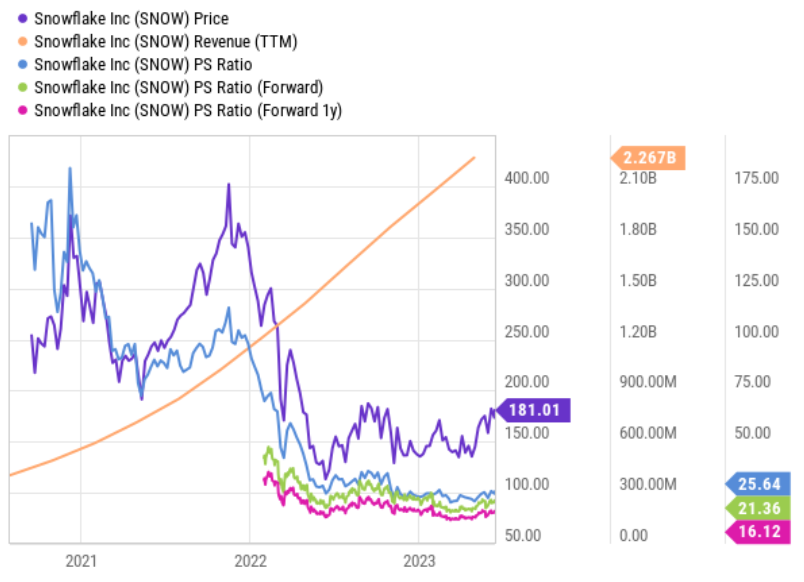

In this quick note, we provide some brief updated data and valuation metrics for Snowflake (SNOW), as well as our thoughts on the market opportunity, health of the business and risks. This one was so popular when it IPO’d during the pandemic bubble in late 2020, and the shares have now fallen so hard.

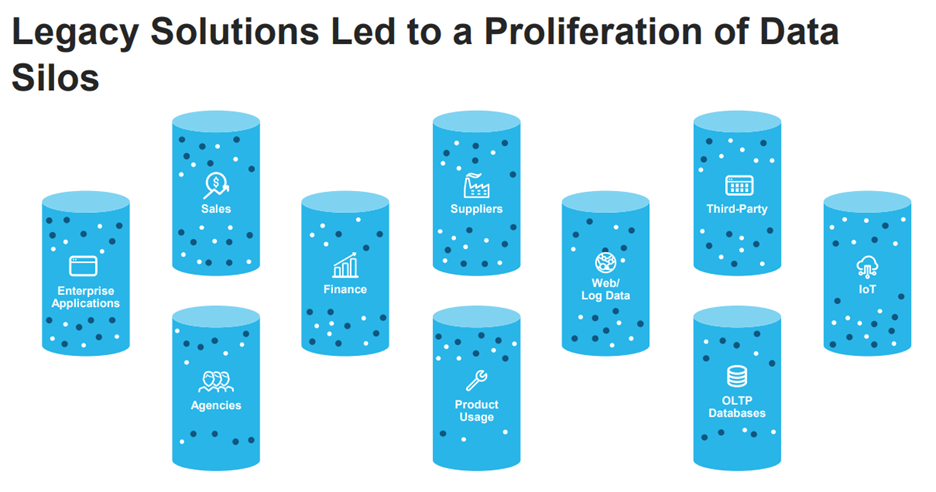

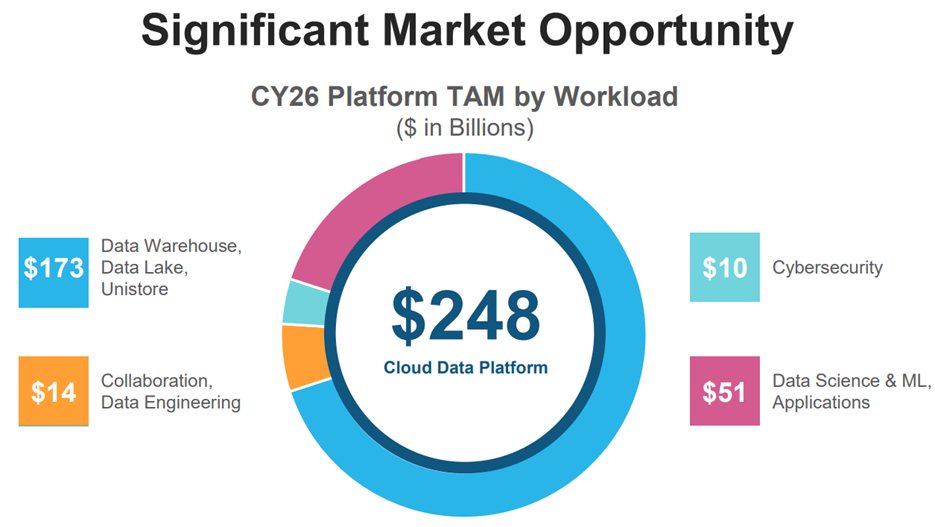

In a nutshell, as data moves to the cloud, Snowflake’s “Data Warehouses” and “Data Lakes” solve a couple big problems. First, Data Warehouses allow once siloed cloud data to be shared efficiently (low cost) by those who need to access it (including a company's own departments, as well as outside suppliers and others). Further, Data Lakes allow AI (artificial intelligence) to do its thing on the data. Data Warehouses and Data Lakes are a huge deal as the amount of data in the cloud continues to explode.

Next, Snowflake's solutions are cloud agnostic, meaning they can work with data from Microsoft Azure, Amazon Web Services and others. This is a big valuable deal. AWS and Azure have way more resources and could crush Snowflake if they wanted (by opening their cloud data to other providers) but this seems unlikely.

Data security is another risk, but if companies got comfortable storing their data in the cloud--it seems they can get comfortable sharing it in data warehouses and data lakes.

Snowflake has a strong balance sheet (zero debt, plus nearly $4 billion in liquidity), impressive revenue growth and a truly massive secular trend (the explosion of cloud data which will be accelerated further by AI).

Further still, the valuation is lofty (but not nearly as lofty as it was during the pandemic bubble), and not lofty compared to its growth.

The Bottom Line:

These shares are a long-term buy. We currently own shares of Snowflake in our Blue Harbinger Disciplined Growth Portfolio.