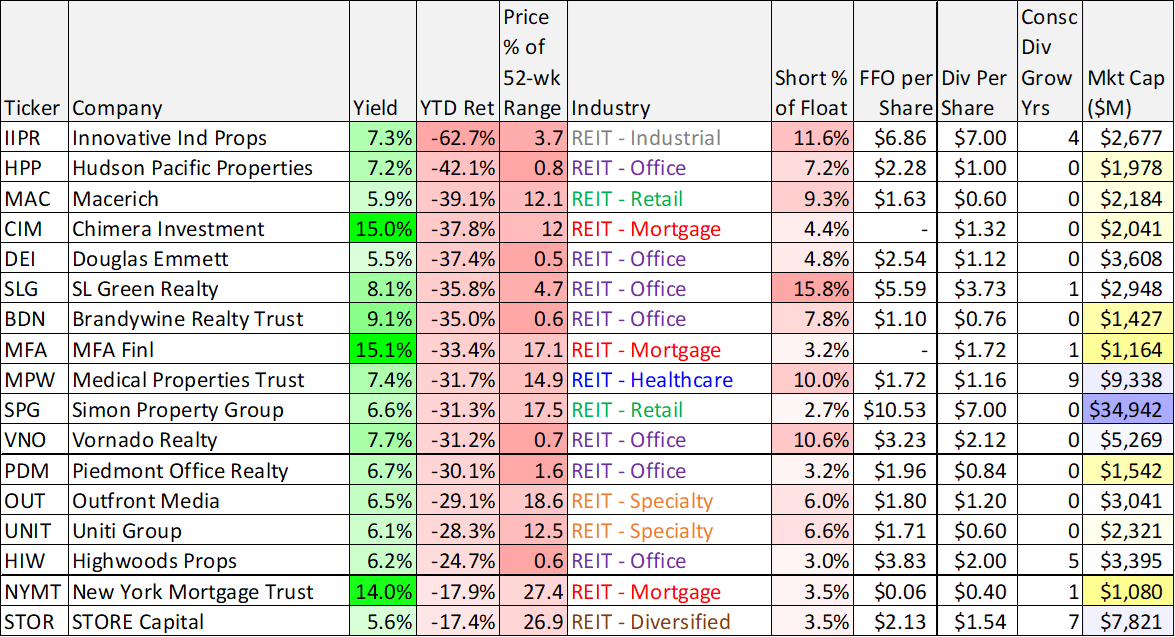

There are around 50 RIETs (traded on NYSE and Nasdaq) that currently offer at least a 5% dividend yield. Here they are sorted by year-to-date performance. While most are down a lot this year, on average the group is down around 12%—about the same as the S&P 500. In particular, there are a few on the list that are worth taking a closer look.

For starters, Innovative Industrial Properties (IIPR) (a pot stock) is the worst performer. This one garnered a ton of media attention last year (almost “meme stock” status) and it’s no surprise the shares have sold off so hard.

However, Medical Properties Trust (MPW) is compelling. They provide capital to hospitals by buying the hospital real estate from the hospitals (so they get upfront cash) and then basically lease it back to them. The hospitals still pay all the expenses of maintaining the real estate, it’s just that they benefit from the immediate cash infusion when the sell the real estate (this can be extremely helpful to a challenging financial position). Despite the high short interest, we continue to believe the real estate of these hospitals has a ton of important value to the communities in which they exist, and for this reason (among others) we believe MPW is attractive and worth considering for investment (we have a small position in our Income Equity portfolio). You can read of recent full report here.

Mortgage REITs are also interesting this year. For example, AGNC Inc (AGNC) and Annaly Capital (NLY) are both down sharply as interest rates have risen. If you don’t know, mortgage REITs don’t generally own physical properties, but rather mortgage-related assets (such as agency mortgage-backed securities, for example). And when rates rise, bonds (such as agency mortgage-backed securities) fall in price—which is exactly what has happened to a lot of mortgage REITs this year. The falling asset prices have caused some damage to mortgage REIT book values, but going forward high rates also mean mortgage REITs can earn higher returns on the assets they own. We don’t currently own any mortgage REITs, but we have owned AGNC in the past, and we currently believe those shares (especially the preferred shares) are interesting and worth considering if you are an income-focused investor.

Simon Property Group (SPG) is a retail REIT we have owned in the past, and it is the 10th worst performer on the list this year. It’s share price has been more than cut in half in recent years as the combination of the pandemic and the growth of online shopping in general has created headwinds. SPG’s balance sheet remains very strong, but the secular trend continues to be against brick-and-mortar retailers (like the properties SPG owns).

Finally, the four best performers this year are all healthcare facility REITs. This sub-industry was hit extremely hard by the pandemic, but has experienced a rebound as conditions have improved. This should serve as an important reminder that being a contrarian investor can be quite lucrative. That is to say, picking good investments when they are out of favor can be rewarding. For example, as mentioned, we currently like the shares of MPW (which are down big) and the preferred shares of AGNC (which trade below $25).