If you are a growth investor, cloud data AI company, Snowflake (SNOW) has massive revenue and massive revenue growth. However, the share price has fallen from extreme highs (in 2021) so that its recent 33%+ pop in share price (following strong quarterly earnings) still leaves a lot to be desired. In this brief note, we review the company’s incredible revenue growth, earnings (still very negative net income), valuation and share dilution. We conclude with our strong opinion on investing.

Overview:

Snowflake is a big-data, cloud-based, artificial intelligence company. That’s a lot of buzz words, but Snowflake is in the right place at the right time to benefit from explosive growth in AI (as you can see in the following graphic) as it solves the data silo problem every organization has.

Valuation:

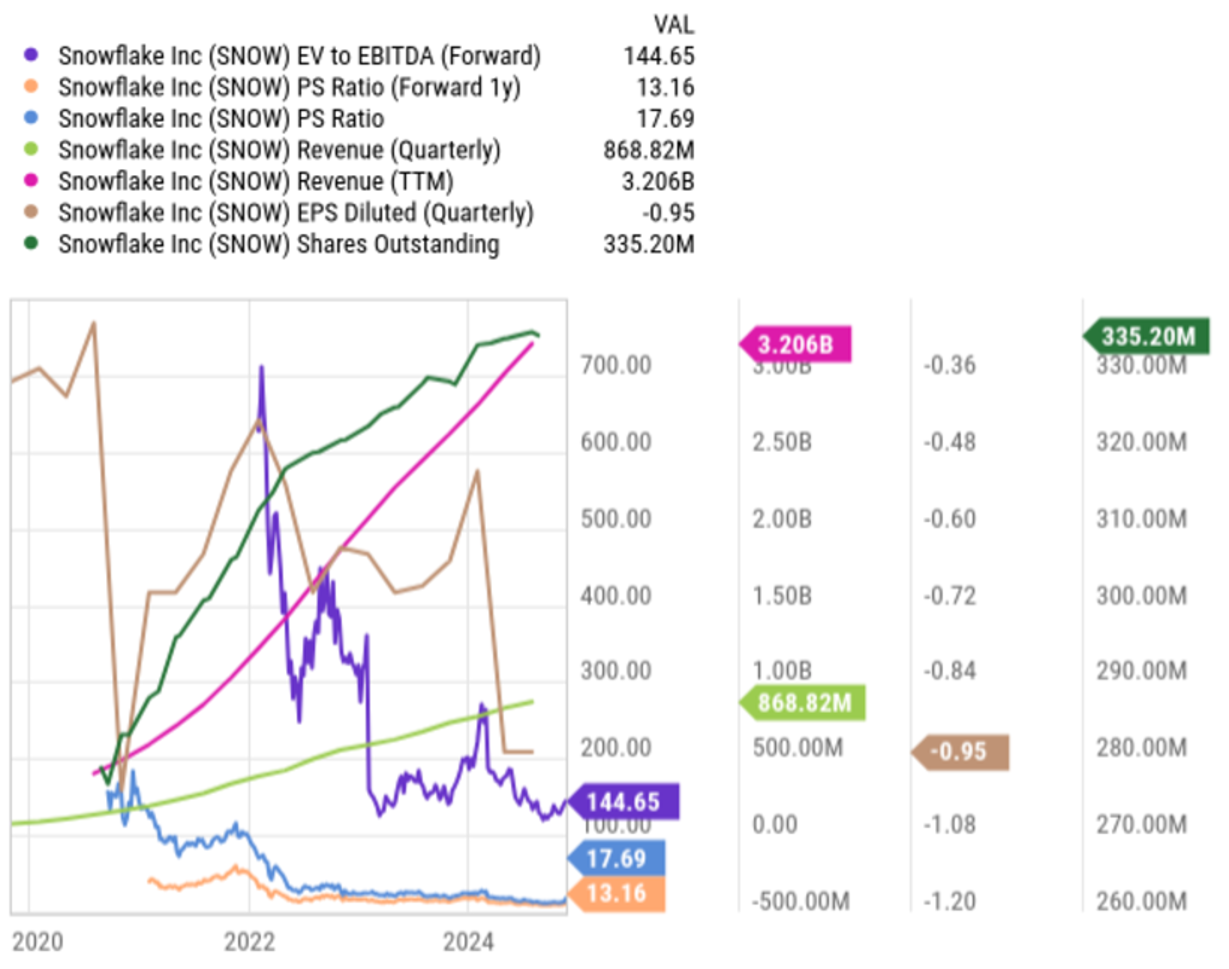

Unquestionably, Snowflake’s revenue growth is truly massive and impressive (see chart below), however its valuation causes a lot of concern and consternation. For example, here is a look (below) at the company’s forward enterprise value to earnings before interest taxes depreciation and amortization (EV/EBITDA), which is very high. Furthermore, the price-to-sales metrics are high, and the net income (and earnings per share (“EPS”) are negative and getting more negative. Yuck!

Part of the problem with the EPS is the company keeps diluting existing shareholders by issuing more shares to fund growth. And even though this is common for relatively newly public high-growth companies, it’s still painful and financially destructive for existing shareholders.

Why Invest?

If the company still cannot turn a profit, why would anyone invest? If you are a low-volatility income-focused investor, stay the heck away from investing in Snowflake (it doesn’t even pay a dividend).

But if you are a long-term growth investor, it is worth considering because it seems at some point it will turn the corner (earnings will become positive) and the business will eventually become a cash cow.

But how long are you willing to wait? It could be quarters or even years before the company actually becomes profitable (if ever). But if you try to time the exact right time to “buy” you could miss this incredible secular growth opportunity.

We currently own shares of Snowflake within our prudently-diversified, long-term, Blue Harbinger Disciplined Growth Portfolio because we a willing to wait patiently (for a long time) for the financials of this business to turn around and keep up with the massive revenue growth and potential for extreme future profits.

Snowflake is in revenue growth mode right now, and they are paying heavily (in terms of negative profits and existing shareholder dilution) to fund the growth. Truthfully, as hard as it is to understand for some, this is the correct approach to capture market share and to build a long-term business behemoth and juggernaut. New CEO Sridhar Ramaswamy seems to be embracing the long-term growth opportunity, and we like that.

The Bottom Line:

If you are a disciplined, very-patient, long-term investor, Snowflake shares are absolutely worth considering. If you are an income-focused investor—stay away.

*Long Snowflake (in our Blue Harbinger Disciplined Growth Portfolio).