Income-focused investors are frequently attracted to business development companies (“BDCs”) for their large dividend payments. And among BDCs, Ares Capital (ARCC) is the stalwart blue chip that leads the industry (and currently offers a big 9% dividend yield). But before you invest in Ares, let’s take a closer look at what they do and how they compare to peers (especially ahead of this upcoming BDC earnings season). In this report, we review the business, the current market environment (especially fixed-versus-floating interest rate dynamics, plus rising non-accruals), what we like and don’t like (i.e. risks) and then conclude with our strong opinion on investing.

Overview: Ares Capital

Like other BDCs (and to dramatically oversimplify), Ares basically provides capital (usually loans and sometimes equity investments) to small business (i.e. the “middle market”). BDCs are unique versus other publicly-traded investments because they don’t have to pay any taxes at the corporate level as long as they pay out the majority of their income in the form of dividends to investors. This gives BDCs a distinct advantage (Congress did this to help “small business” compete) and it’s also why BDCs pay the big dividends that so many investors love.

Just as a side note, know that BDC dividends are usually not “qualified dividends” which means they don’t qualify for the lower dividend tax rate that most publicly-traded companies do, so pay attention to this depending on your tax bracket and the type of account you own your BDCs in (taxable brokerage account versus tax-advantage retirement accounts, for example).

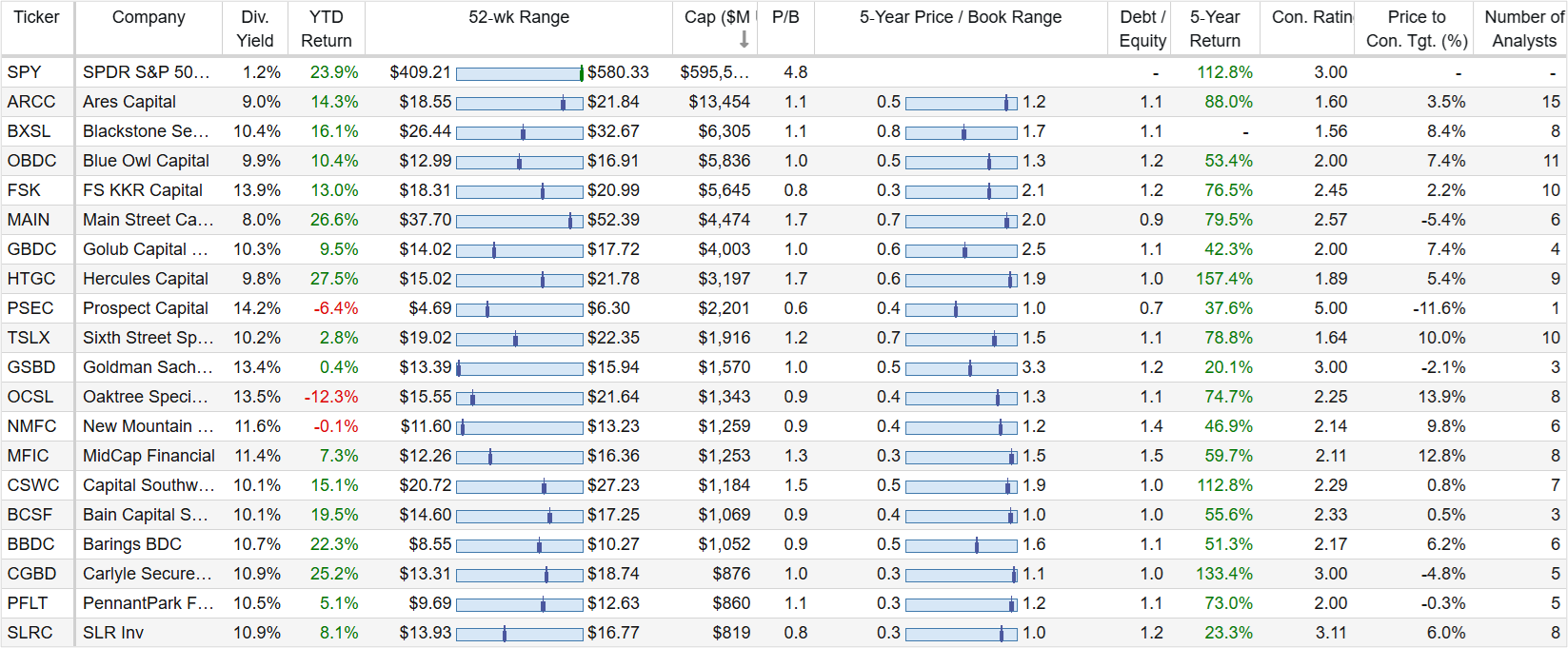

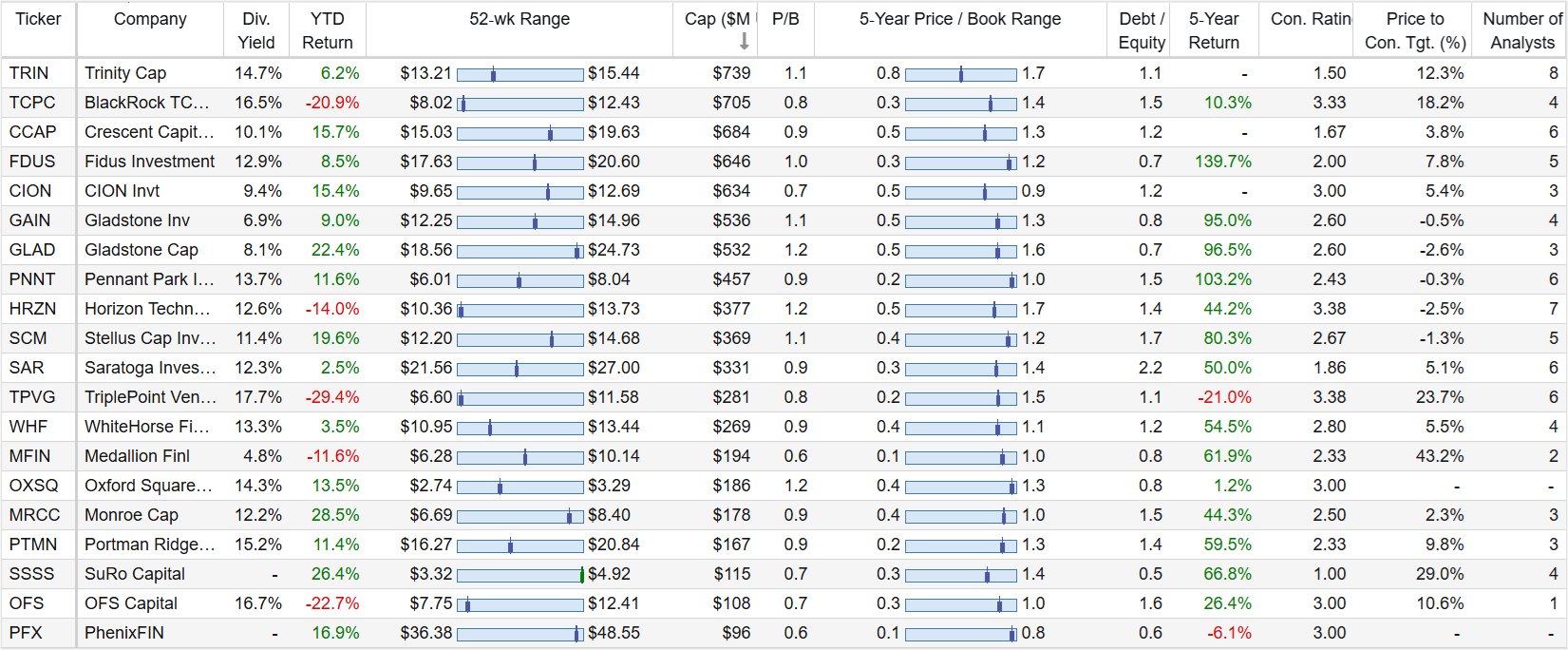

25+ Big-Yield BDC’s Compared

For some perspective, here is a look at 25+ big-yield BDCs, sorted by market cap (Ares is at the top of the list, after the S&P 500 index (SPY) because it has the largest market cap).

You likely recognize many of your favorite BDCs in the table above. You’ll also notice important BDC metrics, such as price-to-book value versus history, debt-to-equity ratios, recent share price performance (total returns) and of course dividend yields (as you can see, many of them are quite large).

How Ares is Different

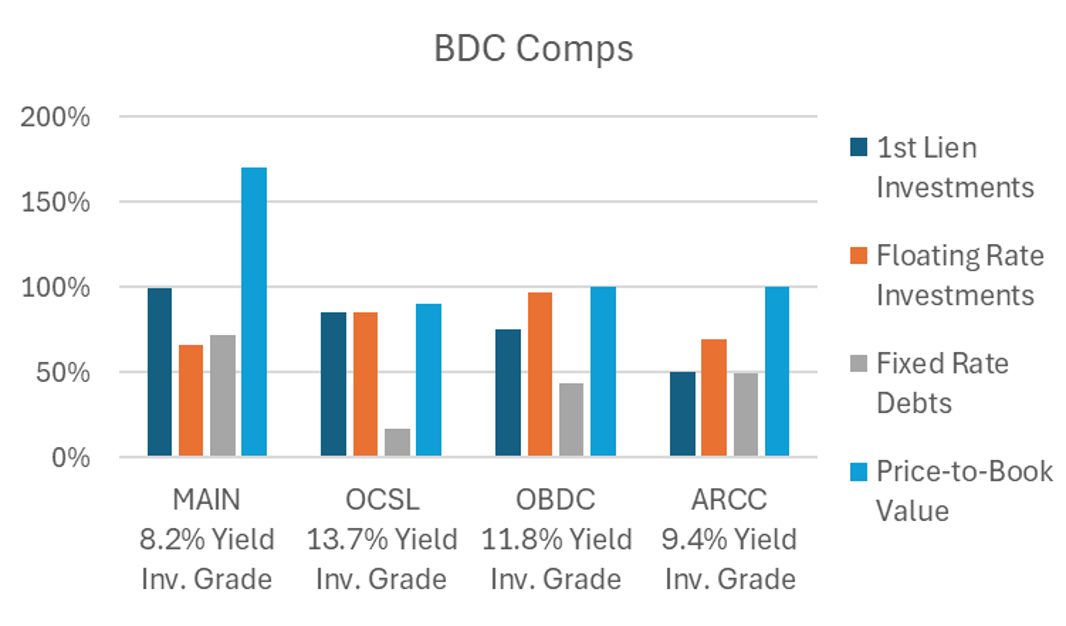

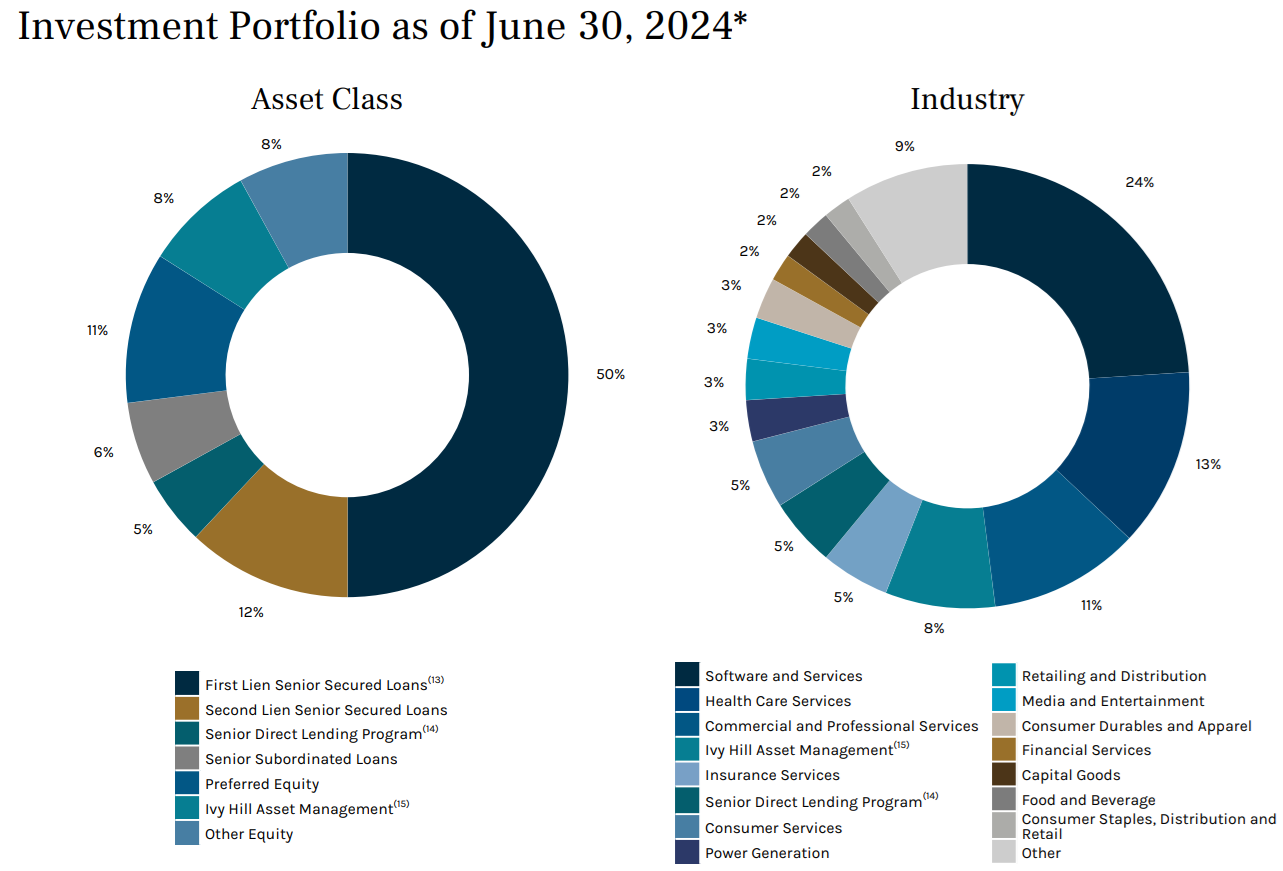

But before you go selecting BDCs based only on the data in the above table, just know that BDCs can be dramatically different in many ways, such as the industries they serve (e.g. tech, industrials, etc.), the types of financing they provide (e.g. debt, equity), the types of loans (e.g. safer first lien loans or second lien loans) and the types of financing they use and give (e.g. fixed versus floating rate loans), to name a few. For example, you can see how Ares recently compared to a few other top BDCs in the following graphic.

So basically, Ares has a good balance between fixed and floating rate debts and investments, thereby mitigated the more extreme interest rate risks some other BDCs face. For example, when rates go up other BDCs earn more on floating rate investments, but that can also cause more stress on those investments potentially leading them to default (not good for the BDC or the BDC investors).

Current Market Environment

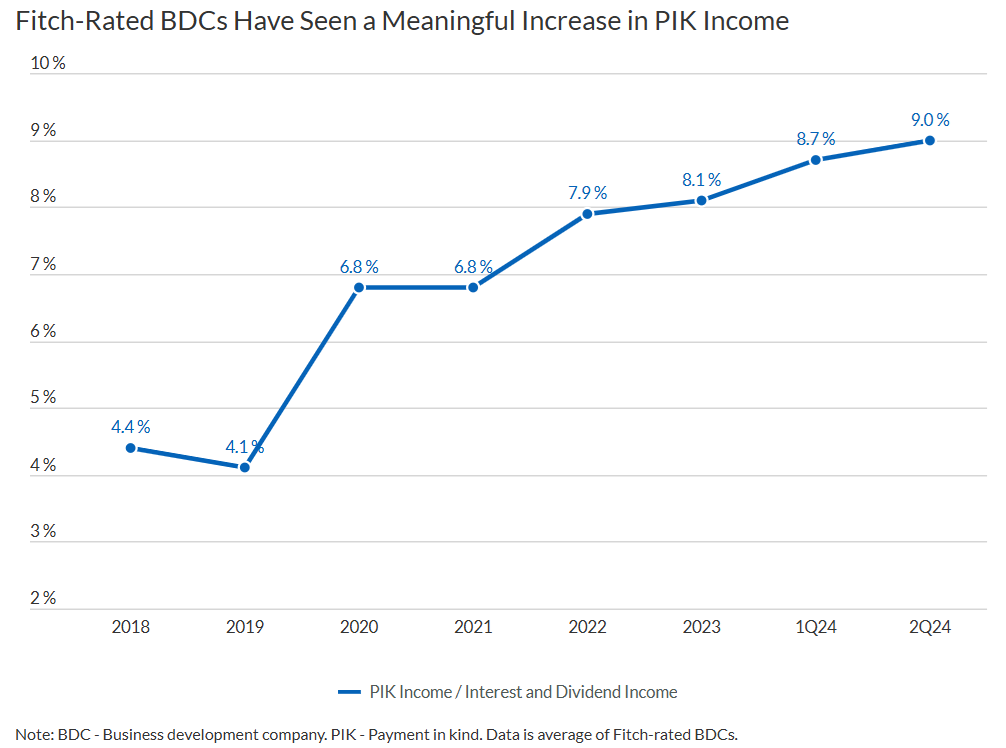

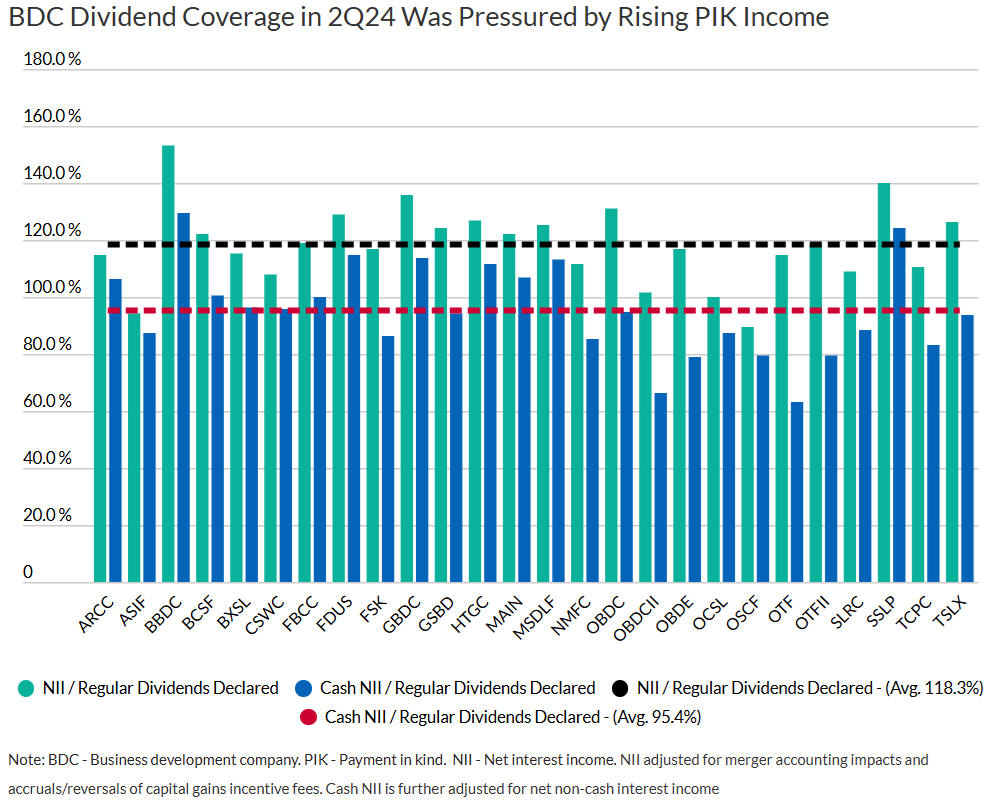

And as we head into earnings season in the upcoming weeks, it’s important to consider the current market environment. For example, you can see below that BDCs across the industry have been experiencing increased PIK income (not good).

PIK income is “payment-in-kind” bonds (for example) which are a unique type of debt security where the issuer can make interest payments by issuing additional bonds rather than paying cash. This allows companies to defer cash interest payments until the bond matures, reducing immediate cash outflows and providing flexibility in managing their cash.

BDC Dividend Safety:

And according to a recent report from Fitch Ratings, dividend coverage ratios are expected to weaken

U.S. business development companies’ (BDCs) cash earnings coverage of dividends is expected to weaken further from 2Q24 levels as the persistence of elevated interest rates will drive further increases in paid-in-kind (PIK) income, Fitch Ratings says. Potential rate cuts, spread compression and higher non-accruals are also headwinds to BDCs’ net-investment income (NII).

Fitch also notes that BDC’s clever introduction of supplemental dividends in recent years will help keep the normal dividend coverage ratios healthier. Many BDC’s net investment income (“NII”) has already fallen below 100% on a cash earnings basis (not good). Notably however, Ares continues to cover its dividend (as you can see in the above table which includes the most recent quarterly data).

Fitch also notes:

“BDCs are required to distribute 90% of taxable income, including PIK interest, and increasing PIK interest income could result in mismatches between cash interest received and cash dividends paid out.”

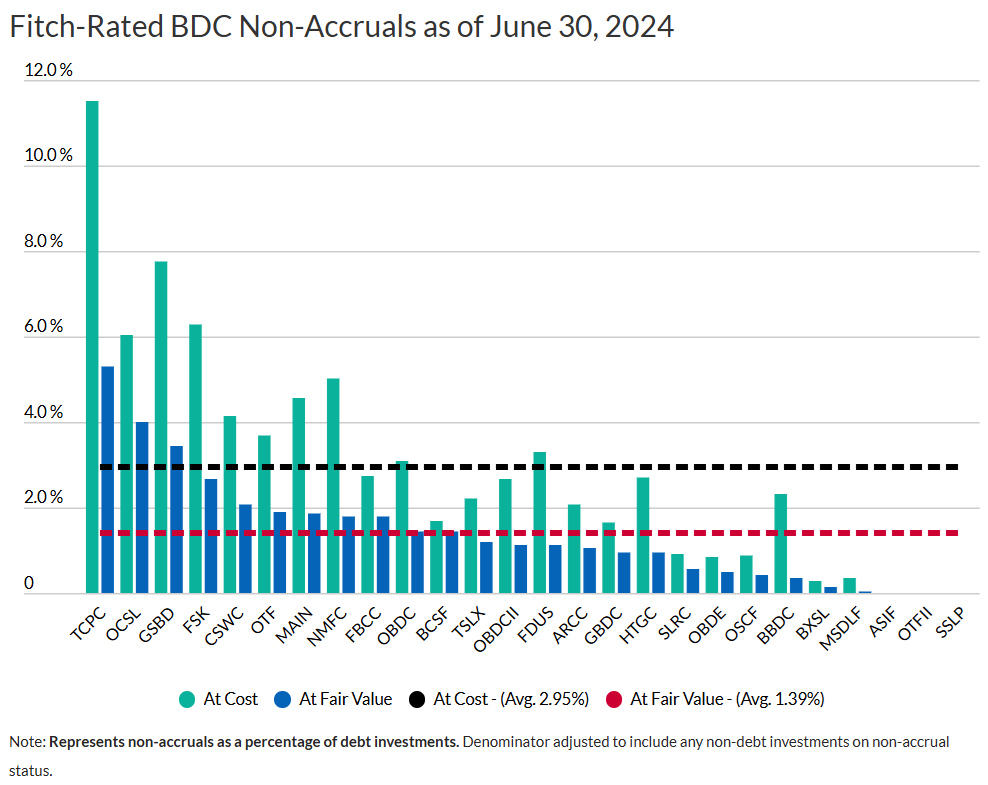

Further still, BDCs face asset quality risks as “non-accrual” levels have risen (non-accrual is basically when a loan recipient doesn’t have the financial wherewithal to pay back the loan per the agreed upon terms—i.e. it’s not a good thing).

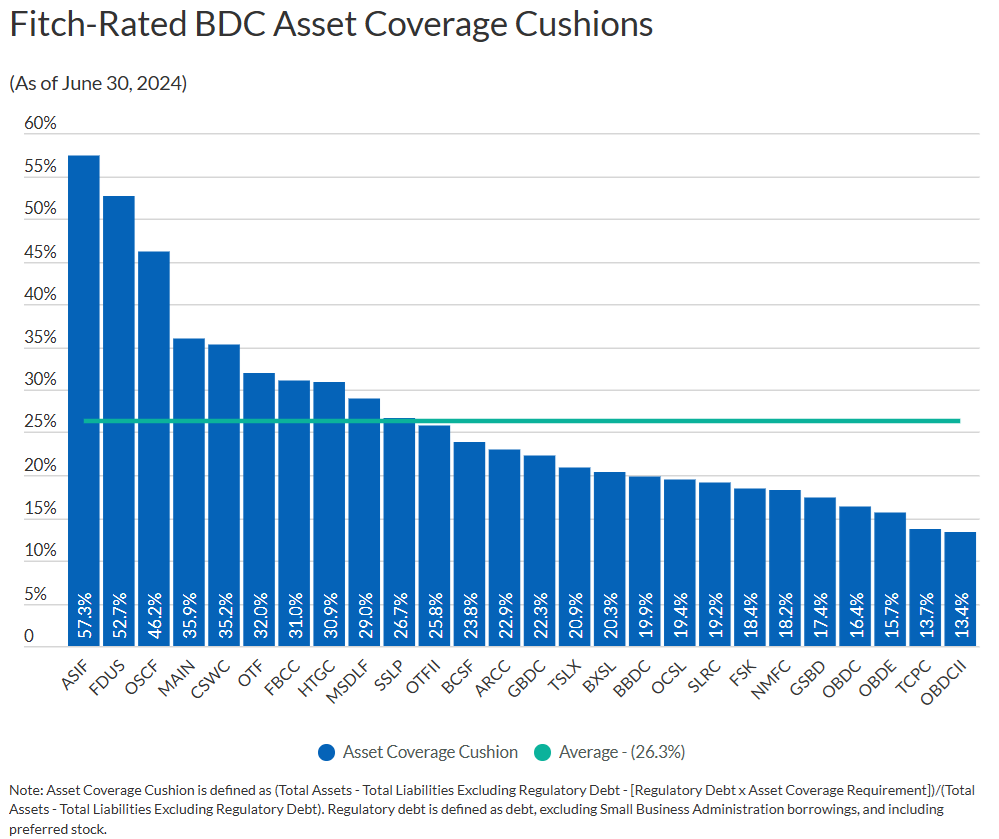

However, “asset coverage cushions remain sufficient to account for additional realized losses and investment valuation declines in the near term,” according to Fitch.

Why Ares is Attractive

So with that backdrop in mind, let’s consider a few key reasons why Ares is attractive:

Dividend coverage: Ares continues to cover its big dividend in the current market environment; and it has plenty of asset cushion (as we saw earlier) to support the business. Further, Ares has lower PIK income versus many peers (also a good thing).

Large size is another attractive Ares quality because it gives the company deep resources, allows it to diversify prudently and helps it win more deals (through financial wherewithal and existing wide relationships).

An investment grade credit rating is another attractive quality and testament to the strength of the business.

Balanced interest rate risk exposure: As we saw earlier, this reduces Ares risks versus many other BDCs if interest rates continue to be volatile.

A well-diversified portfolio also reduces risks for Ares versus other BDCs which have higher concentration risk (due largely to their smaller size).

Deep resources and talent also give Ares a competitive advantage versus other BDCs. This is a result of their years in the business and large size.

Reasonable price-to-book value: Ares’ current price-to-book value is just over 1.0 (it trades at a small premium) and fairly consistent with its own history, an indication that it may be appropriately valued. Additionally, the companies recent moves towards more first lien loans (safer) also warrants a higher valuation multiple anyway.

Highly-rated among Wall Street analysts: As you can see in our earlier table, Ares is one of the most-covered and highly-rated BDCs, adding additional support to its attractiveness.

Big Dividend: And of course, the big steady dividend, which has never been cut (only increased) over the last 19 consecutive years is another reassurance of the company’s commitment to supporting the big dividend paid to investors.

Risks

The economy (and interest rates) are probably the biggest risk for Ares. If the economy slows then more investment companies may not be able to support their debt payments to Ares (i.e. more defaults). Additionally, dynamic interest rates put pressure on Ares in different ways, considering the company’s balanced mix of fixed and floating rate investments and debts.

Increasing BDC Competition (in a crowded market) is another risk Ares faces. In particular, there is a growing number of BDCs (many of them increasing in size) chasing after the same middle market opportunities. The BDC space has grown since regulation following the ‘08-’09 financial crisis removed a lot of competition from banks (because new regulatory reserve requirements made it unattractive for banks to compete in some lucrative middle market lending spaces). However, Ares has competitive advantages versus other BDCs based on its large size, deep resources and existing relationships all of which help it win more deals.

Regulatory Risks are another concern. The entire BDC industry basically exists because tax laws (no corporate taxes if BDCs pay income out as dividends) made BDCs more profitable versus the risks they are taking on. The previous Trump administration was favorable to BDCs (allowing them to take on higher levels of debt, although most of them have avoided it so far). However, any changes to regulatory or tax rules could have a significant impact on BDCs in general and Ares in particular.

Conclusion

Despite the risks, Ares is well positioned to handle the dynamic economic environment while still supporting and growing its business and its dividend. The valuation is neither low or high by its own historical standards, but if you are looking for a financially strong and leading BDC for your high-income portfolio, Ares is absolutely worth considering. We continue to own shares in our Blue Harbinger High Income NOW portfolio and have no intention of selling (as the big dividend keep rolling in).