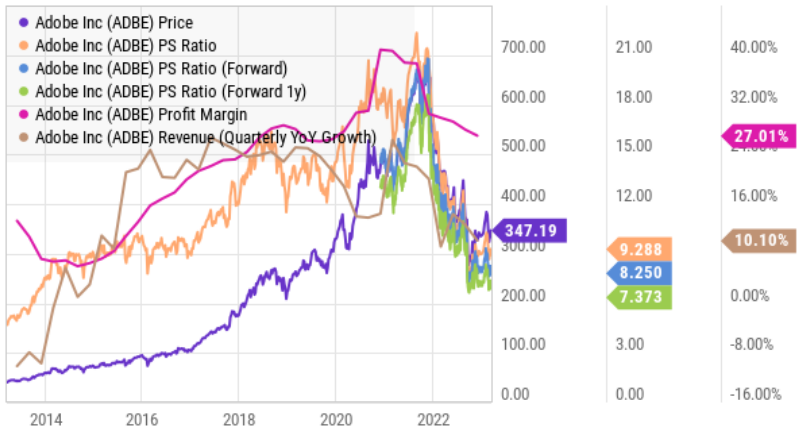

This highly-profitable “creative” software company announced powerful revenue and operating income on Wednesday after the close (the shares are up significantly Thursday), and it’s well-positioned to keep driving profitable growth for the decade ahead. Its products benefit from strong moats (high switching costs), increasing subscription revenue and lots of cash flow to fund growth and buy back shares. This is a business that is positioned to weather the economic cycle well, and it trades at very reasonable valuation multiples, especially considering profit margins and revenue growth guidance both remain robust.

Importantly, here is an update (from CEO Shantanu Narayen during the latest earnings call) about Adobe’s planned Figma acquisition which has been brought into question by the Department of Justice (Adobe believes they’re still on track to closed by the end of 2023):

We believe the transaction continues to be on track for a close by the end of 2023. It goes without saying that our Q1 success demonstrates that we continue to be ruthlessly focused on executing against our immense opportunities, independent of this combination.

Adobe is paying a lot for Figma, but in the long-term we like the acquisition if it goes through. Here is what we previously said about it:

Adobe paid too much for Figma. This is often a problem for very profitable companies with lots of cash (like Adobe)—they go shopping for inorganic growth and end up paying too much for it. However, in the long-term the deal will eventually be accretive to shareholders. What’s more, the share price damage is already done as Adobe shares fell ~16% on the news. We intend to continue holding our shares of Adobe, and if you don’t already own shares—you might consider purchasing because it will continue to be a high-growth, highly-profitable business with lots of long-term share price appreciation potential. Ten years from now, we expect Adobe’s share price can easily be 5x (or more) what it is right now.

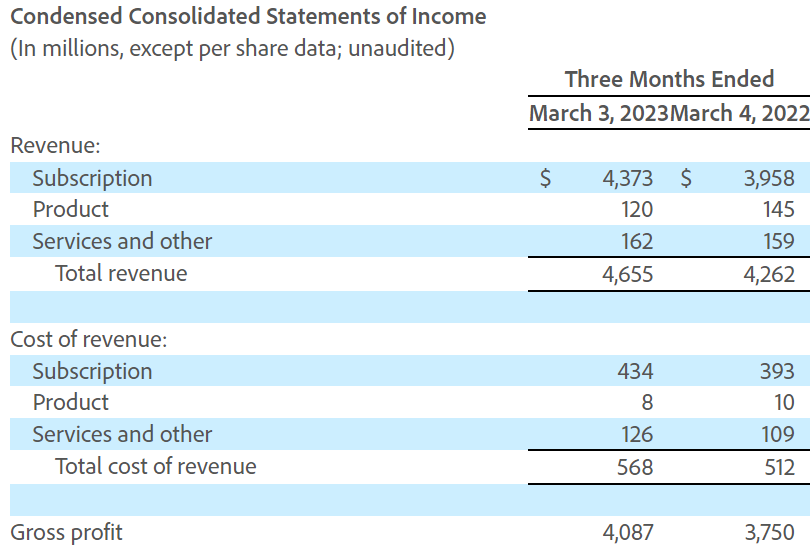

Importantly, Adobe achieved revenue of $4.66 billion in its first quarter of fiscal year 2023, which represents 9 percent year-over-year growth or 13 percent in constant currency. Diluted earnings per share was $2.71 on a GAAP basis and $3.80 on a non-GAAP basis.

Here is a helpful quote (about Adobe’s business) from CEO Shantanu Narayen during the latest earnings call (emphasis ours):

Our performance demonstrates the critical role that Adobe products are playing in fueling the global digital economy, empowering everyone everywhere to imagine, create and bring any digital experience to life. We are executing against our strategy to unleash creativity for all, accelerate document productivity and power digital businesses, delivering on our innovative product roadmap and engaging a growing universe of customers from individuals to small businesses to the largest enterprises.

The Bottom Line:

We own shares of Adobe in our Disciplined Growth Portfolio, and we have no intention of selling. The shares continue to be attractively priced relative to their long-term growth and earnings. Adobe shares have impressive long-term upside price appreciation potential.