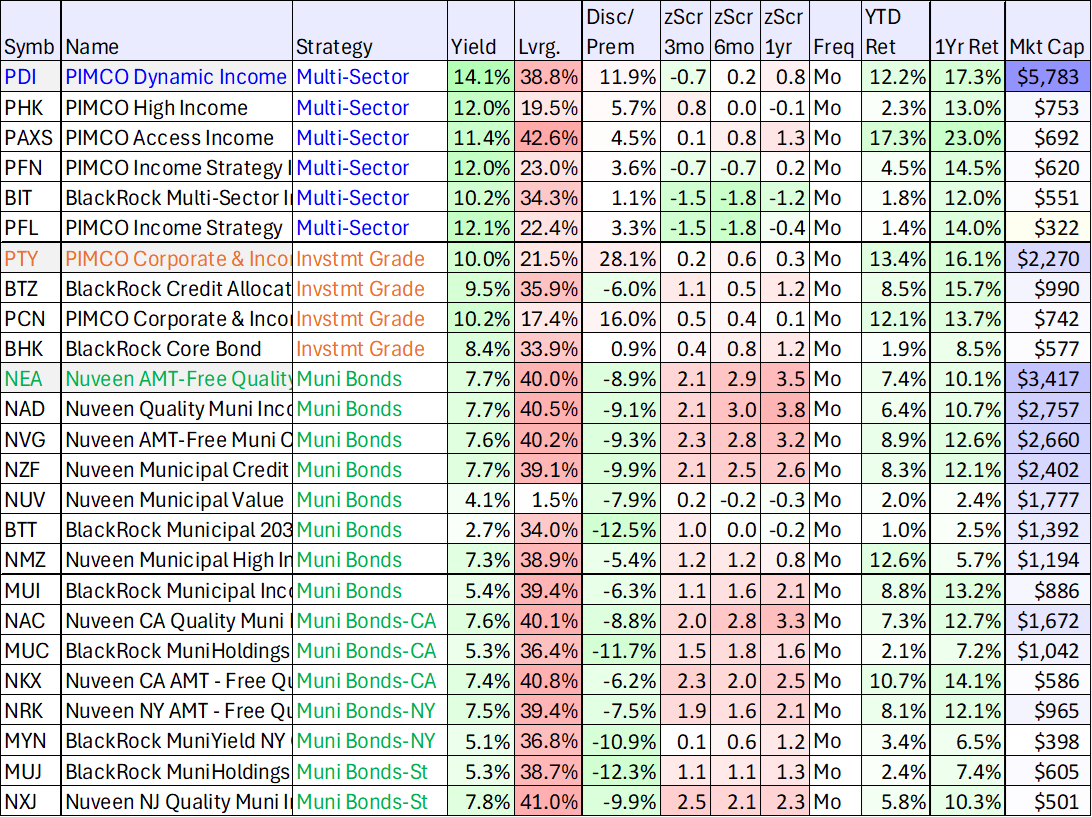

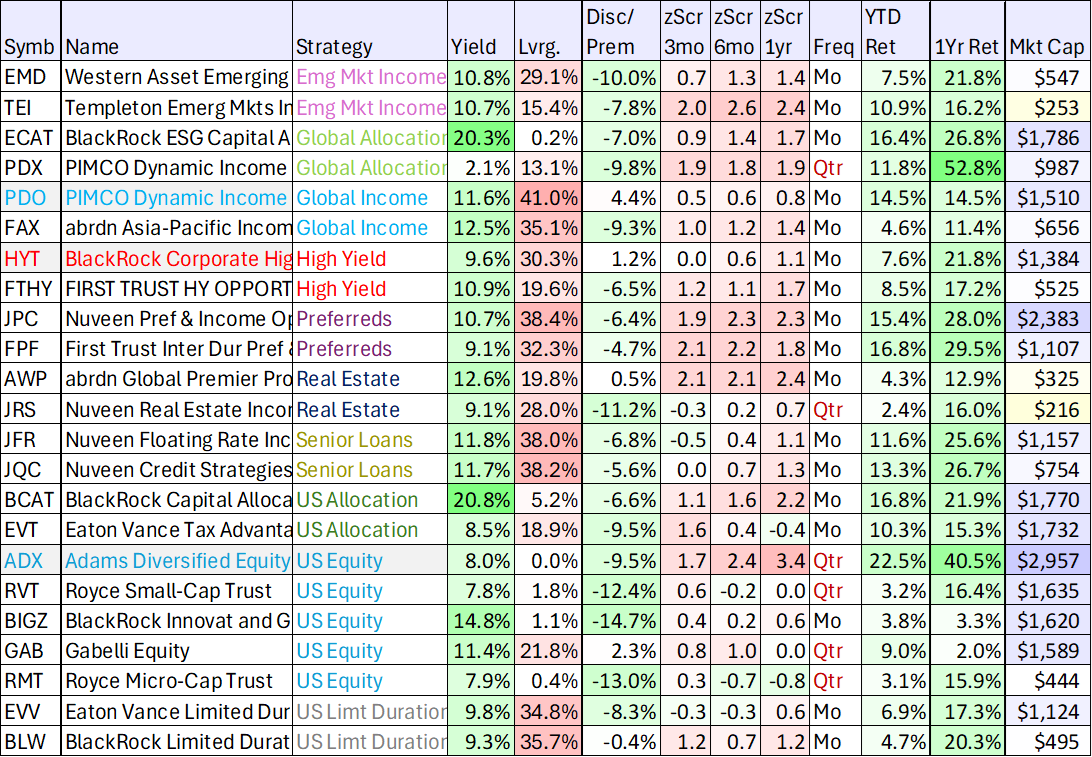

In this quick note, we’re sharing updated data on 50+ big-yield closed-end funds (“CEFs”) from across categories. You likely recognize many of these top names. We’re also highlighting two in particular that are attractive because of management’s new active initiatives to shrink the discount to NAV (a good thing).

50+ Big-Yield CEFs

(data as of 6/28/24, source: StockRover)

Discounts to NAV:

As we’ve written about many times in the past, one of the unique nuances of closed-end fund investing is that (unlike traditional mutual funds and exchange traded funds) CEFs can trade at large premiums and discounts to NAV (as you can see in the table above). And all else equal, we prefer to buy to quality CEFs at a discount to NAV (it’s like buying something you want and need when it’s on sale).

And one thing more attractive than a quality CEF trading at a discount is when management is actively working to reduce the discount (i.e. make the price go up relative to NAV—this is a good thing).

Here are write-ups on two funds than are currently working to reduce the discount (a good thing) on their funds: