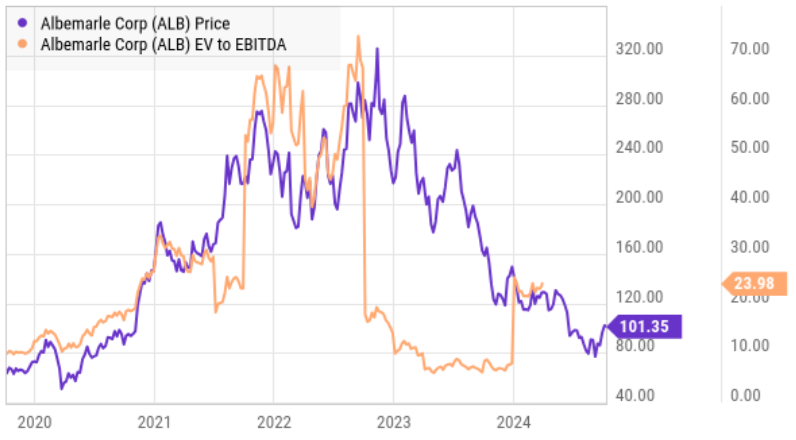

This lithium miner (with a strong tie in to electric vehicle batteries) has gone from “loved” (at over $300 per share in 2022) to “hated” (now trading at around $100). But what many investors may not fully appreciate is the massive lithium supply cycle swing, which now places Albemarle in an interesting position going forward. In this report, we review the business, the lithium supply cycle, current market dynamics and risks. We conclude with our strong opinion on investing.

Overview:

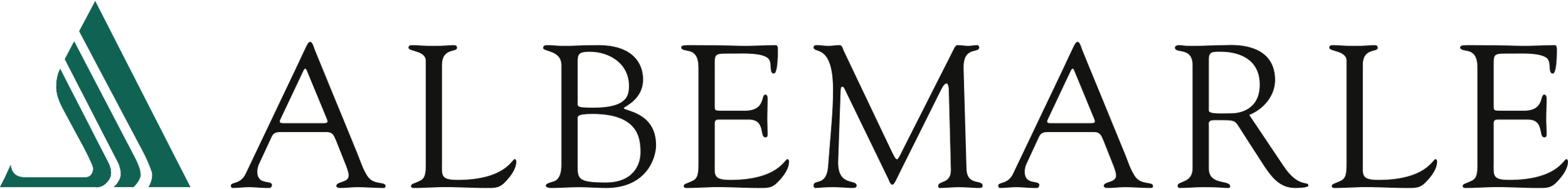

Albemarle is a leading provider of lithium, bromine and other essential elements. As you can see in the graphic below, energy storgage (batteries, including electric vehicles) is the largest part of the business (by sales) and has been a major source of investor attention in recent years.

Long-Term Lithium Demand

For perspective, here is a look at long-term lithium demand (it has a compound annual growth rate expectation of 15-20% through 2030), plus key drivers of demand (such as battery technolgoies).

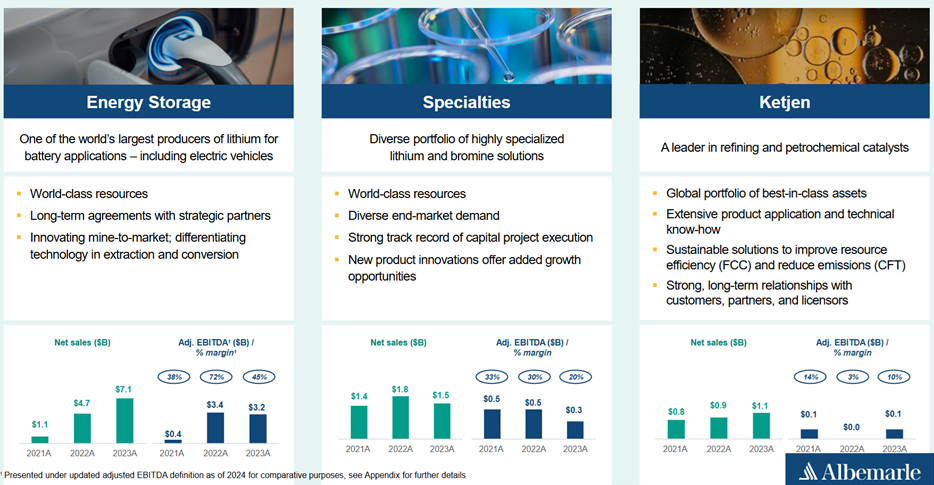

Also a key demand driver for lithium battery technology is the long-term emmission benefits of electric vehicles versus internal combustion emmissions, as you can see in the graphic below.

The Lithium Supply Cycle

Critically important to understanding our invetment thesis for Albemarle is the current lithium supply cycle. Specifically, as the growing demand for lithium because apparent (due to electric vehicle demand) supply flooded the market and drove lithium prices down (this is bad for lithium miners like Albemarle).

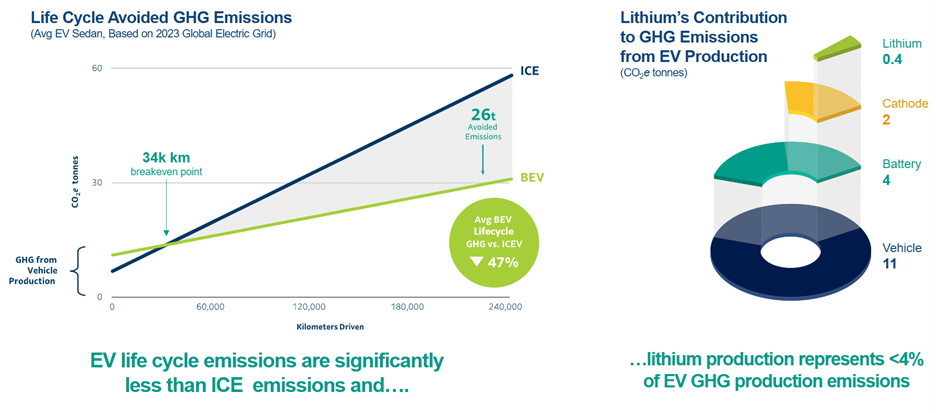

For example, you can see in the graphic below that current marker prices are well below re-investment economics. This basically means there is no enomic incentive for new competitors to enter the market because they won’t be able to make any money (the market price of lithium is below the cost to produce it for most companies).

However, as lithium demand keeps growing, and no new competition enters the market, Albemarle stands to benefit dramatically. For example, you can see in the image above Albemarle’s cost to produce makes them extremely profitable as lithium prices rise.

Albemarle’s Cost Advantage

Also critically important to understand, Albemarle has a cost advantage relative to peers because it owns such high quality assets. Specifically, Albemarle’s lithium assets in Chile (brine operations) and in Western Australia (spodumene hard-rock operations) are a couple of the lowest-cost sources of lithium in the world. So not only is it profitable for Albemarle to mine lithium today (when it is not profitable for others) it will become extremely profitable for Albemarle to mine lithium in the future as both demand and price are on track to rise as the market supply cycle swings.

Market Activity Heating Up:

In perhaps another indication that lithium prices are low and set to rise, deal activity is picking up among lithium companies. For example, Arcadium Lithium’s (ALTM) stock price just jumped dramatically on news it will be acquired by Rio Tinto in a $6.7B deal. Albemarle’s market cap is only $11.7B (small compared to Rio Tinto at $112.9B), thereby making Albemarle a potential acquistion target at this point in the market cycle (i.e. lithium companies appear very inexpensive right now). If Albemarle were to be acquired, it would likely be at a significant premium to the current market price (and thereby proving and immediate gains for shareholders).

Also, China recently announced significant market stimulus activity, which also bodes well for electric vehicles and lithium, as China is a massive user and proponent of increasing the use of electric vehicles.

Valuation

From a valuation standpoint, Albemarles trades dramatically less expensive than a year ago.

And the company maintains an investment-grade credit rating, while also recently announcing measures to further streamline cost efficiency in its operating structure. Moreover, the company’s lithium assets are highly valuable (low-cost production), especially considering growing worldwide demand for lithium.

Risks

The most obvious risk is if lithium prices do not increase, the company will face continuing financial pressures. Lithium market dynamics appear highly beneficial (we seem near a low-point in the suppy cycle while demand continues to grow). Nonetheless, things can still get worse before they get better. It may take years for the Albemarle thesis to play out.

Another risk is that Chile appears to have plans to nationalize lithium production, which could force Albemarle to sell assets at unfavorable prices.

The Bottom Line

Albemarle is a low cost lithium producer at a time when demand is growing. Further, market dynamics indicate we are near a low point in the cycle, and when things turn upward Albemarle’s business is poised to be a huge beneficiary.

The market could rebound over the next few months, or the next few years, but we appear on a collision course with higher global lithium prices whereby Albemarle stands to benefit dramatically. We currently own shares of Albemarle, and look forward to significant long-term price gains.