Super Micro Computer (SMCI), a maker of server and storage solutions, may be about to go on an epic share price rally (courtesy of AI, its new auditor, and its relationship with Nvidia, in particular).

Growth is Ramping:

According to CEO Charles Liang (on this past week’s quarterly call):

"We have confidence that our calendar year 2025 growth could be a repeat of calendar year 2023 if not better, assuming the supply chain can keep pace with demand."

Can you handle the volatility?

After gaining over 300% in Q1 2024, the price came falling down as uncertainty grew, especially following the resignation of its lead auditor.

Super Micro Computer share price

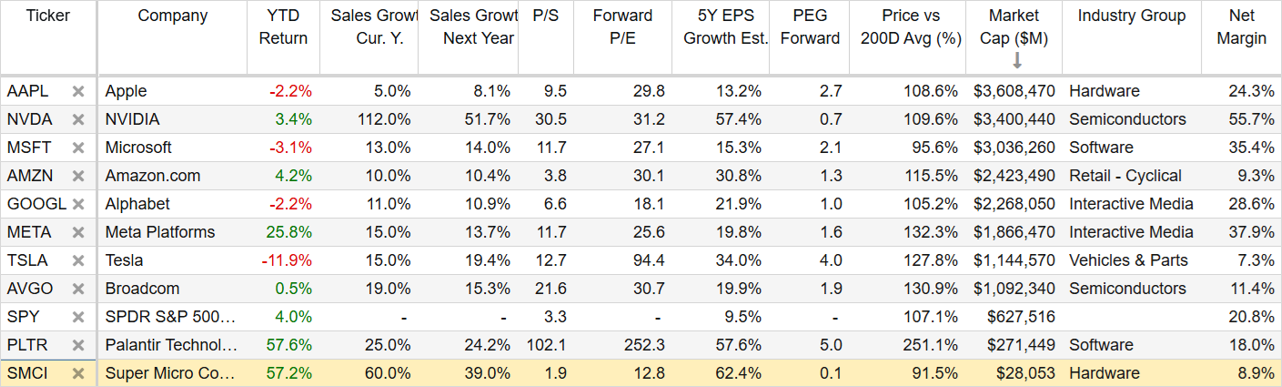

Attractive Value vs A.I. Growth

Having now replaced the auditor, and with the AI megatrend still fully intact, SMCI’s valuation is extremely low (see table below) as compared to its growth (forward PEG is only 0.1x), and it is set to benefit from its transition from Nvidia Hopper to Nvidia Blackwell GPUs (i.e. the hottest chips in the world driving AI), which will accelerate dramatically as supply ramps this quarter and beyond.

Relationships Matter

Super Micro headquarters and Nvidia headquarters are just 10 miles apart, and the CEO’s (Charles Liang and Jensen Huang) are friends with a long and trusted relationship of working together.

Bottom Line:

At this point, SMCI shares are extremely attractive (if you can handle the volatility), and they are absolutely worth considering for a spot in your prudently concentrated long-term growth portfolio.

*Long Super Micro.