A quick note to share some updated data and commentary on a handful of popular big-yield bond CEFs from PIMCO and BlackRock. This note may be of particular interest to those following our High Income NOW portfolio.

Bond CEFs: Premiums and Discounts

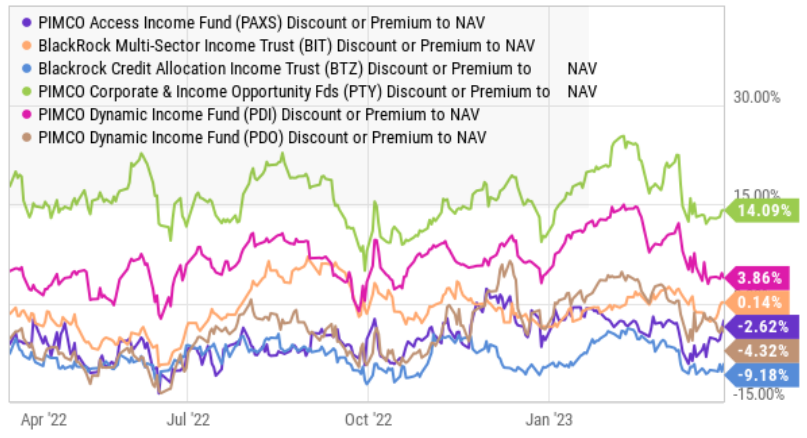

For starters, here is a look at the latest movement in premiums and discounts (versus NAV) for the six largest Bond CEFs in our High Income NOW portfolio.

As you can see, PIMCO’s widely popular PTY (green) and PDI (magenta) trade at the largest premiums, but those premiums have fallen significantly over the last month. As a reminder, we greatly prefer to own quality funds at a discounted price, but in the case of certain PIMCO funds (like PTY and PDI) premiums can be okay, and smaller premiums and better than larger premiums (all else equal).

As a note, the six funds in the table above (and the one below), are the six largest holdings in our High Income NOW portfolio, and collectively they currently yield over 10% (some a little above, and some a little below).

Bond CEF Prices:

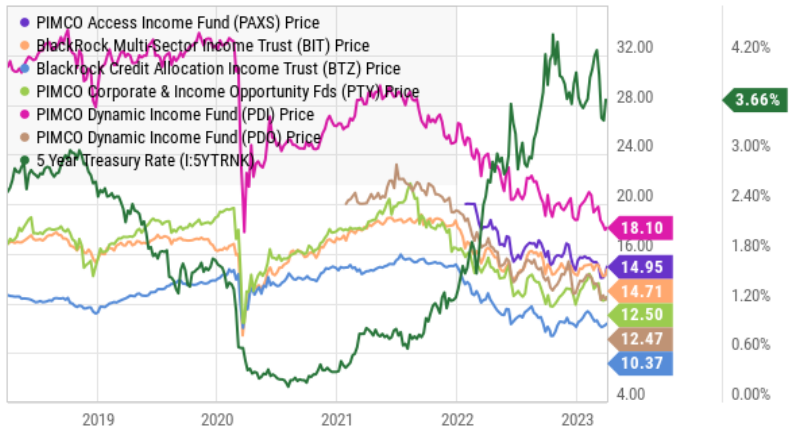

This next chart shows the recent market prices for the same six funds (in the same colors), but this time we’ve also added the current yield on a 5-year US Treasury (dark green line) as a proxy for interest rates. Recall, as rates rise, bond prices fall (and vice versa) and rates have been volatile. Also recall that the market prices in this chart reflect the net asset value of each bond CEF PLUS the premium or discount (from our earlier table).

Clearly these bond CEFs have taken a hit to share price over the last two years as interest rates have risen (and in some cases they’ve returned some of the NAV to shareholders as part of the distributions). The big steady income the funds provide is of critical importance to investors, but prices matter too. And hopefully, the Fed’s interest rate hike cycle is coming to an end—which would be good news for the market prices of these six bond CEFs.

Stocks Versus Bonds:

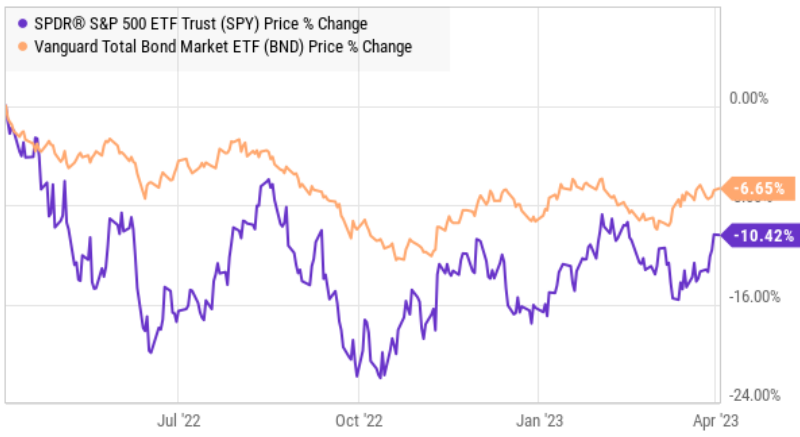

Lastly, as a reminder, this has been a strange period for markets as the Fed has been hiking interest rates (to fight inflation) as the stock market has been declining (they usually lower rates when the market is weak). And as a result, both stock prices and bond prices have been in decline at the same time (rare) as you can see in this next chart.

The Bottom Line:

Hopefully the Fed’s interest rate hike cycle is coming to an end (because this would reduce the downward pressure on bond CEFs). Also, now may be a better time than a couple months ago to add more bond CEFs to your portfolio considering premiums have shrunk and prices are down (i.e. the Fed’s interest rate hike cycle may be ending). We like all six of the bond CEFs in the charts in this report (and we currently own all six in our High Income NOW portfolio).