If you like big steady income, the CEF we review in this article has delivered for decades. And it just got better this year after increasing its quarterly distribution meaningfully. Not to mention, it trades at a compelling discount to NAV which basically eliminates the small performance drag of its very reasonable expense ratio. Furthermore, it provides critical exposure to diversified equity (stock) markets that a lot of income investors frequently miss out on (because they’re overly concentrated in bonds and only a small subset of the equity market). And it does all of this in a highly-disciplined quarterly-distribution approach that allows many investors to “set it on auto-pilot” and sleep well at night.

Adams Diversified Equity Fund (ADX), Yield: 10.9%

ADX is a closed-end fund (“CEF”) that has been paying distributions for over 85 years. In a lot of senses, it is an “old school” fund because it doesn’t screw around with goofy leverage or gimmicky strategies. Rather, it buys and holds a diversified portfolio of stocks for the long term, and it also uses the dividends and long-term gains to pay out big steady quarterly distributions to investors (more on this later). According to the company’s website, ADX:

“seeks to deliver superior returns over time by investing in a broadly-diversified equity portfolio. The Fund invests in a blend of high-quality, large-cap companies. The Fund seeks to generate returns that exceed its benchmark as well as consistently distribute dividend income and capital gains to shareholders.”

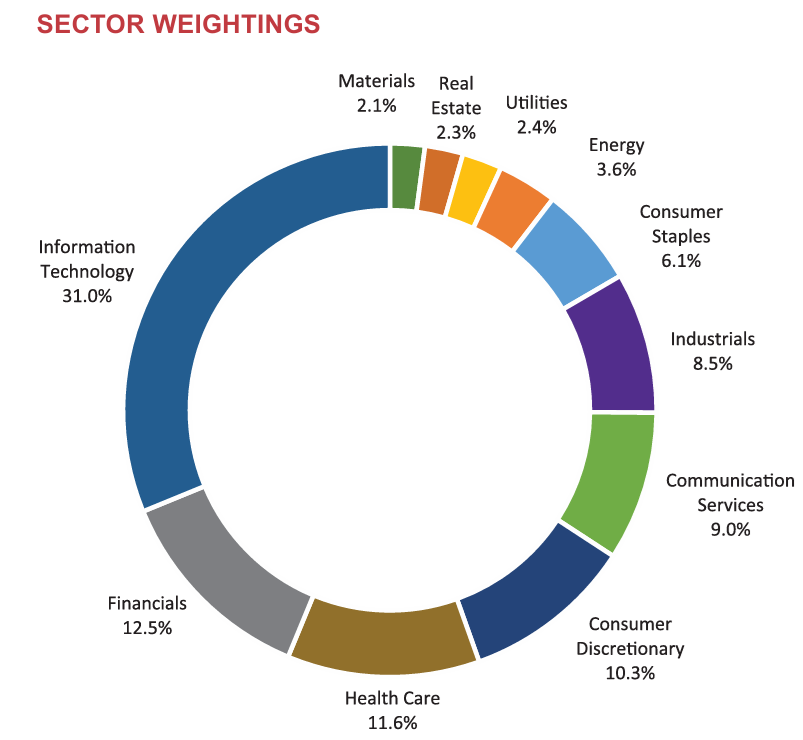

Here is a look at the strategy’s important sector diversification and top 10 holdings.

More on the above sector diversificaiton and holdings later.

7 Big-Yield CEF Questions

Important to note, ADX is a closed-end fund (“CEF”). This means, unlike open end mutual funds and exchange-traded funds (“ETFs”) ADX can trade at a significant discount or premium to its net asset value, or “NAV,” (which is the aggregate value of its underlying holdings), and ADX management has more control over when it creates or offers more shares (it is closed-end) which gives it some advantages, but also means the shares trade in the open market based on supply and demand (which basically causes the premiums and discounts, which are both a risk factor and an opportunity that we will consider in more detail later in this report).

From a high level, here are seven important questions we always ask ourselves before investing in any closed-end fund.

Why ADX is Special

So with that backdrop in mind, let’s consider a few reasons why ADX is special:

Big steady distributions: For starters, ADX offers big steady quarterly distributions that many investors like. Historically speaking, ADX has paid three smaller distributions in the first three quarters each year, followed by a larger fouth quarter distribution that brings the aggregate distribution yield for the year up to at least 6% (and usually higher, depending on market conditions).

New distribution policy: However, ADX just recently revised its distribution policy to be more competitive and consistent with the times. Going forward, ADX will pay a 2% dividend each quarter, followed by a larger fourth quarter distribution that will bring the annual yield to at least 8%. And this year, because the market has been good, ADX announced it will pay a larger fourth quarter distribution bringing the 2024 distribution yield to 10.9% (not bad!)

Important diversification: ADX is special for income investors because it provides important diversification into higher-growth market sectors (such as technology) while still offering that big distribution yield. This can be critically important for many income-focused investors because they frequently are under-exposed to growth sectors of the market and subsequently miss out on some very powerful long-term returns. ADX provides an opportunity for the best of both worlds: high-income and powerful long-term growth.

Big Discount to NAV

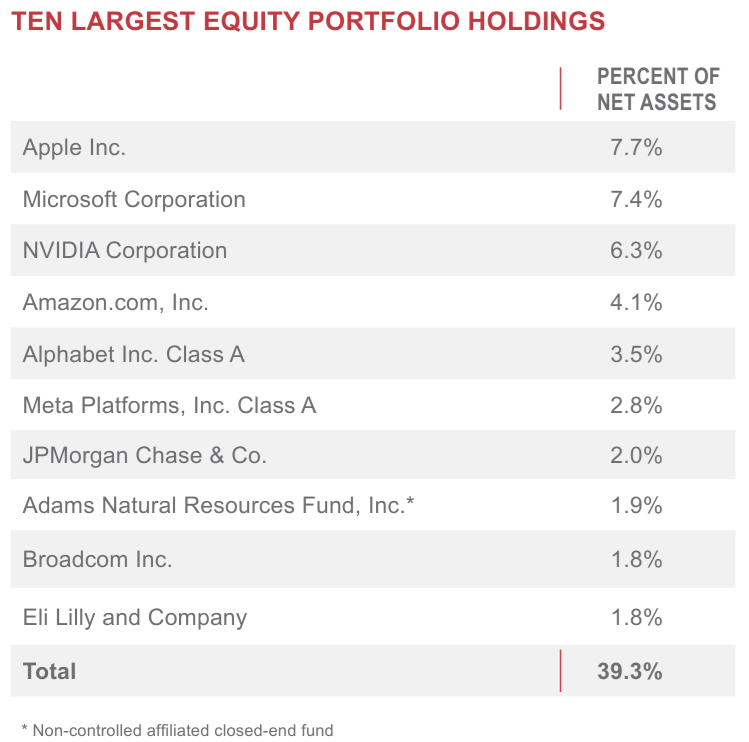

Another critical consideration for investors is the fairly consistent large discount to NAV that ADX trades at, as you can see in the following chart.

This discount provides some risks (it can always get bigger, which would be a drag on invetor returns), but it also allows you to get access to all the underlying holdings at an attractively discounted price (this is a good thing—it’s like buying on sale).

In fact, this discount to NAV helps to basically offset the long-term performance drag caused by the fund’s ~0.61% annual expense ratio (which is already fairly low for an equity CEF in the first place).

Also worth noting, the discount has recently shrunk a bit (see chart above) versus history as the fund’s newly announced bigger distribution policy has had an impact on the discount. Additionally, there was a recent proxy offer (whereby ADX bought back some of its outstanding shares in the open market at a higher price / smaller discount) in an effort to shrink to discount (and perhaps ward off activist investors) which has been successful thus far.

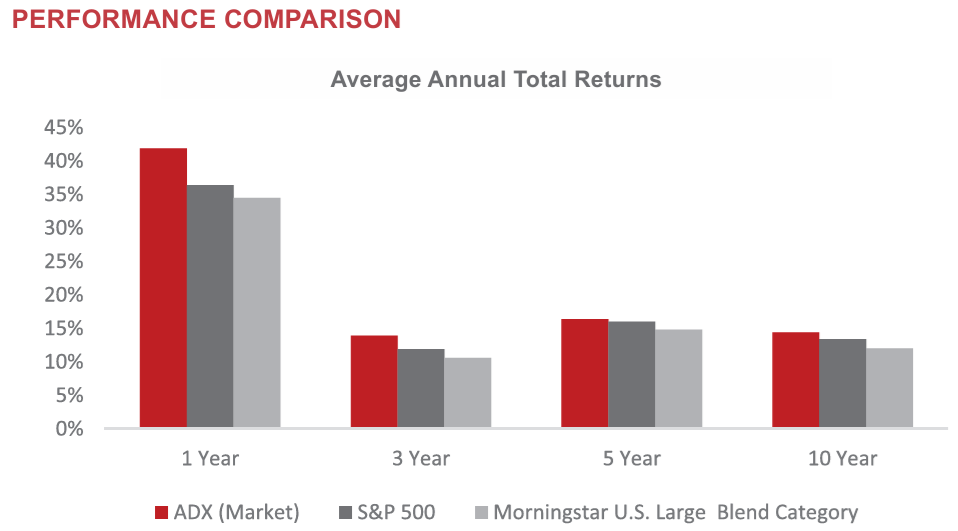

For perspective, here is a look at the fund’s long-term performance vesus the S&P 500. It shows ADX has a strong history of strong absolute (and benchmark-relative) returns (a good thing). Note, these are total returns, which means price returns plus distributions as if they were reinvested (some investors reinvest, some investors don’t because they choose to keep/spend the cash).

Risk Factors:

Of course there are a variety of risk factors every investor should consider before investing in ADX. For example:

Strategy fit: Should you even be invested in a stock market strategy like ADX (which can be very volatile in the short run) or would you be better off investing in a money market fund or certificate of deposit at the bank (which offer lower returns but far less price volatility).

Discount volatility: we generally view the large (~8.8%) discount to NAV (as described earlier) as attractive. Just know the discount can get larger (as we described earlier, and as you can see in our earlier chart) and that would be a detractor from your retuns (i.e. it would drag the market price a bit lower).

Activist investors: As mentioned earlier, some activists were investing in ADX earlier this year in attempt to reduce the size of the discount and make a quick dollar. Generally speaking, we view these types of activist investors as total clowns, but nonethess the can create additional price volatility and uncertainties for ADX.

Big Q4 Distribution: ADX gaurantees at least an 8% annual distribution, but the fourth quarter distribution can be larger than the 2% distributions in quarters one through three, as it will be this year, as per the company’s recent distribution announcement. Some investors are frustrated by the inconsistent Q4 dividend, but again the new policy (as described earlier) is more attactive than the earlier policy (as described earlier in this report).

Critical Discipline

A highly-disciplined investment approach is another attractive quality of this fund. For example, the management team manages the quarterly distributions so you don’t have to worry about them (you simply get to collect (or reinvest) those big steady income payments).

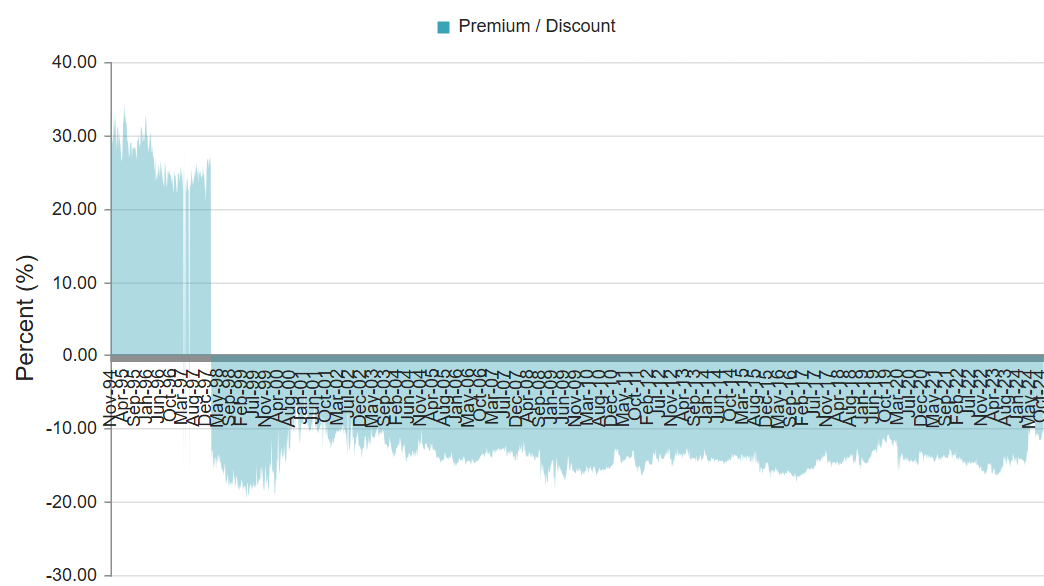

For perspective, here is a look at how the distribution has been sourced recently.

As you can see, the distribution is not entirely “Income” (or dividends on the underlying holdings), but it also includes a healthy doese of long-term capital gains (which are better than short-term gains in most tax situations). There is also the potential for some of the distribution to be sourced from “return of capital (“ROC”) which is typically when the fund simply returns some of your own original investment dollars to cover the distribution payment.

ADX largely avoids ROC (a good thing), but a little ROC from time-to-time is acceptable. For some high-level perspective, as long as the fund’s total annual return is above 8% (which it has been, see our earlier performance chart) then ROC is largely unecessary.

So if you like to set some of your investments on auto-pilot, ADX is a great way to get a professionally-managed 8%-plus annual distribution yield.

Also worth mentioning, ADX typically uses zero leverage (borrowed money). Other CEFs use leverage to magnify returns and income (but also add volatility risk). But considering ADX’s equity market strategy, we believe zero leverage is a prudent use of discipline.

The Bottom Line:

If you are an income-focused investor looking to add diversified equity market exposure (an allocation many income investors are missing), ADX is a compelling and disciplined strategy, trading at an attractive discount, and worth considering (especially following its newly improved distribution policy). We are long shares of ADX in our prudently-diversified, Blue Harbinger “High Income NOW” Portfolio.