They often say “you don’t want to see how the sausage is made,” but in this report we are going to look under the hood at PIMCO’s Dynamic Income Fund (PDI) to see how this popular closed-end fund (“CEF”) really generates that big 13.1% “yield” (paid monthly). We put “yield” in quotes because it’s really an artificially manufactured “distribution” that recently included a massive amount of taxable return of capital (“ROC”) something many investors try to avoid like the plague. After reviewing the fund, the distribution and the risks, we conclude with our strong opinion on investing.

What is PDI?

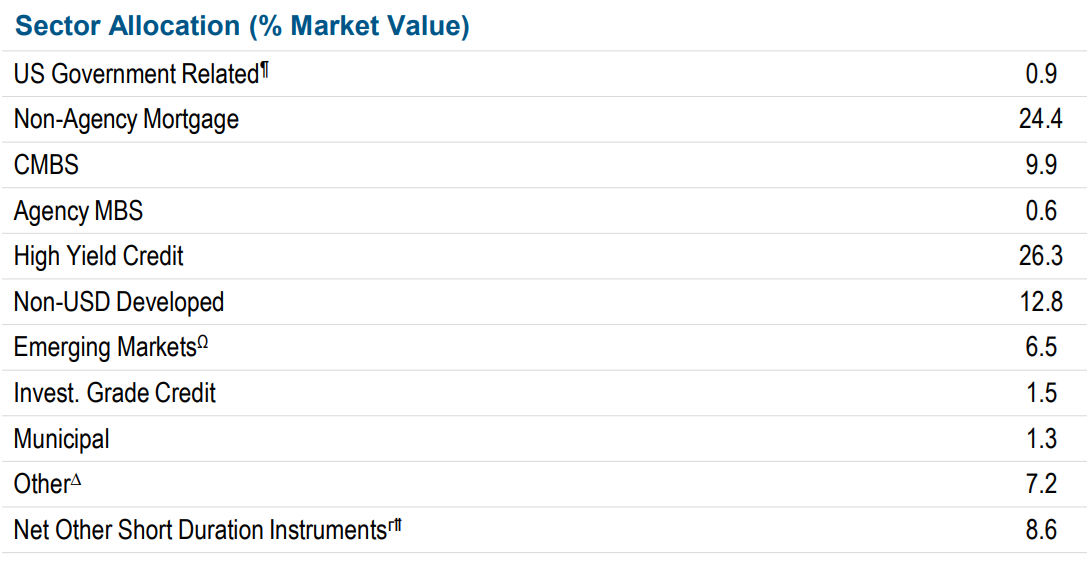

The PIMCO Dynamic Income Fund (PDI) is a bond-focused closed-end fund. That means it invests mostly in fixed-income (bond) securities (see graphic below). And unlike open-end funds, CEFs don’t trade in the open market at their net asset value (“NAV”) price, rather CEFs trade based on supply and demand (because CEFs don’t continuously offer new shares, they’re “closed-end”) which means they can trade at premium prices (above NAV) and discounts (below NAV) in the market (PDI currently trades at a premium of around 16.7%, more on this later).

CEFs come in a variety of shapes and sizes, so we always ask the following questions before investing in any CEF (and we will refer back to these questions throughout this report).

Why is PDI Special?

PDI is special in the CEF world for a variety of reasons. For starters, PIMCO is considered the premier bond fund manager by many around the globe. PIMCO has deep resources and expertise, and PIMCO funds often trade at premium prices because investors are willing to pay up for the trust they have in this company, as well as its long track record of success.

PIMCO bond funds are typically among the largest CEFs by assets under management for the same reasons as described above (e.g. trust, track record of success) and of course the big distributions (paid monthly in most cases, such as PDI).

How Does PDI Source that Big Monthly Distribution?

So the billion dollar question is “how” does PIMCO source those big monthly distribution payments that so many investors have grown to love?

For starters, it’s important to recognize that the distributions are not a yield (i.e. they’re NOT entirely generated from interest on the bonds), but rather a combination of things, such as interest (paid by the underlying bond holdings), capital gains (both short-term and long-term) on the underlying holdings, and even a Return of Capital (“ROC”) whereby the fund may simply return some of your own original investment dollars just to support the monthly distribution payments.

Here is how PIMCO describes it in its most recent annual report (empahsis ours):

Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions.

And for your consideration, here is the most recent monthly Section 19 Notice for PDI (referenced in the quotation above). As you can see, not all of the income is “investment income” and none of it is “realized capital gains.” A significant portion is this new (in recent years) category called “Paid-in Surplus or Other Capital Sources.”

“Paid-in Surplus or Other Capital Sources” is basically just a euphamism for likely ROC (which is considered a bad thing by many investors, especially if it is large or consistently occurs because it can reduce a fund’s future income earnings power by lowering its investment basis).

The reason the company doesn’t use the term ROC is because they’ve been using complex derivative instruments (mainly paired interest rate swap transactions) to basically offset ROC in the short-term, with the possibily of never recognizing it in the long-term if the second leg of the paired swap transaction moves in the right direction before it expires (they’re basically kicking the can down the road).

The naming convention is basically a financial accounting versus tax accounting difference, and here is how PIMCO explains it in its recently released annual report (emphasis ours):

A Fund may engage in investment strategies, including those that employ the use of paired swaps transactions, the use of interest rate swaps to seek to capitalize on differences between short-term and long-term interest rates and other derivatives transactions, to, among other things, seek to generate current, distributable income, even if such strategies could potentially result in declines in the Fund’s net asset value (“NAV”). A Fund’s income and gain-generating strategies, including certain derivatives strategies, may generate current income and gains taxable as ordinary income sufficient to support monthly distributions even in situations when a Fund has experienced a decline in net assets due to, for example, adverse changes in the broad U.S. or non-U.S. equity markets or a Fund’s debt investments, or arising from its use of derivatives. For instance, a portion of a Fund’s monthly distributions may be sourced from paired swap transactions utilized to produce current distributable ordinary income for tax purposes on the initial leg, with a substantial possibility that a Fund will later realize a corresponding capital loss and potential decline in its NAV with respect to the forward leg (to the extent there are not corresponding offsetting capital gains being generated from other sources). Because some or all of these transactions may generate capital losses without corresponding offsetting capital gains, portions of a Fund’s distributions recognized as ordinary income for tax purposes (such as from paired swap transactions) may be economically similar to a taxable return of capital when considered together with such capital losses.

The UNII Report:

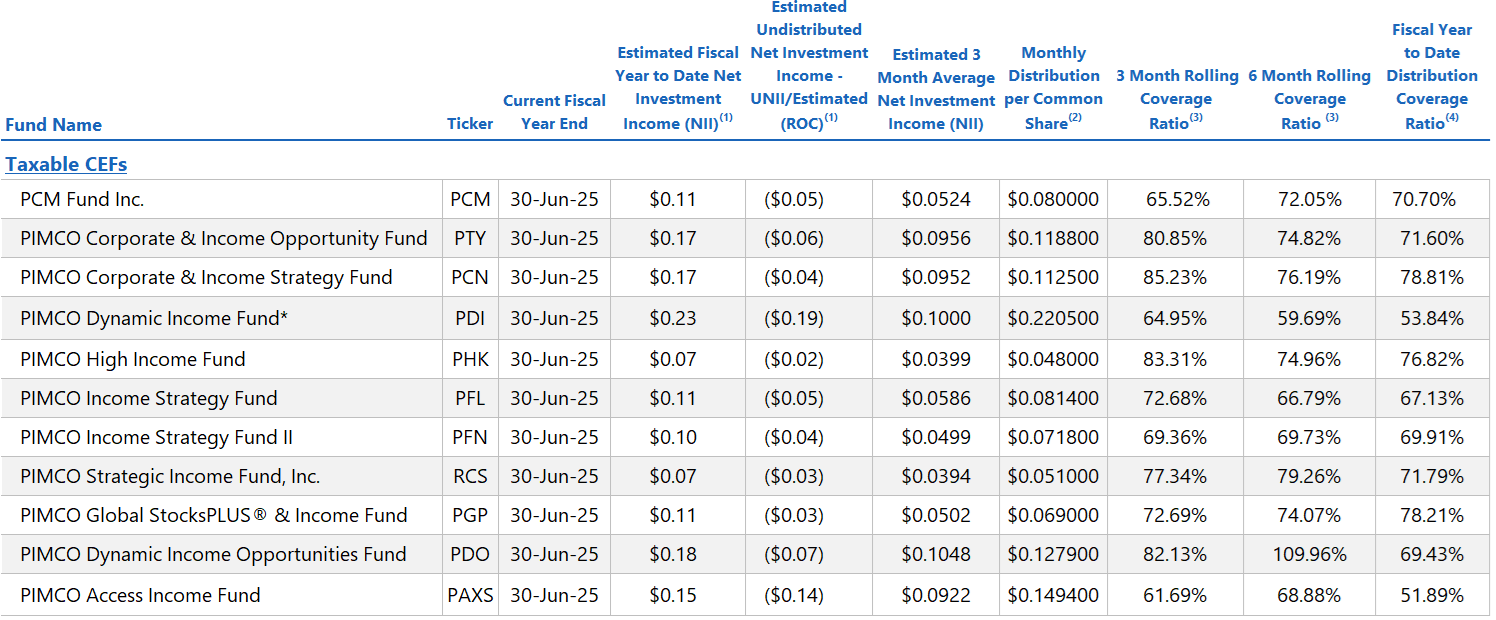

And to give you more perspective, here is a look at PIMCO’s latest “Undistributed Net Investment Income” (or UNII) Report (below), including PDI (and other popular funds too).

You can see the fund(s) have NOT been generating enough investment income to cover the distributions paid. PDI’s recent “3 Month Rolling Coverage Ratio” was only 64.95% (ideally it should average closer to 100%).

Tax Basis Return of Capital (“ROC”)

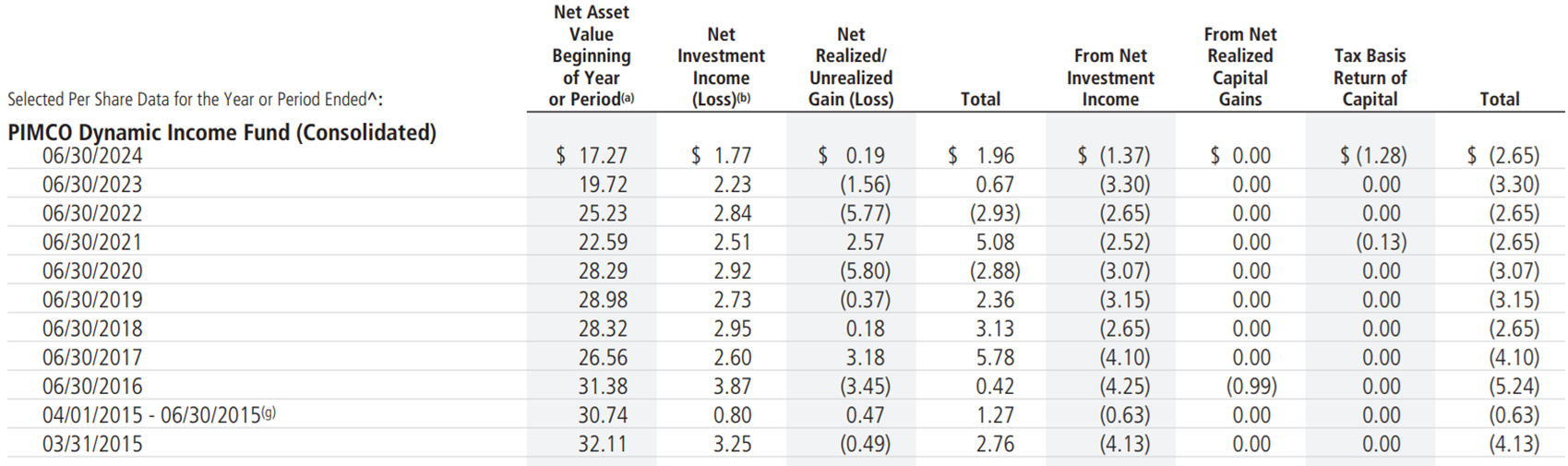

And just to make it explicit, you can see in this excerpt from PDI’s latest annual report (reporting date of 6/30/24), the fund did finally recognize a big “Tax Basis Return of Capital” of $1.28, which is quite large considering the annual forward distribution is currently only $2.65 (so the percent of the distribution that was ROC was nearly 50%—yuck!).

Considering the fund has not been explicitly reporting ROC in its section 19 notices (the location many investors are accustomed to finding it) because of PDI’s use of paired interest swap transactions, many have been investing in PDI wrongly believing it had been covering its big distribution without ROC—which it has not been.

What’s so bad about ROC?

A little ROC here and there isn’t a big deal if it’s being used to keep the monthly distributions big and steady (the way a lot of investors like), especially if the fund is able to add some NAV gains at some point in the future. But when ROC is large (like it has been for PDI) two “bad things” may happen:

First, ROC can reduce the NAV of a fund, and a lower NAV makes it harder for the fund to produce as much investment income. So consistent and/or large ROC can create a vicious cycle of bad performance and potentially distribution reductions.

Secondly, if you own PDI in a taxable brokerage account, ROC can reduce your cost basis. This means when you do eventually sell you may potentially be hit with a larger capital gain tax than you expected. If you own PDI in a tax-advantaged retirement account (and/or bequeath your shares to your heirs when you die) it’s likely not as big of a deal (depending on your situation).

What Caused the ROC and NAV Decline?

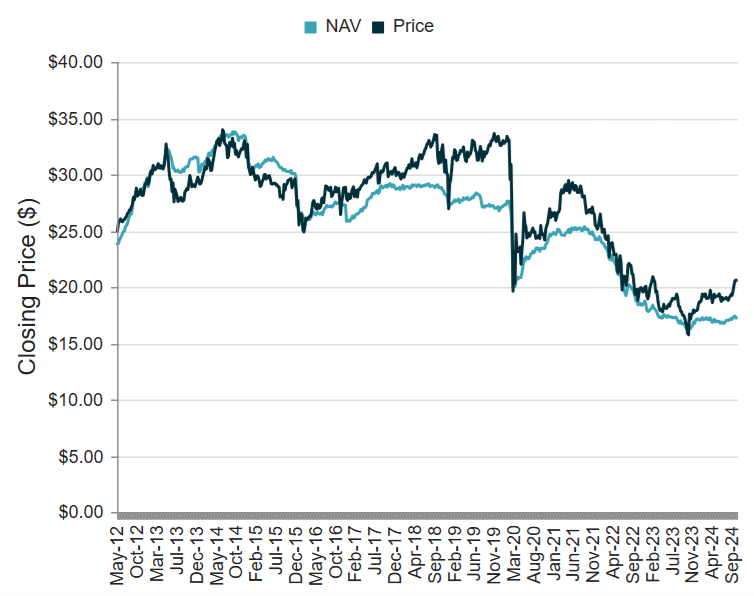

The net asset value of PDI has declined over time as you can see in the following chart. This means the future earnings power of the fund has been diminished (all else equal).

The reason NAV has declined has been a combination of pressures created by interest rates rapidly rising from around 0% following the covid pandemic to where they are now (when rates rise, bond prices (e.g. PDI’s NAV) fall, all else equal), and the resulting ROC (which was only recently reported formally from a tax basis) that has been used to support the big distribution during this historically challenging interest rate environment. For example, compare the $1.28 per share of ROC (from our earlier table) to the size of the NAV decline per share in the chart above (relatively speaking, $1.28 is a lot!). The fund basically just took a big bath (from a tax standpoint anyway, the actual ROC has been recognized over time in the NAV—combined with the lower bond prices from interest rate increases).

Why Should Investors Consider PDI Now?

Aside from the big monthly distribution payments, investors may want to consider investing in PDI now for a couple reasons.

First, PDI just took a big bath in the ROC department. This removes a lot of the legacy ROC (that was being reported as “Additonal Paid in Capital”) from the books. In some sense, this clears the road a bit for investors going forward.

Secondly, unprecidented interest rate volatility (and fiscal and monetary stimulus) following the pandemic created massive headwinds for PDI. However, now that we are in a more “normal” environment the distribution and NAV may be more stable. And if interest rates do come down, as some markets are predicting, then PDI stands to benefit (it has a recent duration of 3.07 years, and if rates fall, PDI’s NAV will rise, all esle equal). We wrote in more detail about this here.

What are the Risks?

Before investing in PDI, investors should also consider the risks. Here are a few of the big ones:

Leverage: PDI recently reported leverage (or borrowed money) of 35.9% (this is down a bit from months prior where it was over 40%). Leverage can help magnify income and price gains in the good times, but it can also magnify risks and losses in the bad times. PIMCO is a highly skilled firm that can manage leverage better than most individuals (and at lower rates through repo markets for example), but leverage is still a risk (it’s basically what got the fund in trouble during the volatile post-covid interest rate environment and thereby lead to the big recent taxable ROC event and significant decline in NAV). Nonetheless PDI has maintained a big monthly distribution throughout (which is essentially what many people want and focus on the most).

Fees and Expenses are another risk. Specifically, management fees detract from performance and leverage (the cost of borrowing) is expensive (particularly as rates have risen over time). However, PIMCO (as a large institution) gets investors access to fixed income markets and income streams that individual investors could not access on their own, and they do it in a disciplined way (also a valuable thing). Nonetheless, the fees and expenses on this fund are very high.

NII not covering distribution is also a risk. As we saw earlier, net investment income has not been covering the distribution recently. While not untypical, it is a risk and should be monitored.

Premium versus NAV: PDI currently trades at a relatively large price premium (+16.7%) relative to its underlying NAV. While large premiums are not uncommon for PIMCO (it is often considered the best in the business) it is still a risk that should be monitored. For perspective, here is a look at the current and historical premium/discount on this fund.

Macroeconomic Conditions are always a risk for this fund and basically all investments. PDI’s price fell hard when the pandemic hit, and any similar or large macroeconomic events could have a significant negative impact on the fund.

Conclusion:

If you have your entire nest egg in PDI… Don’t. That too much risk for one fund. But if you own it as part of a prudently-diversified goal-focused portfolio, that can make a lot of sense. The distribution is large (and will remain large even if market conditions get bumpy) and the bond market (including PDI) may be poised to rebound hard now that interest rates have stabilize (and may even fall from here), especially considering the fund already took a big taxable ROC bath that is now out of the way.

At the end of the day, you need to do what is right for you, based on your own personal situation. We currently have a small position in PDI in our prudently-diversified Blue Harbinger High Income NOW Portfolio.