When two of the economy’s biggest mega trends combine, you get Nvidia (+59% ytd) and offshoots like Super Micro Computer (+202% ytd). And if you’re wondering if its “too late” to invest in these two mega trends (i.e. Artificial Intelligence and/or the Digital Revolution) the answer is a resounding, no way! We’re still in the early innings and here are 5 stock ideas that could potentially ride these waves dramatically higher in the decade ahead (volatility haters need not read on).

1. Nvidia (NVDA): I saw a twitter post this week that said Nvidia is just Taylor Swift for men. Certainly, the excitement surrounding these two brands is incredible, and Nvidia continues to do an amazing job “walking the walk.” (I cannot comment on Taylor Swift, except that I just keep hearing how popular she is). Nvidia announced another quarter of blow out earnings this past week and the shares shot dramatically higher and dragged the entire market up with it.

Nvidia ($1.9 trillion market cap) is now the third largest company in the US behind only Apple (AAPL) and Microsoft (MSFT).

Nvidia makes the semiconductor chips that are leading two mega trends. First, the “digital revolution (whereby data is being digitized everywhere and then migrated to the “cloud” where Nvidia chips continue to reign supreme in data centers across the globe). Second, the incredible possibilities being opened by new technologically advanced “artificial intelligence” models requires massive computational power and data gathering which is being stored in the cloud (i.e. Nvidia wins again!).

Nvidia expects next quarter’s revenue to be $24B, which means despite the strong gains, the shares still trade at only 19.8 times sales (not at all expensive for a company with a very healthy growth trajectory fueled by years of expected high growth from the aforementioned mega trends).

We continue to own Nvidia shares despite the high share price volatility. For example, Nvidia shares have fallen 60% four times since 2000, but the trajectory has remained to the upside, and we believe that will continue for many years to come.

Competitors and alternatives will continue to knock on the door, but the technology behind Nvidia has proven impossible to reproduce (so far), and companies also like to stick with what works (why switch chips and associated hardware if it “ain’t” broke).

2. Super Micro Computer (SMCI): Speaking of associated hardware, SMCI makes servers that house Nvidia chips and it is growing at an insane pace thanks to its ongoing strong relationship with Nvidia (the two companies were founded in the same year and are physically located 10 miles apart). SMCI shares took a huge pause (and pullback) this past week as investors waited for Nvidia’s earnings announcement (which was very positive) and then SMCI shares resumed their dramatic upward pace.

SMCI’s share price will likely be even more volatile than Nvidia’s but its long-term revenue trajectory will also remain dramatically to the upside (fueled by the same mega trends supporting Nvidia).

3. Palantir (PLTR): Palantir is a “big data” / AI software company that is hated by Wall Street and loved by Main Street investors. And the business will continue to grow rapidly thanks to AI. If you can stomach the volatility (and constant drumbeat of “haters”), Palantir shares are also likely going much higher in the decade ahead.

If you’d like, you can check out my recent full report on Palantir here: Palantir: Full Report

4. Meta Platforms (META): The “artist formerly known as” Facebook is another massive beneficiary of AI as its CEO (Mark Zuckerberg) has big plans (and is spending HUGE) to grow the company’s ability to creep on your data, feed it to AI, and then market the heck out of you with pinpoint accuracy all while pretending he’s not creeping on you (all the data is “anonymized” therefore it’s okay, as the common Meta defense refrain goes).

And if you can’t beat them, join them. Meta Platform shares trade at a very attractive forward PEG ratio (price/earnings to growth), especially as compared to most other mega-cap stocks (not as good as Nvidia though) and the shares are very likely to go dramatically higher in the decade ahead thanks to Facebook, Instagram and WhatsApp (not to mention the creepy CEO who is “heck-bent” on creeping on everyone).

5. Amazon (AMZN): Perhaps more on the “digital revolution” side than the “AI” side (for now), Amazon is still the leader in cloud service (ahead of Microsoft and Google, who are both gaining) through Amazon Web Services (AWS). Cloud services is another massive long-term growing beneficiary of the digital revolution (as the amount of data in the world explodes and migrates to the cloud).

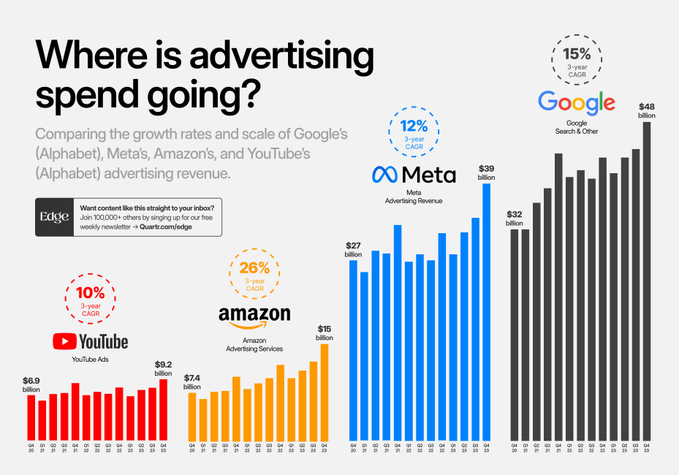

Amazon is also special as relatively new CEO (and original founder of AWS) Andy Jassy expands the company’s revenue generation through advertising, which is now growing at roughly 2x the rate of Google and Meta.

The Bottom Line on Nvidia + The 2 Mega Trends:

People are scared to invest in Nvidia (and others) because the shares have risen so much and so fast. Especially considering technology-driven stocks can be notoriously volatile.

However, from a valuation standpoint, many of these stocks are still inexpensive relative to their increasingly likely long-term high-growth trajectories.

It really comes down to your own personal situation. If you cannot handle the very high volatility (that is likely on the short and mid-term horizon), then stay the heck away from names like Nvidia and Super Micro Computer. But if you do have a long enough investment horizon (say the next 10 years, for example) many of these businesses (such as Nvidia) are just too important to the global economy and the critical mega trends that are fueling them.

Nvidia’s business will continue to grow much faster than the overall economy. And 10 years from now, Nvidia shares will likely trade dramatically higher than today.

*Note: if you have owned Nvidia or Super Micro Computer for the last few years (they’re up thousands of percent), I hope you own them in a Roth IRA so you’ll never pay taxes on the gains!