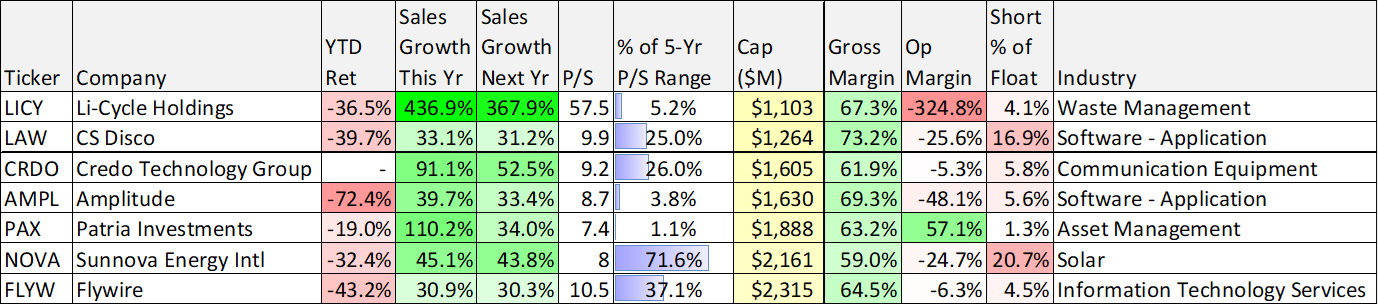

With pre-market futures trading higher, and the market now a bit above its year-to-date lows, some investors are wondering if the selloff is finally over. To the contrary, this market can absolutely go lower from here, but in the long-term we believe “this too shall pass” and this market is eventually going higher. And the next cycle higher will likely be dominated by a new batch of “high growth” stocks. For your reference, here is a look at 28 of the highest revenue growth stocks (this year and next) that have not already grown very large.

The list is sorted by market cap, and you’ll likely recognize a few of the larger names at the end of the list (because they were quite popular during the last bull market run).

To be included in this list, revenue growth of at least 30% (this year and next) was required. You can see gross margins are all very high, but operating margins are often low as many of these companies are still in the early “high growth” phase of the j-curve.

You’ll also notice software is a well represented group, considering the software business tends often be easier to scale quickly with lower costs.

There are names of the list that may be worth researching more. Here is a little more info on a few of them:

Sunnova Energy: Sunnova Energy International Inc. provides residential energy services in the United States. The company offers electricity, as well as offers operations and maintenance, monitoring, repairs and replacements, equipment upgrades, on-site power optimization, and diagnostics services.

Flywire: Flywire Corporation, together with its subsidiaries, operates as a payment enablement and software company in the United States, Canada, and the United Kingdom, and internationally. Its payment platform and network, and vertical-specific software help clients to get paid and help their customers to pay. The company’s platform facilitates payment flows across multiple currencies, payment types, and payment options; and provides direct connections to alternative payment methods, such as Alipay, Boleto, PayPal/Venmo, and Trustly. It serves education, healthcare, travel, and business to business organizations.

Sprout Social: Sprout Social, Inc. designs, develops, and operates a web-based social media management platform in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It provides cloud software that brings together social messaging, data, and workflows in a unified system of record, intelligence, and action. The company offers provides various integrated tools in a range of functions comprising social engagement/response, publishing, reporting and analytics, social listening and business intelligence, reputation management, employee advocacy, and automation and workflows.

Confluent: Confluent, Inc. operates a data streaming platform in the United States and internationally. It offers Confluent Cloud, a managed cloud-native service for connecting and processing data; and Confluent Platform, an enterprise-grade self-managed software that connects and processes data in real-time with the foundational platform for data in motion.

The Bottom Line:

High-growth stocks have fallen the hardest as the market has declined this year (especially thanks to the fed’s aggressive interest rate hikes). But when this sell off eventually reverses (which is eventually will) these stocks that have sold off hard will likely (in many cases) rebound hard and swiftly. Plus, there will also be a new batch of leaders (such as some of the names on this list) that will deliver impressive results.