After two full weeks of 2024, the tectonic big-yield landscape continues to shift, and select highly-attractive opportunities continue to emerge. It’s a fantastic time to be a big-yield investor, and we share top ideas in this report. Specifically, we countdown our top 10 big-yield opportunities, including closed-end funds (“CEFs”), business development companies (“BDCs”), real estate investment trusts (“REITs”), dividend stocks and master limited partnerships (“MLPs”). We also share data on hundreds of big-yield opportunities from across each of these categories (so you can compare and contrast for yourself). Let’s get right into it.

100 Big-Dividend REITs, Down Big

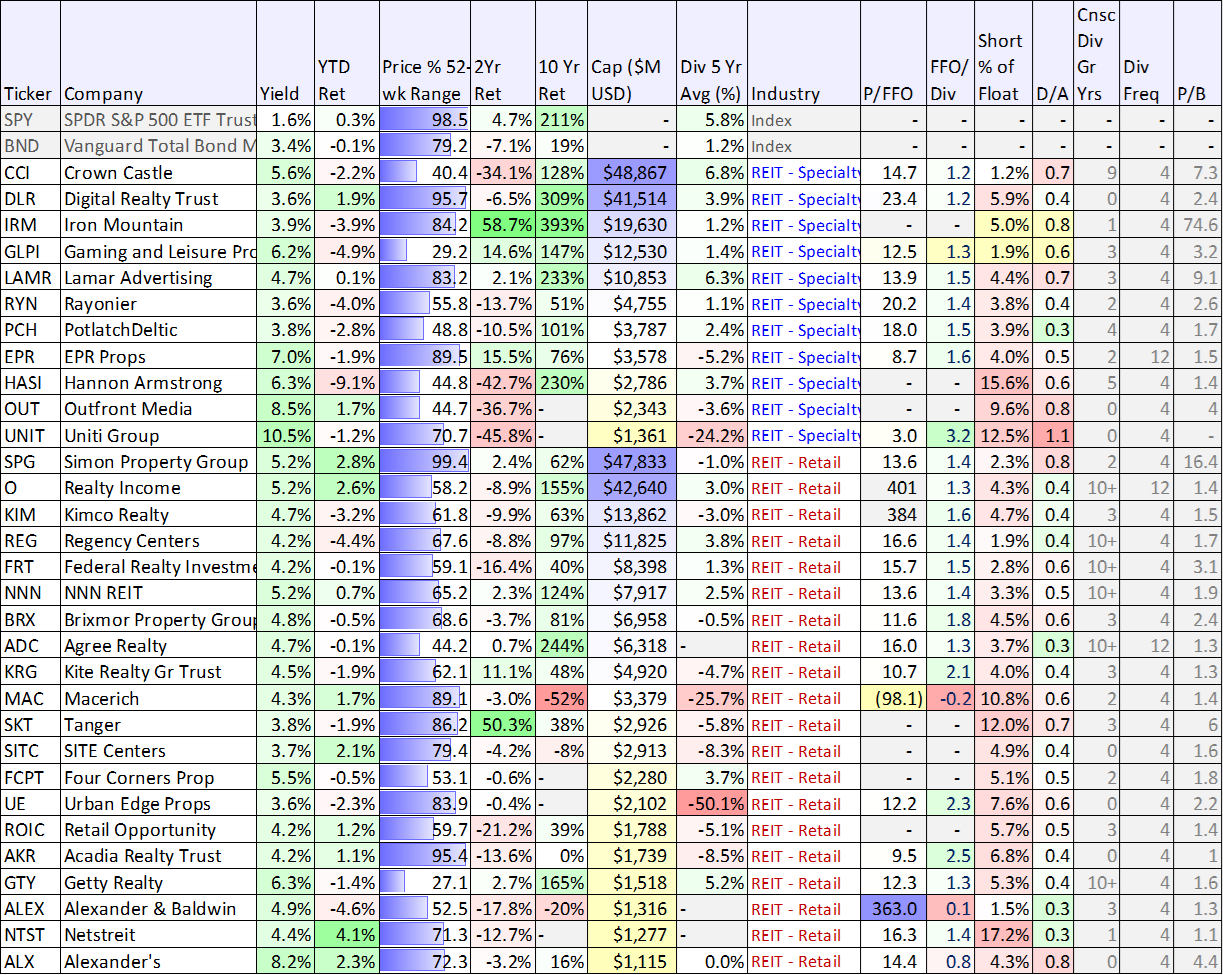

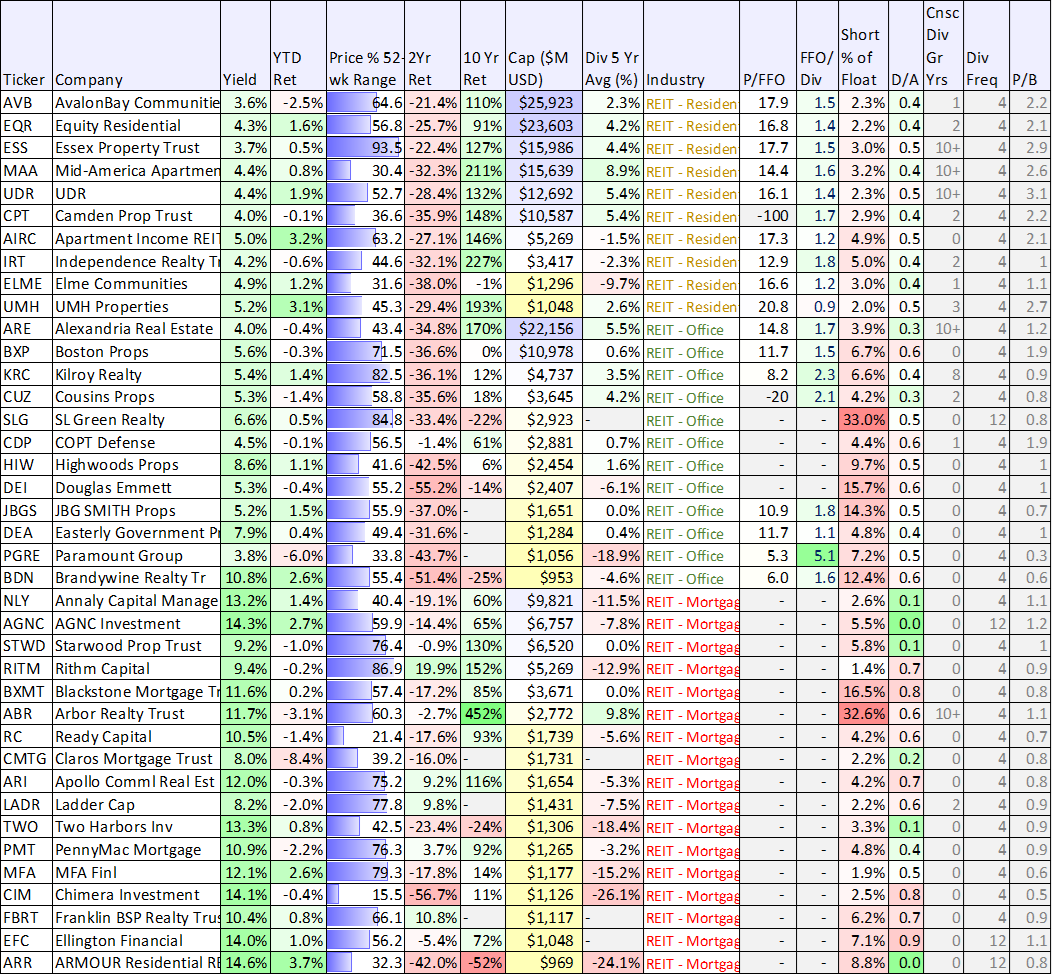

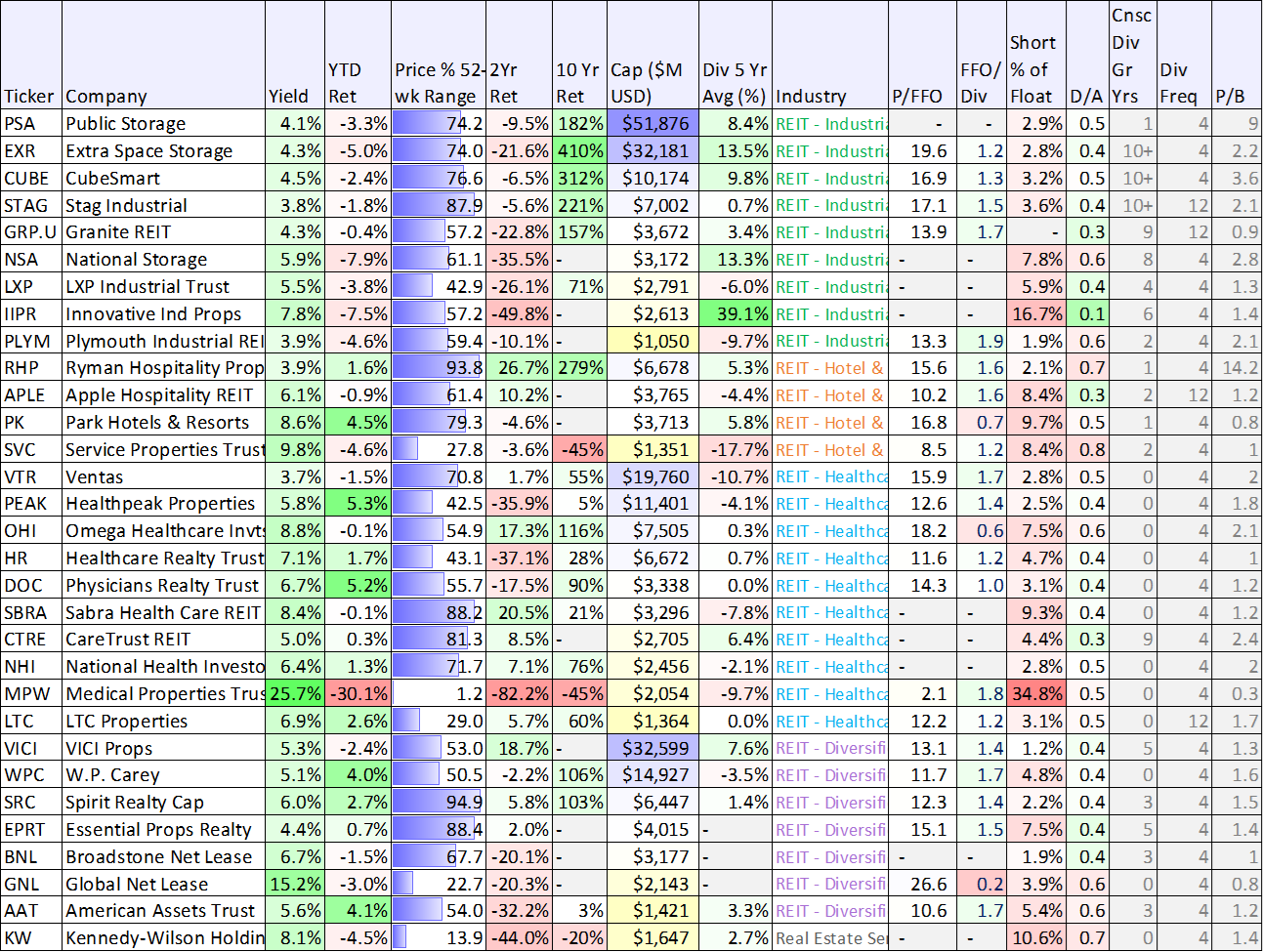

Starting with big-dividend REITs, you can see in the following table that performance for the group has been mixed (to the downside) over the last two weeks, and downright ugly over the last two years (for some sub-sectors more than others). For example, check out the underperformance of industrial REITs over the last two weeks (i.e. year-to-date) and the horrendous 2-year total returns for office and residential properties in the table below.

Data as of Friday 1/12/24, source: StockRover

Data as of Friday 1/12/24, source: StockRover

Data as of Friday 1/12/24, source: StockRover

And while some contrarian investors may be tempted to just buy any REIT at this point, believing a contrarian rebound is imminent, we prefer to be much more selective in our approach. So with that backdrop, let’s get into our top 10 rankings and countdown, starting with a REIT at number ten.

10. Realty Income (O), Yield: 5.2%

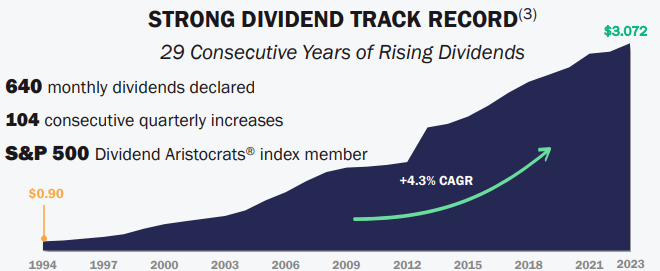

Realty Income, known as “The Monthly Dividend Company,” has paid monthly dividends for over 54 years straight. And the dividends have steadily grown over time. The company generates cash flow from over 13,250 properties, mostly owned under long-term net lease agreements with commercial (mainly retail) clients.

In our view, despite industry challenges (such as ongoing secular shifts in the retail shopping landscape), Realty Income is attractive if you are seeking income growth and and price appreciation potential. For example, the dividend yield is big yet well covered by AFFO (adjusted funds from operations), and the valuation (Price/AFFO) is low by historical standards. Furthermore, we view Realty Income’s “growth through acquisition” strategy as prudent (especially considering it has significantly more financial wherewithal than peers).

We are currently long shares of Realty Income, and expect the share price and the dividend to both rise in the years ahead. You can read our full report on Realty Income here.

Honorable Mention:

Not officially in our top 10 ranking, we also would like to highlight another popular REIT that is worth considering.

*AGNC Investment Corp (AGNC), Yield: 14.3%

We’re including AGNC Investment Corp as an honorable mention only because we do NOT own shares (we generally stay away from mortgage REITs), but the recent opportunity has been particularly compelling considering the current wide spreads (juicy yields) on agency mortgage backed securities (the major component of this mortgage REIT’s holdings. Plus, the price-to-book value is reasonable as well (see our earlier REIT table data). We recently wrote up AGNC in detail for our members, and you can access that report here.

9. British American Tobacco (BTI), Yield: 9.5%

British American Tobacco already offered a big yield and attractive value-versus-the-price, but following last month's news of a $31.5 billion non-cash impairment (mostly related to U.S. Combustible products), the price fell, and now the value-versus-the-price and the dividend yield are both even MORE attractive. We've updated our position in BTI (in our High Income NOW portfolio) from 1.0% to 2.5% following the latest price decline, and you can read out latest full report on BTI here.

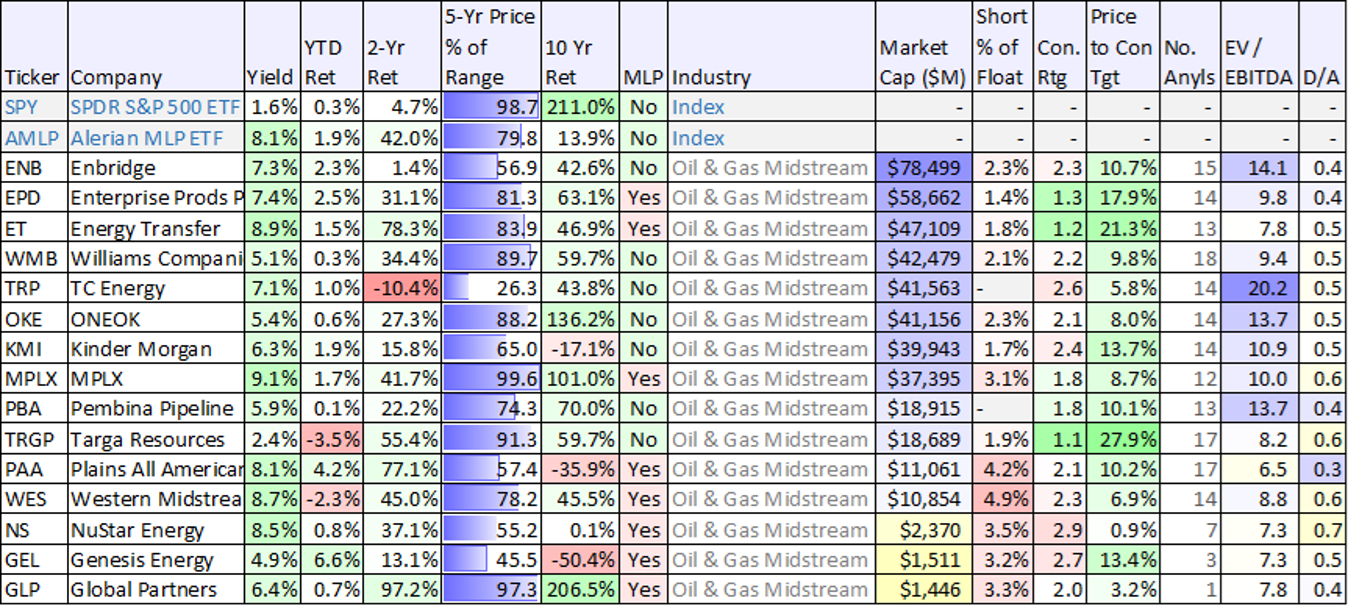

Top Big-Yield Midstream Companies (including MLPs):

Midstream companies generally transport oil and gas through pipelines, and they also generally offer very big yields, as you can see in the table below.

Data as of Friday 1/12/24, source: StockRover

However, important to recognize, some midstream companies are Master Limited Partnerships (“MLPs”) that have unique characteristics that should be considered. For example, they offer K-1 statements (instead of 1099s) at tax time, which can create additional reporting headaches. Additionally, many MLPS are converting to C-Corps which creates big tax risks too. A good way to understand these unique MLP challenges is by reviewing one top MLP in particular, as we do below.

Honorable Mention: Energy Transfer (ET), Yield 9.0%

We’re including Energy Transfer as an “honorable mention” in our rankings because despite its massive yield (which is healthy) and its very compelling valuation, it creates unique challenges for some investors. You can read all the details in our full Energy Transfer report here.

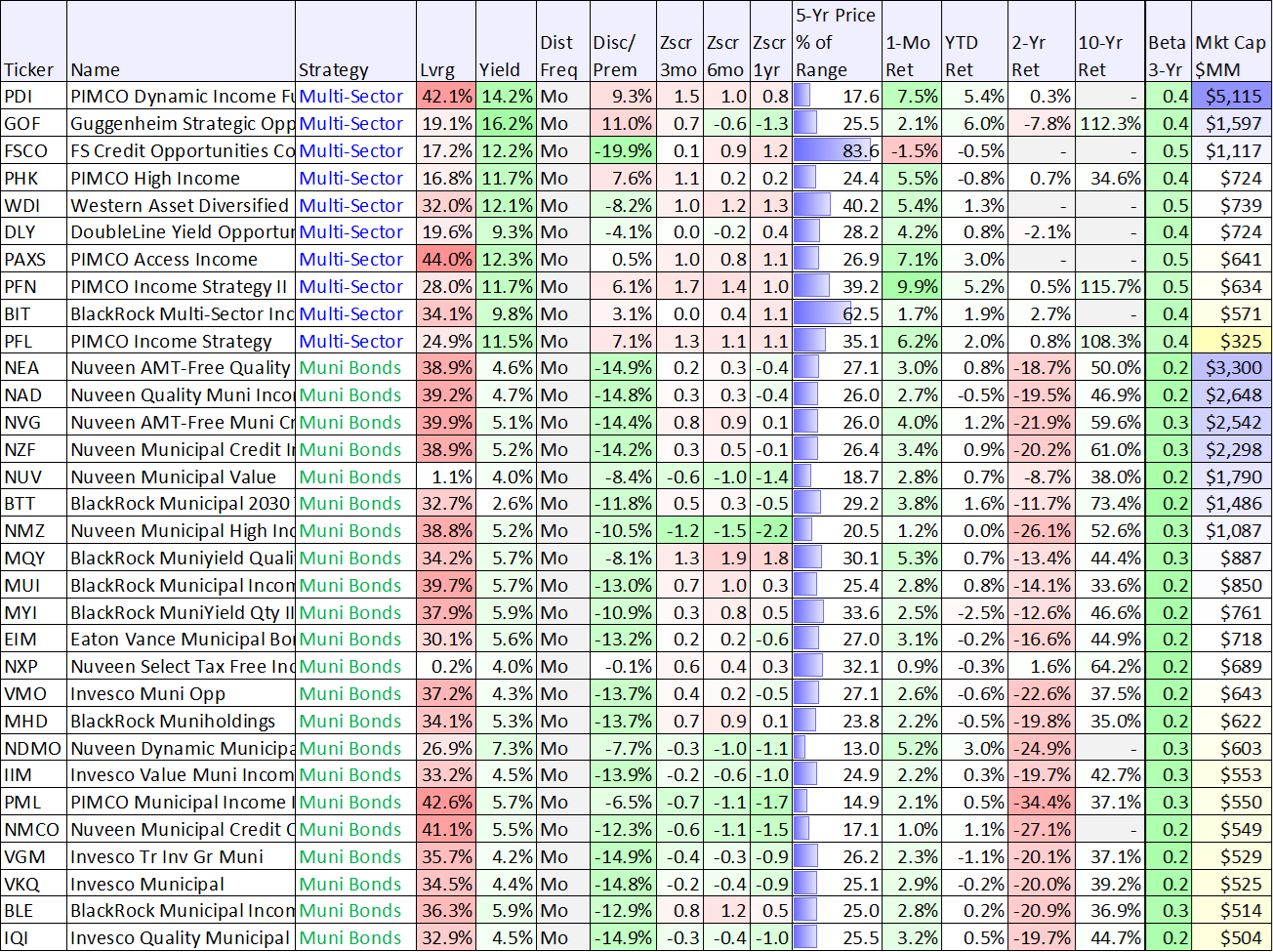

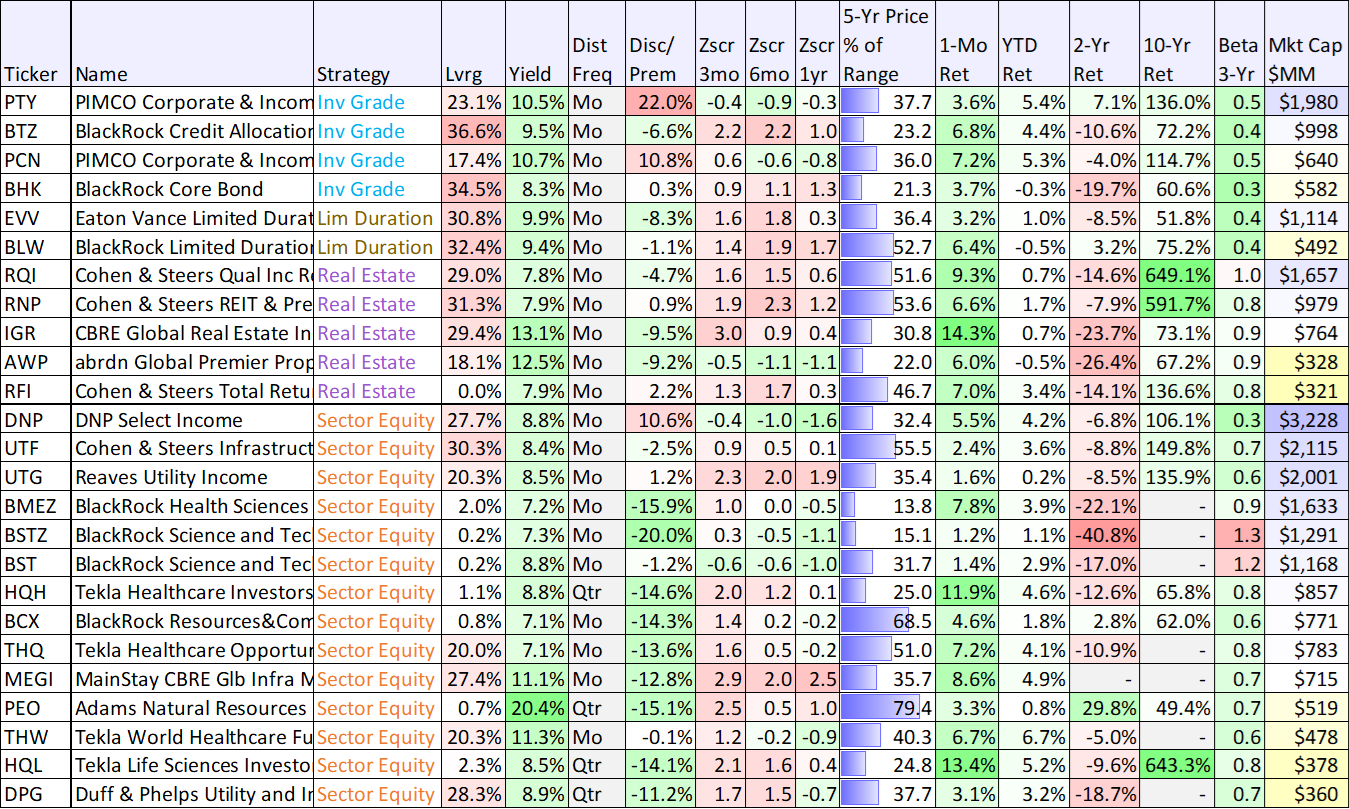

50+ Top Big-Yield CEFs

Business Development Companies (BDCs) are often another income investor favorite because of their big yields and instant diversification (they are funds, and thereby hold many individual positions within). Interestingly, CEFs can also present increased risks and opportunities based on the large premiums and discounts (versus net asset value) as you can see in the following table (we generally greatly prefer to buy things at a discount, but not always).

Data as of Friday 1/12/24, source: StockRover and CEF Connect

Data as of Friday 1/12/24, source: StockRover and CEF Connect

Data as of Friday 1/12/24, source: StockRover and CEF Connect

You likely recognize many of the names from the above list. But before getting into the specific CEFs we like (and own), here are a few important CEF questions we always ask before investing.

So with that information in mind, let’s get into a specific top CEF idea from the list.

8. Cohen & Steers Quality Income Realty (RQI), Yield: 7.8%

As mentioned, REITs offer an impressive contrarian opportunity right now, considering interest rate hikes have slowed (and may reverse). What’s more, select REITs are particularly attractive, and the management team for this particular closed-end fund has established an attractive portfolio (you can view RQI’s recent top 10 holdings below).

What’s more, this fund trades at an unusually large discount to NAV (-6.3%, see our earlier CEF table, especially the negative z-scores—a good thing from a contrarian standpoint). We currently own this fund in our High Income NOW portfolio, and have written about it in the past here.

7. D&P Utility and Infrastructure (DPG), Yield: 9.1%

Sticking with our CEF theme, this $400 million dollar fund, managed by industry stalwart (Duff & Phelps) holds 44 positions, consisting mainly of utilities sector (63%) and energy stocks (25%). It has long been an income-investor favorite until last year (2023) as utilities stocks were the worst performing sector, and a related distribution rightsizing has driven investors away in hoards. We view this as an attractive “buy low” contrarian opportunity (considering the quality of the fund’s holdings).

You can read our recent full report on DPG here, and (as members know) we did purchase shares of DPG in late September.

40+ Big-Yield BDCs

BDCs are another income-investor favorite because of their big steady dividend payments. Generally, BDCs provide financing (mostly loans) to smaller middle-market sized companies. And BDCs make money on the spread between their cost of capital versus the higher rate at which they lend capital to other companies.

For additional background, here is what we wrote in our previous report about BDCs:

For some high-level background, BDCs were created by Congress in the 1980s as a way to help small businesses (middle-market sized) get access to capital. BDCs invest in businesses by providing them debt and sometimes taking an equity position. BDCs can generally avoid paying corporate taxes by paying out most of their income as dividends (you generally still have to pay taxes on the dividends you receive from BDCs—if you own them in a taxable account).

BDCs are subject to a variety of other stipulations. For example, they are regulated by the SEC under the Investment Company Act of 1940, their leverage is limited to approximately 2:1 debt/equity (unless an SEC exemptive order exists to exclude SBA debt) and investments are required to be carried at fair value. The majority of the board of directors must be independent, they offer managerial assistance to portfolio companies and they are subject to comprehensive disclosure requirements under the 1934 Act.

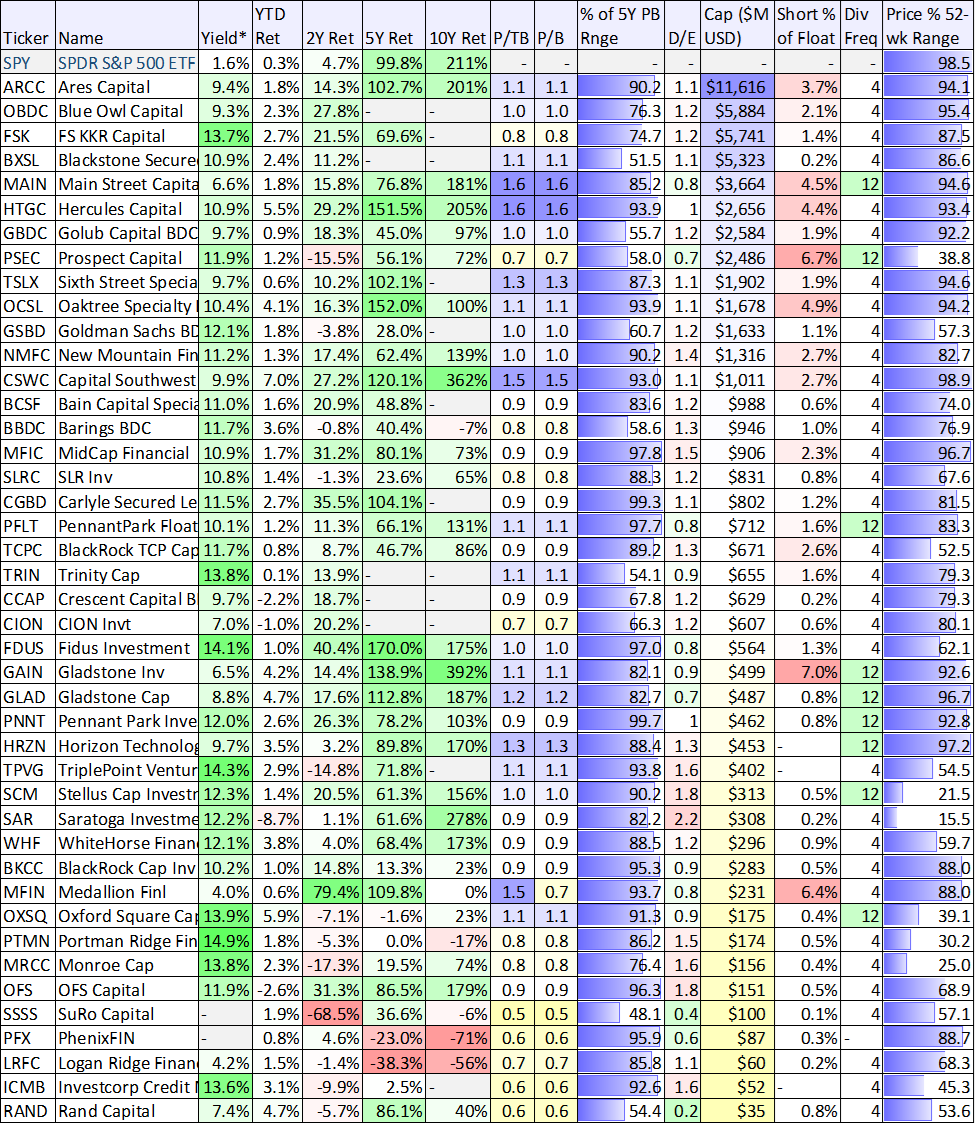

And as you can see in the following table, BDCs have performed a lot better than the REITs (we reviewed earlier) in terms of total returns over the last two years and over the last two weeks (i.e. year-to-date).

Data as of Friday 1/12/24, source: StockRover

You likely recognize many of the names in the above table. Also worth mentioning, you can see the price-to-book value for each BDC (this is a common high-level BDC valuation metric, but of course there is a lot more to analyzing a BCD than simply its P/B ratio).

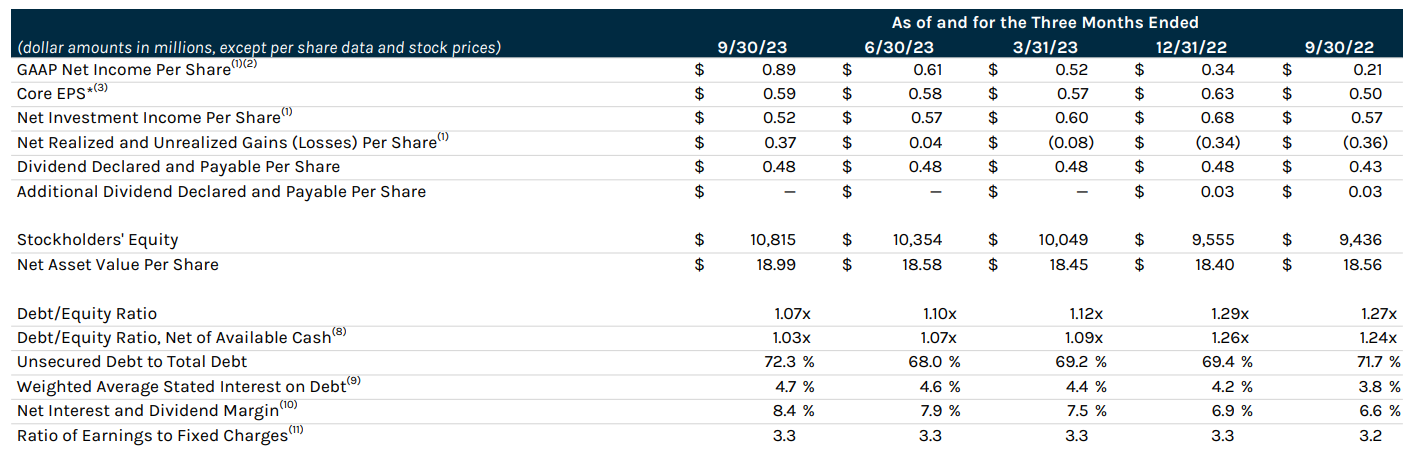

6. Ares Capital (ARCC), Yield: 9.4%

When it comes to BDCs, Ares Capital is the biggest ($11.6B market cap) and one of the most trusted. And its investment portfolio is well-diversified across market sectors and industries.

As you can see in the following table, Ares dividend continues to increase, and it is well covered by net investment income. Further still NAV continues to grow (a sign of strength and health).

Also attractive, Ares currently trades at book value (neither a premium or discount), and this is attractive considering the ongoing high dividend and dividend growth.

We currently own shares of Ares, and we recently wrote it up in great detail here.

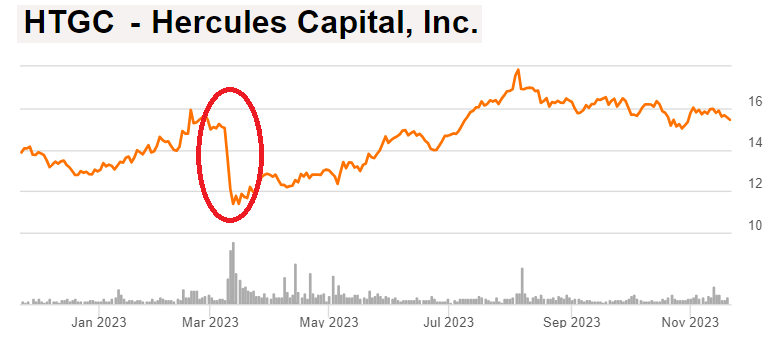

5. Hercules Capital (HTGC), Yield: 10.9%

Hercules Capital is a popular BDC in our list above. And Hercules is unique because it focuses heavily on providing growth and venture capital to newer and more innovative companies. This is different than a lot of other BDCs that focus on more mature businesses.

Hercules ran into some challenges (and a steep share price sell off) earlier in 2023r (see chart below) related to the mini banking crisis. Specifically, Hercules lends to a lot of startups and venture-capital backed companies—the same group that struggled mightily this year and created challenges for the now infamous Silicon Valley Bank.

We initially purchased shares of Hercules shortly after that steep price decline (read about the purchase here). However, not only did Hercules survive the mini banking crisis, but it is now in a better position going forward considering a significant source of competition (Silicon Valley Bank) has essentially gone defunct (and what’s left is under new ownership that lacks the longer-term relationships Hercules has).

Hercules has a higher price-to-book value than many other BDCs (see our earlier table), but the book value of its assets has a lot more upside too (considering the high growth nature of these businesses). We continue to own shares of Hercules Capital.

4a. Royce Value Trust (RVT), Yield: 7.9%

4b. Royce Micro-Cap Trust (RMT), Yield: 9.4%

If you are afraid that mega-cap technology stocks (such as the “Magnificent 7” that dominated the market in 2023) have gotten ahead of themselves, then these two small-cap closed end funds from Royce Partners are worth considering, especially if you like high income.

We’ve been pounding the table on these two funds for months, and we continue to do so as they continue to pay big distributions and continue to offer significant price appreciation potential. The income is steady, growing and quarterly; the price appreciation is longer-term for patient investors.

Both of these funds have outperformed their benchmarks for an extended period of time (over a decade) and both currently trade at attractively discounted prices versus their net asset values (see our earlier CEF data table). In particular, not only have small cap stocks performed poorly (they generally take a bigger hit when the economy is uncertain—like it has been), but selling pressure from investors has made the price discounts significant (i.e. an attractive contrarian opportunity).

When the economy finally becomes more stable (which it should be soon—knock on wood—as the fed’s aggressive interest rate hikes seem to have come to a conclusion) small caps will likely rebound hard—especially as compared to the rest of the market, and both of these two funds are especially attractive, thanks to their discounted prices and very strong management teams at Royce. You can read more about these funds here. We are long both RMT and RVT.

3. Oaktree Specialty Lending (OCSL), Yield: 10.6%

Oaktree is a BDC. It’s objective is current income and capital appreciation by providing companies with flexible and innovative financing solutions, and by emphasizing an opportunistic, value-oriented and risk-controlled approach (this is in contrast to Hercules growth focus, as described earlier).

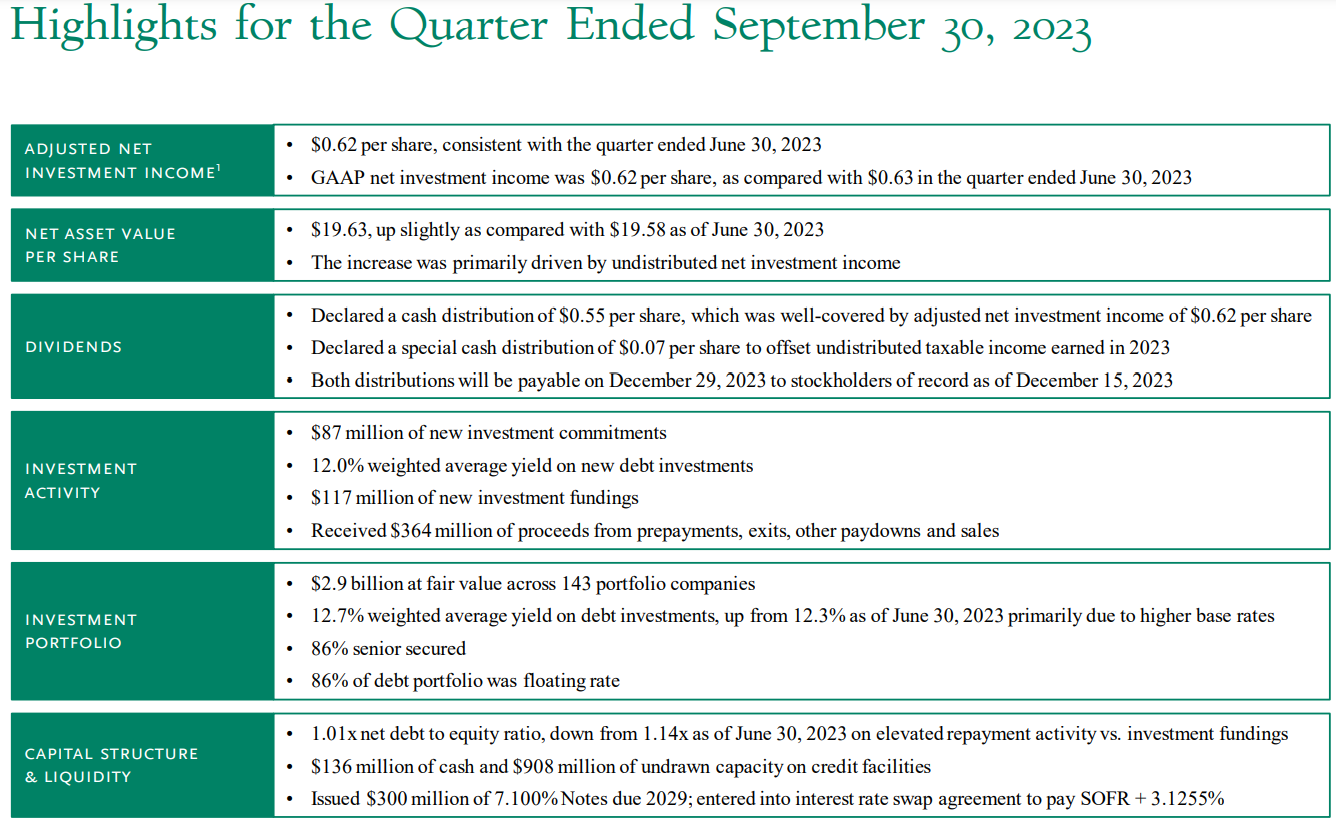

Oaktree’s dividend (technically a distribution) is well-covered. For example, its most recent distribution of $0.55 per share (see graphic below) is well-covered by adjusted net investment income of $0.62 per share. OCSL also just declared a special cash distribution of $0.07 per share (both distributions will be payable on December 29, 2023 to stockholders of record as of December 15, 2023).

We also appreciate that NAV increased in the most recent quarter (a good sign of value creation), and the shares trade at only a small premium to NAV (see our earlier BDC table).

We purchased shares of Oaktree several months ago. The distribution has remained solid and the shares are up only slightly (i.e. it still presents a highly compelling investment opportunity). You can read our previous Oaktree Specialy Lending report here.

2a. PIMCO Dynamic Income Opps (PDO), Yield: 12.7%

PIMCO is often considered the premier bond fund manager. And as such, many PIMCO CEFs often trade at large premiums versus NAV. However, PDO currently trades at a rare discount to NAV (-2.8%) and we view this as a particularly attractive opportunity.

In particular, we like this fund because it is hated by a lot of investors. For example, over the last two years the fund is down more than 20% (and that includes the big monthly distributions it pays, as if they were reinvested).

However, a big reason the fund is down is because interest rates have risen sharply over the last two years, and as interest rates rise—bond prices fall (all else equal). Fortunately, as the federal reserve has slowed the rate of inflation, interest rates are not expected to rise in the near future (they may even fall), and this bodes well for bond funds in general, and PIMCO in particular.

We expect this fund to continue to pay big steady monthly distributions, and we may even see some healthy price appreciation too (especially if the fed reverses course and cuts interest rates in 2024, as is increasingly expected).

We recently wrote about PDO in more detail (we compared it to PDI), and you can access that report here:

*Honorable Mention:

*Nuveen Quality Muni Income Fund (NAD) Yield >4.7%

If you don’t like paying taxes, like most of us, you may have noticed that municipal bond closed-end funds are still trading at historically large (and very unusual—attractive!) discounts to NAV. The “magic” of a municipal bond, is that you generally don’t have to pay federal income tax on the income—so if you’re in a high tax bracket—munis can be quite lucrative (especially on a “tax-equivalent” yield basis). In the following report (link below), we share data on over 75 big-yield municipal bond CEFs, discuss the current historical opportunity (including how funds are actively working to reduce the discounts!), and then share a few thoughts on a few muni-bond CEFs in particular that you may want to consider, including Nuveen. Here is the report.

2b. BlackRock Credit Alloc. Income(BTZ), Yield: 9.8%

A lot of investors don’t like BlackRock (they prefer PIMCO), but this big-distribution bond CEF has a lot of attractive qualities.

For starters, BTZ owns bonds, and bonds are out-of-favor but stabilizing. The duration (or interest rate risk) is 5.97 years, which helps explain the weak performance (like virtually all bond CEFs) over the last two years. However, going forward the fund is positioned to deliver very healthy monthly income and price gains. It trades at a compelling 10.7% discount to NAV (large by recent historical standards, as per its z-scores in our earlier table). We like the 36.2% leverage ratio because it is meaningful for a bond fund, and will magnify returns and income going forward as the bond market (i.e. interest rates) stabilize. We also like the wide resources and competencies of BlackRock, a vast industry leader. We are currently long shares of BTZ in our High Income NOW portfolio.

1. PIMCO Access Income (PAXS), Yield: 12.3%

And if you still don’t like BlackRock, the PIMCO Access Income Fund (a CEF) comes it an #1 in our rankings. Specifically, it is the largest position in our High Income NOW portfolio.

For starters, it’s rare to find an attractive PIMCO bond fund that doesn’t trade at a massive premium to NAV. However this relatively new fund (January 2022 inception date) still flies a bit under the radar and trades at only a 0.5% premium to NAV—very compelling for a PIMCO fund. The duration (interest rate risk) is 3.89 years, which means it will benefit going forward if rates fall, and the worst of the recent bond market pain is likely behind us as inflation seems to have slowed and the fed has ceased hiking interest rates.

We like the 43.8% leverage ratio, very significant, but reasonable, especially considering the fund is managed by the premier industry leader, PIMCO. We expect this fund will eventually trade a large premium (like many other PIMCO bond funds). We are currently long shares of PAXS in our High Income NOW portfolio (you can view all of the current holdings here).

The Bottom Line

If you are an income-focused investor, the high-income space currently offers some particularly compelling opportunities, such as those highlighted in this report (i.e. select REITs, BDCs, CEFs and more). It is the combination of subdued interest rate volatility (and potential rate cuts this year) and some overly negative investors that are creating many of these select big-yield contrarian opportunities. It is a great time to be a big-yield investor.

Overall, we believe disciplined goal-focused long-term investing will continue to be a winning strategy, and you can view how all of these select opportunities fit into our prudently concentrated High Income Now Portfolio here.