Apple (AAPL) shares have been weak this year as compared to other mega-cap names (as you can see in the chart below). And with iPhone market share falling in China, some investors are wondering if it’s time to dump their shares. Here are five (5) key points to consider, followed by my personal opinion on selling versus buying and/or holding the shares.

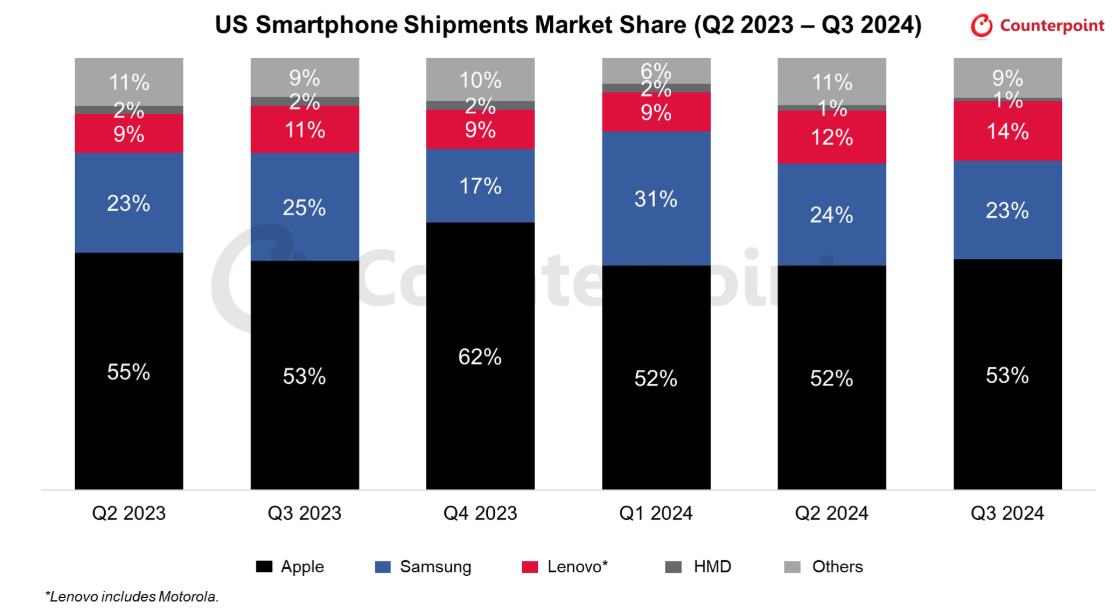

(1) US iPhone Sales

iPhone sales constitute ~49% of Apple’s total revenues, and (according to data from counterpoint), US smartphone shipments (see below) in Q3 2024 decreased 6% YoY, whereas Apple’s shipments were down only 5% YoY (so not overly concerning relative to the rest of the market).

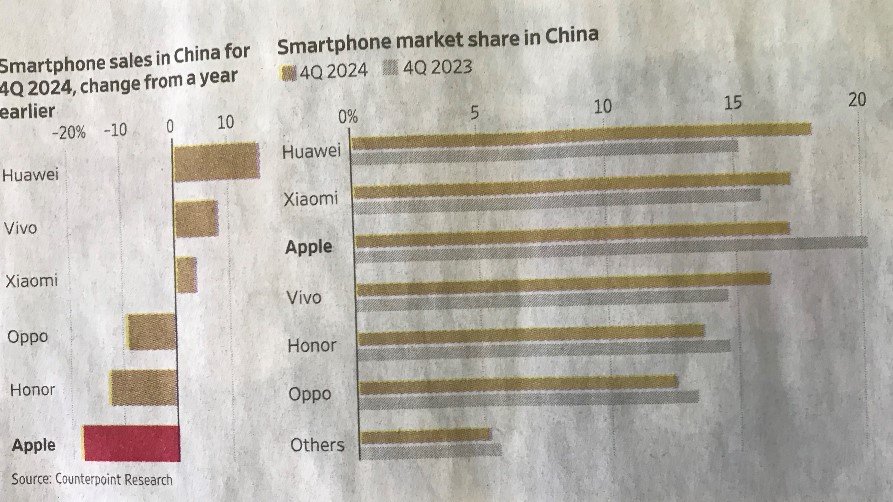

(2) China iPhone Sales

China makes up about 20% of Apple’s total revenues, and in Q4-2024, China iPhone sales have decreased sharply versus a year earlier (as competitor share has been gaining).

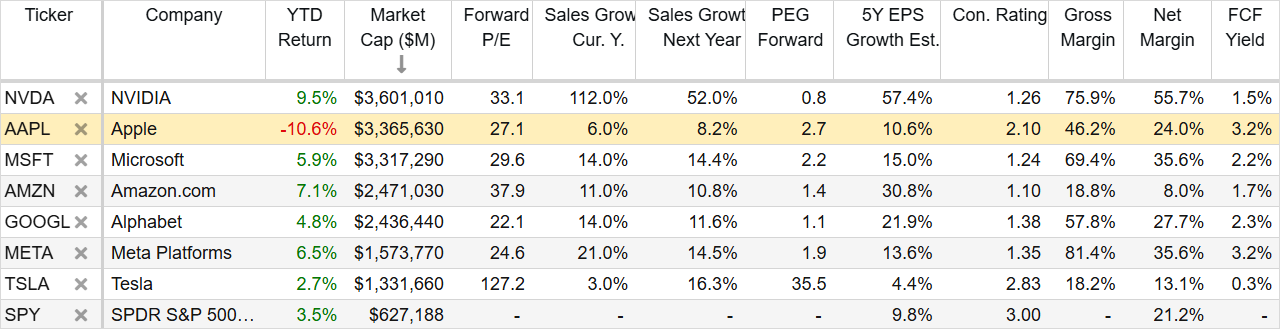

(3) Slower Overall Growth

As one of the largest companies in the world, achieving a high-growth rate can be challenging. And as you can see in the table below, Apples expected Sales Growth rate is significantly below peers (not a good sign). And 5-year EPS growth estimates are also week compared to peers.

(4) Valuation is Rich

On a valuation basis, Apple is still expensive (compared to other mega-cap names). For example, the forward P/E ratio is in the middle of the pack, but the expected growth is considerably lower, and the forward PEG ratio (P/E per growth) is not attractive (Apple is the most expensive of the group). Apple is also the lowest rated of the group (by Wall Street analysts), except for only Tesla.

(5) Wide & Profitable Moat

Despite aa rich valuation and slowing growth, Apple continues to have a wide moat—thanks to its vast ecosystem of loyal customers (some are loyal, and some are forced to be loyal by Apple’s tactics). It’s also very profitable (see gross and net margins) and it has the best free-cash-flow margin of the group (it still spits off tons of cash).

The Bottom Line

Apple is NOT like the other mega-caps names, but that is NOT necessarily a bad thing. Specifically, Apple is more of a mature value stock (it also has a strong dividend-growth trajectory), and at a time when the market (and growth stocks in particular) are getting “frothy,” value stocks like Apple can provide the right mix of value and safety (with a touch of growth) that many investors need.

For example, if the market slows, and growth stocks forward growth expectations fall, their valuations can become a lot less attractive quickly.

If you are looking for disruptive hyper-growth, Apple is not right for you. But if you are looking for a little wide-moat, high-cash-flow, dividend-growth steadiness, Apple share are still worth considering, especially on the latest share price pullback to start 2025.