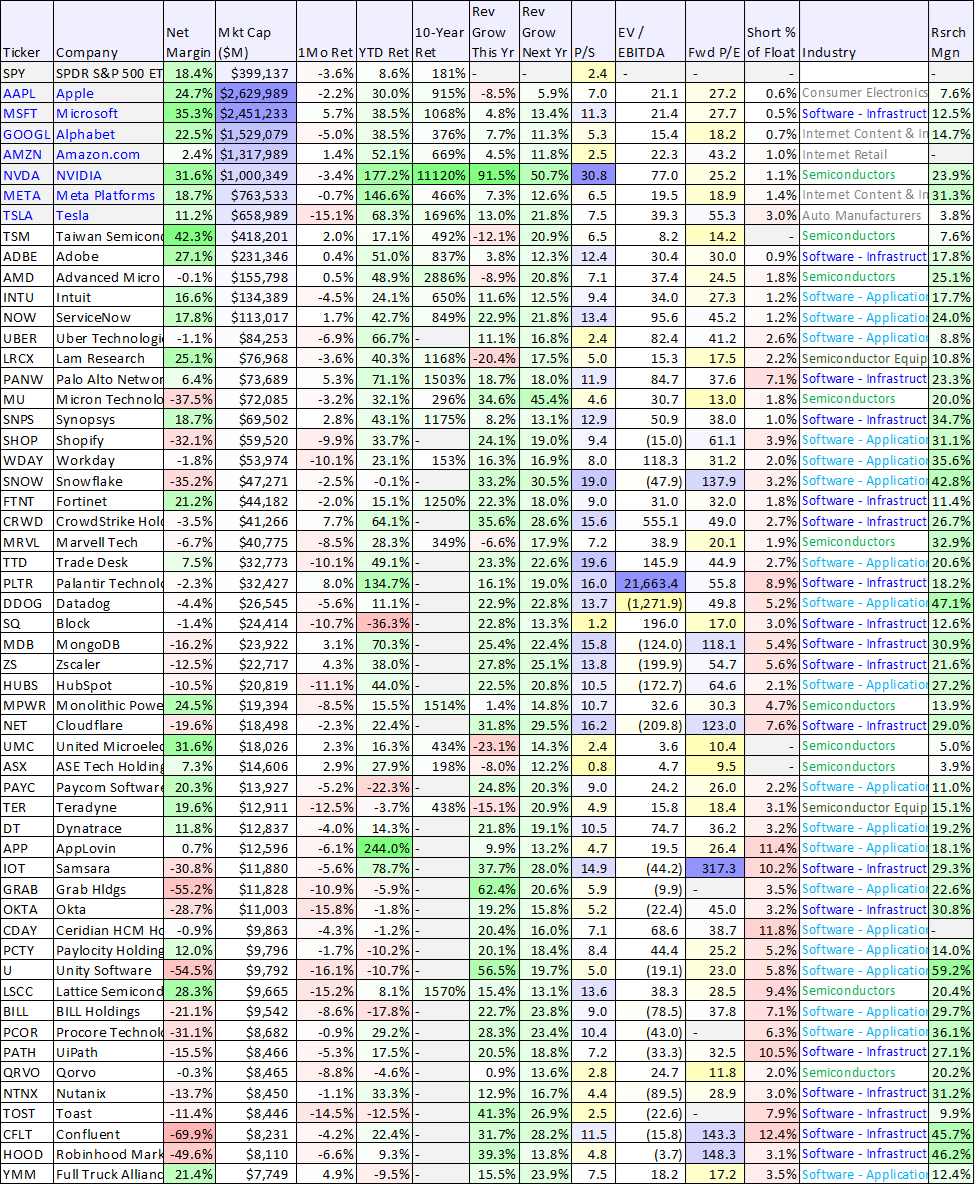

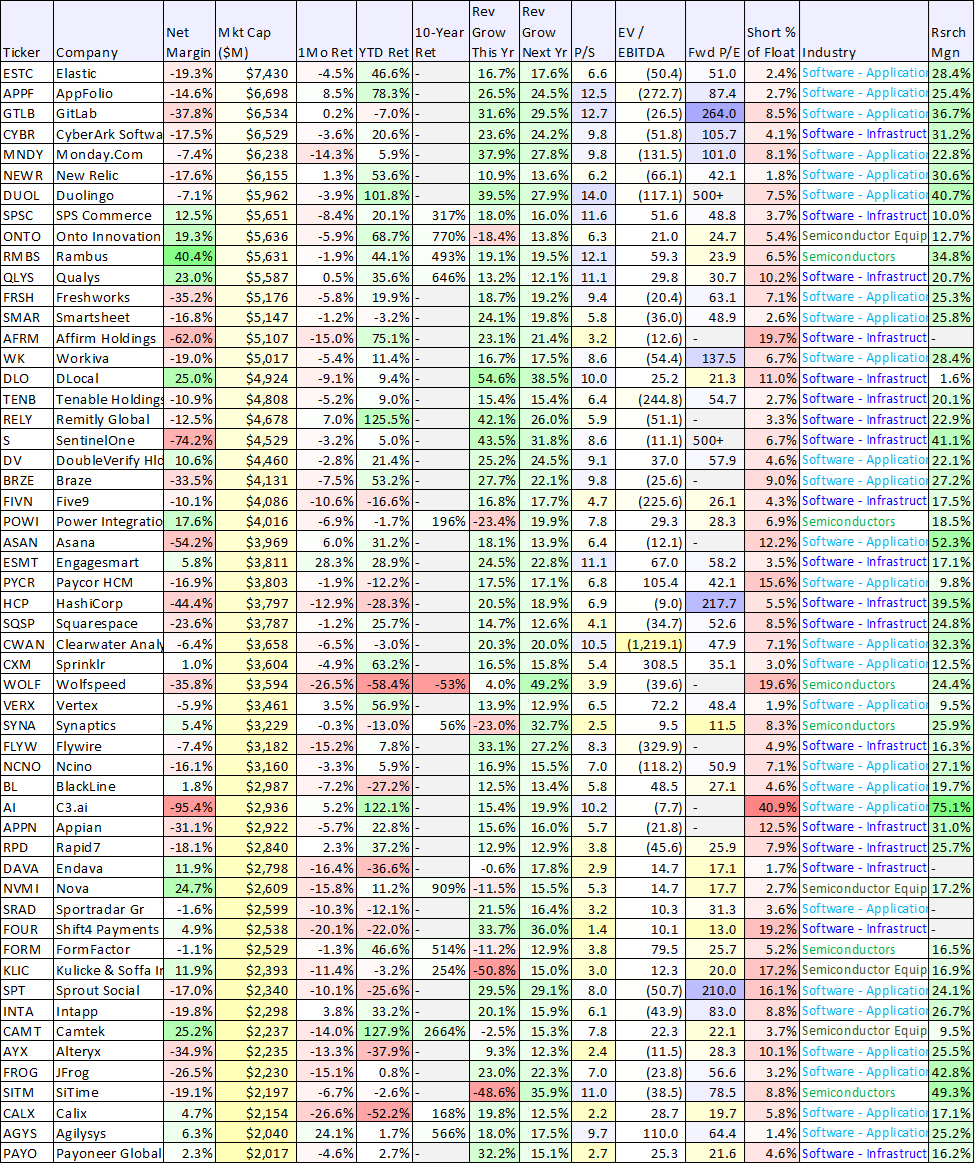

The digital revolution is perhaps the biggest secular trend today, and it is likely to continue (to the benefit of select companies) for many years to come. For example, software and semiconductors stocks are two big beneficiaries considering software processes all the data created by the digital revolution and semiconductors are the “nuts and bolts” behind the data centers, devices and “Internet of Things” that collect data for software, especially now with the explosion of Artificial Intelligence (“AI”) data. In this quick note, we share data on over 100 software and semiconductor stocks with high growth (i.e. 12% revenue growth expectations for next year), plus we’ve included the “Super 7” mega-caps for comparison purposes too.

You’ll notice a lot of these stocks are “down big” over the last 1-month, still strong year-to-date, and haven’t yet existed publicly for 10-years to populate data in the 10-year returns column.

Data as of Friday’s close, Oct 27th. Source: StockRover

Data as of Friday’s close, Oct 27th. Source: StockRover

You likely recognize many of the top high growth names in the above table. In our view, there is a lot of good data here, but we especially like the “net margin” column. That’s the percentage of bottom line net income each company generates relative to its income, and we like high net margin companies in the current macro environment because it makes it easier for companies to support their own growth instead of going to the capital markets where things are a lot more expensive now in light of higher interest rates.

If you are considering adding money to the market, now is a more attractive time than 1-month ago because stocks are down, but the long-term digital revolution remains firmly intact.