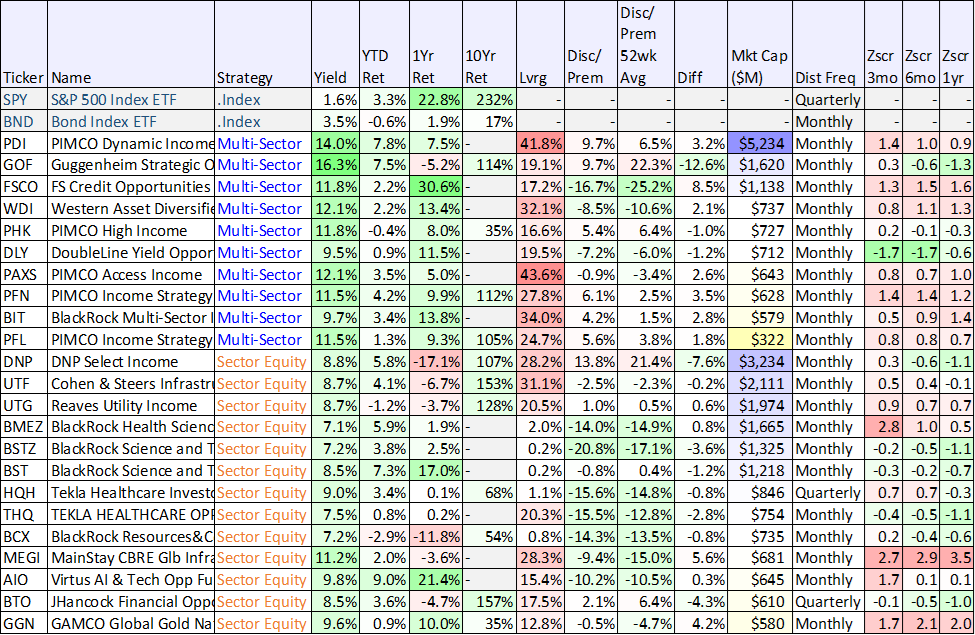

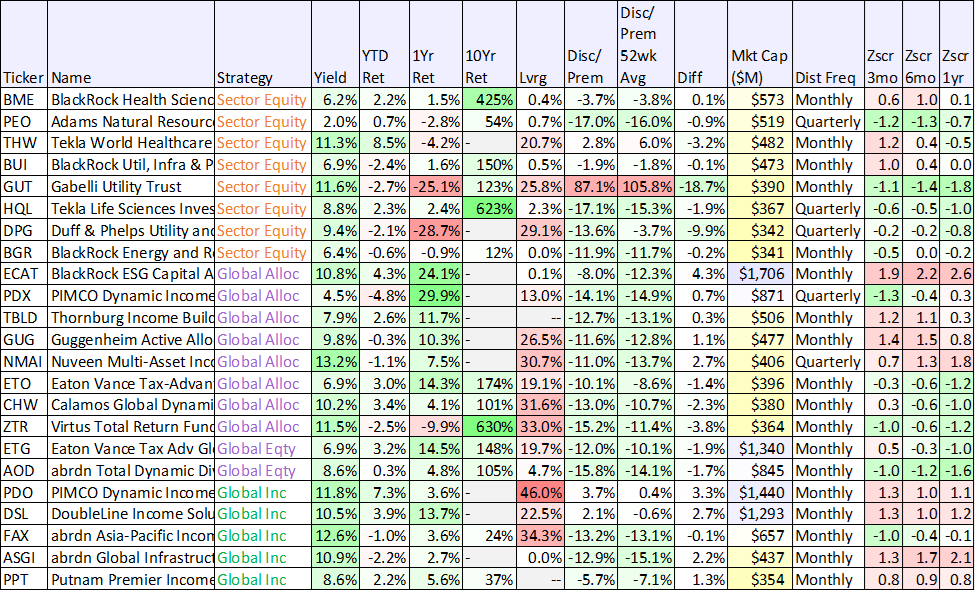

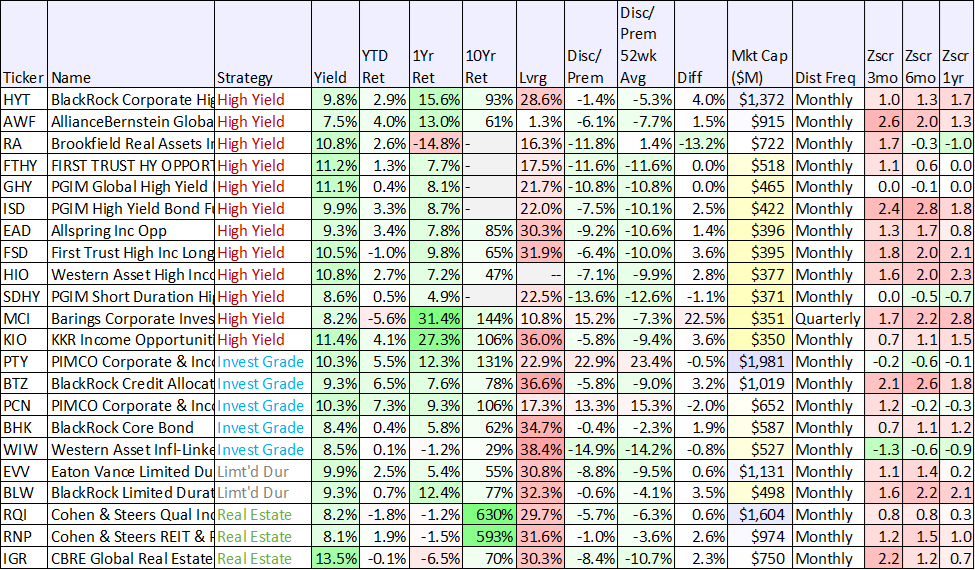

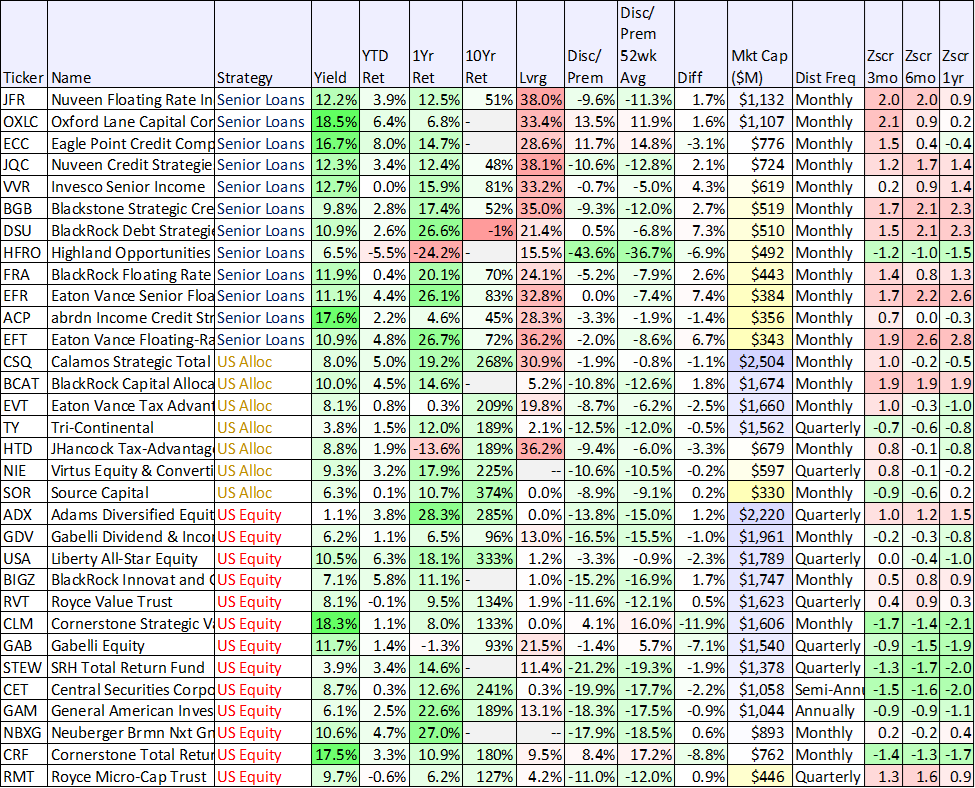

In this report, we share updated data on 100 big-yield CEFs from across a variety of categories. The data is ranked by market cap, per category, but you can also compare these big yield opportunities on discounts-premiums, leverage, recent performance metrics and more. We conclude with our opinion on where we’re seeing the best (and some of the worst) big-yield opportunities in the current market environment.

100 Big-Yield CEFs:

You likely recognize at least a few of your favorite big-yield CEFs in the following table. As mentioned, the table is sorted fist by category, and then by market cap within each category. The most popular CEFs generally have the largest market caps, so that’s a good place to look for your favorites.

data as of 30-Jan-2024, source: StockRover

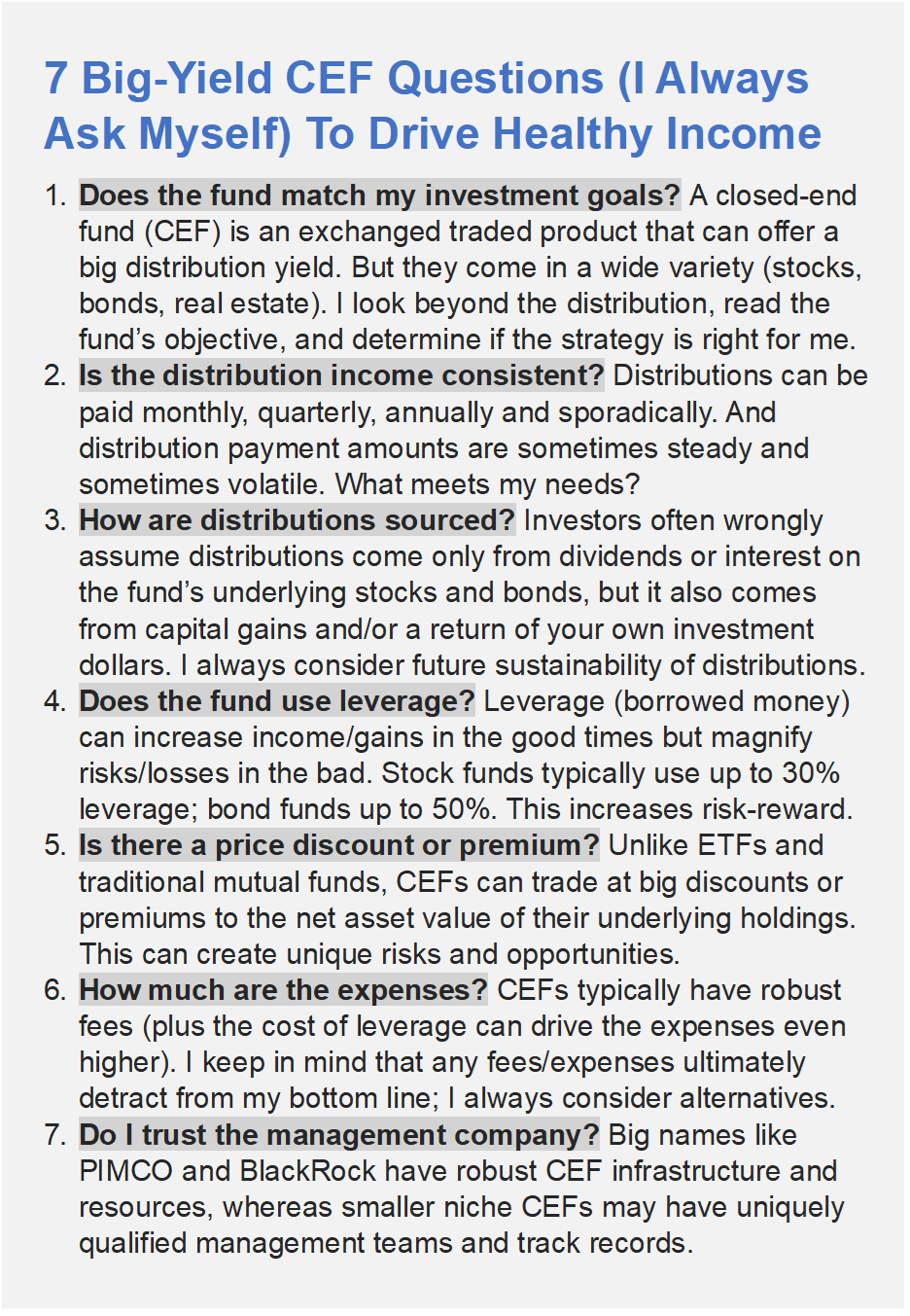

These CEFs vary widely by category, strategy and objectives. However, here is a short list of a few of the things we look for in every CEF opportunity.

Our Top Big-Yield CEF Picks:

If you are an income-focused investor (and depending on your own specific goals), we are seeing a lot of attractive opportunities among bond CEFs right now (such as select opportunities from PIMCO—the leader in the space). Many people have sworn off bond CEFs recently because the historically-rapid rise in interest rates (in 2022-2023) led to a historically-rapid decline in bond prices (as rates rise, bond prices fall). But with interest rate hikes now paused (and increasing expectations for cuts later this year), Bond CEFs are providing some of the most attractive high-income opportunities in the market right now.

In fact, multiple big-yield bond CEFs made it into our latest ranking: Top 10 “High Income NOW” Securities…

At the end of the day, every investor has to do what is right for them, based on their own individual situation. Disciplined goal-focused long-term investing continues to be a winning strategy.