit rating.

What are the Risks?

Williams does face a variety of significant risk factors. For starters, one of its biggest counterparties, Chesapeake Energy has been deteriorating quickly as a result of low energy prices. Williams derives approximately 20% of its revenues from Chesapeake, and if Chesapeake files for bankruptcy then Williams takes a big hit. However, we believe the hit will be temporary (if it happens at all) because Williams will eventually replace the lost revenues. Further, Williams is already undervalued by more than the value of a potential Chesapeake default in our view.

Another risk is the current quarrel between management teams at Williams Companies (WMB) and Energy Transfer (ETE) which are expected to merge in 2016 to achieve operational efficiencies. The details of the deal have recently been called into question as Williams filed a lawsuit against Energy Transfer for issuing preferred shares prior to the deal. In our view this is minor, and will not significantly impact the long-term value of Williams.

Other risks include oil prices in general (though Williams is less exposed because of its high fee business) and rising interest rates. These factors have been working against MLPs in general, and we believe the market has overreacted which is part of the reason why Williams is currently undervalued.

Williams also faces a variety of additional risks. For example regulations from the FERC as well as environmental agencies pose a risk to Williams’ profitability. Additionally, legislation (from both the US and Canada) pose a risk. Further, the company faces risks from its foreign currency exposure, its energy hedging program, and from its use of leverage (debt) on its balance sheet.

Conclusion

If you are an income-focused investor, Williams’ big 11.8% yield is hard not to notice. The stock has declined more than 50% from its highs, and we believe it is now significantly undervalued by the market. This MLP is facing a variety of significant risks as described above, but if you are a diversified long-term investor, Williams could be an attractive allocation for the higher risk portion of your income-focused portfolio.

Union Pacific (UNP) announced earnings last week that exceed expectations by $0.06 per share, and the market reacted positively (the stock was up over 12% for the week). UNP’s stock price had been depressed because of deteriorated business related to the energy sector. We believe a 12% gain is nice for one-week, but this stock continues to have A LOT more upside, and we continue to own the stock. You can read our previous Union Pacific reports here.

Caterpillar (CAT) announced earnings last week that missed expectations by one penny per share. The stock declined minimally for the week (-0.18%) while the S&P 500 posted a gain (+0.84%). Even though Caterpillar has already posted strong gains for 2016 (+15.25%), it’s still down 30% since its all-time high, and we believe it continues to have a lot more upside potential ahead (plus it’s nearly 4% dividend yield isn’t bad either). We continue to own Caterpillar, and you can read our previous Caterpillar reports here.

Lastly, US Bancorp (USB) has posted strong gains this month. As the stock market continues to climb, the chances of an interest rate hike from the Fed increase, and this impacts banking stocks (like USB) positively. An interest rate hike would likely slow the overall market, but it means an improved net interest margin (and more profits) for banks. We continue to own USB because we believe it has a lot more upside (and it offers a decent dividend yield). You can read our earlier USB reports here.