Advanced Micro Devices’ (AMD) revenue has been growing rapidly. This is because of its datacenter tie in with Artificial Intelligence (“AI”) and the great cloud migration and digital revolution. However, the shares have been falling, sitting near a 52-week low. In this report, we review the business, the AI megatrend, AMD’s valuation and the big risk factors for investors. We conclude with our strong opinion on investing.

About AMD:

AMD is a semiconductor company (a rapidly growing industry) that designs microprocessors (i.e. central processing units, or CPU’s, for desktops, laptops and servers), GPUs (graphics processing units for gaming, professional graphics, and data centers) and related technologies.

Top customers include Microsoft (uses AMD's chips in Xbox consoles and in their Azure cloud computing services), Google (has used AMD's EPYC processors in their internal datacenters and has offered them in their cloud computing services), Meta (has used AMD datacenter chips) and Oracle (has adopted AMD's AI GPUs), to name a few.

And considering the company’s strong tie in to datacenters and the cloud, AMD is well positioned to keep benefiting from the AI megatrend.

The AI Megatrend:

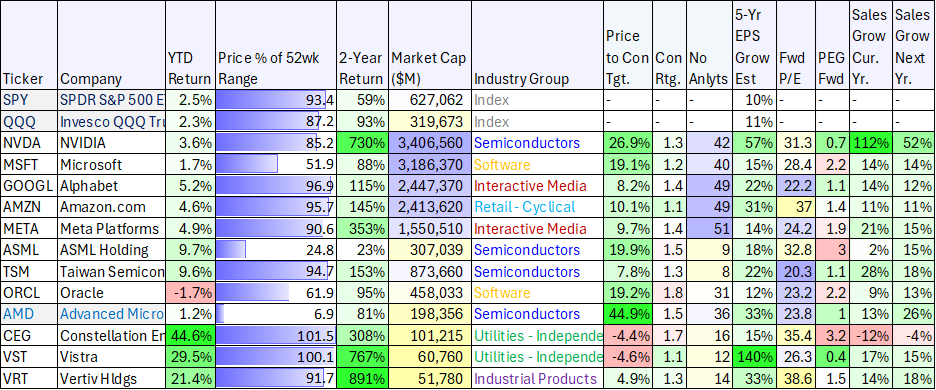

Unless you have been living under a rock, you have heard about the incredible economic growth potential stemming from new artificial intelligence technologies. It has been a major driver of growth for mega-cap stocks that use the technology (e.g. Amazon, Microsoft, Google), semiconductor companies that enable the technology (e.g. Nvidia, AMD, Taiwan Semiconductor, ASML), and others that provide energy and components for the datacenters (e.g. Constellation Energy, Vistra Corp, Vertiv). For example, you can see expected growth (e.g. sales growth, earning growth, PEG ratios and more) for these companies in the following table.

And for a little more perspective, here is a look at the incredible growth in electricity demand being placed on datacenters (due to AI and the great cloud migration).

The AI and cloud megatrend is expected to continue for years, and AMD stands to benefit. Here is what AMD CEO, Lisa Su, had to say about it on the latest earnings call:

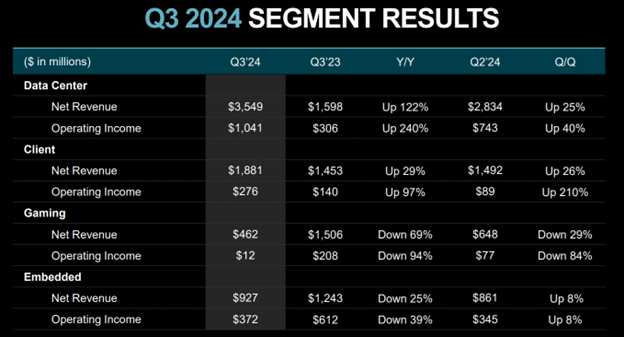

“[We] increased earnings per share by 31% year-over-year as Data Center segment revenue more than doubled”

“Looking out over the next several years, we see significant growth opportunities across our Data Center, Client and Embedded businesses driven by the nearly insatiable demand for more compute.”

“Each of these opportunities is amplified exponentially by the rapid adoption of AI, and -- which is enabling new experiences that will make high-performance computing an even more essential part of our daily lives.”

Also noteworthy, AMD’s recent acquisition of Xilinx, expands the company’s footprint into AI and machine learning (i.e. offering hardware solutions such as Instinct accelerators for AI workloads in data centers).

AMD’s Valuation:

Considering AMD’s strong growth tie in with the AI megatrend (datacenters in particular), its valuation is compelling. For example, as you can see in our earlier table, AMD trades at a compelling 1.0x forward PEG ratio (price/earnings to growth) which places its value per growth ahead of many other AI megatrend beneficiaries (attractive!).

AMD also has an impressive 5-year expected EPS (earnings per share) growth rate (+33%), again better than most peers. Further still, it has more upside than any other AI stock on our list, as per the 36 Wall Street analysts covering the shares (they believe AMD has more than 44% upside). In a nutshell, AMD’s valuation is attractive as compared to peers and on an absolute standalone basis.

AMD Risks:

Despite the attractive megatrend growth and valuation, AMD’s current share price sits near the bottom of its 52-week range (which is odd compared to the other AI beneficiaries on our list). So let’s consider some of the big risks AMD is currently facing.

AMD is NOT Nvidia: Nvidia is the grandaddy of the AI revolution; it is the clear GPU leader and commands higher demand and higher prices. In its own quarterly report risk disclosures, AMD explains: “Nvidia’s dominance in the graphics processing unit market and its aggressive business practices” are “material factors that could cause actual results to differ materially from current expectations.” A lot of investors have flocked to Nvidia shares, thereby putting selling pressure on AMD. Some view this as an attractive contrarian investment opportunity in AMD (“buy low”), but it remains a serious risk factor, nonetheless.

Customer Concentration is another risk factor investors should consider. For example, big customers include Sony (AMD chips are used in the Sony PlayStation 5, and reports from as recently as 2023 indicate that Sony accounted for 16% of AMD’s total revenue); Microsoft is a big customer (with its use of AMD chips in their cloud Azure services and in Xbox consoles—but there are concerns this could end); Google (has used AMD's EPYC processors in their internal data centers); Oracle (has adopted AMD's AI GPUs, with significant purchases noted for 2024).

Deferred Tax Assets: AMD carries significant deferred tax assets that it may not be able to realize. For example, the figure has grown from near zero to over $1.1 billion in recent quarters (likely a result of recent acquisitions, such as Xilinx ), and according to the company’s 10-K, these assets “remain under a valuation allowance [and] could be subject to limitations under Internal Revenue Code Section 382 or 383, separate return loss year rules, or dual consolidated loss rules. The limitations could reduce our ability to utilize the net operating losses or tax credits before the expiration of the tax attributes.”

Industry Cyclicality is another risk factor, as the semiconductor industry is prone to wide market cycles in demand and supply. For example, if demand were to slow, analyst growth expectations could decline significantly, and this would make the company’s valuation metrics look dramatically less attractive.

The Bottom Line:

Based on the current AI megatrend trajectory, as well as the company’s diverse revenue streams, AMD’s shares are attractively priced and have significant upside. However, there are risks investors should consider (e.g. it’s not Nvidia, it has customer concentration, uncertain deferred tax assets and it faces the threat of wide industry cyclicality). Overall, it seems unlikely AMD shares will remain this low forever, and you might want to consider adding a few shares to your prudently-diversified, goal-focused, long-term investment portfolio.