The world is being “digitized,” and besides software, semiconductors are the "nuts and bolts" making it all happen (in datacenters, on devices, in the cloud and just about everywhere else too, considering the expansive "Internet of Things" ("IoT")). In this report, we share data on 40+ top semiconductor stocks, ranked by net profit margins (a particularly important metric in the currently challenging macroeconomic environment). We have a special focus on Monolithic Power Systems (MPWR) an "offense-and-defense" chip stock, including a review of its business, financials, valuation and risks. We conclude with our strong opinion on investing in semiconductors in general, and Monolithic Power in particular.

The Digital Revolution Secular Trend

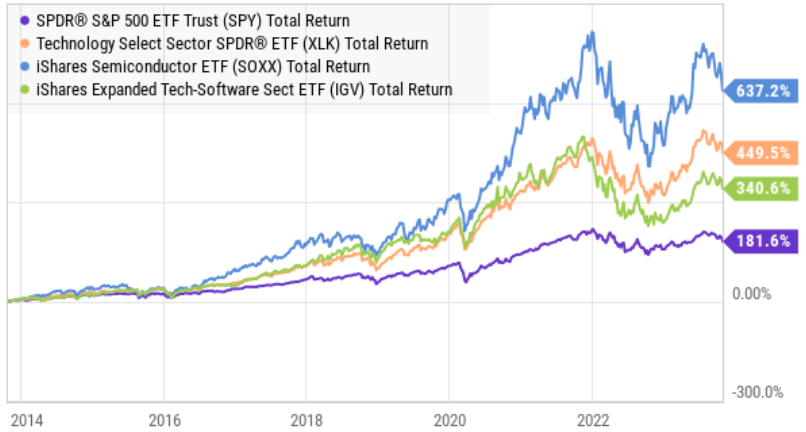

Chip stocks (or semiconductors) are the "nuts and bolts" behind the massive digital revolution and migration to the cloud. We often hear how the technology sector is dominating the rest of the market, but chip stocks and software stocks are a big part of that, as you can see in the following chart.

And what’s more, the digital revolution still has a long way to run (i.e. it’s still in the “early innings”), so there in plenty of opportunity for more gains ahead for semiconductor stocks in general, and certain semiconductor names, more so than others.

40+ Top Semiconductor Stocks, Ranked

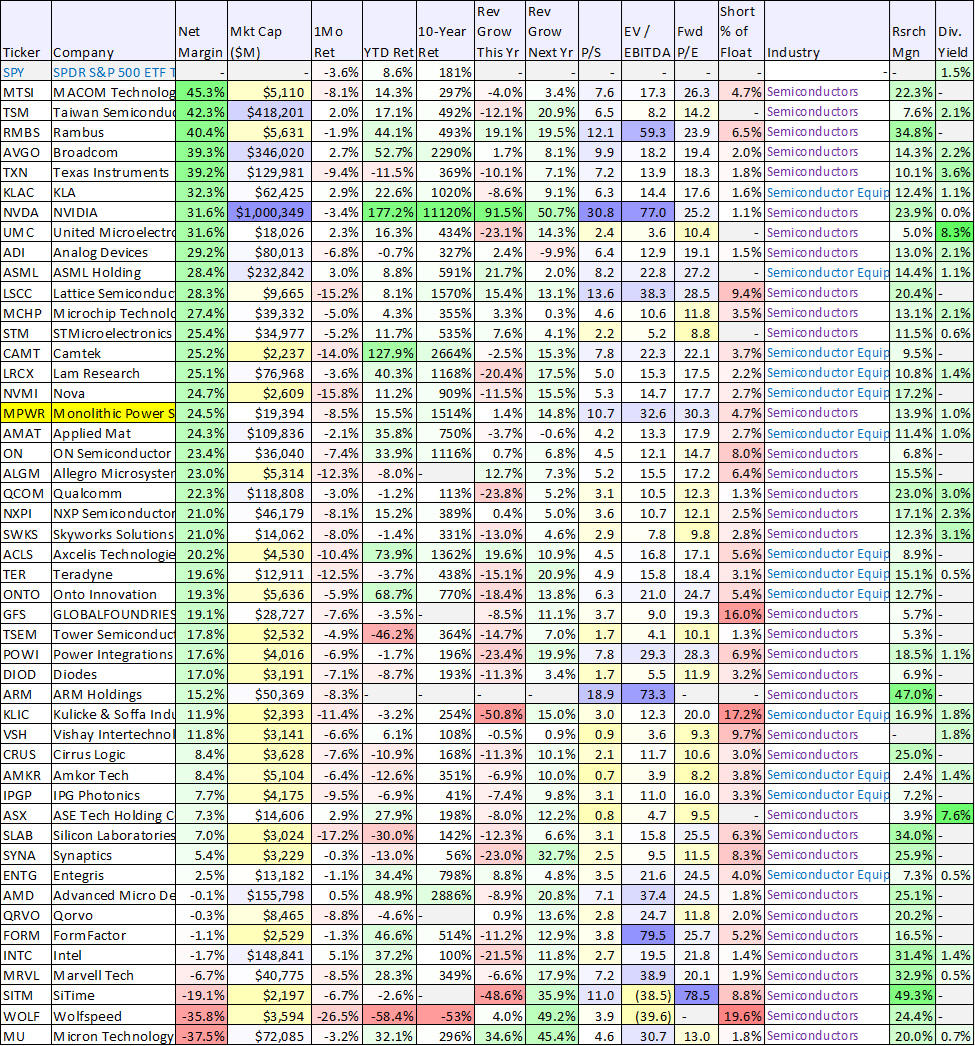

To give you a little perspective on the industry, here is a look at 40+ top semiconductor stocks (market caps over $2 billion), ranked by net profit margin.

Data as of Friday, October 27th. Source: StockRover.

Net profit margin (basically the percent of total revenue you’re able to translate into bottom line net income) is a particularly important metric in the current macroeconomic environment. Specifically, with rates rising and market cycle growth slowing, it becomes more expensive for companies to go to the capital markets to fund growth, and companies with high net profit margins can keep funding their own growth (i.e. a distinct competitive advantage). You like recognize at least a few of your favorite chips stocks in the table above.

Monolithic Power Systems: A Chip Stock Worth Considering

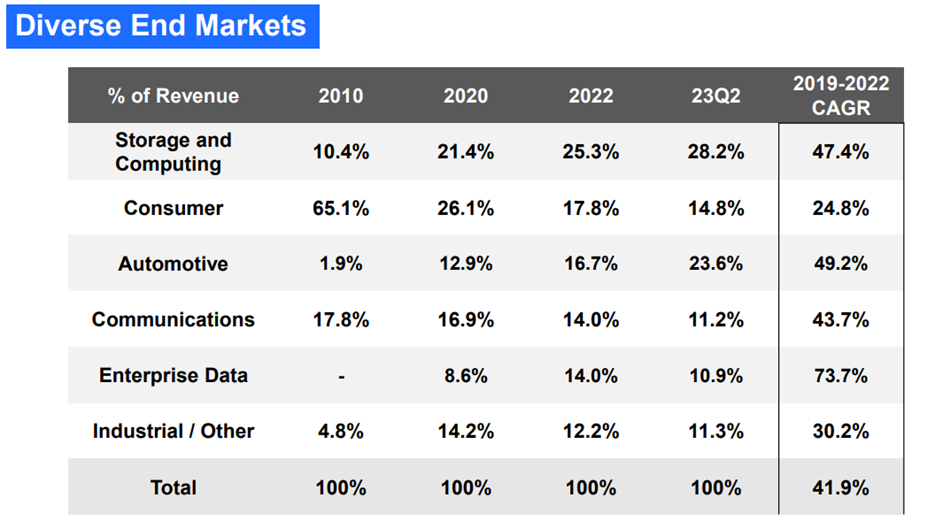

Monolithic Power Systems (from the table above) serves diverse end markets (see graphic below) and is growing rapidly, boosted by two massive secular trends: (1) the cloud (and artificial intelligence), and (2) dramatically increasing technology in the automotive industry (i.e. its chips have increasing applications in new cars). Additionally, it is a wide-moat founder-led company with impressive profit margins (again, important in the current macro environment), and generates tons of cash (for increasing dividends and share repurchases). Furthermore, if you are looking for an attractive “offense-and-defense” investment opportunity, these shares are worth considering. In the paragraphs below, we review its business, financials, valuation and risks, and then share our strong opinion on investing.

Monolithic Power Overview, Yield: 1.0%

Monolithic Power Systems is a leading international semiconductor company. It was founded in 1997 by current CEO Michael Hsing, and is based out of Kirkland, Washington, USA (but operates with locations across the globe). According to the company’s website:

Monolithic Power Systems, Inc. is a global company that provides high-performance, semiconductor-based power electronics solutions. The company’s mission is to reduce energy and material consumption to improve all aspects of quality of life. Formed in 1997 by CEO Michael Hsing, the company has three core strengths: deep system-level knowledge, strong semiconductor design expertise, and innovative proprietary semiconductor process and system integration technologies. These combined advantages enable MPS to provide customers with reliable, compact, monolithic solutions that offer highly energy efficient, cost-effective products, as well as provide a consistent return on investment to our shareholders.

Importantly, MPWR operates across diverse end markets, as you can see in the following graphic.

source: Investor Presentation

You’ll also notice in the above table that the compound annual growth rate (of revenues) in each end market is growing rapidly.

Benefiting from Big Secular Trends

A big part of the reason MPWR is growing rapidly is because of the strong tailwinds from two massive secular trends (the cloud/AI and automotive). For example, despite the challenging macro environment, here is what CFO Bernie Blegen had to say on the most recent quarterly earnigns call:

“We do see order acceleration for products related to artificial intelligence, autonomous driving, and power modules, and our customer engagement and design win momentum remains strong across all of our markets.”

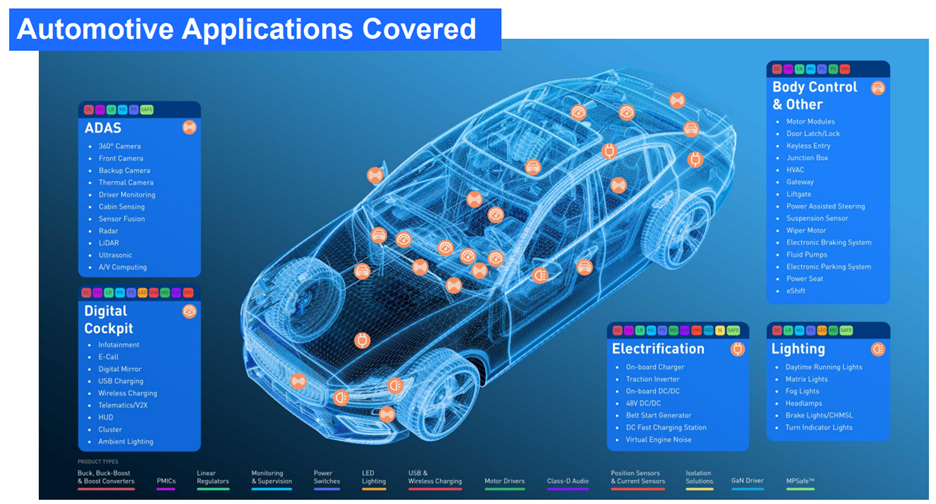

1. Automotive Applications:

For some perspective, here is a look (below) at some of the applications for MPWR chips with regards to automobile applications.

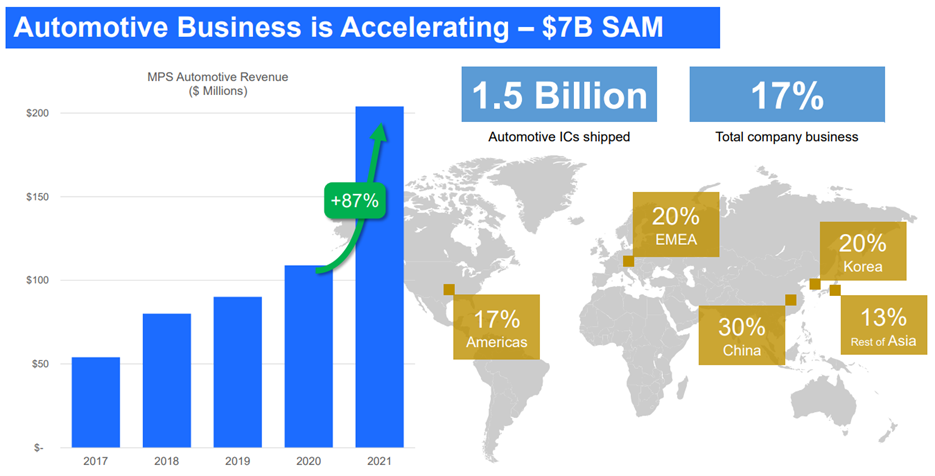

As you can see, product is required for everything from electrification to lighting and more. And as shown in this next chart, automotive revenues are climbing rapidly, yet the market opportunity is huge (leaving more room for accelerating growth).

And MPWR works with a wide variety of well know automotive-related brands, as you can see in this next graphic.

For a little more perspective on automotive growth for MPWR, according to CFO Bernie Blegen:

“First quarter 2023 automotive revenue of $105.3 million increased $8.0 million or 8.2% from the fourth quarter of 2022. This sequential revenue increase was primarily due to continued acceptance of our highly integrated solutions for advanced driver assistance systems, the digital cockpit and lighting applications. First quarter 2023 revenue was up 93.1% year-over-year. Automotive revenue represented 23.3% of MPS' first quarter 2023 revenue compared with 14.4% in the first quarter of 2022.”

2. The Cloud and AI:

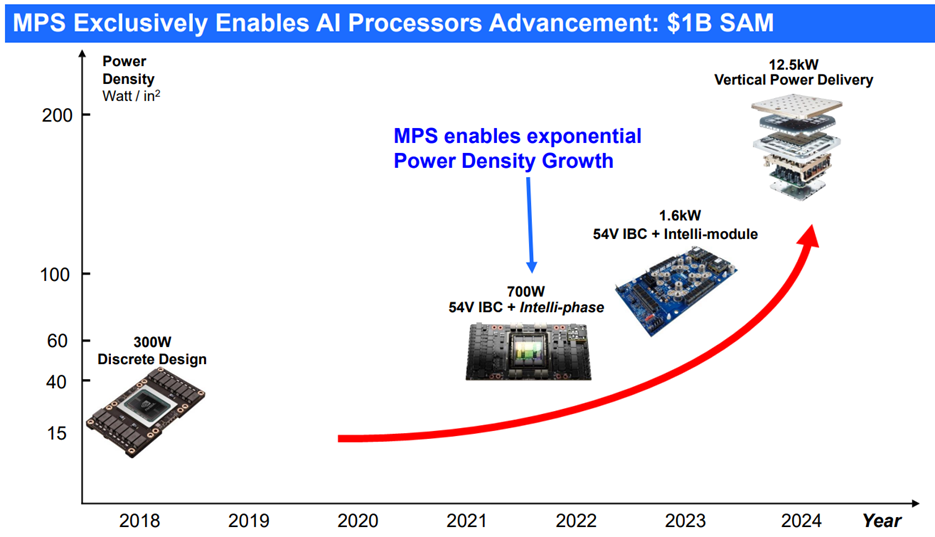

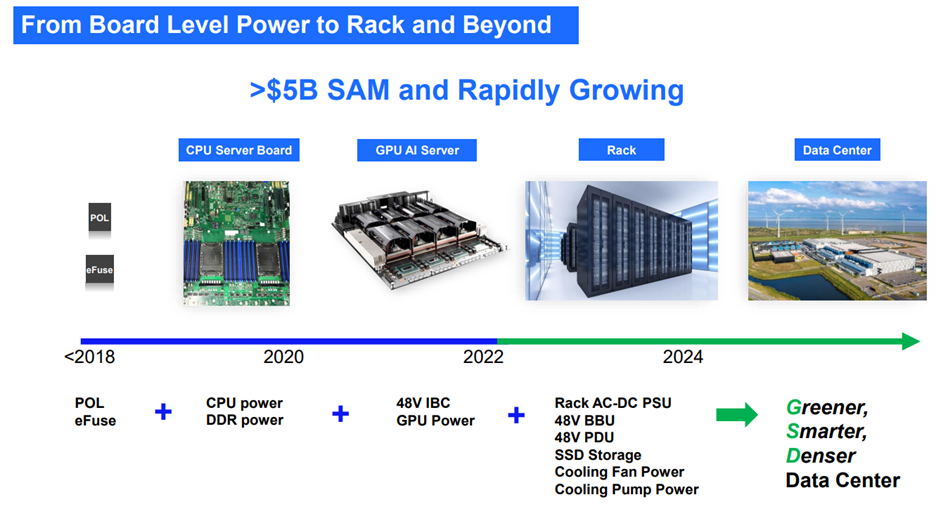

The cloud and artificial intelligence comprise the other big secular trend supporting MPWR’s business growth. For example. MPWR products are used in various data center applications (data centers are where “cloud” data is actually stored).

Further, MPWR products are enabling the explosive growth in AI data, and the market opportunity is very large.

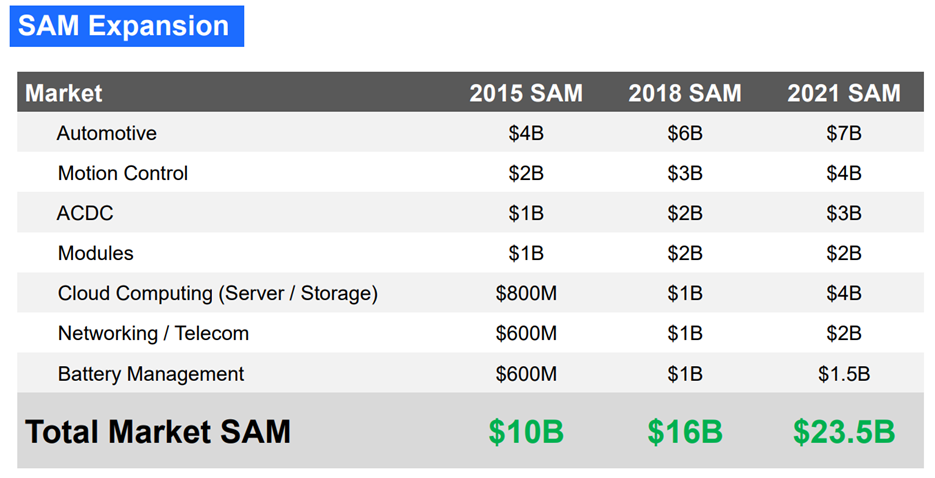

And again, the total market opportunity is very large and continues to expand.

So despite the overall macroeconomic uncertainty (as described by CFO Bernie Blegen, below), the company continues to thrive, especially due to the big secular tends supporting the business.

“I'd like to share some general business observations. During our 2 most recent earnings calls, we highlighted that customers were becoming more concerned with near-term business conditions and that ordering patterns might oscillate. This behavior continued through the first quarter of 2023. However, we do see order acceleration for products related to artificial intelligence, autonomous driving, and power modules, and our customer engagement and design win momentum remains strong across all of our markets.”

And the company’s overall market opportunity remains large and growing.

Financial Considerations:

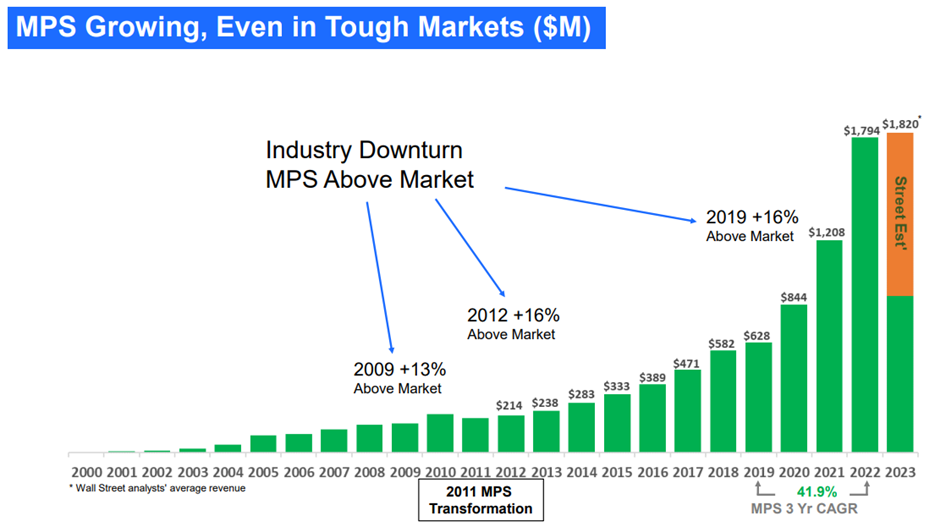

For starters, here is a look at Monolithic Power Supply revenue growth in recent years.

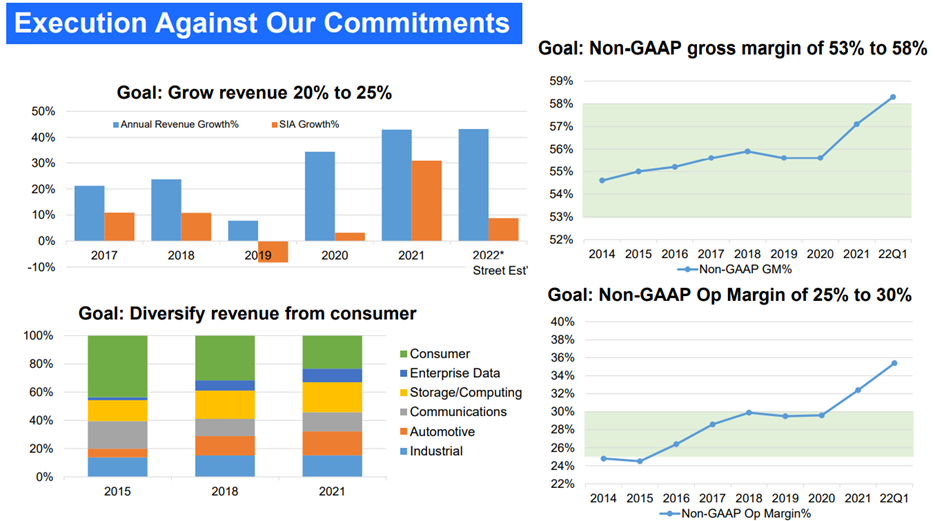

As you can see, the company has continued to grow, across market cycles, thanks to its diversified business capabilities. In fact, it’s been a priority for the company in recent years to grow across multiple operating segments to reduce the dependence on simply the “Consumer” which was the main driver of revenue back in 2010 (as you can see in our earlier graphic).

Cash, Dividends and Share Repurchases:

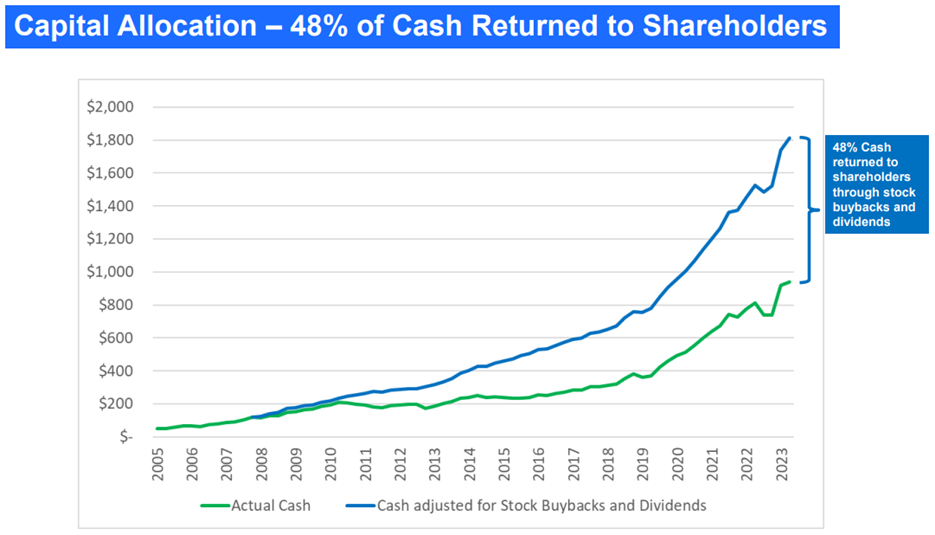

Importantly, MPWR has a lot of cash and generates a lot more cash, as you can see in the following chart.

Having such a strong cash position is really important, especially in the current macroeconomic environment. Specifically, rates have risen thereby making it harder (more expensive) for companies that don’t have cash, to raise cash. Secondly, MPWR has plenty of cash to continue innovating (it has a high “research margin” in our earlier table), to continue growing, and to continue returning cash to shareholders through dividends and share repurchases.

Furthermore, being in such a strong cash position makes MPWR a bit of an “offense-and-defense” company in the sense that it can play offense with regard to secular industry growth, and it adds a level of safety for investors because it keeps generating tons of cash in a market downturn thanks to its high margins, strong cash flow and steady dividends and share repurchase.

Wide-Moat:

Worth mentioning explicitly, MPWR’s wide moat stems from its strong relationships with customers from across many segments and industries. Once a customers selects a chip company, they are unlikely to switch (switching costs can be prohibitive). Further, MPWR continues to build scale, thereby strengthening is strong financial position. Additionally, the company’s relatively high research margin helps it innovate and differentiate itself from larger peers.

Valuation:

MPWR’s shares have outperformed peers in recent years thanks to its innovative and diversified business, and (as you can see in our earlier chart) MPWR is still expected to grow revenue this year while many competitors will have declining revenue in the challenging post-pandemic environment. What’s more, MPWR is expected to grow at a higher rate (than peers) next year thanks to its exposure to large secular trends (automotive and the cloud/AI), and we suspect these trends could fuel faster growth than currently expected.

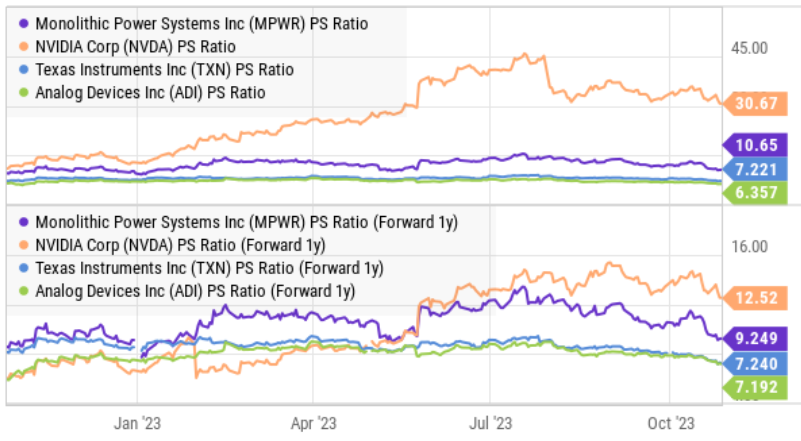

Trading at 10.7x sales and 30.3x forward earnings, MPWR is not cheap. However, this valuation is reasonable considering its already strong margins will improve with scale, and considering it will continue to benefit as a leading innovator from ongoing secular trends (namely in automotive and the cloud/AI).

Relative to it own recent history, MPWR is reasonably priced. And considering its expected growth rate, it’s also reasonably priced as compared to other semiconductor stocks. MPWR is a very profitable business, with improving margins and can accelerate its growth from large secular trends and once the current macroeconomic uncertainty dissipates.

Risks

The main risks for MPWR include the overall economy and competition. From an economic standpoint, MPWR has experienced rapid growth across all sectors as the economy boomed from pandemic-era stimulus. However, the stimulus is subsiding, and a severe economic recession could undoubtedly slow growth (although MPWR is in a strong position relative to many semiconductor companies). Regarding competition, MPWR is still smaller than peers (such as Texas Instruments and Analog Devices), and if larger competitors were to focus their efforts more directly against MPWR that could create slower growth for the business.

The Bottom Line:

We like the semiconductor industry in general because it underpins the massive digital revolution secular trend. And we like certain semiconductor names in particular, especially including those with competitive advantages and strong enough profit margins to support their own well being.

One name in particular, Monolithic Power Systems, is especially attractive. We like the diversified, economically less-sensitive and growing business. Especially as it benefits from the massive digital revolution secular trend (and sub-group trends automotive and AI). We also like the founder-led business and the incredibly strong profit margins and cash flow generation. In our view, this is a company that can weather the economic cycle much better than most chip stocks, while simultaneously benefiting from growing secular trends. If you are a long-term growth investor, Monolithic Power Systems in absolutely worth considering for investment.