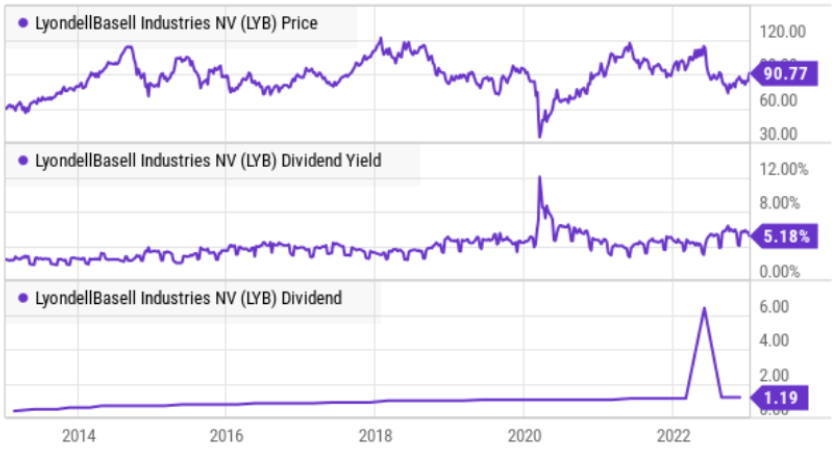

If you are looking for a contrarian investment opportunity, trading at an attractive valuation and offering a large dividend (currently 5.2% yield) that has increased for the last 11 years in a row, you might want to consider the materials (chemicals) business we review in this report. It has been slowed by global covid disruptions (e.g. China’s zero-COVID policy), but remains highly profitable, has a significant competitive (cost) advantage, and has healthy upside in the years ahead.

LyondellBasell (LYB), Yield: 5.2%

Based in Houston, Texas (and with operations around the globe) LYB is one of the largest plastics, chemicals and refining companies in the world. Specifically, it is the leading producer of oxyfuels worldwide, as well as polypropylene in North America and Europe, and it is the world’s largest global licensor of polyolefin technologies.

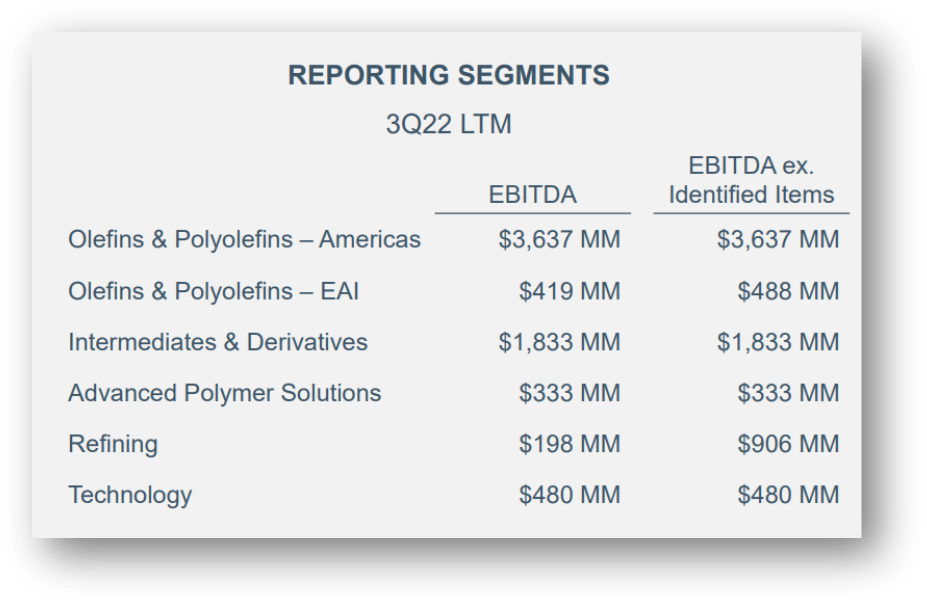

Its market cap is currently around $30 billion, and it divides its business into six segments, as described in the graphic below.

Challenging Market Conditions:

LYB remains a very profitable and high-margin business (as we will review later in this report), however it is currently facing challenging market conditions. Specifically, challenging conditions stem from weakness in Chinese markets (due to China’s zero-COVID policies) and weakness is North America (because new supply and inventory destocking led to a fall in polyolefin pricing). According to CEO, Peter Vanacker:

"During the third quarter [the most recently reported quarter], higher energy costs, new supply and weaker markets pressured global petrochemical margins. Global demand for LyondellBasell's products utilized in consumer packaging remained stable, but demand from durable goods markets softened. In Europe, olefins, polyolefins and intermediate chemicals markets encountered significantly higher energy costs and weak demand."

Competitive Advantage:

Despite the challenging market conditions, LYB continues to benefit from lower-cost North American natural gas feedstocks that allow the company to produce at a significantly lower cost than global competitors. Further, lower natural gas prices and higher oil prices have increased profits in North America (more on this later) a condition that is likely to persist.

Strong Financial Position:

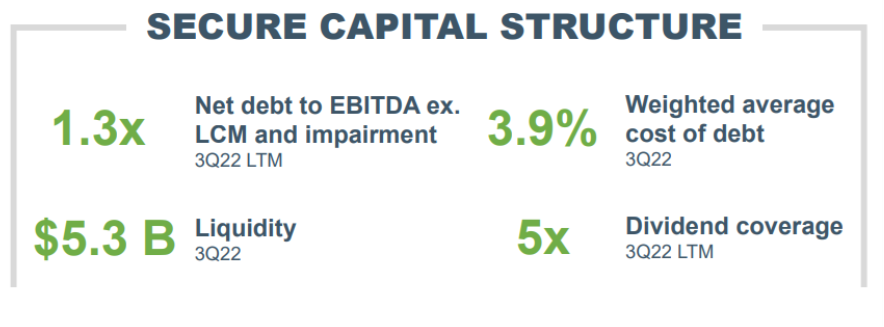

LYB is supported by a strong balance sheet. For example, the company has significant liquidity (recently $5.3 billion as of Q3, versus total long-term debt of around $11.3 billion) and a relatively low cost of debt (at 3.9%). Further, net debt/EBITDA was a reasonable 1.3x at the end of Q3.

Closing Its Refining Business:

Interestingly, LYB has plans to close its refining business, a smaller segment (see chart above) and apparently the the least cohesive of its six operating segments (also, the refining segment has not been profitable in recent years). The firm plans to cease operations this year and is considering refurbishing it (e.g. recycling and renewables) or potentially selling it. Again, refining, is a relatively small segment.

Healthy Dividends and Share Repurchases:

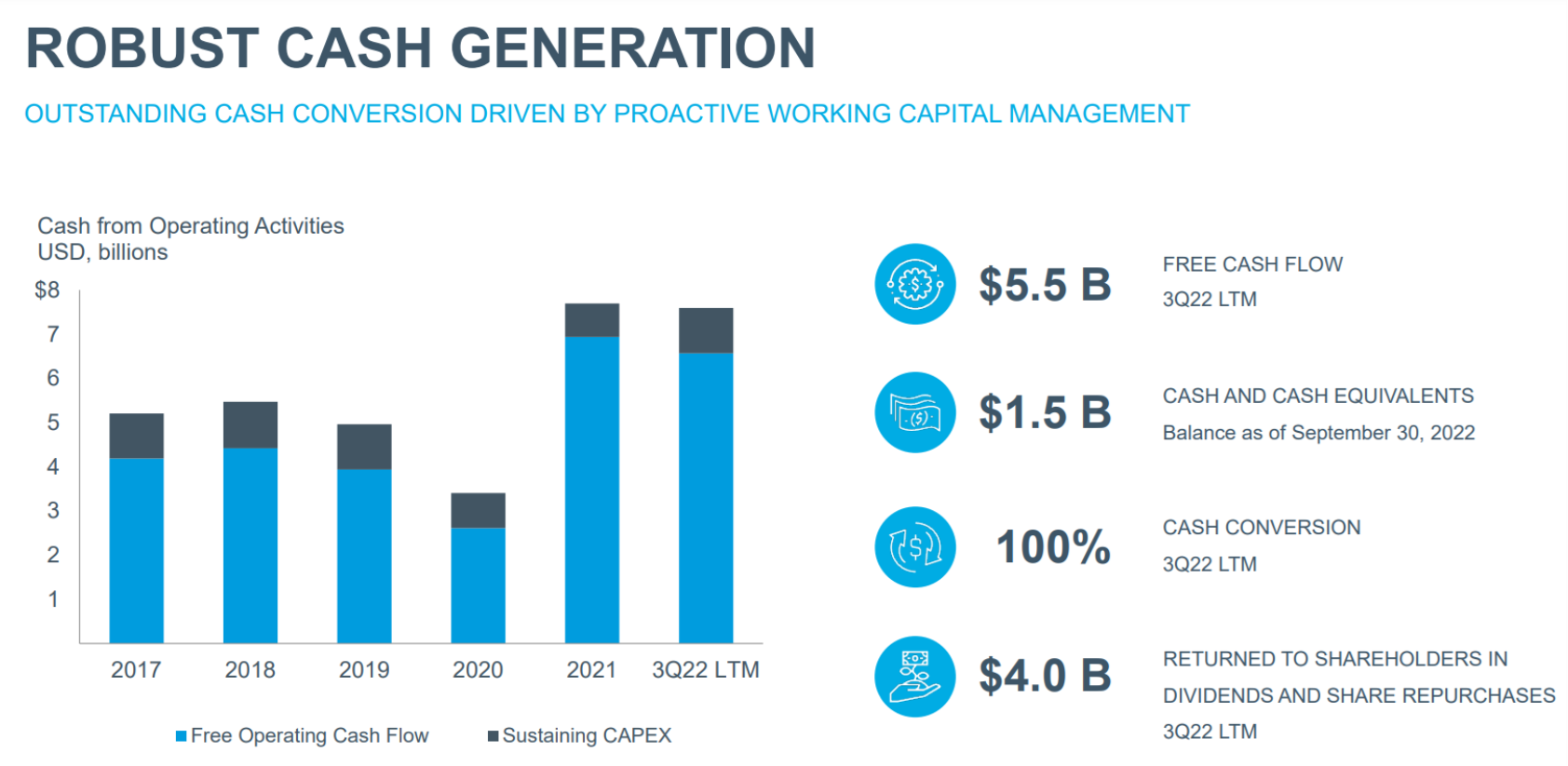

LYB pays a big (5.2% current yield) healthy dividend (it’s been increased for 11 years in a row), and there was an additional one-time large special dividend in 2022). The dividend is supported by robust cash flow generation from operations, as you can see in the graphic below.

Additionally, the company has a history of returning cash though share repurchases. having recently resumed the program after a pause during covid.

Also the dividend yield is currently higher than normal, an indication the the shares may be trading at a lower price than management believes they should.

Valuation:

Trading at an Enterprise Value of around 5.7x EBITDA, LYB is relatively inexpensive as compared to its own historical levels (as you can see in the chart below). Further, profit margins remain healthy.

Considering more than two-thirds of LYB’s business is in North America, a good measure of profits is the oil-gas ratio (i.e. Brent oil divided by Henry Hub natural gas). Generally, 7x or above implies a comparative cost advantage (according to industry standards) and the current ratio sits at around 21x (with brent at $80 and henry hub at $3.75); this is a good thing for LYB. However, commodity prices can be volatile, and this volatility (and uncertainty) creates a significant risk for the business.

Conclusion:

Anytime you invest in a commodity-related business, there are likely significant risks related to commodity prices. However, given the financial strength and competitive advantages of LYB, combined with current and projected commodity prices and demand (respectively), the business appears undervalued and remains in a good position to keep growing its already large dividend payments and share repurchases. If you are an income-focused investor that likes to invest across market sectors, LYB is worth considering for a materials sector (chemicals) allocation in your prudently-diversified long-term portfolio.