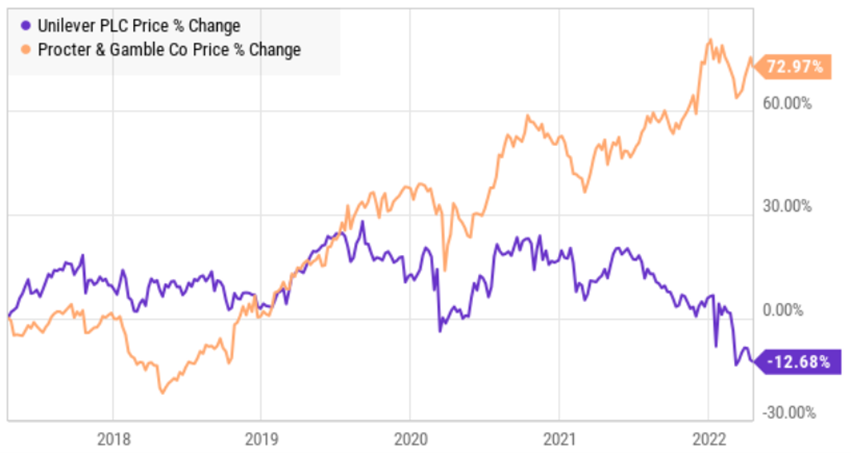

Short-term headwinds have dragged the share price lower, but this steady, blue-chip consumer staples company has a wide moat, significant competitive advantages and the stock is currently trading at an attractive price. In this report, we review the business, the challenges (both short-term and long-term risks), the valuation, opportunities and finally our opinion on who might want to invest.

Unilever (UL): Overview

Unilever is a consumer goods company that trades as an ADR in the US (it is based in London). The company operates through Beauty & Personal Care, Food & Refreshment, and Home Care segments.

Competitive Advantages:

Unilever enjoys two big competitive advantages: (1) As a large company with a widely-diversified product portfolio, Unilever has a significant cost advantage over its many smaller peers. (2) Unilever is entrenched as part of the retail supply chain (an enviable position an that smaller and newer competitors wish they could overcome).

Recent Challenges:

Unilever’s stock price has recently declined (see chart later in this report) as it faces multiple near-term challenges, such as inflation and the Russia-Ukraine conflict. For example, on March 7th, the company announced that it had:

“suspended all imports and exports of our products into and out of Russia, and we will stop all media and advertising spend. We will not invest any further capital into the country nor will we profit from our presence in Russia. We will continue to supply our everyday essential food and hygiene products made in Russia to people in the country. We will keep this under close review.”

Furthermore, the Russia-Ukraine conflict has added to already high inflation costs and challenges. Specifically, commodity input costs have risen dramatically this year, and Unilever cannot easily passthrough those costs to consumers immediately. And aside from the obvious challenges of higher input costs to produce goods, Philip Gorham (Morningstar Director) pointed out another big one in an April 1st research note:

“Around 20%-25% of Unilever's cost of goods sold is linked to energy prices, and this is likely to materially affect the profit and loss statement this year. Packaged goods manufacturers are under pressure to raise prices in light of the recent broad-based commodity cost inflation. However, price cuts implemented before the spike in inflation, a strategy designed to help mitigate the loss of middle-market retailers to both discounters and high-end stores, suggest that this year's price increases may not be maintainable.”

However it is important to note that Unilever can pass some costs through to consumers in the short-term (and more in the long-term) considering it is a consumer “staples” company, meaning many of its products are considered necessities by many consumers and they will continue to buy regardless of most price increases.

Long-Term Challenges:

The long-term challenge for Unilever is that lower growth is common for the industry, especially for already large businesses like Unilever. Unilever is never going to be an ultra-high growth stock (like some of the popular names in other sectors, such as technology), however this is actually a good thing in the minds of some investors because it means lower volatility risks. In particular, as a lower beta stock, some investors find comfort in the steadying nature of Unilever’s consumer staples business.

Room for Improvement:

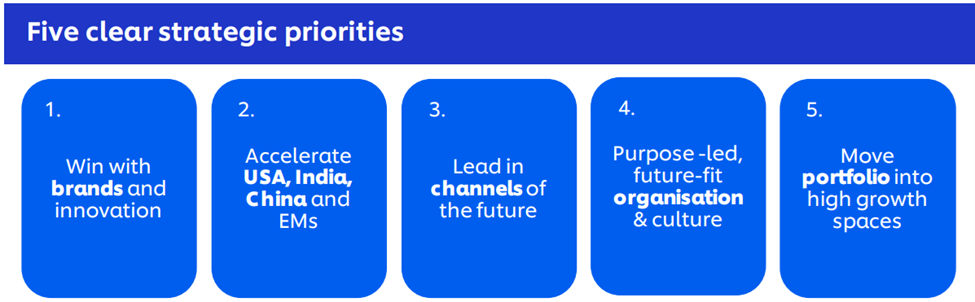

Despite the near-term and longer-term challenges that Unilever faces, there are attractive opportunities for improvement. In fact, the company has laid out five clear strategic priorities in the graphic below (from the latest quarterly earnings presentation):

In particular, Unilever has an opportunity to streamline its brand roster by trimming less profitable brands. This is a multi-year strategy that recently worked well for another big consumer staples company, Procter & Gamble (PG).

Also, Unilever announced earlier this year that it has plans to eliminate potentially thousands of jobs as a way to streamline the decision-making process. The company has also faced news of hedge funds increasingly interested in driving dramatic operational improvements at the company, such as interest from Trian. While some investors may view these “improvement opportunities” as a red flag, others see them as potential upside in the years ahead—exactly what many low-volatility income-focused investors want to see.

Valuation:

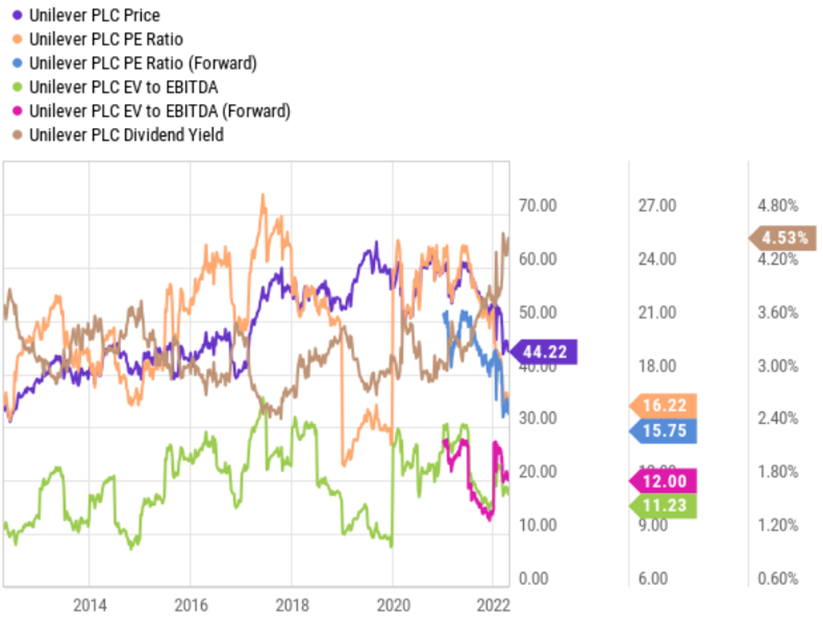

From a valuation standpoint, Unilever appears inexpensive relative to its own history (and relative to peers, such as Procter & Gamble). For example, as the share price has fallen in recent quarters (see chart below), the dividend yield has also risen (currently over 4.5%)—an indication of value to many contrarian investors. Furthermore, valuation ratios (such as forward P/E and forward EV/EBITA) have also become increasingly attractive.

Conclusion—Who Might Want to Invest

Income-focused investors that like lower-volatility and a steady wide-moat business might want to consider adding shares of this consumer staples stock. Unilever faces short-term challenges and the share price (and valuation) have declined. However, the strength of the core business remains firmly intact, and there are significant mid- to longer-term opportunities for improvement—which could bring the share price significantly higher. Furthermore, the 4.5% dividend yield is compelling. If you are a contrarian, income-focused, value investor, Unilever is worth considering for a spot in your portfolio.