There comes a time in every investor’s life when they realize chasing high growth stocks makes absolutely no sense whatsoever. Sure, if you’re 25 and want to roll the dice (on “the next big thing”) go for it. But if you’ve built a nest egg, and you just want your investments to produce big steady income, this report is for you. We countdown our top 10 big yield investments (including REITs, BDCs, CEFs and more) with a special focus on why each opportunity is uniquely attractive right now.

10. Reaves Utility Income (UTG), Yield: 8.2% (Monthly)

In case you haven’t noticed, the market has been ugly lately (and it could get worse). But one type of investment that performs relatively well when the market gets ugly is boring utility stocks. The utilities sector is known for steady low-volatility businesses and reliable dividend income (no matter what the broader market conditions are). And UTG is one excellent way to play this industry for a variety of reasons.

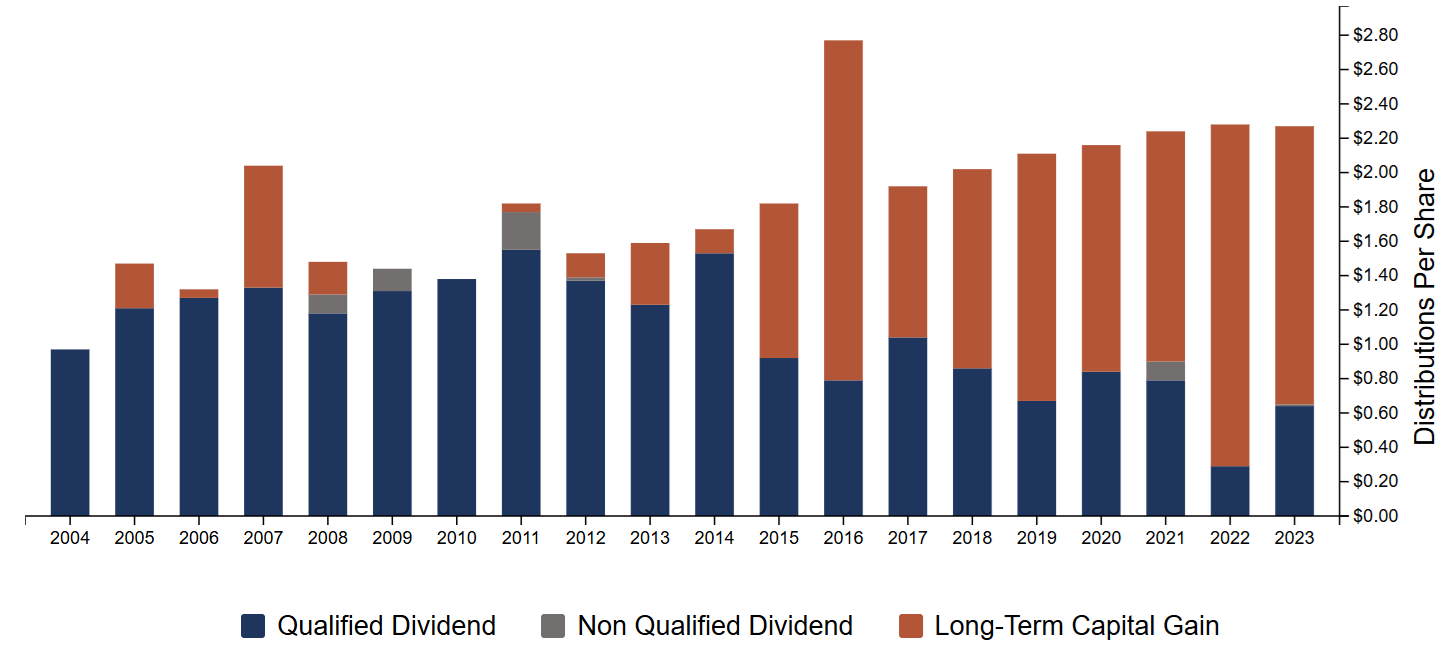

For starters, UTG offers a big 8.1%, that is paid monthly, and has never been cut since the fund’s inception back in 2004. It’s a closed-end fund (“CEF”) so it owns a basekt of stocks (recently 64) mostly from the utilities sector. It also trades at only a small premium to NAV (recently 1.9%) which is consistent with recent history (over the last 5 years) and not bad at all considering the fund uses a prudent amount of leverage (borrowed money was recently 19.5%) to magnify the returns and steady income of this lower volatility (and low beta) utility sector fund.

We’ve been touting the attractiveness of this one since back in February (when the price was a little lower and the yield a little higher) as you can read about here: Contrarian CEF: Attractive 8.8% Yield. However, considering utilities companies are a critical part of the economy (for example, energy demand keeps rising—for instance from the growing demand from data centers), we still find this fund quite compelling if you are an income-focused investor.

You can read our new UTG report here: A Top CEF: Big Steady Income, AI and Fed Tailwinds, Tax Advantages

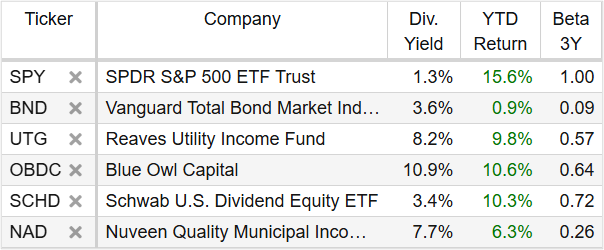

Source: StockRover. Note: Blue Owl’s dividend yield (above) includes past special dividends.

9. Blue Owl Capital (OBDC), Yield: 9.7% (Quarterly)

Another industry known for lower-beta volatility and big steady income is the BDC group (i.e. “business development companies). As a business model, BDCs provide capital (mostly loans and sometimes equity investments) to smaller “middle-market-sized” companies.

One reason BDCs are attractive is because they are able to take advantage of lucrative opportunities that big banks are often precluded from (for regulatory reserve-requirement reasons and because the financing arrangements are often just too nuanced for big banks to handle).

We also like BDCs, right now in particular, because they are relatively smaller companies, and small caps are arguably undervalued, especially versus mega caps (which are increasingly overextended according to a growing chorus of investors). Further still, the BDC group has finally just sold off a bit, thereby creating an attractive opportunity to pick up some big yield at a relatively lower price.

In particular, Blue Own Capital is a top BDC that has recently sold off (following May earnings that came in below expectations), and it currently trades at only 1.0x book value (attractive). It also has a strong aggregate rating from the 11 Wall Street analysts covering it (it’s rated stong buy). If you are looking for an attractive big-yield BDC opportunity, Blue Owl is absolutely worth considering.

Honorable Mention:

*Schwab U.S. Dividend Equity ETF (SCHD), Yield: 3.4% (Quarterly)

Although not officially included in our top 10 ranking (because the yield is too low) we’re including SCHD has an honorable mention (because it is a reasonable “dividend-value” strategy that some investors may want to include in their portfolio for specific diversification reasons).

For some perspective, SCHD is not necessarily about “beating the market.” Rather, by investing in dividend value stocks from across market sectors SCHD provides steady “qualified” dividend income (good for taxable accounts, depending on your tax bracket) with less volatility. This is exactly what many investors want (i.e. steady, lower-volatility and higher income than the S&P 500).

SCHD also offers instant diversification by owning around 100 stocks from across all major market sectors, but with slightly lower weights to higher-volatility sectors like technology, and slightly higher weights to lower-volatility sectors like consumer defensive.

SCHD also has a low management fee and a track record of healthy price appreciation (to complement its healthy dividend yield), and this is a long-term trend we fully expect to continue. If you are an income-focused investor, and depending on your personal goals, SCHD is absolutely worth considering (for a spot in your portfolio) and we’ve included it as an “honorable mention” in this report.

8. Nuveen Quality Muni Bonds (NAD), Yield: 7.7%

Switching back to CEFs again, Nuveen offers a variety of municipal bond funds (i.e. funds that hold bonds issues by state and local governments) that are generally exempt from federal income tax. This means the attractive big yields on these funds are even bigger after you calculate the “tax equivalent yield” (people in higher tax brackets achieve higher/more attractive tax equivalent yield).

The caveat is municipal bond funds generally should NOT be held in tax-advantaged retirement accounts (such as IRAs), but instead they are for generating high income in your taxable account (especially if you are in a high tax bracket).

And these muni bond funds are particularly attractive right now for a few reasons. First, muni bonds are fairly save (they are generally investment grade and backed by either the taxing authority of the municipality issuing them or by the revnue of the municipal project they are issued for).

Next, muni bonds funds currently trade at sinificant discounts to NAV (attractive). And they have a bit longer duration (interest rate exposure) than other bond funds (for example, the average years to maturity and duration on NAD are 19 and 12.5 years, respectively (which means if interest rates fall then the price of these funds go up, all else equal). However, these aren’t something you invest in primarily for the price apprecation, you invest in muni bond funds for big steady tax-free income (paid monthly).

And with regards to NAD in particular, Nuveen just announced a large distribution increases in an effort to reduce some historically large discounts to NAV (a good thing). You can read our recent detailed writeup here: Muni Bond CEFs: 2 Big "Tax-Equivalent Yields," Attractive.

7. British American Tobacco (BTI), Yield: 8.4% (Quarterly)

The amount of cash flow produced by this tobacco company is truly impressive. For example, it’s net profit margin is over 30%, and its free cash flow per share covers the share price in just over 5 years (amazingly!) This attractive low price and massive dividend yield exist mainly because of the stigma of tobacco (it’s bad for your health) and the fact that the industry is stagnating (it’s not a disruptive growth stock).

However, it has low volatility as compared to the rest of the stock market (people buy cigarettes in good times and bad), and the dividend remains strong. We wrote up this stock way back in December, and since that time it has continued to pay big steady dividends (exactly as expected): British American Tobacco: Despite Risks, Big Dividend Is Attractive.

6. Adams Diversified Equity Fund (ADX), Yield: 8% (Quarterly)

This fund is attractive right now for many reasons. First, a lot of income-focused investors end up owning only value and income sectors of the economy, which is fine except that it introduces a little diversification risk. As the name implies, the Adams “Diversified” Equity Fund addresses this problem by investing across all 11 stock market sectors while still paying large distributions (in fact, the fund has been paying distributions for over 85 years!).

Next, ADX just introduced two big changes to its distribution policy that are very attractive. First, ADX just increased its annual distribution to +8% from the previous +6% (they also smoothed the distributions out so investors receive 2% each quarter). Second, ADX is conducting a tender offer in the open market to buy shares back from investors at a price that is higher than the current market price.

The two distribution policy changes are being implemented in attempt to reduce the current price discount on the shares versus NAV. ADX has been trading at a steady large discount to NAV for years (attractive), and the recent distribution policy changes have been reducing that discount (also attractive). We recently wrote up ADX in detail, and you can access that report here: Big-Yield (8%+) Equity CEF: Big Discount to Narrow.

5. Ares Capital (ARCC), Yield: 9.2% (Quarterly)

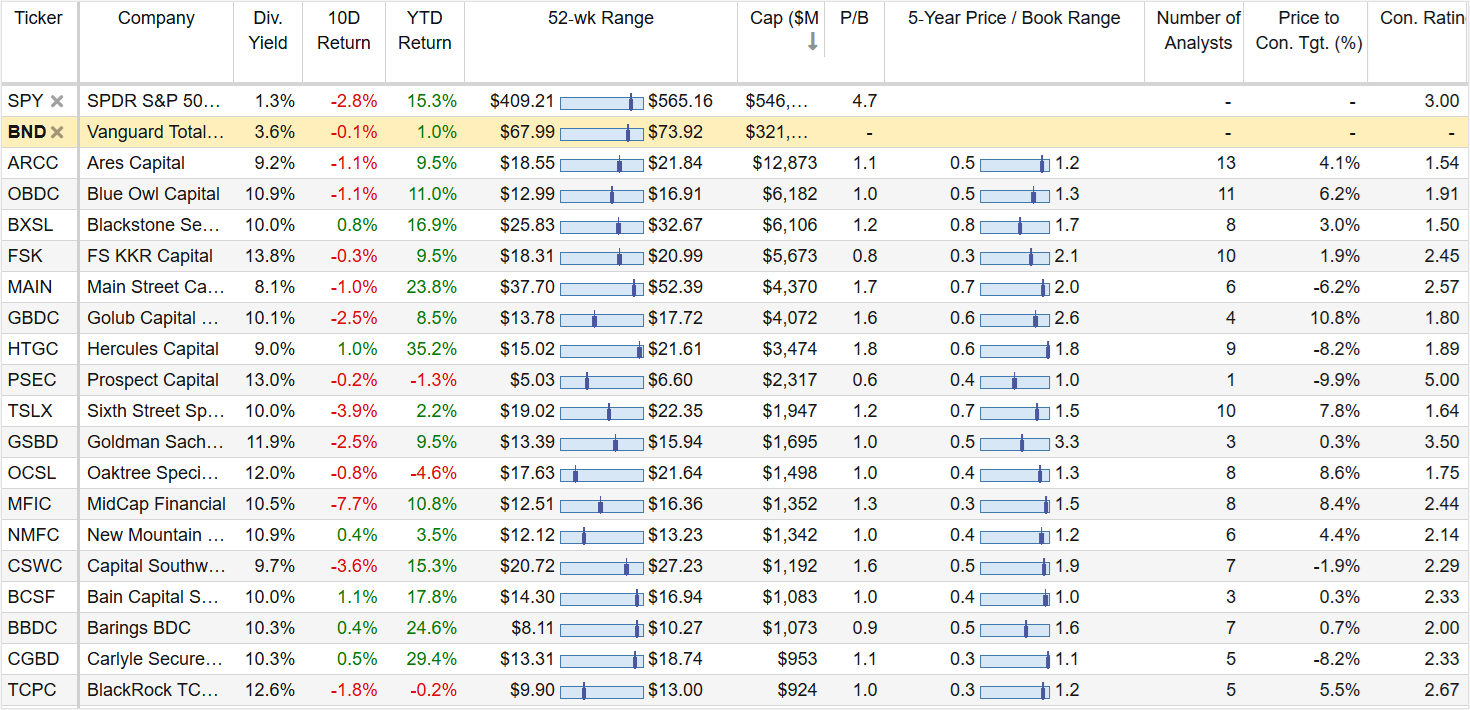

Returning to another BDC, Ares Capital is the largest publicly-traded business development company (“BDC”), and if you have owned it in recent years you are probably quite happy with the strong performance (BDCs have perfomed particularly well following the ‘08-’09 financial crisis as traditional banks largely left this lucrative space due to more stringent regulations).

Some investos were worried that performance had been too good (e.g. price-to-book values were not particularly attractive, and there are too many BDCs chasing after too few oppoortunities). However, BDC prices, including Ares, have just pulled back a bit and thereby have created some additional margin of safety for investors.

Ares is the well-managed industry leader, with deep resources (to handle any market corrections) and now trades at a reasonable 1.0x price to book value. We currently own shares of Ares, and we previously wrote it up in much detail here: Ares Capital: Building A Monster-Yield Portfolio.

4. Cohen & Steers Qlty Inc Realty (RQI), Yield: 8.4% (Monthly)

If you are an income-focused contrarian investor, you may have noticed that performance in the real estate sector has been particularly terrible in recent years. Many things have taken a toll on the sector, including Covid (increasing work from home, and bad for office real estate) to interest rates (increasing the cost of everything) and online shopping (continuing to pummel retail real estate). However, if you are looking for a well-managed contrarian CEF that invests in unloved real estate and has a larger than normal price discount vs NAV (-6.7%), this CEF is worth considering.

The REITs RQI owns are beat up but far from dead. It uses 28% leverage, has a 1.4% managemet fee and pays distributions monthly. We view RQI as a compelling way to invest in REITs that are attractive but offer lower yields (it has positions in names like Prologis, VICI Properties and American) while still mainintaining an aggregate higher yield. You can read our previous article on the opportunity here: REIT CEF: Big-Yield, Big Discount, Contrarian Opportunity.

Honorable Mentions:

*Enbridge Inc. (ENB), Yield: 7.3% (Quarterly)

Enbridge is an oil & gas midstream company, which is a very steady business because revenue is based on long-term contracts instead of volatile oil and gas prices. These long-term contracts also allow the company to pay big steady distributions to investors. We also like this industry in general because it is much less volatile than the overall market, and it has a tendency to zig when the rest of the market zags (this lower correlation is good for diversification reason).

We also like ENB because unlike other midstream companies it is NOT an Master Limited Partnership (“MLP”). MLPs have unique tax reporting requirements, and they can cause significant problems if/when you own them in an IRA (some brokerages won’t even allow you to own them in an IRA). Further still, because ENB is not an MLP, it doesn’t have the “MLP Conversion” risk that other midstream companies (that are MLPs) do have (mainly, it can create big and painful tax bills for investors if/when an MLP converts to a more traditional C-Corp.

If you are looking for some big steady income with lower correlation to the rest of the market, Enbridge is worth considering.

*Royce Small Cap Funds (RMT) (RVT), Yields: 7.6%, 7.1% (Quarterly)

Small cap stocks have been underperforming large cap stocks (such as the magnificent 7 mega caps) for many years. This trend is not always the case throughout history, and a lot of investors have been calling for some relative performance improvement for small caps stocks. And what’s more, we’ve recently seen some relative improvement in the performance of small cap stocks versus large caps, and it seems there may be more room for small caps to run (especially versus large cap). Said differently, smasll caps can provide important diversification and they appear to be an increasingly compelling “value play” opportunity.

One attractive way to play small cap stocks, while still generating big quarterly income payments, is by investing in one of these two small (and micro) cap funds from Royce. Royce is highly-regarded leader in small-cap investing, and both of these closed-end funds trade at at attractive discounts to NAV (11.9% and 10.3%, respectively). So if you are looking for an attractive way to generate high income while benefiting from the relative value opportunity in small caps, these two small cap funds can be an excellent way to play it. We currently own both.

3. Blackrock Credit Allocation (BTZ), Yield: 9.5% (Monthly)

This big-yield bond-focused closed-end fund has a variety of attractive qualities, and provides a compelling alternative if you are looking for opportunities to diversify away from PIMCO (more on PIMCO in a moment).

For starters, BlackRock is very large and has ample resources, and lower fees, as compared to most closed-end fund providers. It also trades at an attractive 6.5% discount to NAV, it provides multi-sector bond exposure, a reasonable management fee (1.05%), healthy leverage (~35.7%) and pays distributions monthly.

We previously wrote BTZ up in more detail, and you can access that report here: Big Yield Bond CEF: Max Interest Rate Pain, Taper Tantrum Looms.

2. Duff & Phelps Utlty and Infrstct (DPG), Yield: 8.1% (Monthly)

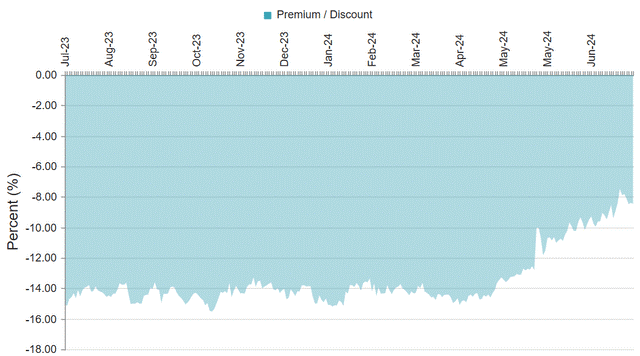

This attractive fund went from trading at a large premium to NAV to a large discount to NAV (currently -10.8%) after a distribution “rightsizing” last year drove investors away and put emtional selling pressure on the shares. We’ll gladly pick up the shares at the discounted price considering it own ~53 individual stocks mostly from the utilities sector. We view the sector as attractive for its low-volatility and steady income.

The fund also uses a prudent amount of leverage (recently 28%) to magnify returns and income. It also just switched from paying distributions from quarterly to monthly—something that may help reduce the price discount (good for investors). You can read our previous report on this fund here: Attractive 9.5% Yield Contrarian CEF.

1. PIMCO Bond Funds

We’re putting three top PIMCO bond funds at #1 because we own all three, even though we have a larger position in PAXS and PDO, which we view as less risky than PDI…

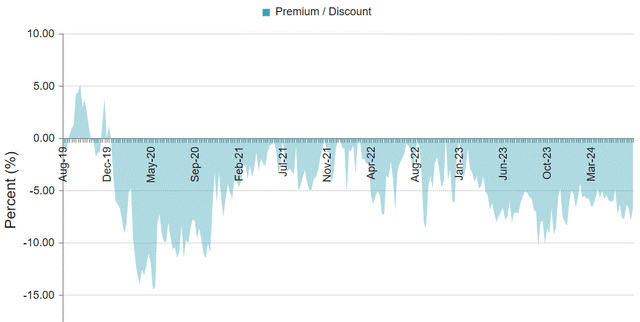

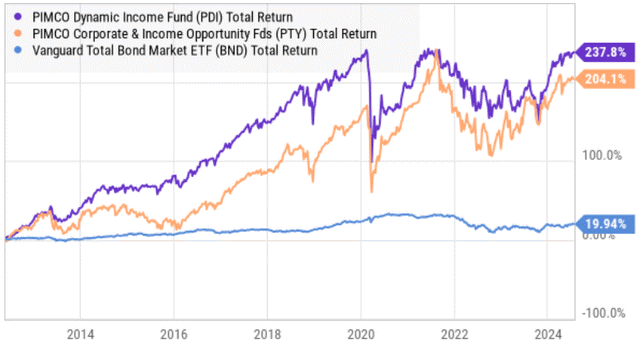

1c. PIMCO Dynamic Income (PDI), Yield: 14% (Monthly)

If you are an income-focused investor, you’ve likely considered PIMCO’s popular big-yield bond funds (often yielding in excess of 10%, paid monthly). In the following report (link below), we compare high-level data on 10 big-yield bond funds (from PIMCO and BlackRock), and then dive deeper into PIMCO’s 14% yielding Dynamic Income Fund (PDI), including a discussion of its risks (such as leverage, interest rates, distribution coverage and interest rate swaps).

Note: chart shows PDI and PTY (and omits PAXS and PDO) because they have a longer history.

1b. PIMCO Dynamic Income Opps (PDO), Yield: 11.5%

We’re putting two PIMCO funds at 1a and 1b thanks to their big steady yields and because PIMCO is the premier industry-leading bond fund manager. The company has massive resources and skills, and PDO currently trades at only a 4.9% premium to NAV (which is low for a PIMCO fund, and could quite easily increase significantly over time—good for owners of the fund). It uses a heafty does of leverage at ~40% and pays income monthly. You can access our previous PDO reports here: PIMCO PDO Reports.

1a. PIMCO Access Income Fund (PAXS), Yield: 11.7%

And at “1a” we’re putting PAXS, a relatively new PIMCO fund (launched in 2022) that is benefiting from stabilizing interest rates (it doesn’t have all the legacy uncovered distribution baggage of many other PIMCO funds). It also trades at a relatively small premium of 1.9% (which is low for PIMCO). It invests in multi-sector bonds, pays monthy, and is attractive (we own it). You can view our previous PAXS reports here: PIMCO PAXS Report.

The Bottom Line:

If you’ve reached a point in life where steady income (without all the volatility) is what matters, then don’t go chasing after volatile growth and technology stocks. Rather, consider investing in attractive opportunities that pay high income now, such the ideas shared in this report.

At the end of the day, diversified, goal-focused, long-term investing continues to be a winning strategy. You can view all of our current holdings here.