PIMCO’s Dynamic Income Fund (PDI) is popular among income-focused investors, and it should be. It offers big monthly distribution payments (that have increased over time), and it occasionally pays additional special dividends too. Plus, the fund is managed by a world-class company, PIMCO. However, there are significant costs, both implicit and explicit. In this report, we weigh the fund’s attractive qualities against its various costs, and then conclude with our strong opinion on investing.

PIMCO Dynamic Income Fund (PDI), Yield: 14.5%

Per the PIMCO website, the PIMCO Dynamic Income Fund (PDI):

“Seeks current income as a primary objective and capital appreciation as a secondary objective.”

And as you can see in the distribution chart below, the fund has a long history of successfully delivering strong current income (i.e. its primary objective).

source: Seeking Alpha

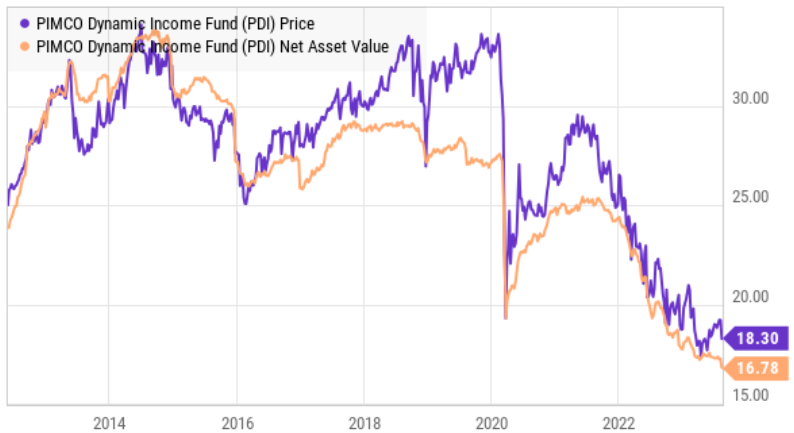

However, the fund’s high current income comes at a cost, namely it detracts from PDI’s secondary objective (i.e. capital appreciation), especially over the last four years (as you can see in the price and net asset value (“NAV”) chart below).

We’ll have more to say about the significant costs (both implicit and explicit) supporting this fund’s big yield (later in this report), but first let’s review some of the fund’s basics.

For starters, here is a look at PDI’s recent investment allocations. As you can see, the fund holds a mix of government, mortgage-backed and high-yield securities (MV is market value and DWE is duration weighted exposure).

Duration is a measure of interest rate risk. PDI’s duration was recently 3.41 years (reasonable for this type of fund). And the varied maturities of the underlying holdings gives the fund some diversification and flexibility in terms of dealing with interest rate movements.

The fund also uses a significant amount of leverage (or borrowed money). Leverage can magnify income and price gains in the good times, but it increases risk in the bad times (such as the last couple years as interest rates have risen swiftly. As rates rise, bond prices fall).

The Costs of PDI (Hidden and Explicit):

As mentioned earlier, PDI’s very big and successful monthly distributions have come at a high price, as described in the paragraphs below.

Management Fees: Perhaps the most apparent and obvious cost to investors are the management fees. In PDI’s case (as per the company website) the management fee was recently 1.10% per year. That is what you pay the PIMCO management team for delivering the strong income this fund has delivered. This fee is fairly high compared to the universe of fund fees, but it is reasonable for this type of bond-focused closed-end fund, especially one managed by PIMCO.

Operating Expenses: PDI’s total expense ratio (excluding interest expense) was recently 2.0%. And if we back out the management fee, that means the operating expense is 0.90%. This is a lot, and it detracts from your total returns. However, as long as the big income payments keep rolling in, many investors don’t mind this very significant (high) total expense ratio.

Interest Expense: The fund’s total expense ratio (including interest expense) was recently 2.64%. So that means the interest expense was recently 0.64% (i.e. 2.64%-2.0%). The interest expenses account for borrowing costs (remember, this fund has a significant amount of leverage, or borrowed money, to help magnify returns and income). A 2.64% expense ratio is a lot! But it’s also reasonable for this type of PIMCO high-income CEF.

Price Premium: As described earlier, PDI currently trades at a price premium of around 8.9%. That means when you purchase shares you pay 8.9% more than the net asset value of the fund’s underlying holdings. That is a big price premium and a big cost to you, but it is fairly common for popular PIMCO CEFs because many investors appreciate and trust the steady long-term income track record.

Return of Capital (“ROC”): CEFs can source their big distributions from a variety of sources, including dividend and interest income on the underlying holdings, capital gains (both short-term and long-term) and a return of capital (for example, returning some of your own original investment dollars just to support that big steady monthly distribution payment). Many investors don’t mind where the income comes from, as long as they can spend it! But others recognize these various sources of income have various tax consequences and can impact the fund’s long-term sustainability differently. For example, we previously wrote in great detail about PDI’s ROC (which many investors don’t realize exists) and how it reduces NAV thereby reducing future earnings potential of the fund and even weakens the long-term sustainability of the distribution. ROC is a risk factor and a cost that investors should be aware of.

Interest Rate Risk: Interest rate volatility impacts the value of this fund (as rates rise, prices fall), and the extremely steep rise in interest rates over the last two years has been a big contributor to this fund’s price and NAV declines. The duration of this fund (a measure of interest rate risk) was recently 3.41 years, which is reasonable and achieved through a wide variety of underlying holdings with widely different maturity and interest payment dates). Even though losses from climbing interest rates aren’t always realized right away, it impacts the operations of the fund, especially with regards to various derivatives instruments PDI uses to offset interest rate risks. Rising rates have been a big cost to this fund.

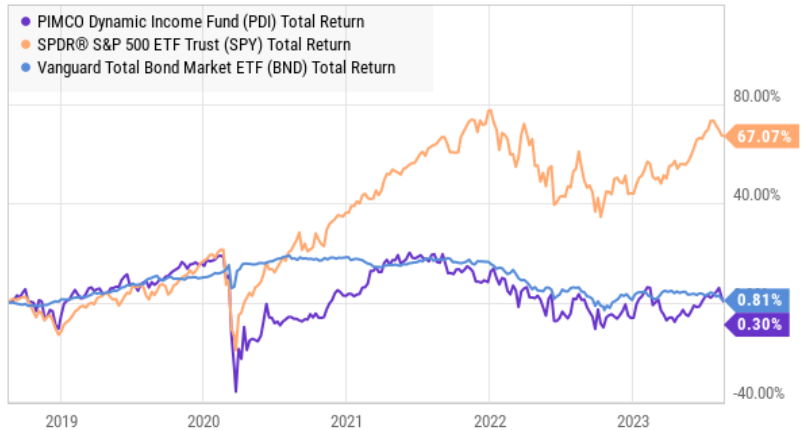

Opportunity Costs: The opportunity cost (or the cost of choosing PDI over other investment opportunities) really comes down to the investment objectives of those who invest in PDI. For example, many people simply invest in PDI because they want those big steady monthly income payments. And throughout its history, PDI has delivered. However, all of the costs described above detract from this fund’s value and capital appreciation (recall, capital appreciation is PDI’s secondary objective). For instance, here is a look at PDI’s 5-year performance (i.e. total return: price appreciation + distributions reinvested) versus unlevered bond (BND) and stock (SPY) funds.

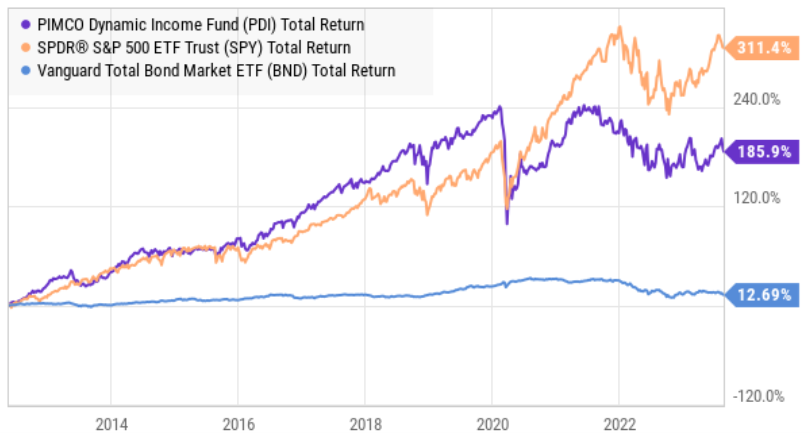

PDI is not impressive over the last five years, but for more perspective, the fund looks a lot better over the longer-term (since inception), but the opportunity costs are still very real and worth considering.

And worth mentioning again, PDI’s future earnings potential has arguably been seriously damaged by the destruction of NAV over time (especially the last few years), as you can see in this next chart showing NAV only (excluding distributions). You can only earn so much income (to pay distributions) based on the NAV you’re working with.

The Bottom Line

The management team at PIMCO has worked their magic over the last few years (through all kinds of derivatives instruments, income reclassification technicalities and even a fund merger—as we described in the ROC article linked earlier) to maintain the big steady distribution payments that so many investors love. And with interest rate volatility finally seeming to slow down, the road ahead for PDI’s price appears more promising. Just know that the fund’s big steady income payments come at a cost (such as those described in this report).

If you don’t need big steady income payments, it’s probably in your best interest to stay the heck away from PDI (because of all the costs and expenses that detract from long-term capital appreciation and total returns). But if big steady monthly income is your primary objective, then PDI is absolutely worth considering for a spot in your high-income-focused investment portfolio. We currently own shares of PDI in our 27-position Blue Harbinger High Income NOW portfolio.