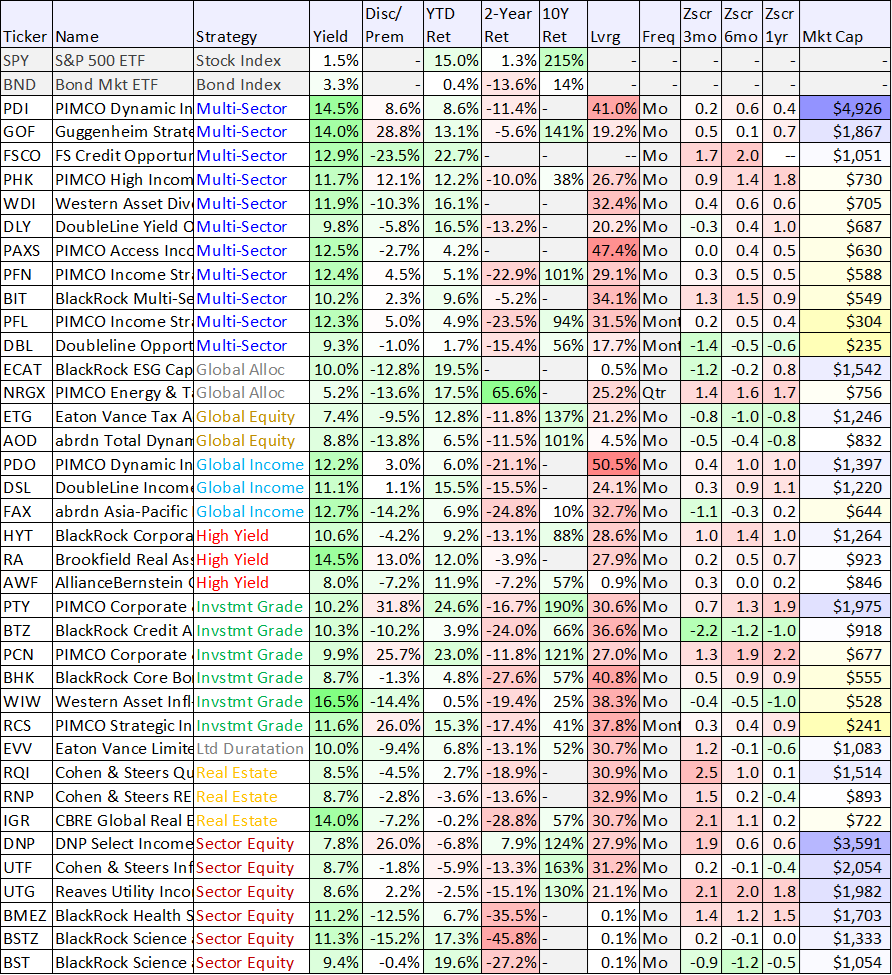

Quick Note: The tables below include updated data for 75 big-yield Closed-End Funds (CEFs) from across many categories. As you can see, there are some very interesting discount/premium things happening, as well as a wide variety of year-to-date returns (based on category).

data as of market close on Friday, August 18.

We’ll have more to say about this data soon (with regards to our High Income NOW portfolio) but a few noteworthy points below:

PIMCO’s popular PTY (and to a lessor extent PDI) are seeing their large premium prices getting even larger.

Tekla Healthcare Funds are getting interesting, considering the healthcare sector has been weak (potential contrarian opportunity) and the discounts (versus NAV) are getting very large.

Real Estate has been weak, but is potentially stabilizing as the recessionary prices are increasingly priced in and interest rates may be stabilizing (see funds: RQI and RNP).

Equity Funds CET and USA are also getting increasingly tempting.