Intuit (the financial platform behind TurboTax, QuickBooks, MailChimp, CreditKarma and Mint) released earnings on Tuesday after the close, and they were positive. The company beat expectations on revenue and earnings, and also raised forward earnings guidance. This note is a quick review of the latest results.

As a reminder, Intuit is a significant holding in the Income Equity Portfolio.

The shares were added several months ago at $369 and have already climbed to $474 (a 28.5% gain).

Intuit announced it received board approval for a quarterly dividend of $0.78 per share, payable October 18, 2022. This represents a 15 percent increase versus last year."

We continue to believe in the businesses going forward.

About Intuit

Intuit divides its business into three (really four) segments, and in fiscal year 2022 (the fiscal year that just ended) revenues were as follows:

51% of revenue came from the Small Business and Self-Employed Group,

35% from Consumer and ProTax businesses (combined), and

14% from Credit Karma.

Intuit’s strategy is to be the global AI-driven expert platform powering prosperity for consumers and small businesses. Basically, Intuit is focused on solving customers’ biggest problems by putting more money in their pocket, eliminating work and saving people time and ensuring that they have complete confidence in every financial decision they make.

The company expects the following segment revenue results for fiscal year 2023:

Small Business and Self-Employed Group: growth of 19 to 20 percent.

Consumer Group: growth of 9 to 10 percent.

ProConnect Group: growth of 3 percent.

Credit Karma: growth of 10 to 15 percent.

Importantly, the business has highly predictable reoccurring revenue (much of the business is subscription-based), Also important, Intuit is keep pacing with the changing business world, particularly the digital revolution and cloud migration.

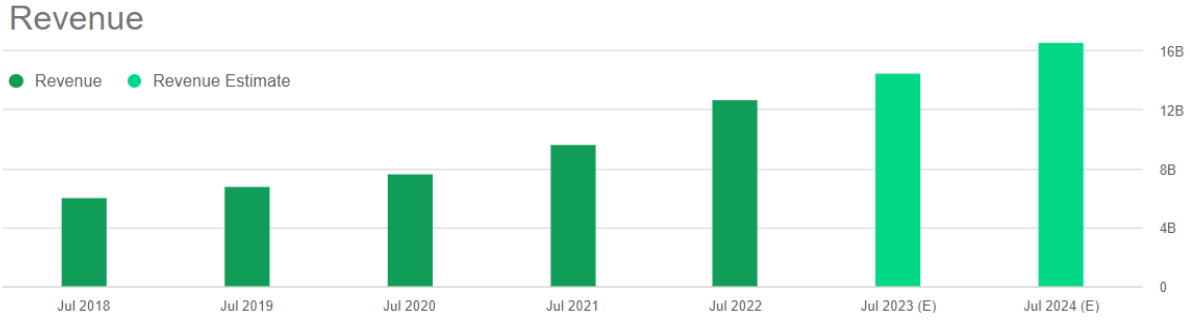

Growth

As mentioned, both revenues and earnings are growing, as you can see in the following charts.

And the company believe they can keep growing because the market opportunity remains large. According to Intuit:

We have a nearly $300 billion addressable market driven by tailwinds that include shifts to virtual solutions, acceleration to online and omnichannel capabilities and digital money offerings. This, combined with the team’s execution, is contributing to the strength of our performance.

Valuation

From a valuation standpoint, the share price and valuation metrics are still significantly lower than they were to start the year, and growth expectations remain strong. Both the price-to-earnings ratios and price-to-sales ratios are not low, but they are reasonable as compared to the companies strong profitability and growth.

The Bottom Line:

We continue to own Intuit as a large position in our Income Equity portfolio. We believe the business is very healthy (growing recuring revenues that are mission critical to businesses) and the valuation is reasonable. The dividend yield is low (because the company is investing in growth), but the dividend yield is also growing rapidly (“yield on cost” can be an important metric for dividend-growth stocks like Intuit). We continue to look forward to years of share price increases and dividend increases from Intuit.