In case you’ve been living under a rock, Artificial Intelligence (“AI”) has been hot. Beneficiaries like Nvidia and Super Micro Computer have experienced truly incredible price rallies (thereby making lots of shareholders very happy). But the reality is, AI is not the only megatrend driving the market today (it’s not even the biggest one). In this report, we countdown our top 10 growth stock rankings, and we view them through the lens of three separate long-term megatrends (that could lead shares dramatically higher for many years to come). If you are a long-term growth investor, the ideas in this report are worth considering.

The AI Megatrend:

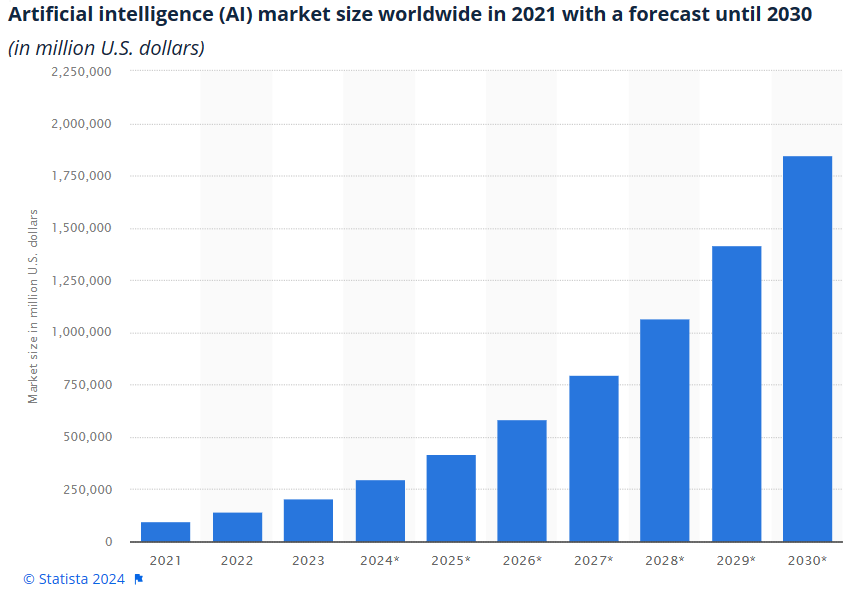

Before getting into the top 10 growth stock rankings, let’s first consider the articial intelligence megatrend. For starters, you can see an estimate (below) of just how large the AI market is expected to grow by the end of the decade.

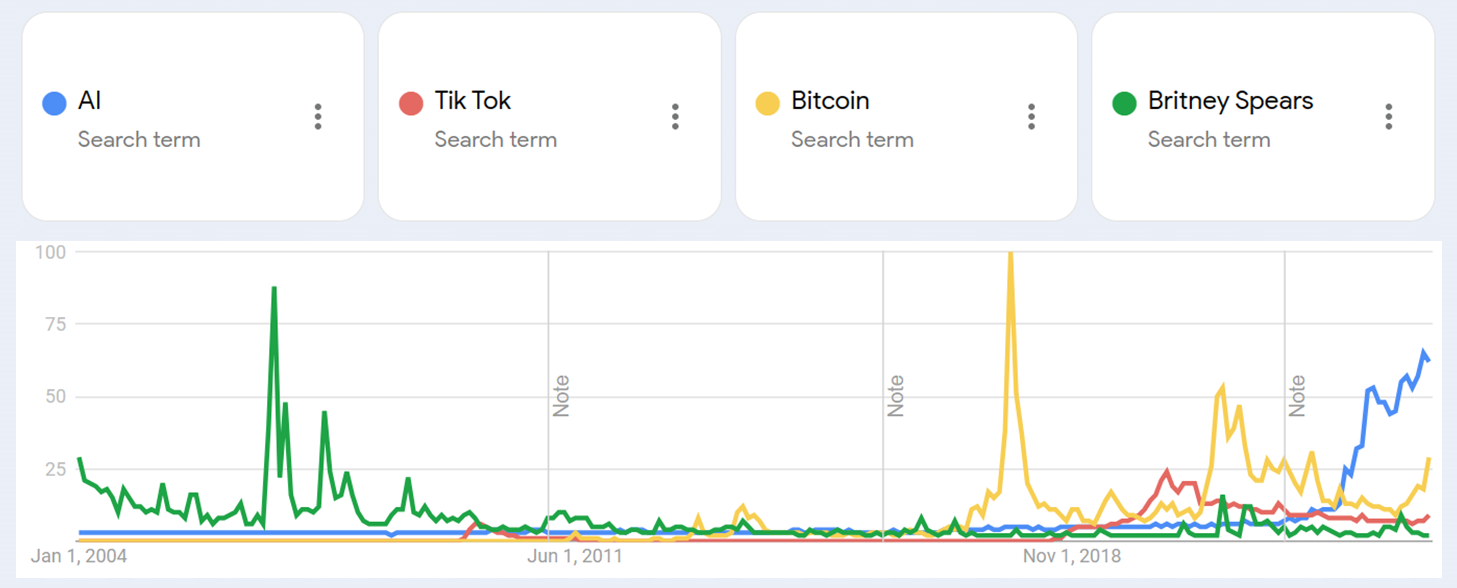

For a little more perspective, here is a look at how the term “AI” has been climbing recently among Google searches (and as compared to a few historical search terms)

In our view, AI is a much bigger deal than the other comparative search terms in the chart above, and here is what Nvidia (NVDA) CEO Jensen Huang had to say about it at a Microsoft (MSFT) Ignite conference in November 2023:

“Generative AI is the single most significant platform transition in computing history… In the last 40 years, nothing has been this big. It’s bigger than PC, it’s bigger than mobile, and it’s gonna be bigger than the internet, by far.”

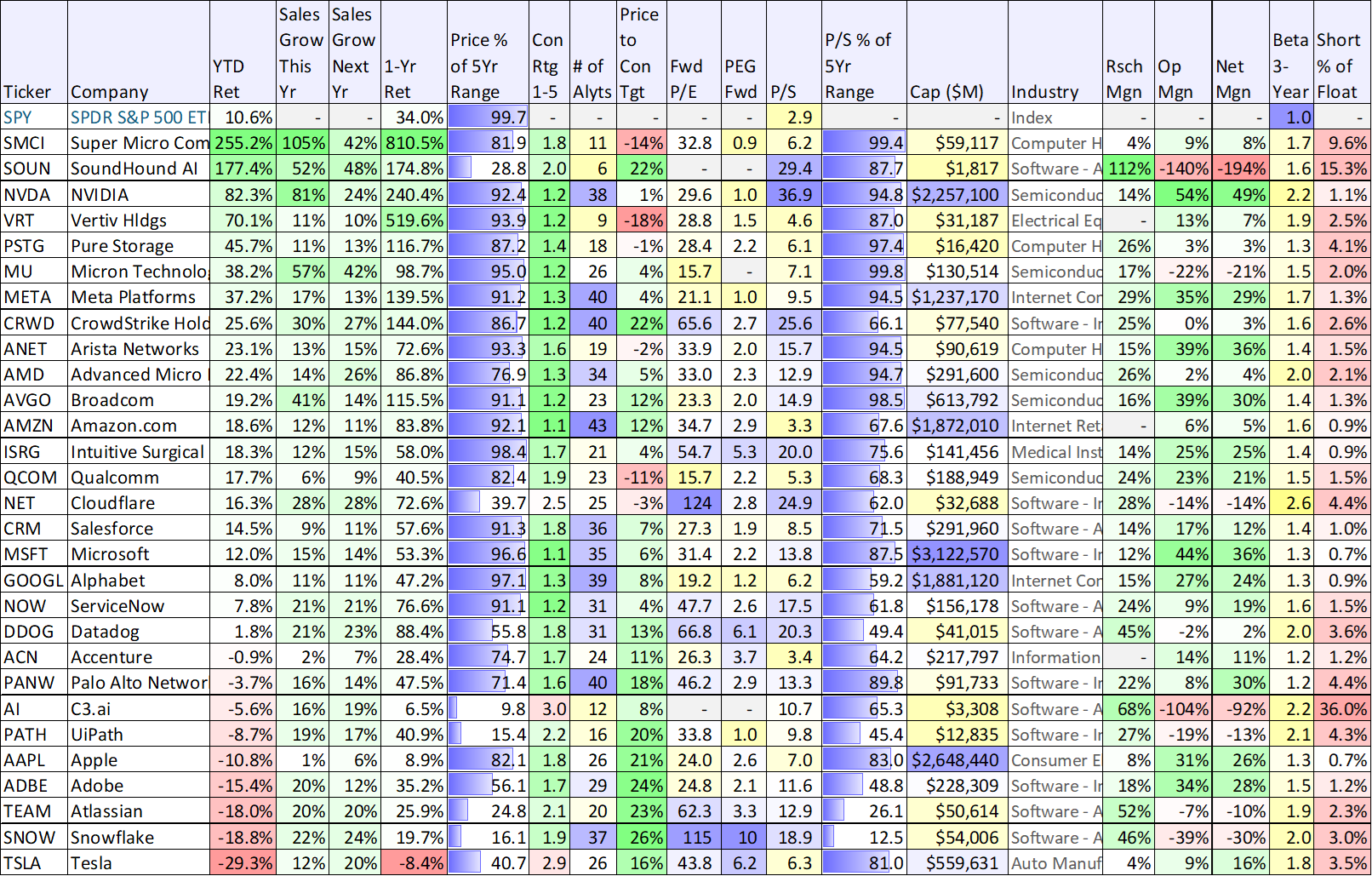

And for a little more perspective, here is some data on the recent performance of a variety of top AI stocks (you likely recognize many of the names in this table.

Data as of market close 3/28/24 (source: StockRover)

Top 10 Growth Stocks:

So with that backdrop in mind, let’s get into our top 10 growth stocks, beginning with #10, a stock benefiting big-time from AI.

10. Vertiv Holdings (VRT)

Vertiv provides digital infrastructure technology for data centers. And it continues to be an enormous AI beneficiary as data centers are where the “cloud data” powering AI is actually stored. In its most recent quarterly earnings presentation, the company explained that they are seeing:

“Continued signs that AI-related demand will provide a tailwind on pipeline and sales in 2024+. [And they] Continue to invest in capacity expansion across liquid cooling, thermal, UPS, switchgear, busbar and Modular Solutions to accommodate AI driven demand growth.”

With a healty 6.7% net profit margin, double-digit forward sales growth and trading at 4.7x sales (TTM) (not to mention a 1.5x forward PEG), Vertiv remains an attractive healthy growth story courtesy of the secular AI trend that is still just getting started.

9. Snowflake (SNOW)

Snowflake is a “big data” company, and without big data the explosive growth in AI (that the market has been experiencing) would not be possible.

However, for all the hype surrounding this big-data cloud company, the shares have been a disappointment (so far). Revenues continue to scream higher, but profits scream lower and CEO Frank Slootman has just “stepped aside” (he’s now Chairman) to allow relative company newcomer (and AI expert) Sridhar Ramaswamy to take the reigns as the new CEO. We’re optimistic about the new CEO and believe it can make a lot of sense to purchase high-growth stocks benefiting from megatrends when the they’re out of favor in the market. You can read our recent detailed report on Snowflake here.

*Honorable Metnion: Zeta Global Holdings (ZETA)

We’re including Zeta as an honorable mention because it is a strong beneficiary of AI and of the insatiable demand for inceasingly efficient advertising strategies. More specifically, Zeta is a leading omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises. You can read our detailed report on Zeta here.

8. Super Micro Computer (SMCI)

You might think it odd to consider a stock that is already up 255% this year (see table above), but the valuation of this AI beneficiary is still quite attractive, trading at a forward PEG ratio (price/earnings to growth) of only 0.9x (very attractive). Super Micro makes servers to house microchips used for AI, and the company is benefiting dramatically from its long-standing symbiotic relationship with leading AI chipmaker, Nvidia (NVDA). We’ve been long shares of Super Micro since it traded in the $200’s (not too long ago) and we’re still comfortable owning some shares now even if it has crossed the $1,000 per share price. Basically, the company is benefiting from a situation where there is a lot more demand for its products than supply. The company is growing to increase supply, but still cannot keep up with demand (a good thing). You can read our previous report on SMCI here.

The Interest Rate Megatrend

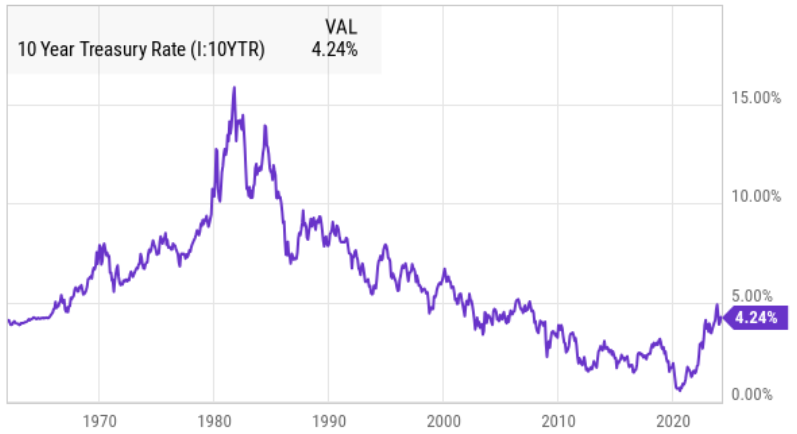

Switching back to megatends, interest rates (and monetary and fiscal policy, more generally) have a profound impact on growth stocks in particular. And the interest rate megatrend that was in place since the 1980’s (whereby interest rates kept coming down) has reverted. Interest rates are now decidedly higher, and this will absolutely impact some businesses (for example, growth stocks) dramatically more than others.

For example, after the pandemic hit in 2020, the fed almost immediately dropped interest rates to zero (and endless easy money was pumped into the economy through both monetary and fiscal policy), and the result was the share prices of unprofitable growth stocks soared to levels many of them will never achieve again. For example, check out the returns of the famous ARK Innovation ETF (ARKK) a growth and innovation fund (led by Cathie Woods) notorious for invesing in disruptive growth stocks that aren’t yet profitable.

More broadly speaking, the growth stock phenomenon following the pandemic (such as the extreme and rapid ascent of ARKK) was a magnification of the declining interest rate megatrend that was in place for decades and lifted many growth stocks higher.

What has changed now, is that easy money is evaporating (interest rates are up and the fed is unwinding its balance sheet which ballooned during the pandemic and after the 08-09 financial/housing crisis) so it becomes much easier for some stocks to grow more than others. Specifically, companies that rely on the capital markets (such as borrowing or issuing more shares) to fund growth will now face more headwinds, and big monopolistic profitable companies with ample cash flow generation can fund their own continued growth without needing to go to the capital markets.

For example, the Magnificent 6 (sorry Tesla, you’re exluded in this instance, even though we’d never count out Musk) has an insane advantage in this regard.

7. Meta Platforms (META)

Meta Platforms (formerly Facebook) is an absolute money-printing machine (it has incredible gross and net margins), and this essentially insulates the business from any challenging capital market condtions (if interest rates go up, Meta doesn’t care too much because they don’t need to borrow money and they don’t need to issue shares to raise capital). At times when capital market volatility may hurt other, smaller, businesses, Meta is (in many ways) immune from the interest rate megatrend.

Furthermore, Meta is a massive beneficiary of AI as its CEO (Mark Zuckerberg) has big plans (and is spending HUGE) to grow the company’s ability to creep on your data, feed it to AI, and then market the heck out of you with pinpoint accuracy all while pretending he’s not creeping on you (all the data is “anonymized” therefore it’s okay, as the common Meta defense refrain goes).

And if you can’t beat them, join them. Meta Platform shares trade at a very attractive 1.2x forward PEG ratio (price/earnings to growth), especially as compared to most other mega-cap stocks, and the shares are very likely to go dramatically higher in the decade ahead thanks to Facebook, Instagram and WhatsApp (not to mention the creepy CEO who is “heck-bent” on creeping on everyone).

6. Pure Storage (PSTG)

Pure Storage is another profitable company (i.e. less negatively impacted by the interest rate megatrend) and big beneficiary of AI. For some perspective, Pure’s strategy to consolidate data storage (using a single operating and management environment) solves the two big non-AI legacy problems…

existing data storage arrays were selected to provide just enough performance for their primary function, leaving little performance left for AI access, and

existing storage arrays are not networked, limiting access to AI apps not provisioned directly on their primary compute stack.

And per the CEO on the latest earnings call:

Looking forward to FY '25, a I have high confidence of returning to double-digit revenue growth, given our platform strategy, our growing product portfolio, our cloud operating model, and strong customer demand for our Evergreen and Fort Works subscription offerings.

We continue to be long shares of Pure Storage in our Blue Harbinger Disciplined Growth Portfolio and believe it has continuing strong upside potential thanks to the ongoing digital revolution and explosive expansion in AI data (not to mention it’s already profitable therefore less negatively impacted by the interest rate megatrend). You can access our previous writeups on Pure Storage here.

The Government Megatrend

Perhaps you’re aware that the earnings per capita in the Washington DC area has dramatically outpaced the rest of the country over the last few decades. Beneficiaries of goverment spending range from DC metro residents to defense contractors (such Boeing (BA) and Lockheed Martin (LMT)) and consulting companies (like Booz Allen Hamilton (BAH) and Accenture (ACN)).

But the government megatrend also swings the other way, whereby the government monitors monopolistic companies on antitust grounds, such as the recent Apple antitrust case or the previous crackdown by politicians on corrections facilities (aka for-profit-prison stocks). For better (there are a lot of good things) or worse, government growth seems unlikely to slow, especially as the overall economy continues to grow.

And the government megatrend creates risks and opportunities, such as the examples below (note: we’ll have more to say about the government megatrend in the conclusion of this report—mainly, don’t bet against the US!).

5a. Albemarle (ALB)

Fortunately, for those of us that like to breath clean air, the government creates incentives for certain businesses (and entire industries) to thrive. One such industry where governement regulation has had a dramatic impact is electric vehicles (i.e. in an effort to reduce pollution from fossil fuels). And one such company that has been dramatically impacted is lithium company, Albemarle (Albemarle mines lithium used in electric vehicle batteries).

A lot has been said of EVs (both good and bad), but our contention is that due to dynamic market forces, the shares of Albemarle are dramatically underpriced in the market right now, and the shares represent an extremely attractive long-term investment opportunity.

We are currently long shares of Albemarle, and you can read our recent report on the company using the link below, but our basic thesis is that lithium demand is highly cyclal and we are currently at a low point in the cycle (due to supply and demand forces) and the shares of Albemarle may revert dramatically higher in the quarters and years ahead. You can read our detailed Albemarle report here.

5b. Aspen Aerogels (ASPN)

Sticking with our government megatrend and electric vehicle theme, we’re including materials company Aspen (we currently do own shares). Aspen makes insulation materials used in electric vehicle batteries to prevent overheating, and the company’s business is on a high growth trajectory. You can read our previous full report on the company here.

4. Palantir (PLTR)

Palantir is a battleground stock (there are lovers and haters) that benefits from the AI megatrend (they work with clients to build custom software utilizing AI) and the government megatrend (Palantir has many lucrative, and hard to get, government contracts). Our view on Palantir is that the shares are volatile, but the busines will grow in the years ahead courtesey of two megatrends: AI and government growth. You can read our recent full report on Palantir here.

3. Nvidia (NVDA)

On the street, they endearingly like to refer to Nvidia CEO Jensen Huang as “the godfather” of AI, and it’s really hard to imagine a world where this leading AI GPU chip maker doesn’t keep growing rapidly. Nvidia chips are the best (so far) for AI, demand is off the charts (driving prices higher) and customers don’t like to switch out one solution (such as Nvidia) due to the switching costs and risks (if it “ain’t” broke, don’t fix it).

So much of the global economy relies on Nvidia to function (including governments), the company just prints money (i.e. they’re not as susceptible to interest rate volatility) and despite the meteoric rise in share price, Nvidia still trades at a compelling valuation. We recently wrote up Nvidia in detail, and you can access our full report here.

2b. Alphabet (GOOGL)

Alphabet (Google) is one of our largest holdings (in our Disciplined Growth Portfolio), and we expect it will remain that way for a long time. Alphabet will continue to benefit from secular trends, including Artificial Intelligence (despite media stories that it is behind) and the overall digitial revolution and migration to the cloud (through Google Cloud and its vast ecosystem). And despite all the positives, the shares still trade at a compelling valuation. Considering Alphabet is such a large part of the S&P 500 and the overall economy, there is no way we’re not investing in it. We remain long this high-growth, wide-moat, undervalued, mega-cap juggernaut, and you can read our latest full report here.

2a. Amazon (AMZN)

Amazon is special because it has the economies of scale (in cloud and in bascially anything else it does) to overpower its competion, but it has low enough profit margins to keep the government off its back (not to mention the US government and Washington DC represents a huge client base of Amazon Web Services), and because Amazon is opening the advertising spigot on its marketplace, and that is in addition to its leadership position in cloud (ahead of both Microsoft and Google—although they are gaining). Finally, new CEO Andy Jassy has something to prove (he was the original leader of AWS). And oh, by the way, the valuation is attractive (it’s in the lower end of its 5-year P/E range, and it trades well below its 5-year Price-to-sales range (unlike other megacaps). We’re long Amazon, and you can read our previous full report here.

1. Prudently-Concentrated Top Growth Stock Portfolio

We included two names at number 2 (and multiple honorable mentions throughout this report) to ensure you got even more than 10 top growth stock ideas as promised in the headline), but we are including an important lesson (and our strong belief) at number one.

Specifically, as a long-term growth investor, we believe in investing though a prudently-concentrated (diversified) portfolio of top growth stocks because it can reduce risks and keep returns high.

You can view all of the current holdings in our Blue Harbinger Disciplined Growth Portfolio here.

The Bottom Line:

As alluded to earlier, markets are dynamic and things are constantly changing. For example, rates could go down in which case certain growth stocks on our list would likely go evern higher and faster. We also believe the AI megatrend has many years of dramatic growth ahead, but that doesn’t mean it couldn’t pullback a bit in the quarters ahead.

Additionally, the government (or some other unforseen megatrend) could cause the shares of any one business on our list to thrive or suffer. This is why we invest in top stocks through a portfolio approach (instead of just one or two stocks only). We also believe it’s a bad idea to bet against the people of America (or the people of the world for that matter). This economy is eventually going much higher, and by investing in top growth stocks you will benefit, perhaps dramatically.

Discisiplined, goal-focused, long-term investing continues to be a powerful way to build wealth.