The tech stock we review in this report has a lot of attractive qualities. For starters, the dividend is very healthy (it has been increased for 11 years in a row, and the current yield is 3.1%). Next, the company is the leader in legacy networking (it commands premium pricing) and well positioned to keep benefiting from future networking solutions as the market evolves. It has high margins, growing subscription revenues, high customer switching costs, a strong balance sheet, incredible cash flows and an attractive share price (relative to valuation). We review the details in this report and conclude with our opinion on investing.

About: Cisco Systems (CSCO), Yield: 3.1%

Cisco Systems makes networking hardware and software products (75.2% of revenues) and provides related services (24.8%). Founded in in 1984 (by a couple Stanford scientists) and having gone public in 1990 (with a then market cap of $224 million), Cisco Systems may seem like a dinosaur, but it remains highly relevant (and the market leader) in Internet Protocol networking solutions. Customers pay a premium for Cisco, and the company’s path forward remains bright as a leader in both legacy networking and future networks. With a current market cap of around $200 billion, Cisco shares are a steal (attractive valuation) as we will cover in a later section.

For a little perspective, here is a look at a few Cisco product categories.

Strong Financial Position:

We like Cisco as a blue chip leader, especially in the current market environment because as the economy moves towards recession—Cisco’s sticky customer cash flows will remain strong, and as the recession resolves—the company continues to have attractive growth potential for a long time into the future.

For example, here is a look at the company’s healthy recurring revenue trend.

And here is a look at revenue growth and margins.

As you can see above, revenues have continued to grow, despite a challenging environment. Also margins are high. And net income is very positive (something many high-revenue-growth tech companies still cannot say). Further still, cash flows remain healthy.

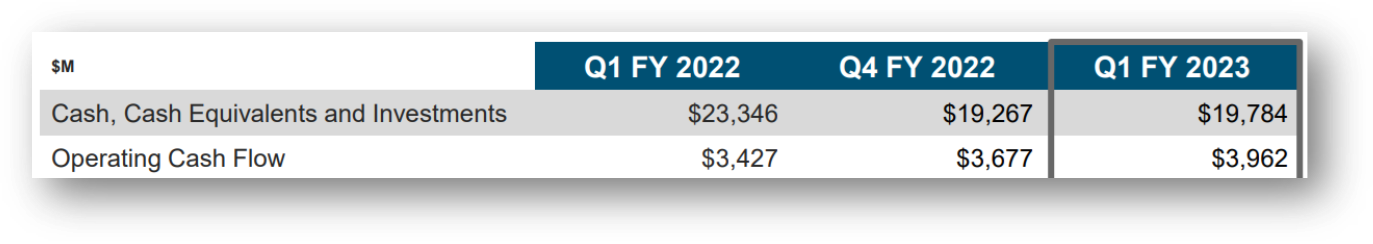

Healthy Cash, Dividends and Share Repurchases

Cash flow is always attractive because it allows a company to allocate it where it can be most valuable. For example, new investments (growth initiatives or acquisitions), to pay down debt, to repurchase shares and to pay dividends. Here is a look at Cisco’s cash flow from operations (and the cash on its balance sheet).

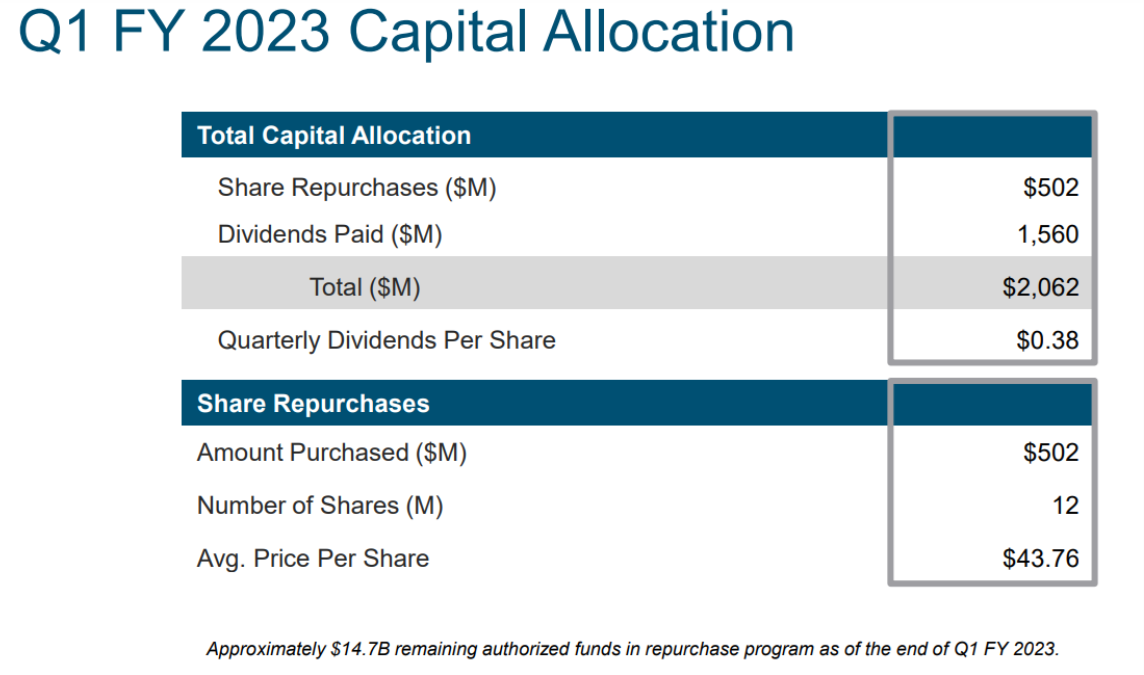

More specifically, here is a look at the size of Cisco’s share repurchases and dividend payments (both are well covered by cash flow from operations)

Valuation:

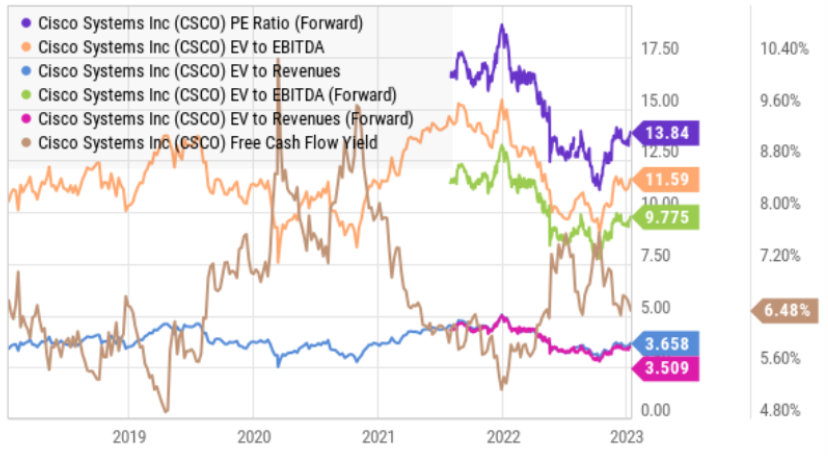

Cisco shares are down more than 20% over the last year and now trade at 13.8x forward earnings, which is quite reasonable as compared to history and as compared to EV/EBITDA and EV/Revenues.

On the most recent earnings call, Cisco raised forward guidance, expecting next quarter’s:

“revenue to grow between 4.5% and 6.5%, with earnings between 84 and 86 cents per share. Analysts were expecting sales growth of 4.2% and adjusted earnings of 85 cents per share.”

Also noteworthy, Cisco’s profits margin remains very strong at over 20%.

Looking forward, we believe Cisco continues to have steady growth potential from cloud-solutions, network security and improving margins as it continues to grow software subscription revenues. The shares have significant upside, and that is in addition to its well-covered and growing dividend payout.

Risks:

The Cloud: Cisco has done a good job of developing hybrid-cloud solutions for enterprises as the market has moved dramatically towards the cloud (and away from Cisco’s traditional non-cloud business). There will always be a need for non-cloud solutions, and Cisco has done a good job of developing solutions and adapting to cloud the cloud. Also, Cisco’s business is arguably considerably less volatile than the cloud-only companies that have sold off so hard over the last 18-months as the pandemic bubble burst with rising interest rates.

Market Environment: Like virtually all businesses, Cisco faces headwinds as economic growth slows—as it has been recently. However, we view Cisco’s business as much stronger versus less-profitable tech companies. In fact, we view the recent market wide sell off somewhat indiscriminate and as having inappropriately dragging Cisco’s share price too low relative to the strength and health of its business.

Bottom Line:

Cisco is an attract business during the current economic environment (i.e. slowing macroeconomic growth) because of its high switching costs, sticky subscription revenue and powerful cash position. Further, it can continue to grow both organically and inorganically as its market opportunity (cloud, hybrid-cloud, security) continues to grow. The dividend adds to security during volatile markets (it has grown for 11 years straight), and the valuation suggests the shares are undervalued (perhaps related to the somewhat indiscriminate sell off in the technology sector). If you are looking for steady dividend income increases and long-term share price appreciation, Cisco Systems is attractive and worth considering for investment.