SoFi Technologies (SOFI) is a financial services company, focused mainly on lending (see Income Statement operating segments below). And the shares are currently getting pummeled for one main reason: Fear. Specifically, fear of the upcoming Supreme Court ruling on student loan forgiveness and fear of banks defaulting (i.e. contagion to the financial system from the recent run on Silicon Valley Bank (SIVB)). In this note, we quickly review SOFI’s business and valuation, and then conclude with our strong opinion on investing (i.e. is the recent sell off an opportunity or a warning).

Overview: SOFI’s Business

As you can see in the following table, SOFI breaks its business down into three operating segments, and “Lending” is by far the biggest. And within lending, you can see “student loan originations” was the biggest sub-section in 2020, but that segment has slowed (more on this in a minute) while personal loans have grown quickly.

Student Loan Forgiveness:

The main reason SOFI’s student loans business has slowed is NOT because rates aren’t competitive (they are), but rather because of the Biden Administration’s student loan forbearance. Specifically, Biden froze federal student loans during the pandemic (so borrowers didn’t have to make payments and so they weren’t charged interest), but this did not affect SOFI loans because they’re private loans (not government loans). As a result, students and graduates essentially stopped refinancing their loans over to SOFI (this was formerly SOFI’s bread-and-butter) because there was no need (why refinance when you’re not making payments or being charged interest anyway).

SOFI is Suing the Biden Administration

Now that the pandemic lockdowns are over, Biden is still continuing federal student loan forbearance. As a result, SOFI is suing the Biden Administration because they believe Biden does not have the legal authority to do what he is doing and because it is costing SOFI many millions of dollars in profits.

The supreme court is expected to rule on the case by the end of June. Of course media outlets have wildly different opinions on who will win the case, but this author believes Biden is likely to lose (and even if SOFI loses its case, there are still many additional attractive SOFI qualities, as we will review later in this report). If SOFI wins the case, the shares have a lot of upside (as we explain later in this report).

Silicon Valley Bank Repercussions:

Fear has gripped the financial services sector (particularly banks and lenders like SOFI), and as a result—the shares are down significantly. It seems unlikely the current challenges facing the banking sector (basically rising rates are reducing the value of the bonds they hold to meet reserve requirements, and in some isolated cases—such as SBV where they were concentrated in pandemic-bubble assets like technology and venture capital loans, the challenges are exacerbated) will be anywhere near as severe as the 2008-2009 financial crisis. However, memories of the 2008-2009 crisis are still fresh in many investors minds so they are reacting to the SVB news with a lot of fear. It is our view that fear can create great opportunity (i.e. “be greedy when others are fearful”).

Financially Speaking

SOFI is a real business that is growing revenues rapidly and it has a lot of room to keep growing revenues for a long time. That said, SOFI is also a relatively young company at it is still not GAAP-profitable (although it is heading in that direction rapidly). SOFI’s most recent quarterly earnings update was positive as the company beat expectations and raised guidance.

And from a valuation standpoint, SOFI shares trade at only 2.6x forward sales (very low and attractive for a company growing rapidly) and at only 19x the midpoint of 2023 EBITDA guidance (also attractive considering the high growth and large market opportunity).

Also worth mentioning, SOFI loans to borrows with higher higher earnings (and higher FICO scores) than the typical bank (a good thing when the market gets bumpy) and SOFI will benefit significantly as rates rise (because variable rate loans will pay more money to SOFI).

Insider Buying:

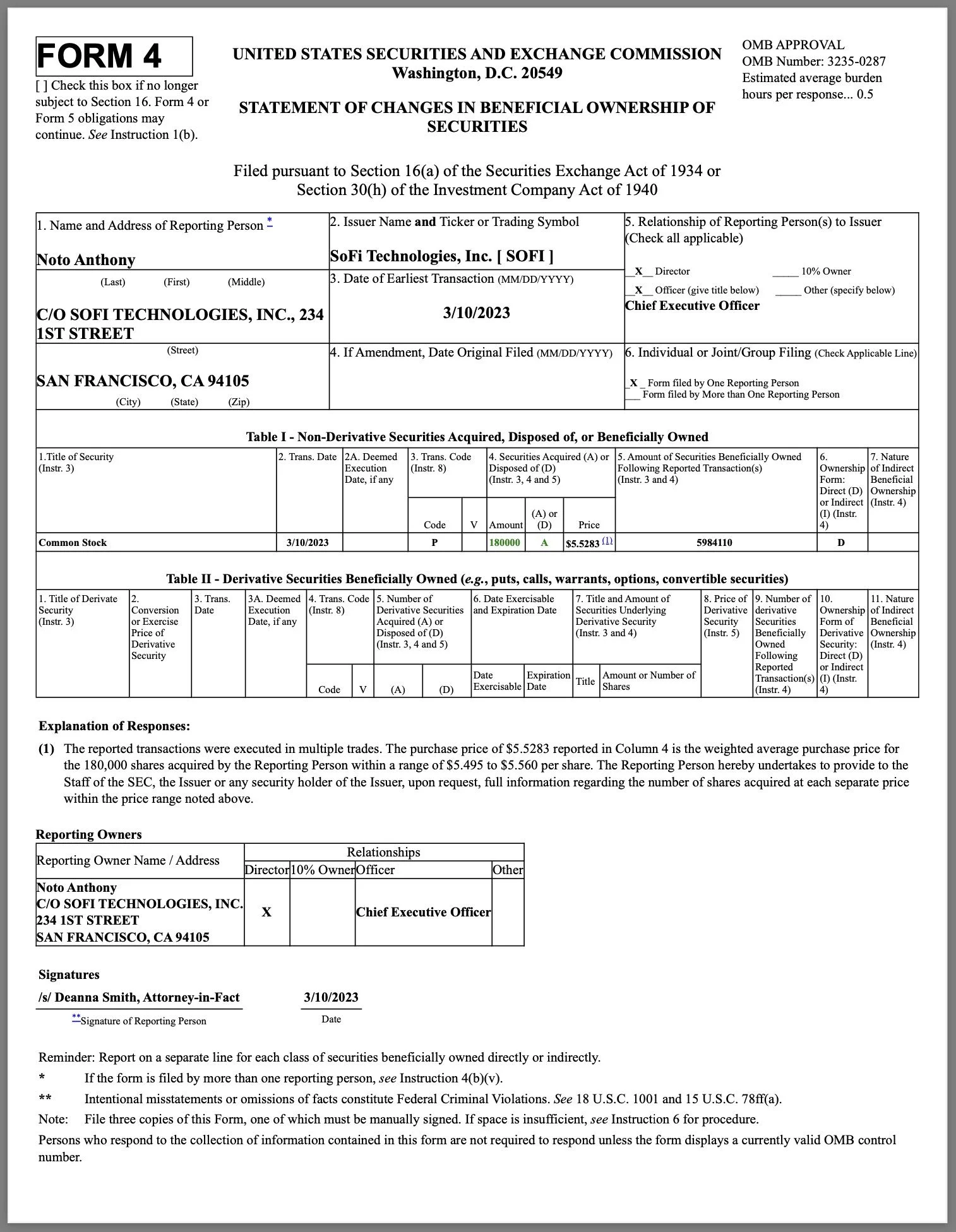

Also encouraging to note, insiders have been purchasing shares of SOFI. For example, CEO Anthony Noto recently notified the SEC of nearly $1 million worth of share purchases.

The Bottom Line:

We view SOFI’s business is attractive, and the shares could rise significantly in the second half of this year, especially if the Supreme Court ruling goes in its favor and as investors recognize the current banking crisis isn’t anywhere near as serious as the 2008-2009 crisis (knock on wood). In our opinion, SOFI shares are attractive and worth considering for a position in a prudently-diversified growth-focused portfolio. We are currently long shares of SOFI in our Disciplined Growth Portfolio (and have added to the position this week).