Now trading at only 6.4 times sales (down from over 12x in late 2021), but with an ongoing sales growth trajectory of nearly 20%, this CRM (customer relationship management) technology company has a lot of room to run (large total addressable market) and a highly defensible moat to its business. In this report, we review the business details and the risks, and then conclude with our opinion on investing (we currently own shares).

Overview: Salesforce (CRM)

Salesforce is the #1 CRM software provider worldwide by revenue for 8 consecutive years, and it is uniquely positioned to benefit as it helps customers with the massive ongoing economy-wide digital transformation. As you can see in the following graphic, Salesforce revenue is expected to keep growing rapidly in the years ahead (for example 21% this year and 18% next year).

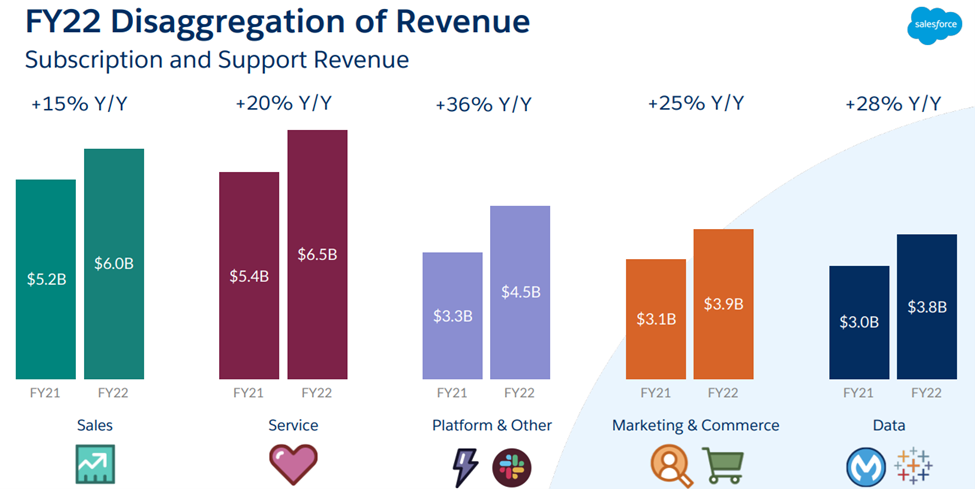

And for a little perspective, here is a look at a breakdown of the company’s revenue drivers.

For further perspective, the company’s offerings can be broken down into:

Sales: to help customers sell smarter and faster

Service: to manage customer support across every channel

Marketing: to deliver personal messages on any channel

Commerce: to unify the shopper experience

Engagement: engaging web and mobile apps for customers

Platform: empowering everyone to build apps

And two things that make this high revenue growth particularly attractive are the company’s expanding TAM and impressive unit economics, as you can see in the charts below.

Specifically, Salesforce’s total market opportunity continues to expand as businesses around the world adapt to the massive secular digital transformation.

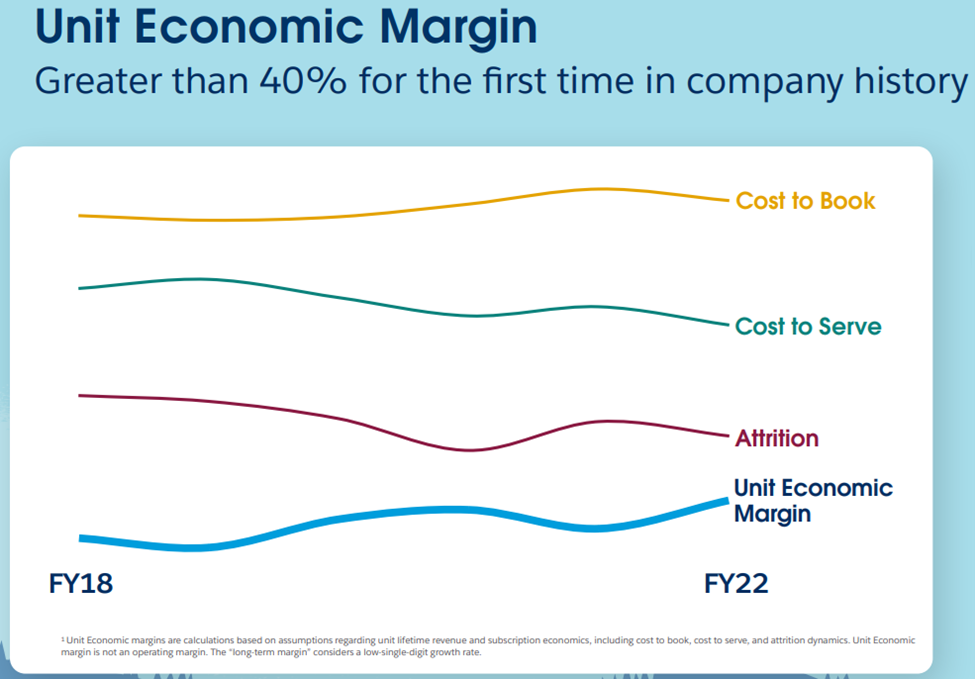

Further, the following graphic shows the impressive unit economics of Salesforce’s business.

Specifically, the company continues to quantify the long-term costs and benefits of acquiring customers and ultimatel benefits to the bottom line in the years that follows (as customers renew). Longer-term unit economics are an important (and often overlooked) metric for Software-as-a-Service companies, considering this business model has expanded dramatically in recent market cycles and old-school valuation metrics have a hard time quantifying valuable future economic benefits because they get distracted by expensive short-term acquisition costs (we’ll have more to say about Salesforce margins later in this report).

Economic Moat:

Further, Salesforce continues to build a strong economic moat (thereby providing a dramatic competitive advantage) because switching costs are high and the network effects of its many complimentary offerings are extremely difficult for the competition to overcome.

Risks:

Naysayers point to several Salesforce concerns that are worth addressing. For example, Salesforce margins are strong (gross margin: 73.5%, operating margin: 2.1%), but some will argue that operating margins should be higher considering the already large size of the business. However, in our view that attractive unit economics overcome these concerns, and the lower (yet still profitable) operating margins are because the company continues to focus on growth opportunities (a good thing!).

Another concern is that Salesforce has been active in acquisitions. Most investors and analysts prefer organic growth (instead of inorganic growth through acquisitions). However, Salesforce acquisitions have been strategic and complementary. Most recently (in 2021), Salesforce acquired Slack for $27.7 billion. Slack was an extremely high growth and important tool for workforces to stay connected during the pandemic, and provides an important complement to Salesforce’s existing tools. Other recent large acquisitions have included MuleSoft (for $6.5 billion in 2018, and Tableau Software for $15.7 billion in 2019).

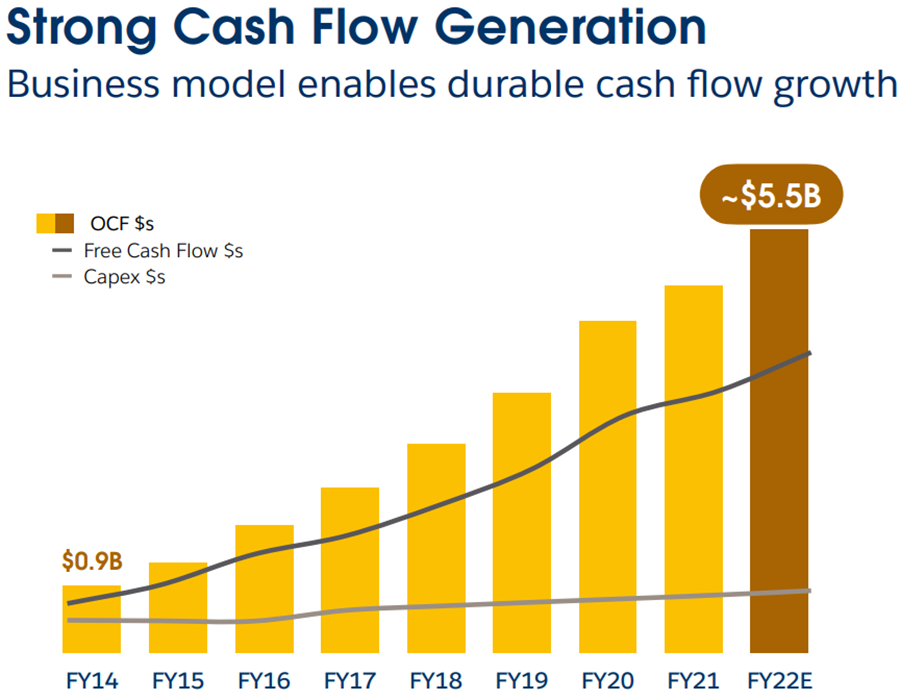

Important to note, Salesforce continues to generate strong (and steady) free cash flow to support the business (including recent acquisitions).

Valuation:

As mentioned, Salesforce now trades at below 7 times sales (dramatically lower than just 5 months ago—as it’s gotten inappropriately caught up in the pandemic trade unwind), yet the business continues to growth dramatically and with a large total addressable market (to maintain its leadership position and continue its high growth trajectory).

Conclusion:

Simply put, Salesforce is trading at too low of a price (it’s worth a lot more than the share price suggests). Clearly, the share price has been pulled lower as the pandemic trade has unwound (high growth stocks have sold off hard) and as interest rates are expected to rise dramatically to combat inflation (also bad for high growth stocks). However, Salesforce is not like other high growth stocks that generated massive revenue growth during the pandemic (only to see significant post-pandemic slowdowns). Salesforce, on the other hand, has maintained its high growth rate right through the pandemic, and its business is healthy, profitable and generates strong free cash flow. In our view, Salesforce’s recent 40% share price decline (over the last 5 months) is totally inappropriate. These shares are going significantly higher in the years ahead. We are currently long shares of Salesforce.