So the much anticipated monthly Consumer Price Index (CPI) inflation number was released this morning. The year-over-year number ticked slightly higher (even though gas prices are down) and the market is selling off hard. Here are four ways to keep the media’s unrelenting sensationalized fearmongering in check as you stay focused on your investment goals.

The Bearish Argument Always Sounds More Intelligent:

It’s a well documented reality that most people react much stronger to negative information that to positive information. For example, when the market is up—investors are content, but when the market is down (like this morning) they can act like the sky is falling.

The media plays off this reaction with negative stories that tug at your emotions. The reality is that the market goes through ups and downs in every market cycle. This year’s market declines have been painful, but not unheard of—and the market has always gotten better. We believe it will this time too.

Afterall, the Fed keeps raising rates to fight inflation, and once they get inflation under control—the market will be in much better shape. As counterintuitive as it may seem, you should buy low (or keep holding what you have) instead of panicking and hiding your money under your mattress—which is generally a bad idea.

Just remember that the bearish argument always sounds more intelligent, and that can help you avoid making silly emotional mistakes.

Focus on Dividends and Corporate Earnings:

If you are particularly sensitive to market volatility, it can be helpful to focus on dividends, for example. Many companies continue to pay steady (and increasing) dividends, even though the market is down, and focusing on this steady income can help some investors cope—and it can help them avoid making ugly mistakes.

Similarly, many companies continue to growth revenues and earnings. We know that the market is a voting machine in the short term—but a weighing machine (based on fundamentals like revenues and bottom line earnings) in the long run. There are many fundamentally strong businesses that will continue to thrive despite the short-term volatility.

Interest Rate Hikes Are Coming to an End:

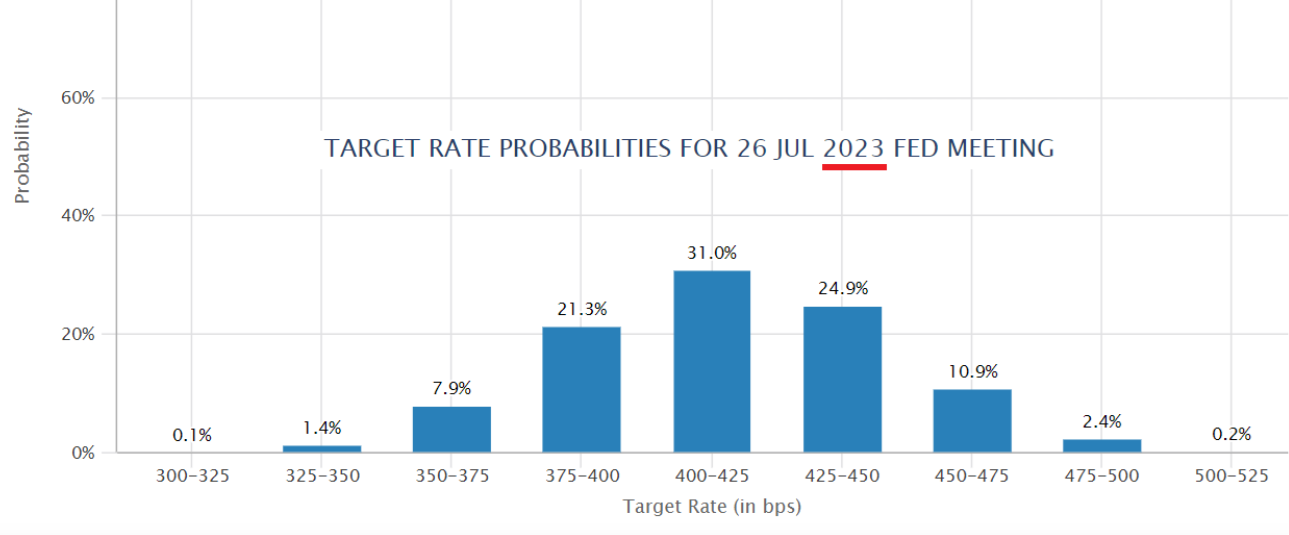

The CME FedWatch Tool provides market expectations for future interest rate hikes based on futures contracts. And the CME Fed Watch Tool says rate hikes are coming to an end. Specifically, the market is already pricing in another 75 basis point rate hike by the fed at the next meeting on September 21st. However beyond that, the market is expecting only another 100 to 125 basis point increase over the next year. That means the rate of increases will slow (i.e. rates aren’t expected to keep going up forever, and they’re not expected to even come close to the double digit rates of the early/mid 1980’s). That’s good news for investors. And as rate hikes and inflation slow, the market will get better.

It Feels Bad Now, But You Will Feel Worse When…

Perhaps the only thing in investing that feels worse that significant price declines (like we have seen this year) is selling after the declines (such as right now) only to watch the market recover dramatically in the months and quarters ahead. As much as this year’s declines may hurt, it’ll hurt a lot more if you miss out the subsequent rebound. Stay focused on your long-term goals—it’s a winning strategy.

The Bottom Line:

Stay calm and carry on. That means stay focused on your long-term investment goals. Market volatility is par for the course, and it is important to not let near-term market moves take you out of your long-term game. Disciplined long-term investing has always been a winning strategy—and it will be this time too.