Albemarle is very profitable, growing rapidly, and the business benefits from a lithium supply deficit that will likely remain in place (and support strong profits) through 2030 and beyond (courtesy of demand largely for electric vehicle batteries). The company just recently announced quarterly earnings, whereby they raised forward guidance. But are the shares a good investment? In this report, we review the company, the lithium opportunity, financial performance, growth strategy, dividend (the yield is low, but the dividend has been increased for 29 years in a row), valuation and risks. We conclude with our strong opinion on investing.

Albemarle (ALB), Yield: 0.8%

Headquartered in Charlotte, North Carolina, Albemarle develops, manufactures, and markets engineered specialty chemicals worldwide. Albemarle is the industry leader in lithium and lithium derivatives, one of the highest growth markets in the specialty chemicals industry (demand for lithium-ion batteries is growing at an exciting rate, driven in large part by increasing global demand for electric vehicles, mobile devices and grid storage). To a lessor extent, Albemarle also specializes in bromine (bromine plays a leading role in providing performance solutions for fire safety, oilfield drilling, pharmaceutical manufacturing, high-tech cleaning, water treatment and food safety).

The company operates in three business segments (effective January 1, 2023), including Energy Storage, Specialties and Ketjen, as explained in Albemarle’s press release below:

“Effective January 1, 2023, Albemarle realigned its Lithium and Bromine global business units into a new corporate structure designed to better meet customer needs and foster talent required to deliver in a competitive global environment. In addition, the Company announced its decision to retain its Catalysts business under a separate, wholly-owned subsidiary renamed Ketjen. As a result, the Company’s three reportable segments include: (1) Energy Storage; (2) Specialties; and (3) Ketjen. Each segment has a dedicated team of sales, research and development, process engineering, manufacturing and sourcing, and business strategy personnel and has full accountability for improving execution through greater asset and market focus, agility and responsiveness. This business structure aligns with the markets and customers we serve through each of the segments. This structure also facilitates the continued standardization of business processes across the organization, and is consistent with the manner in which information is presently used internally by the Company’s chief operating decision maker to evaluate performance and make resource allocation decisions. The segment information for the prior year period been recast to conform to the current year presentation.”

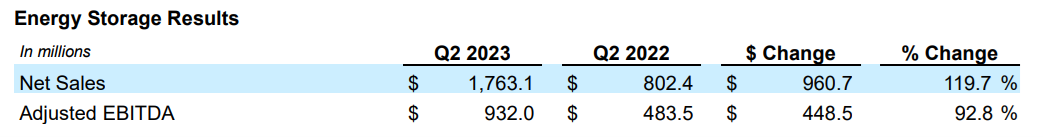

As you can see in the following tables, lithium (Energy Storage) is the largest segment generating most of the revenue and EBITDA.

Regarding Ketjen, it is a provider of advanced catalysts solutions to leading producers in the petrochemical, refining and specialty chemicals industries. From fluidized catalytic cracking to clean fuels solutions to hydro-processing to organometallics and curatives, Ketjen delivers solutions that increase production performance and business value. Ketjen is a wholly owned subsidiary of Albemarle Corporation (ALB), and Ketjen Corporation is headquartered in Houston, Texas (it serves global customers through operations in 27 different markets).

Secular Lithium Demand:

As mentioned, Albemarle is benefiting significantly from the high growth trajectory in lithium markets. For a little perspective, here is a look at global electric vehicle (“EV”) demand so far this year versus past years (demand continues to grow).

And according to an August 3rd research note from Morningstar strategist Seth Goldstein:

“We expect the lithium market will end 2023 in a deficit, driven by rising electric vehicle sales and the growing buildout of energy storage systems, the utility-scale batteries used to support renewable power generation. As demand more than triples by 2030 to 2.5 million metric tons from 800,000 in 2022, we expect the lithium market will remain in a deficit, supporting prices well above the marginal cost of production. We forecast prices will average in the mid-$30,000 per metric ton range from 2023 through 2030.”

Q2 Update

As mentioned, Albemarle recently announced quarterly earnings results, and they were compelling for long-term investors. Specifically, Albemarle beat earnings expectations, fell slightly short of revenue expectations, but increased its “all-important” forward guidance. For example, here is what CEO Jerry Masters had to say on the quarterly call:

“Our second quarter results continued the positive trend from last quarter, with net sales up 60% and EBITDA up 69% versus the same period last year. We have increased our energy storage outlook for 2023 based on current market prices. Of course, the long-term shift to electric vehicles is well established and growing. Automakers are planning ahead to accommodate that future growth. For example, we signed a strategic agreement with Ford (F) to supply over 100,000 metric tons of lithium hydroxide over a 5-year period, starting in 2026.”

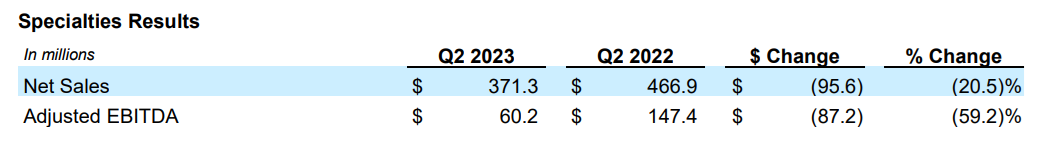

The guidance increase was driven primarily by higher prices (as mentioned), and you can see the updated outlook in the graphic below.

To get more specific, Albemarle is facing some pressure on its specialties business, but that is more than offset by the larger energy storage (lithium) segment.

Growth Strategy:

On a go-forward basis, Albemarle remains in growth mode. For example, here is a long-term look at the expected volumetric lithium growth through 2027 (see below). This is significant growth that will likely occur regardless of lithium prices because of electric vehicle demand (and the company is already very profitable, as we will explain, and expected to become more profitable as the lithium deficit persists).

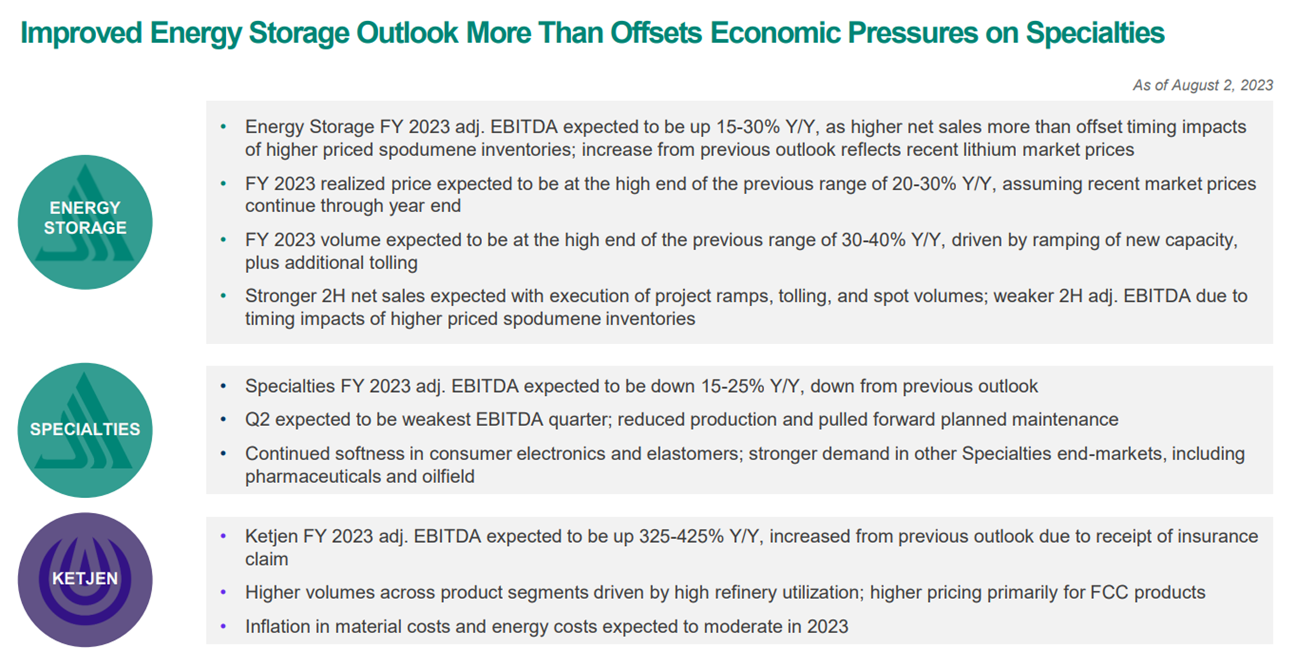

A few important things to note about the company’s growth strategy are highlighted in the following graphic. For example, Albemarle plans to grow its Energy Storage and Specialties segments considering they are the low-cost producer. Specifically, new competition is coming online (from the likes of Lithium Americas (LAC), Livent (LTHM) and Chinese producers), but Albemarle is in the strong position of already having rich productive assets they can expand—which they are doing).

Dividend Growth:

Another interesting aspect of Albemarle is that the company has paid a growing dividend for the last 29 years straight, and they remain committed to growing it. This is in stark contrast to some of the newer Lithium producers. However, Albemarle’s dividend yield remains relatively low (+0.8%) and the company does not anticipate significant share repurchases considering they are spending capital on attractive growth opportunities (both organic and inorganic).

Valuation:

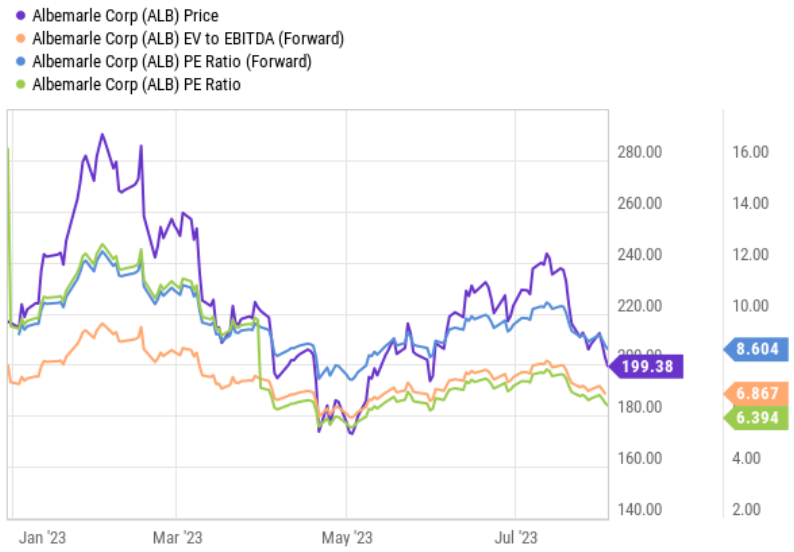

From a valuation standpoint, Albemarle’s share price has fallen as lithium prices decreased, but has started a rebound as prices have been rebounding, as reflected in the company’s most recent earnings announcement. Albemarle currently trade at 8.6x forward earnings estimates which is compelling considering its strong net profit margins (recently over 40%) and its ongoing long-term growth trajectory.

Also, Albemarle continues to focus on operational improvement (as you can see in the graphic below), something competitors cannot do yet as they are still building out their assets (i.e. competitors are focused on just getting into production, and don’t yet benefit from Albemarle’s growing economies of scale).

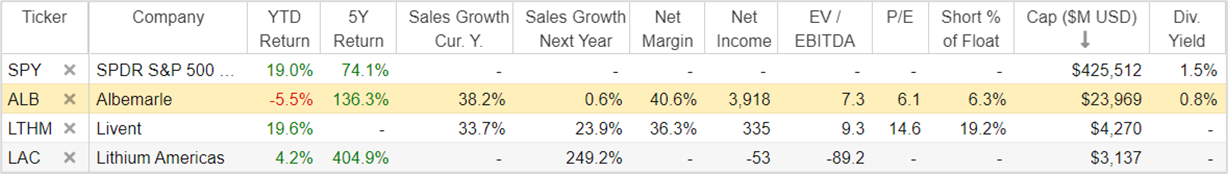

For a little more perspective, here is a look at Albemarle versus pureplay lithium competitors, Lithium Americas and Livent. As you can see, Albemarle is the largest and most profitable (although the others have some very high but volatile upside potential in the years ahead as the industry continues to mature).

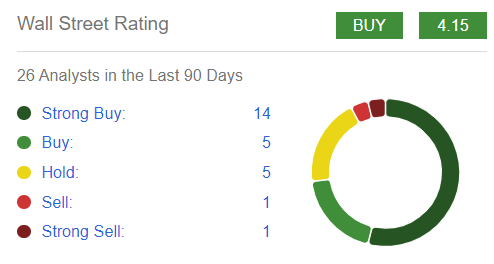

Most Wall Street analysts rate Albemarle as strong buy, as you can see in the following graphic.

And Morningstar strategist, Seth Goldstein, has a “5-star” strong buy rating on the stock, assigning Albemarle a $350 fair value (over 40% upside). On August 3rd (following earnings) he wrote:

“Given the wide range of potential lithium prices, we see a range of outcomes for Albemarle. In an upside scenario, continued strong lithium demand growth would create the need for poor-quality resources to enter production. The long-term marginal cost of lithium production would rise to $20,000 per metric ton and Albemarle would realize higher midcycle prices. In this upside scenario, our fair value estimate would be $600 per share.”

Risks:

Of course Albemarle and the entire lithium industry face risks that investors need to consider. For starters, lithium prices are volatile and this impacts the valuation of the firms. Additionally, there is competition for global competitors as well, including Chinese producers. Further still, if the demand for electric vehicles were to be lower than expected, that could have a significantly negative effect on Albemarle and the entire industry.

Worth mentioning, Albemarle does have an advantage over competitors because it is an already established business building out existing assets that are already producing. Whereas competitors coming online are acquiring and building out entirely new assets (which comes with unique risks including delays and quality uncertainty).

Environmental and sustainability concerns are another big risk factor to consider. However, Albemarle works hard to get ahead of these risks, as CEO Jerry Masters explained on the most recent quarterly call (highlighting several important initiatives).

“One of the reasons our customers choose Albemarle is our commitment to sustainability. In June, our Salar de Atacama site became the first lithium resource in the world to complete an independent audit and have its audit report published by IRMA, the Initiative for Responsible Mining Assurance. We achieved an IRMA 50 level of performance and a third-party auditor verified that the Salar site met 70% of over 400 rigorous IRMA requirements, covering topics such as water management, human rights, greenhouse gas emissions, fair labor and terms of work.”

The Bottom Line:

Albemarle is volatile (particularly as the lithium industry ramps up and prices remain dynamic), however the shares present an attractive long-term opportunity. For example, the company is a global leader with world-class assets and a diversified product portfolio (plus a long-term supply with reliable, consistent quality). And this allows Albemarle to capitalize on the tremendous growth opportunities in electric vehicles and beyond (e.g. mobility, energy, connectivity, health). Further still, the company’s growth strategy is clear and disciplined (in terms of an operating model to scale and innovate, accelerate profitable growth, and advance sustainability). In our view, Albemarle shares are undervalued significantly, and have tremendous (albeit volatile) upside in the decade ahead. We are currently long shares of Albemarle in our Blue Harbinger Disciplined Growth portfolio.