Despite the recent “dip” (shares are trading 20% below recent all time highs), Eli Lilly remains a very attractive company and compelling investment opportunity (e.g. blockbuster weight-loss drugs, wide moat, massive growth, attractive valuation). In this report, we share the bull case (plus a few bear case arguments, for balance). Let’s get into it.

Overview: Eli Lilly (LLY):

Eli Lilly (a $797 billion market cap pharmaceuticals company) announced quarterly earnings back on August 8th whereby it crushed expectations and raised guidance. Here is how chaiman and CEO, David A. Ricks, explained it in the company’s press release:

"Mounjaro, Zepbound and Verzenio led our strong financial performance in the second quarter as we advanced our manufacturing expansion agenda, and it is equally exciting to see the growth around the world of our medicines for cancer, neurological disorders and autoimmune diseases,"

Weight Loss Drugs are the Story:

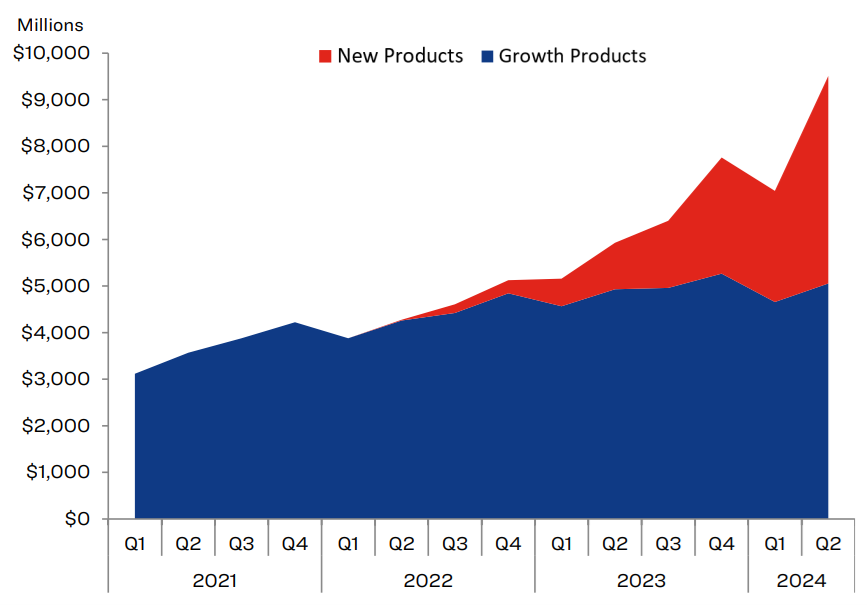

Lilly’s weight loss (and type 2 diabetes) drugs have been the main story, including “new products” Mounjaro and Zepbound.

For reference:

Mounjaro is an injectable prescription medicine that is used along with diet and exercise to improve blood sugar (glucose) in adults with type 2 diabetes mellitus.

Zepbound is an injectable prescription medicine that may help adults with obesity, or with excess weight (overweight) who also have weight-related medical problems, lose weight and keep it off. Zepbound should be used with a reduced-calorie diet and increased physical activity.

Additionally, Verzenio (mentioned in the press release statement above) has also been a growth driver:

Verzenio + hormone therapy is specifically for women with HR+, HER2–, node-positive early breast cancer with a high chance of returning, as determined by a healthcare provider.

Verzenio in addition to hormone therapy (tamoxifen or an aromatase inhibitor) can reduce the risk of recurrence vs hormone therapy alone.

Powerful Growth, Attractive Valuation:

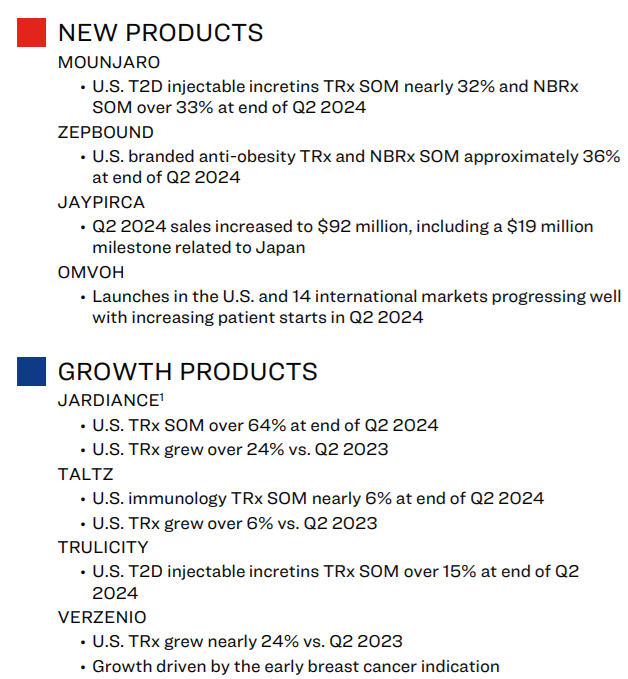

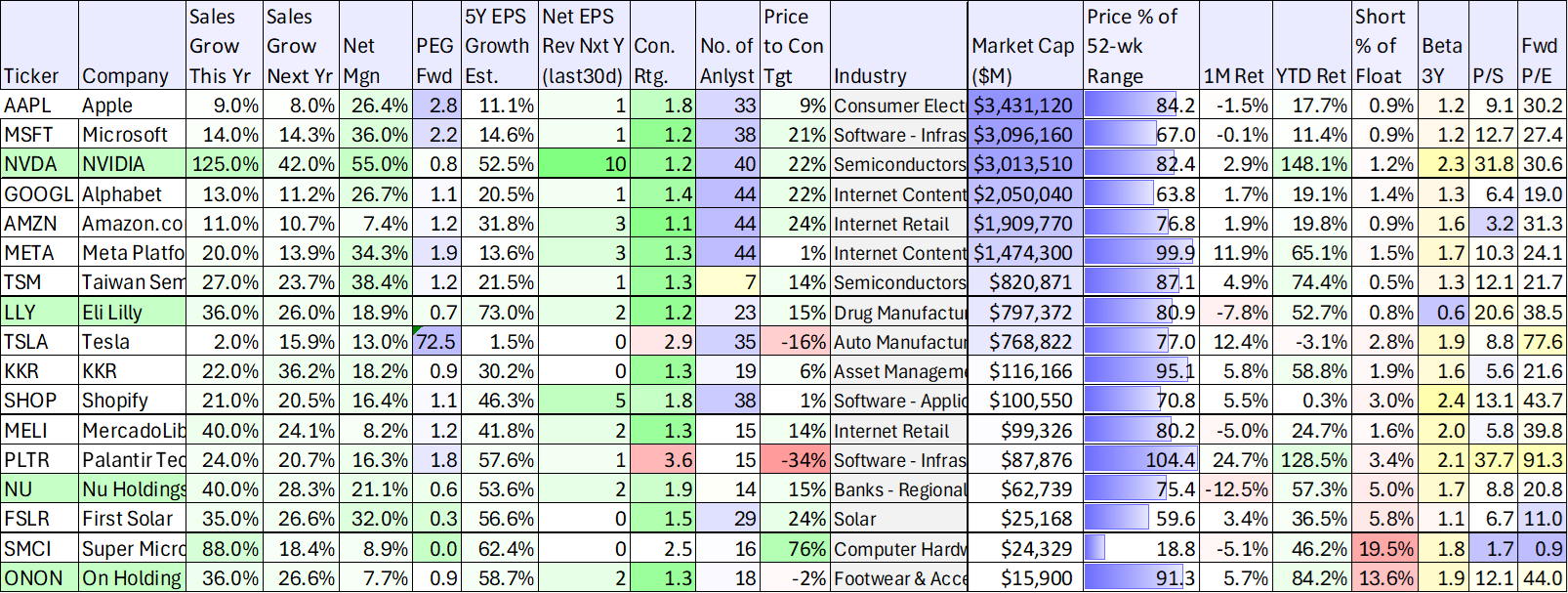

To put Lilly’s business in perspective, here is how it compares to other attractive “high growth” stocks:

Specifically, the stocks in the table above rank highest in terms of expected growth (this year and next) and most attractive (lowest) in terms of forward PEG ratio (i.e. forward Price-to-earnings versus growth, lower is better). These metrics are extraordinary for a company of Lilly’s size. Analyst like it too (as you can see in the table).

Some additional standout metrics include:

25%+ sales growth (this year & next)

18.9% net margin

0.7x Fwd PEG Price

20% off the high

And weight loss drugs people are willing to pay up for.

Also important to mention, Lilly has very strong net profit margins (i.e. it is very profitable), enabling it to continue to pay dividends in addition to growing its business rapidly (noteworthy, it bought back zero shares in the most recent quarter).

Wide Moat

According to Morningstar analyst, Karen Andersen:

“Unlike traditional drugs, Lilly's insulin drugs are very hard to copy by generics and create barriers to entry for noninsulin producers because of the large up-front investments needed to create scale efficiencies. A new weekly insulin in late-stage development offers another avenue of growth in this mature market.”

Important to mention, being overweight, obese and type 2 diabetes are major health issues in the US and around the world, thereby making Lilly’s blockbuster drugs “high demand” for both health and vanity reasons.

Risks

To be balanced, here are “bear case” arguments and risks Lilly faces:

Regulation and lawsuits: Regulation and lawsuits are a constant threat for pharmaceutical companies. For example, if some new health risk (or adverse affect) of one of Lilly’s blockbuster drugs was to be discovered, this could have a dramatically negative affect on the stock price if regulators shut it down (the particular drug) or lawsuits demand massive financial compensation. As a reminder, this is why we invest through a diversified portfolio (i.e. to reduce and offset the potential impacts of these types of risks).

Competiton is another risk. Even though Lilly is a wide moat business (with competitive advantages, as described earlier), it does face competiton. For example, according to Morningstar analyst, Karen Andersen:

“Competition to weight-loss drug Zepbound could significantly increase over the next three years, from both established competitor Novo Nordisk and new entrants.”

High Traditional Valuation Metrics: Lilly does have high traditional valuation metrics, such as price-to-earnings and price-to-sales ratios, as you can see in our earlier table. However, these metric are actually quite reasonable when you consider them relative to the companies high sales and earnings growth trajectories. Nonetheless, the 23 Wall Street analysts covering the shares (as you can see in our earlier table) rate Lilly a “Strong Buy” (with a 1.2 aggregate rating, on a scale of 1-5, with “1” being the best).

No recent share repurchases may be a red flag to some, as perhaps an indication from management they believe the shares are a bit overpriced in the near term.

The Bottom Line

Eli Lilly is an extremenly attractive business trading at a low price relative to the growth trajectory of its high-growth and high-profit blockbuster drugs, particularly Mounjaro, Zepbound and Verzenio. And despite the relatively high traditional valuation metrics, Lilly remains inexpensive relative to growth (such as forward PEG ratio), and the shares just sold off 20% from all-time highs (despite beating and raising on quarterly earnings and guidance, which has resulted in analyst upgrades), thereby providing some additional margin of safety.

We currently do NOT have a position in Eli Lilly in our Disciplined Growth Portfolio, but we may add shares soon.