In this report, we review market sector performance. Technology continues to dominate, semiconductors in particular. We consider the themes behind the sector strength (e.g. Artificial Intelligence and the digitization of everything), and then dive into our top semiconductor (and related hardware) companies benefiting from the secular trends, including our current holdings.

Market Sector Performance:

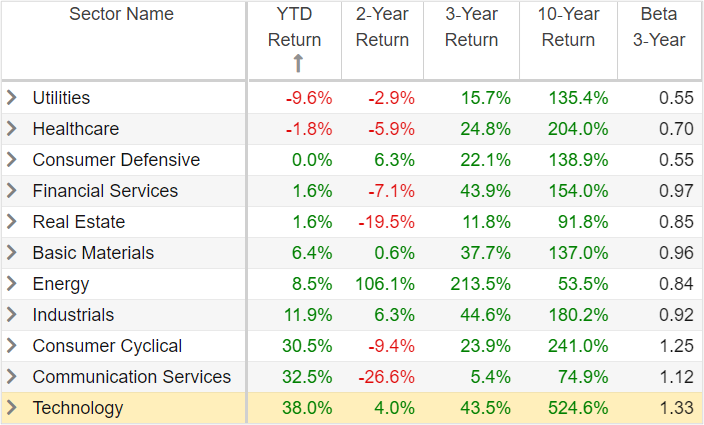

Thus far, it’s been a fairly textbook “risk on” year, with conservative market sectors lagging and more volatile sectors leading (see table below). The story remains fairly consistent over the last decade, however a strong case can be made that it is the large ongoing secular disruption in the technology sector that has caused particularly outsized returns relative to other sectors. For example, mega cap stocks have largely benefited from the ongoing “digital revolution” and migration of data to the cloud.

And within the technology sector, semiconductor stocks (see below) have dominated as they are a necessity to the aforementioned megatrends (i.e. data stored in the cloud is actually stored in datacenters and semiconductor chips are a datacenter requirement).

Semiconductors (i.e. Chip Stocks)

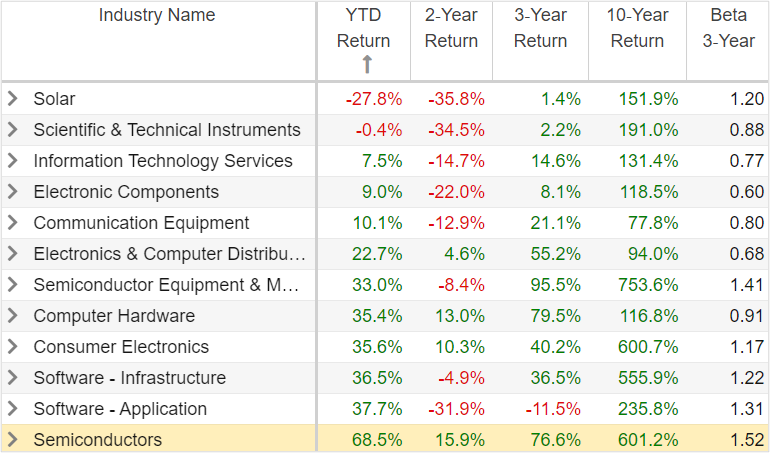

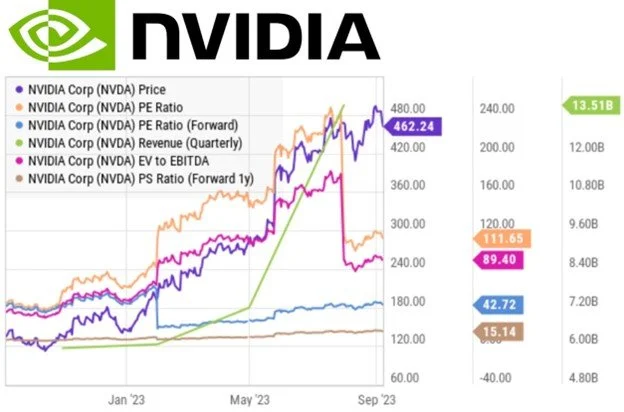

However, not all chip stocks are created equally, for example Nvidia’s GPU chips are displacing Intel’s old-school CPU chips in datacenters, as you can see in the next chart.

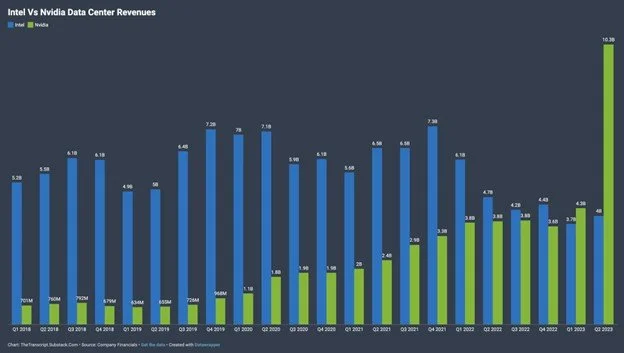

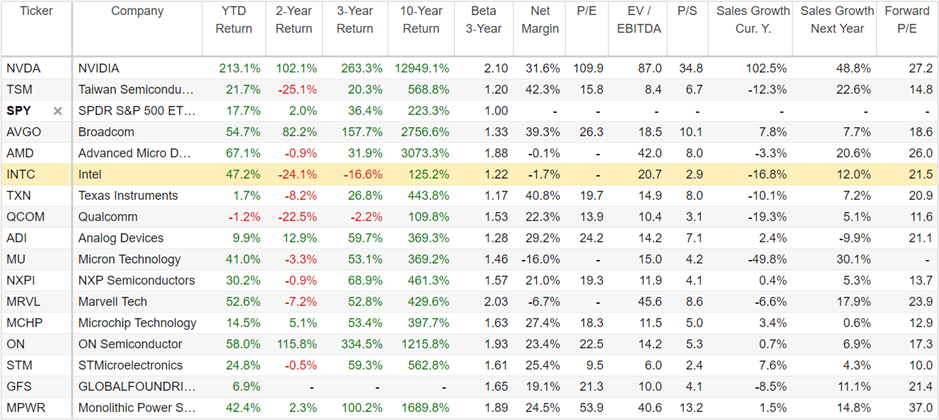

And performance has been widely different too. For example, check out Nvidia’s 10-year total return versus Intel and the S&P 500 (below).

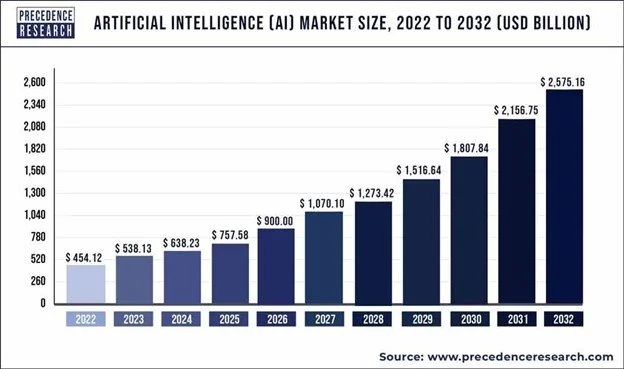

The most recent leg of data center growth has been driven largely by demand for datacenter storage and processing power to support the new Artificial Intelligence (“AI”) trend (that began ramping up this year following the notoriety of ChatGPT and the likes).

Also interesting to note, chip sector leader, Nvidia, is now less expensive (see chart below) on some valuation metrics (such as a simple P/E ratio) than it was three months ago (even though the share price has skyrocketed over the last 3 months). Specifically, Nvidia’s earnings has skyrocketed faster than its price, and its forward growth (see table above) remains high and the total addressable market also remains enormous for many years to come as chips remain a necessity for almost all modern technology.

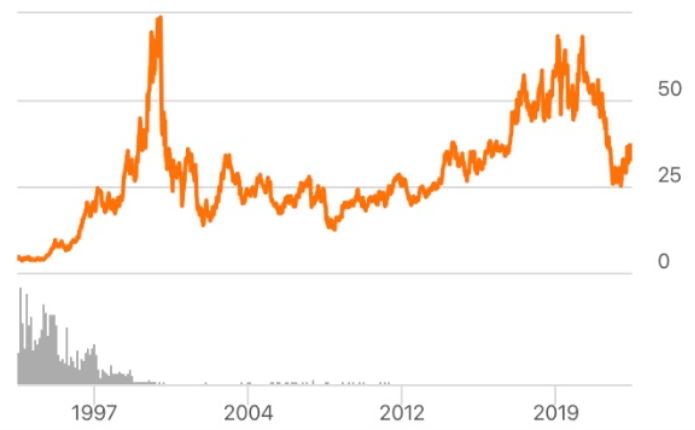

Further still, once dominant Intel, is still trading below its “tech bubble” highs 23-years ago because it has lagged Nvidia and others in the innovation department.

Intel (INTC) share price

However, Intel is now attempting to reinvent itself as a foundry chip maker (they would manufacture chips designed by other companies) and is gaining increasing market attention as a potentially attractive value stock. National security is also a big part of the story because the entire world basically relies on Taiwan Semiconductor for chips in one way or another, and if they were to cut us off, many modern technologies would simply come to a halt going forward.

The Bottom Line

We currently own shares of Nvida (despite the recent strong price gains, the shares are still reasonably valued as compared to its powerful long-term growth trajectory). Nvidia is a strategically important US-company (headquartered in Santa Clara, CA). We also own shares of US-based Monolithic Power Systems (MPWR) (read report) because it benefits from two large secular tends (the cloud/AI, plus its strong foothold in the automotive industry, as we wrote about here). Further still, we like and own computer hardware companies Super Micro Computer (read report) and Pure Storage (read report) because they are both positioned to continue benefiting from the powerful AI/Cloud secular tends (they both supply hardware that enables Nvidia chips to be utilized efficiently and effectively. Lastly, we believe it is important to diversify beyond just the technology sector, and we have strategically done so as you can see in the holdings of our long-term Disciplined Growth Portfolio.