The Liberty All-Star Equity Fund (USA) is a popular big-yield closed-end fund (“CEF”). It offers an annual distribution yield equal to 10% of its net asset value (“NAV”) with 2.5% paid quarterly. And it currently trades at a discount to its NAV (it previously traded at a large premium). In this report, we review USA in detail (including its strategy, distribution policy and current pricing), and then compare it to 20 other popular big-yield CEFs from varying categories (including some important guidelines on when it might be okay to purchase a CEF at a premium to NAV and when it might not be). We conclude with our strong opinion about investing in USA and a few other CEFs in particular, especially considering their current price premium-versus-discount dynamics.

Liberty All-Star Equity Fund (USA), Yield: 10.0%

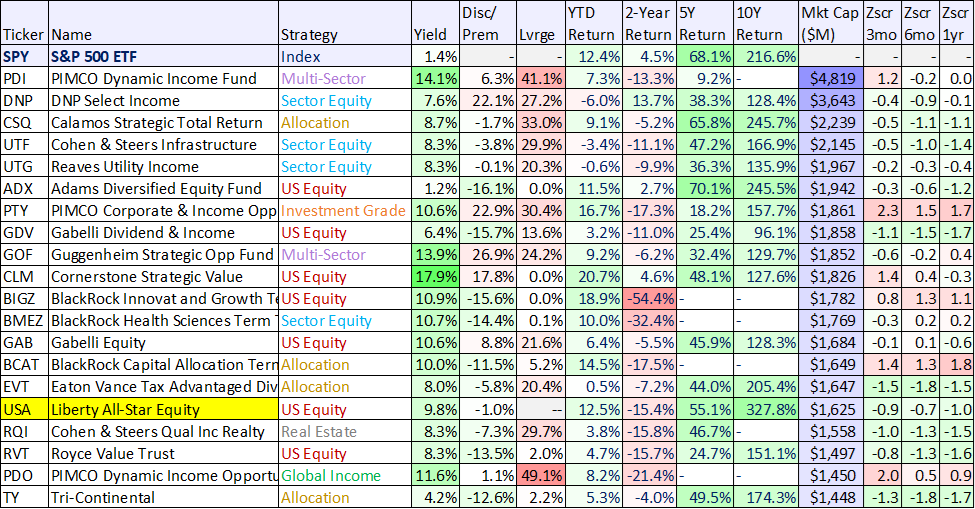

As mentioned, USA is a popular big-yield closed-end fund. And as you can see in the following table, it has delivered some powerful long-term total returns (as compared to other CEFs and as compared to the S&P 500). Plus, USA currently trades at a discount to its net asset value (i.e. the aggregate value of all of its underlying holdings is higher than its current market price) a quality that many investors find attractive (and something that is only true of some of the funds in our table below).

To be fair, the funds in the above table follow widely different strategies (some are stock funds and others are bond funds) and they shouldn’t all be benchmarked to the S&P 500 (a 100% stock index). However, the table does highlight some important differentiators, which we will cover in more detail throughout this report.

With regards to the Liberty All-Star Equity Fund, it employs a unique multi-strategy approach. Specifically, the fund combines three value-style managers and two growth-style managers into one fund. More specifically, the fund’s current “value managers” are:

Aristotle Capital Management, LLC | Howard Gleicher, CFA & Greg Padilla, CFA

Fiduciary Management, Inc. | Patrick J. English, CFA & Jonathan T. Bloom, CFA

Pzena Investment Management, LLC | Richard S. Pzena, John J. Flynn, & Benjamin S. Silver, CFA

And the fund's current “growth managers” are:

Sustainable Growth Advisers, LP | Kishore Rao, Robert Rohn & HK Gupta

TCW Investment Management Company | Craig C. Blum, CFA & Brandon Bond, CFA

And according to USA, the investment managers selected (above):

“demonstrate a consistent investment philosophy, decision making process, continuity of key people and above-average long-term results compared to managers with similar styles.”

Also important to note, USA’s investment objective is:

to seek total investment return, comprised of long‐term capital appreciation and current income. It seeks its investment objective through investment primarily in a diversified portfolio of equity securities.

From a high-level, USA appears attractive, considering its big yield, long history of out-performance and current market price discount versus NAV. But before investing, there are a few more things investors need to consider.

USA Distribution

USA’s current annual distribution rate is 10.0% of the fund’s NAV (paid quarterly at 2.5% per quarter). However, it is important to note, the fund’s distribution policy provides a systematic mechanism for distributing funds to shareholders. Specifically, the historical total returns on this fund (going back to the start of this century) assume distributions are reinvested, but here is a look at the long-term price return if distributions are not reinvested (and as compared to the S&P 500).

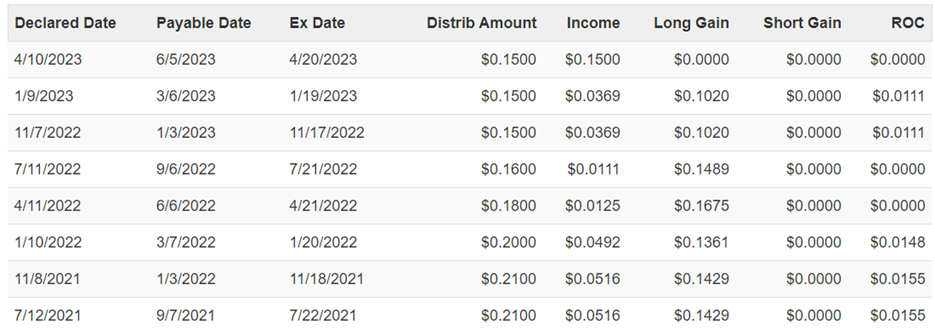

So basically, if you take your USA distributions as spending cash, then your long-term returns will likely lag the S&P dramatically. More specifically, here is a look at the recent composition of USA’s distributions.

As you can see, a portion of the distribution comes from income (dividends) on the underlying holdings, a portion comes from capital gains and some comes from Return of Capital (“ROC”). ROC can become problematic if too much of the distribution comes from ROC for too long (because it reduces the NAV of the fund thereby also reducing its future earnings and income-generation power), but from time-to-time a little ROC is acceptable (and even preferred in order to keep the big distribution fairly steady). For USA, we’re comfortable with the ROC (especially considering markets have been particularly volatile over the last two years).

Automatic Distribution Reinvestment Plan

Another important consideration is the fund’s automatic distribution reinvestment plan, described in the fund’s annual report, as follows:

Distributions declared payable in cash will be reinvested for the accounts of participants in the Plan in additional shares purchased by the Plan Agent on the open market at prevailing market prices. If, prior to the Plan Agent’s completion of such open market purchases, the market price of a share plus estimated brokerage commissions exceeds the net asset value, the remainder of the distribution will be paid in newly issued shares valued at net asset value (but not at a discount of more than 5% from market price). Distributions declared payable in shares (or cash at the option of shareholders) are paid to participants in the Plan entirely in newly issued full and fractional shares valued at the lower of market value or net asset value per share on the valuation date for the distribution (but not at a discount of more than 5 percent from market price). Dividends and distributions are subject to taxation, whether received in cash or in shares.

So basically, if you decide to automatically reinvest your distributions back into the fund (instead of receiving them in cash), you get the new shares at a discounted price (if the market price exceeds the NAV), but that discount shall not exceed a 5% discount to the current market price. This is helpful to investors because they often end up owning more shares than if they had used the distribution to purchase more shares in the open market.

Current Price Discount Versus NAV

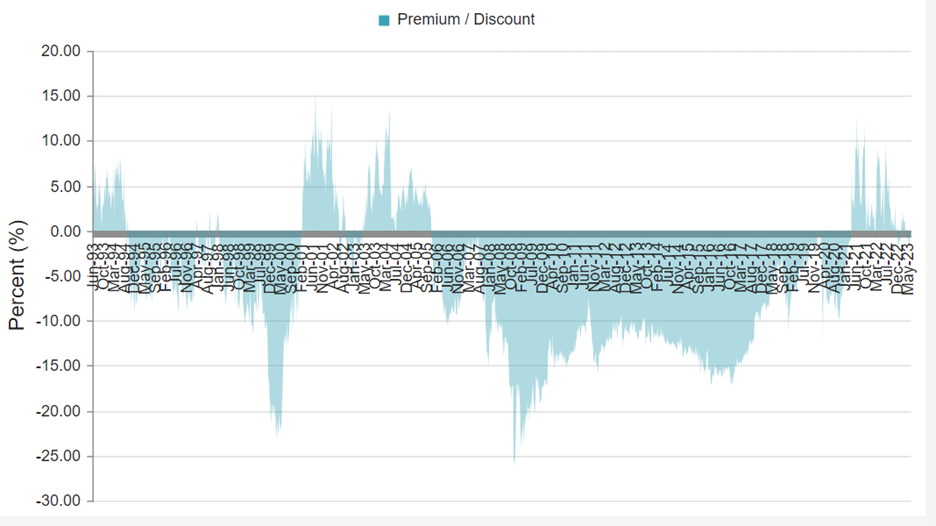

As you can see in our earlier table, USA currently trades at a small discount to its net asset value. And many investors greatly prefer to buy their CEFs at a discounted price because it means they’re getting access to all the dividends and potential gains of the underlying holdings at a discounted price (a good thing). Further, the current discount on USA is somewhat unusual, considering it has often traded at a premium, as you can see in the following historical USA premium-versus-discount graph.

When is it okay to buy a CEF at a “premium” price?

In our opinion, there are situations when it is acceptable to buy a CEF at a premium price (as compared to NAV) and situations where it is probably a bad idea to do so.

Unique Asset Classes: Depending of the asset class strategy of a CEF, it can be okay to invest at a premium price. For example, many popular bond funds (such as the PIMCO funds in our table) trade at almost perpetual premiums to NAV and it still may be okay to purchase them because they provide exposure to assets classes that are difficult to invest in for most individual investors. For example, due to economies of scale, bond funds can purchase large lots of bonds at attractive prices that are otherwise not feasible for investors lacking large dollar amounts and/or lacking the institutional capabilities and connections of large bond fund managers (i.e. certain types of bonds are simply not available to smaller investors). In these cases, it can be acceptable to purchase at a premium if the CEF gives you attractive exposure to investment types that you simply cannot achieve on your own.

Use of Leverage: Another important consideration with regards to CEFs is there use over leverage (i.e. borrowed money). Leverage can magnify income and total returns, but it also increased volatility and risk (leverage is great when the market is going up, but painful when it is going down). However, if a fund is making prudent use of leverage this can help to justify pruchasing a fund at a premium to its NAV. For example, it can be costly and risky for individuals to try to use leverage on their investments, but larger institutions can do this in a more disciplined fashion (and generally at a significantly lower cost). So if a big CEF is prudently deploying leverage then is can be okay to purchase at a premium price, in some instances.

Availability of Alternatives: If there are no good alternative ways to get exposure to an attractive investment type, then it may be okay to purchase a CEF at a premium price. For example, if there are no comparable funds trading at a more reasonable prices, then the premium may be okay.

However, in the case of stock funds, such as USA, there are usually alternatives. For example, USA has no leverage, so investing in three low-cost value-focused ETFs and two low-cost growth-focused ETFs will likely provide a similar return steam with lower fees (USA’s recent expense ratio was 0.94%). USA has outperformed the S&P 500 over some time periods and underperformed it over other time periods. Further, there are other equity CEFs with similar strategies and similar performance track records, that currently trade at wider discounts and have lower expense ratios,

Who Cares About the Premium if the Income is Steady

A lot of investors will claim they don’t care about a large premium as long as the fund keeps paying the big steady distributions they love. And to a certain extent, this makes complete sense. If you are personally comfortable with an investment, that matters—a lot. There is no alternative to being comfortable with what you own and sleeping well at night. Every investor needs to make decisions that are right for them, based on their own individual situation.

Expense Ratio:

As mentioned, the expense ratio on USA was recently 0.94%. It is important to understand that ALPS Advisors Inc (“AII”) is the company that serves as the investment advisor to USA, and AII receives its fees (monthly) based on total assets in the fund. The critical point to know is that AII then pays the five previously mentioned investment managers (three value managers and two growth managers) from the fee AII has already collected. So it appears there are no hidden management fees associated with USA (although there are some additional operational expenses included in the 0.94% figure provide above).

Conclusion

In our opinion, the Liberty All-Star Equity Fund is an okay fund, but not a great one. The 10.0% distribution may be compelling to some investors, but it is important to understand how this distribution is sourced (i.e. mainly through gains on the underlying holdings) and unless you reinvest the distributions you are very likely to dramatically underperform the S&P 500 over time. Further, this fund performs well over certain historical time periods (assuming distributions are reinvested), but not-so-well over others, and when you factor in its 0.94% expense ratio, there are other alternatives that are more attractive.

We do like USA’s currently discounted price (versus NAV), but the discount is not particularly large, and there is nothing particularly unique about USA that makes it standout as a top idea. In fact, there are other funds (particularly prudently-levered bond funds) that are worth considering for investment—even when they do trade at significant price premiums.

At the end of the day, you need to select only investments that are right for you, based on your own individual situation. We currently own more than 12 CEFs in our Blue Harbinger “High Income NOW” portfolio, and USA is NOT one of them. You can view all of our holdings here.