In a world where instant gratification often takes precedence, the virtues of disciplined long-term investing stand as a beacon of financial wisdom. The practice of committing to a well-structured investment strategy, characterized by compound growth, prudent diversification, and infrequent trading, has the potential to reshape your financial future in profound ways. Let me explain…

Compound Growth: A Remarkable Phenomenon

First and foremost, disciplined long-term investing harnesses the remarkable power of compound growth. This phenomenon, often referred to as the "eighth wonder of the world" by Albert Einstein, allows initial investments to snowball over time. As earnings accumulate, they generate additional returns, which, in turn, lead to more earnings. This compounding effect amplifies the growth of your investment portfolio exponentially, transcending the limits of linear growth. By committing to a disciplined approach and allowing investments to mature over extended periods, investors have the opportunity to reap the rewards of this compounding miracle.

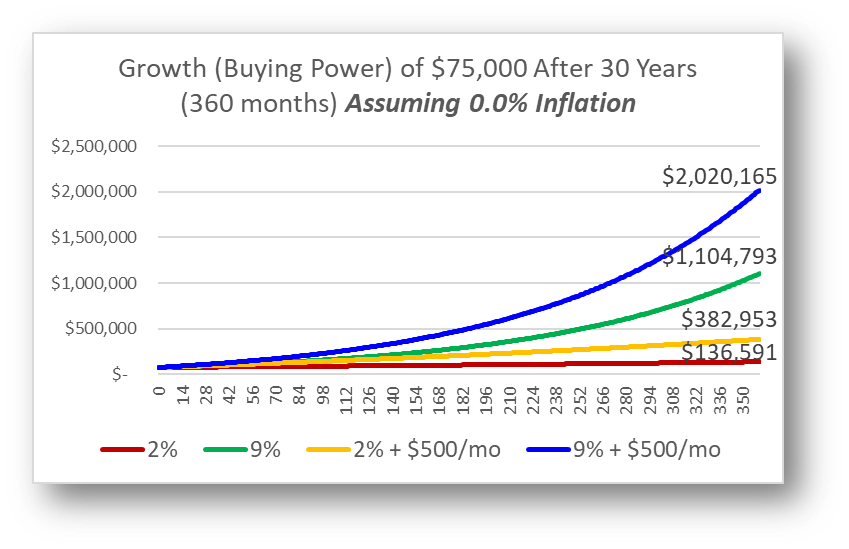

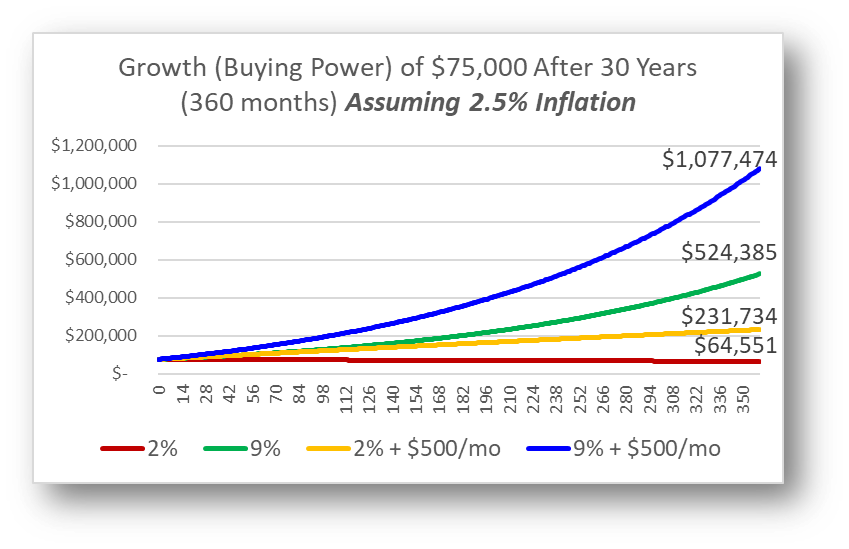

Example: Here is a look at the growth of $75,000 over 30 years if you earn 2% per year versus 9% per year, and if you add $500/month at each rate. The 2nd chart is your buying power if you factor in a 2.5% inflation rate!

Prudent Diversification:

Prudent diversification is another cornerstone of disciplined long-term investing. By spreading investments across a variety of asset classes, sectors, and geographic regions, investors can mitigate risks and reduce the impact of any single market fluctuation. This approach safeguards portfolios against severe losses that might arise from overexposure to a particular investment. Furthermore, diversification enhances the potential for steady, consistent returns, even during turbulent economic times. Through disciplined allocation, investors position themselves to weather storms and capitalize on emerging opportunities.

Infrequent Trading:

In the quest for sustained financial success, the practice of infrequent trading cannot be overstated. The allure of market timing and frequent trading often leads to emotional decision-making, which can erode the potential for long-term gains. Disciplined long-term investors recognize the futility of attempting to predict short-term market movements. By focusing on the bigger picture and resisting the urge to succumb to market volatility, they maintain a steady course towards their financial objectives. This approach not only reduces transaction costs but also minimizes the negative impact of emotional biases on investment decisions.

The Bottom Line:

The benefits of disciplined long-term investing are far-reaching. From the exponential power of compound growth to the shield of prudent diversification and the wisdom of infrequent trading, this approach has proven repeatedly throughout history to be a healthy pathway to financial success. And we believe it will continue to be going forward.