Realty Income (known as the monthly dividend company) has been a safe haven this year as markets have declined sharply but Realty Income’s share price has remained roughly flat. However, some investors are left wondering if Realty Income still offers an attractive valuation or if it’s time to shift new investment dollars elsewhere. We offer our opinion on the relative attractiveness of the shares, including a discussion of business strategy, the risks and the current valuation as compared to 50 other big-dividend REITs.

Overview:

Founded in 1969, Realty Income Corp (O) began trading publicly in 1994 and is focused on acquiring and managing commercial real estate properties. Its impressive track record of dividend increases has made it part of an elite group of 65 companies that make up the S&P 500 Dividend Aristocrat Index (i.e., S&P 500 companies that have increased their dividends for at least 25 consecutive years). the elite group of 65 companies in the S&P 500 Dividend Aristocrats index.

The company’s portfolio consists of more than 6,700 properties that generate rental revenue from long-term lease agreements with commercial tenants (such as Walgreens, CVS and Dollar Tree, to name a few).

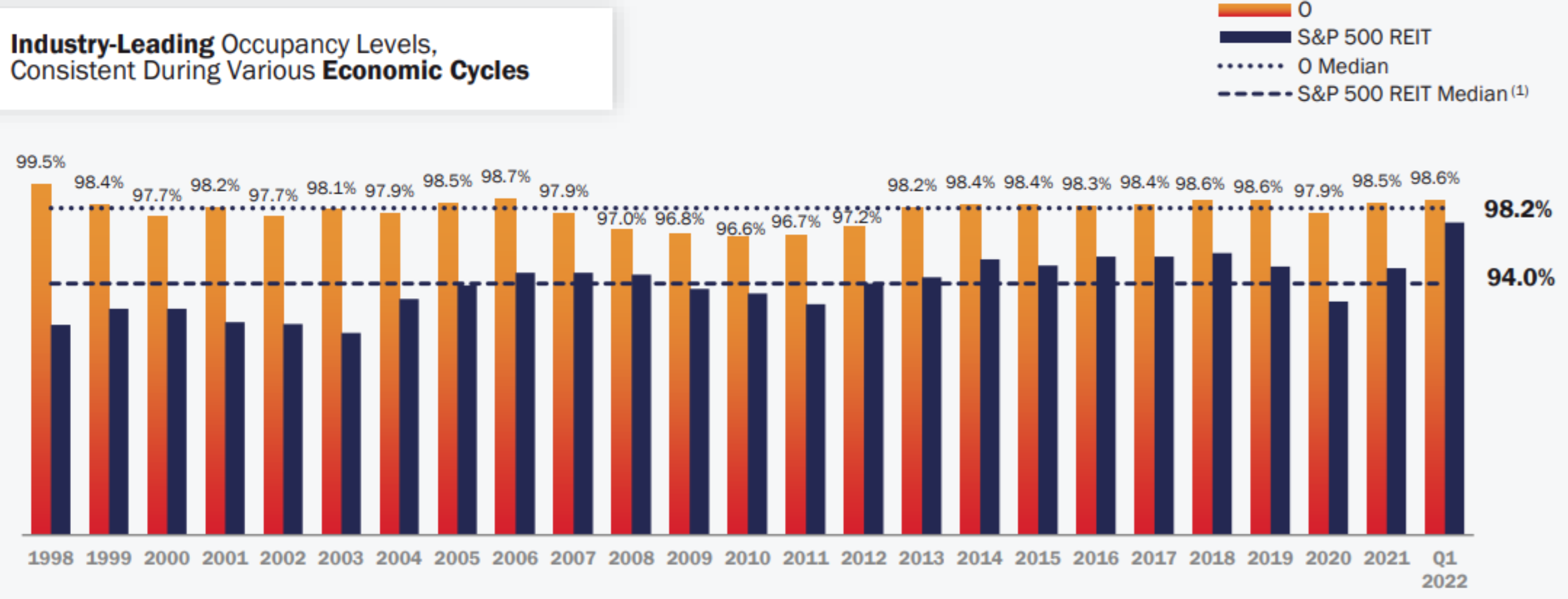

The portfolio is diversified across tenants, industries and geographies. Nearly 96% of its rental revenue comes from tenants with a nondiscretionary service and/or a low price point component to their business. These tenants are resilient to economic downturns and significantly isolated from e-commerce pressures (from the likes of Amazon, for example).

Business Strategy

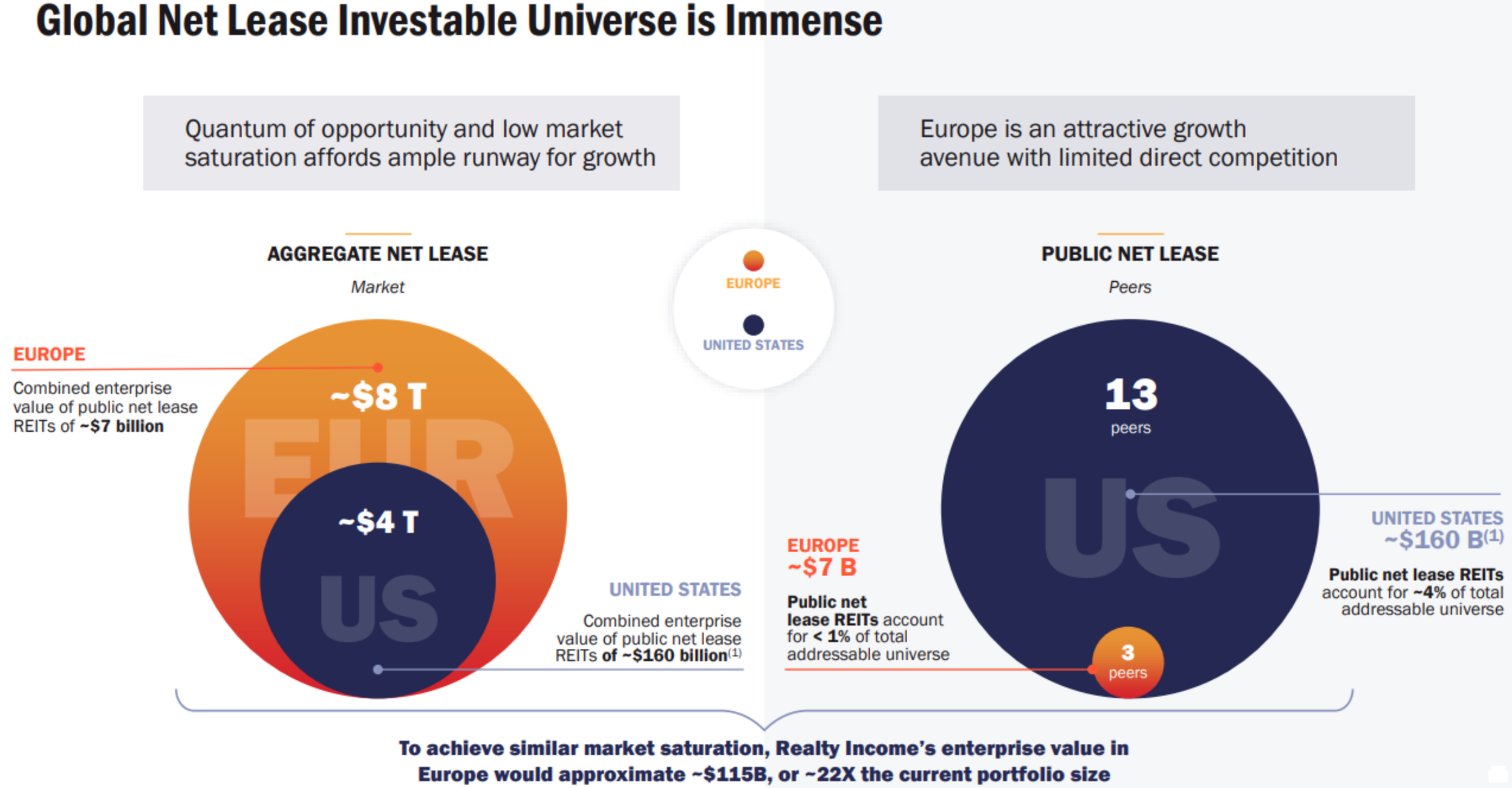

As one of the most stable and financially strong REITs in its space, Realty Income increasingly looks to acquisitions as a big part of its growth strategy.

And it has the financial wherewithal to do this (for example, Realty Income is one of only seven U.S. REITs with two A3/A- ratings or better). Plus the environment remains attractive for such a strategy considering the market is highly fragmented and because this year’s economic challenges may leave increasing acquisition targets in some distress (i.e. a better time to get good deals on potential acquisitions).

For example, Realty Income’s recent large strategic merger with VEREIT created a premier net lease REIT with increased size and scale, supporting long-term growth through consolidation of a highly fragmented net lease industry.

Risks:

Of course Realty Income’s business does face risks. For example, the business is very large already (as compared to other REITs) and this can make it challenging to grow at scale (thus the increasing acquisition strategy as described above). Another risk is simply interest rate risk. Specifically, Realty Income has long-term tenant leases with built in rent escalators, but the escalator increases are small and high inflation could pressure margins. This could create challenges, but as the company takes on new acquisitions, the new rates will be commensurate with the market, and the old rates will eventually roll off and be replaced.

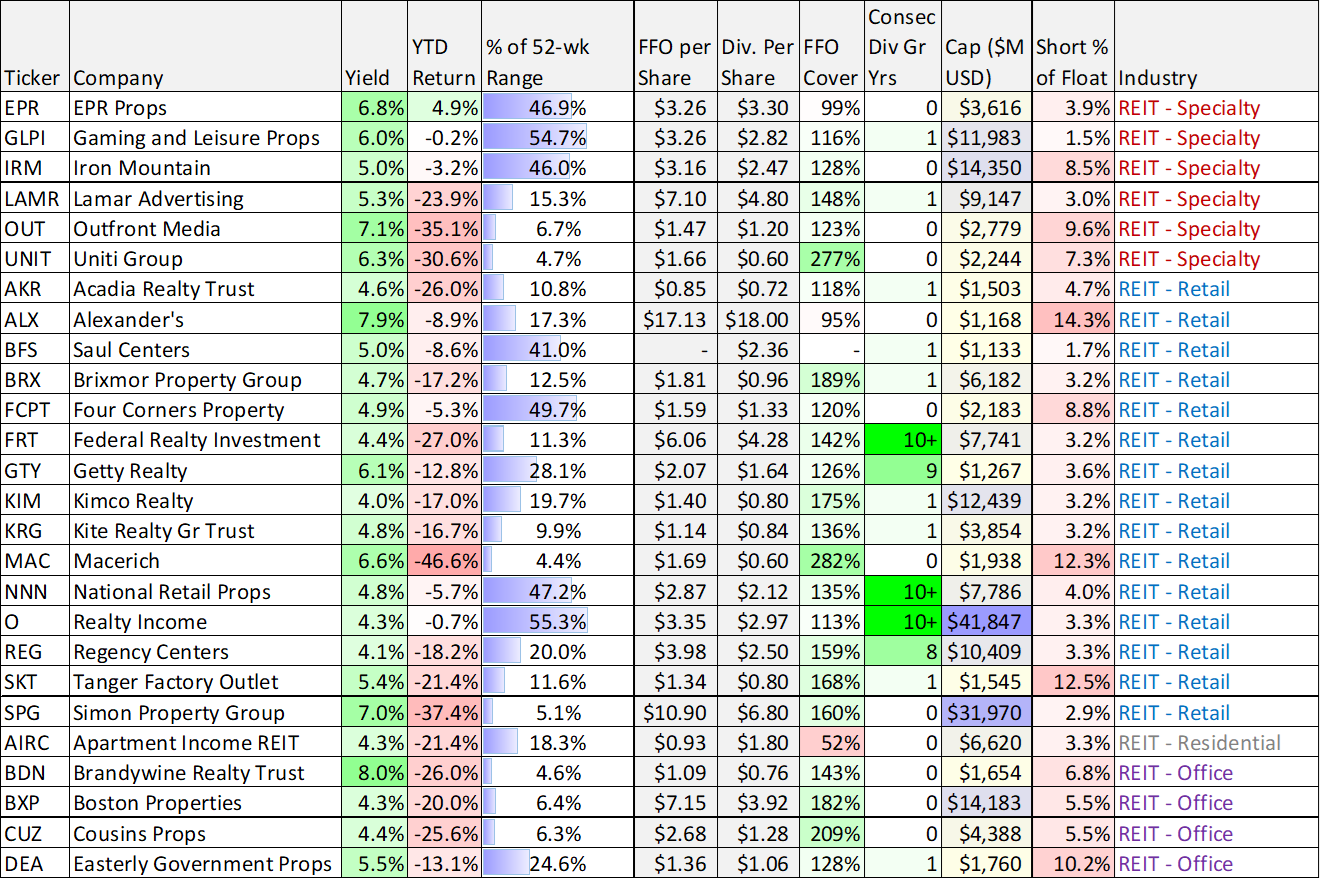

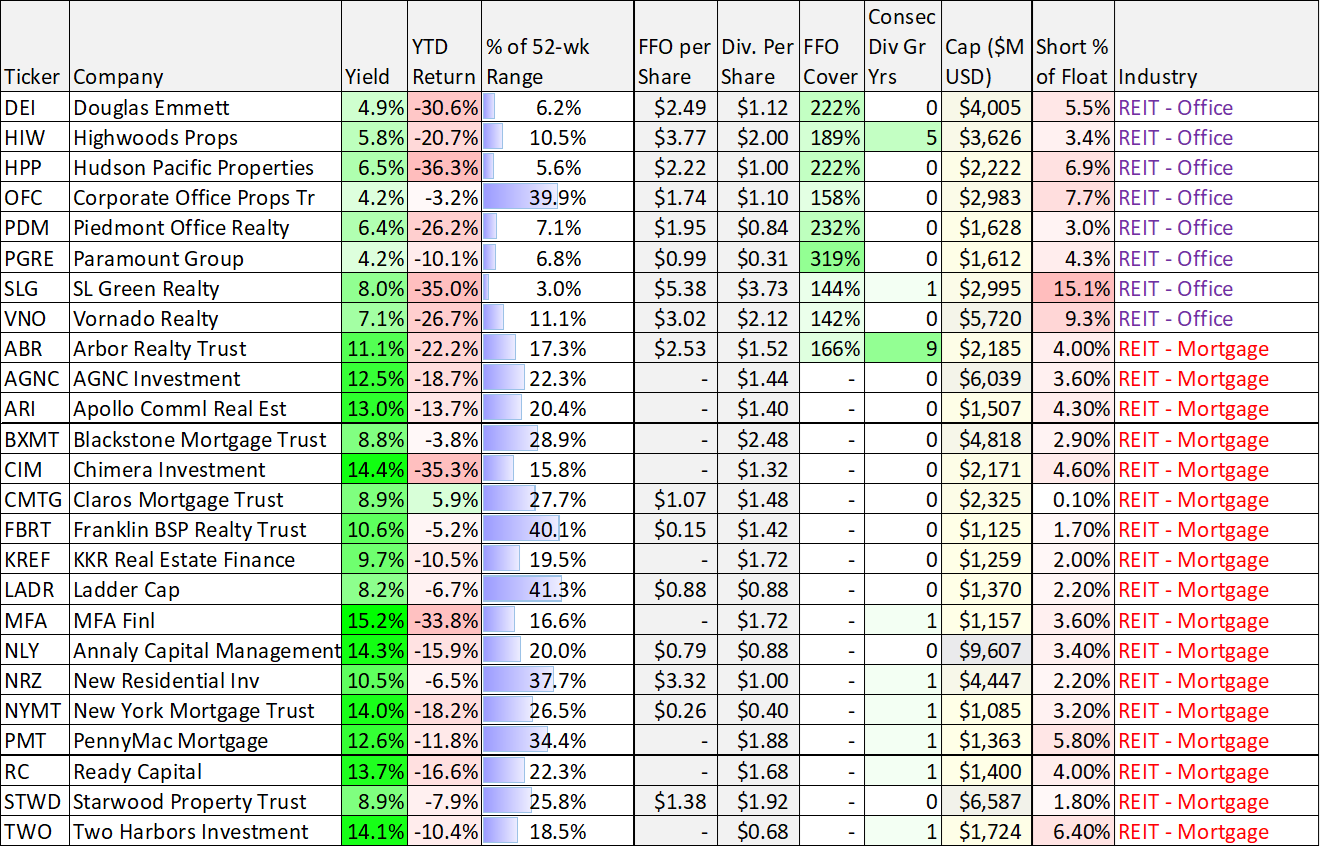

50 Big-Dividend REITs, Compared:

Before getting into more detail on valuation, here is a look at some important metrics on 50 big-dividend REITs. The table is organized by REIT sector, and as you can see—there has been some pretty ugly performance so far this year for most REITs, but not for Realty Income.

Valuation:

From a valuation standpoint, Realty Income is relatively expensive compared to some peers, but not expensive as compared to its value.

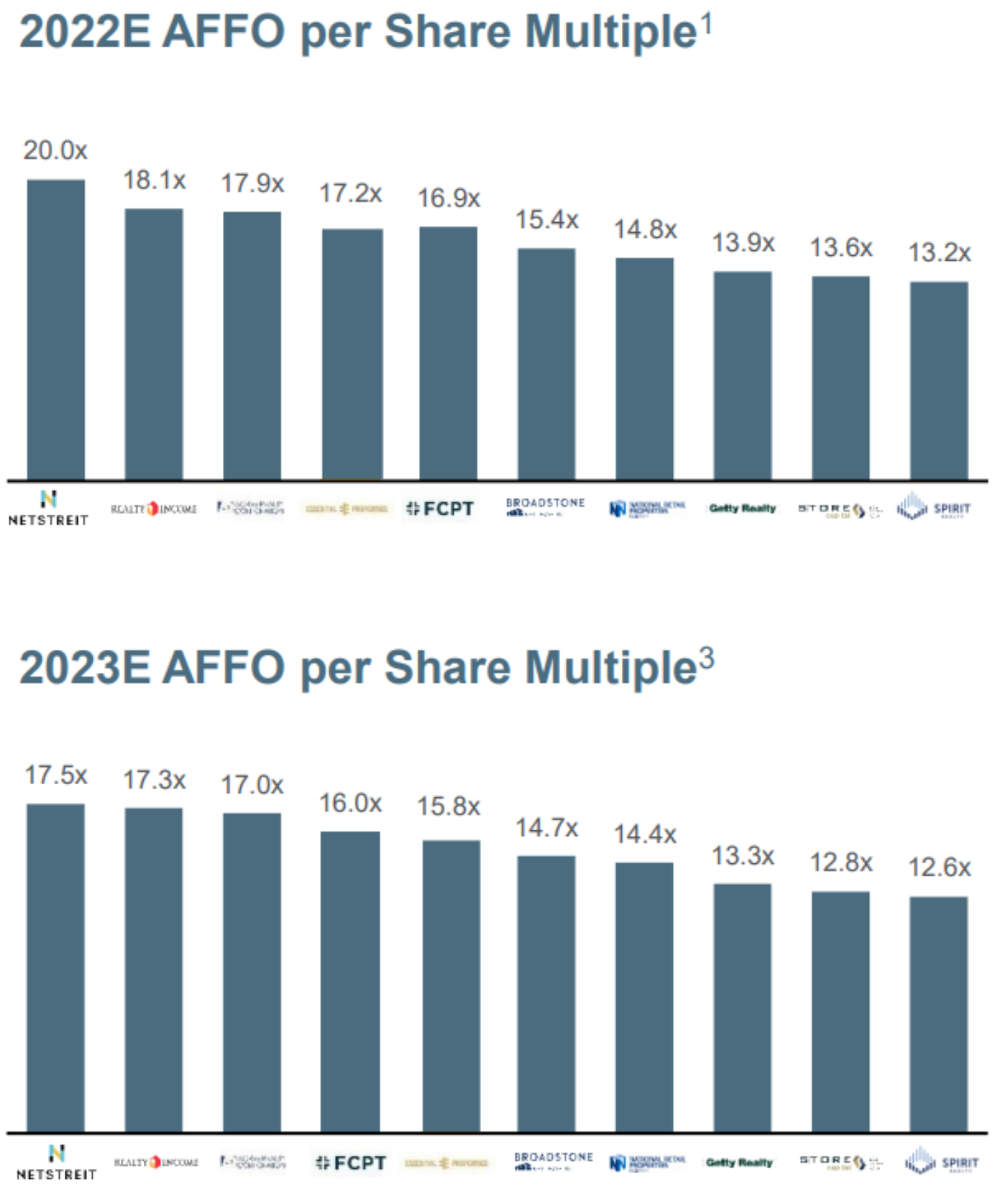

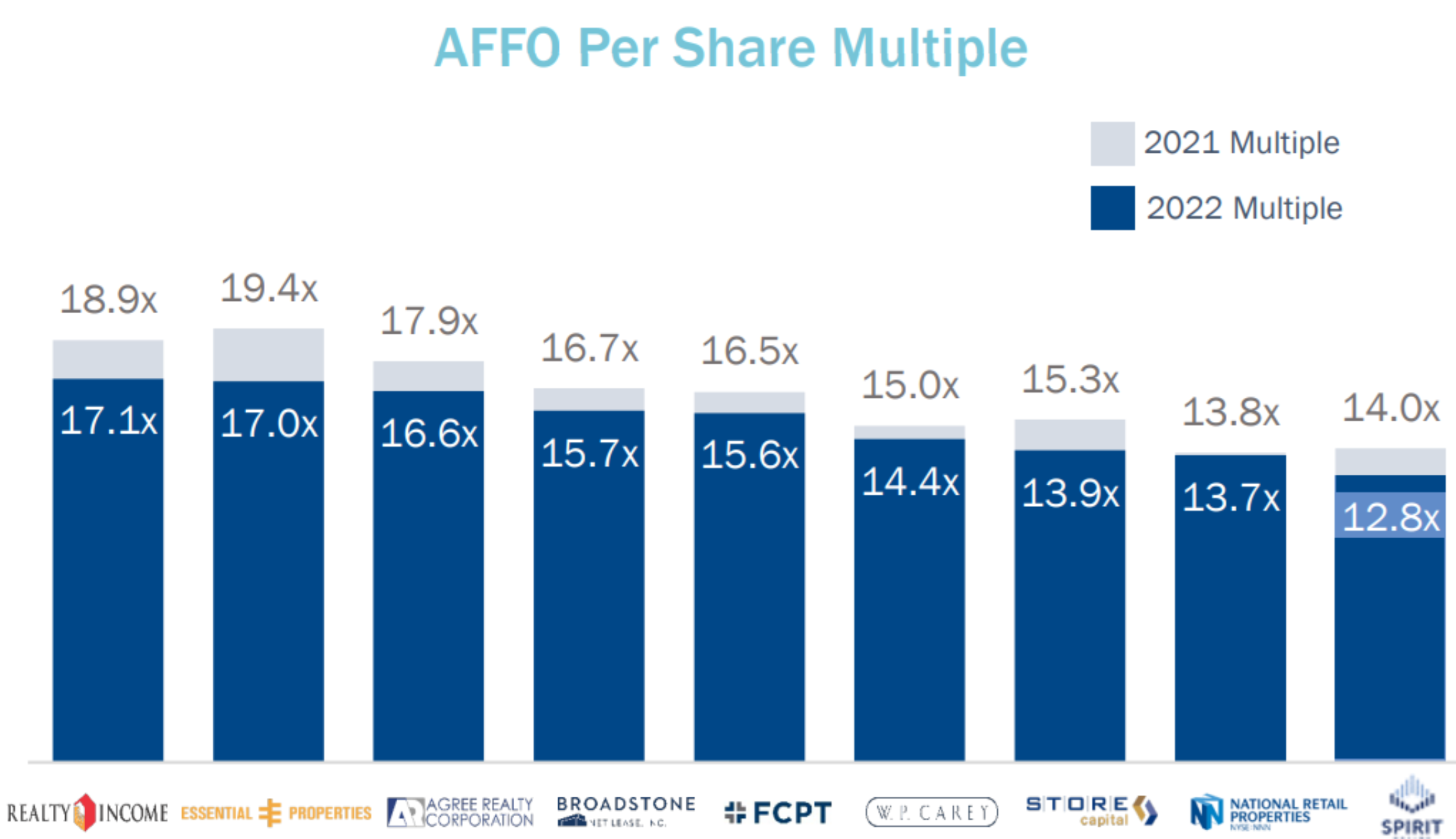

For starters, Realty Income trades at a higher price-to-Adjusted-FFO multiple (this year and next) than many of its peers, simply because it is a stronger healthier business (i.e. less risk). In part, the multiple is also stronger because the price of Realty Income has outperformed most other REITs so far this year (as the market has sold off) because of the strong “blue chip” nature of its business.

Here is a look at Realty Income’s price-to-FFO multiple as compared to peers.

Again, Realty Income is not particularly inexpensive as compared to peers, but this is because Realty Income is considerably healthier. I is also very important to note from a valuation standpoint, Realty Income still has positive expected growth in Adjusted Funds From Operations this year and next (a good thing), as you can see in this next chart.

And as Realty Income grows its acquisition pipeline, the expected growth for 2023 (see chart above) will likely rise (a good thing for Realty Income).

And for reference, here is Realty Income’s AFFO multiple earlier this year, and you can see it has come down a bit (good for “buy lower” long-term contrarians).

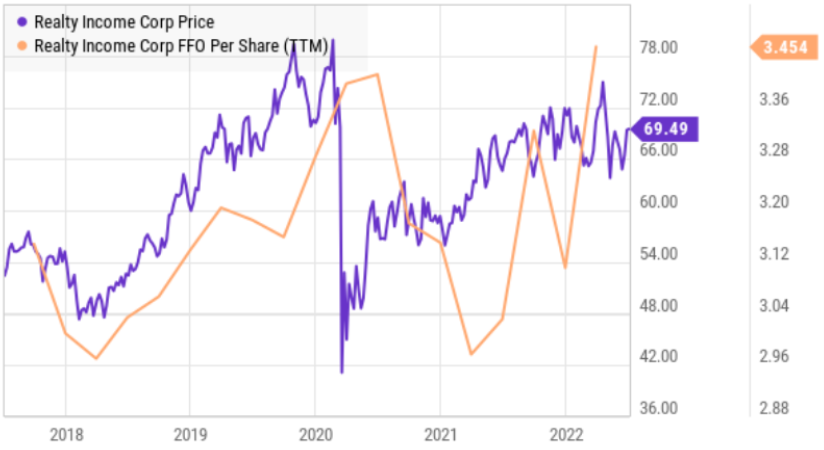

And very importantly, you can see in this next chart that Realty Income’s valuation is also attractive by historical standards. For example, recent FFO per share exceeds levels before the pandemic, yet the share price does not, another indication that Realty Income currently trades at an attractive price-to-FFO mutliple.

The Bottom Line:

In our view, Realty Income remains attractive for a variety of reasons, including its very strong financial position, its prudent acquisition-focused business strategy, its incredible dividend-growth (and safety) and its attractive current valuation. Not to mention, the outlook for its real estate business remains attractive because of the prime location properties that are largely not vulnerable to the online shopping trend that other types or REITs face (for example shopping malls). And despite the shares relative strength this year, and despite the risk factors (such as rising rates and conservative rent escalators), we continue to believe Realty Income presents a very attractive investment opportunity for steady income-growth (and price appreciation) investors. We are currently long shares of Realty Income in our Income Equity portfolio, and have no intention of selling.