If you are an income-focused investor, you’re likely familiar with Closed-End Funds (“CEFs”) because they can offer big steady dividend income. However, they also present unique risks and opportunities because they often trade at significant premiums and discounts to the net asset value (“NAV”) of their underlying holdings. The monthly-pay CEF we review in this report is very large and hugely popular, and its large price premium (as compared to NAV) isn’t as unattractive as some investors think. In this report, we review the fund and then conclude with our opinion on investing.

Guggenheim Strategic Opportunities Fund (GOF), Yield: 13.4%

With an inception date of 26-July-2007, GOF describes its investment objective as follows:

The Fund’s investment objective is to maximize total return through a combination of current income and capital appreciation. The Fund will pursue a relative value-based investment philosophy, which utilizes quantitative and qualitative analysis to seek to identify securities or spreads between securities that deviate from their perceived fair value and/or historical norms. The Fund’s sub-adviser seeks to combine a credit managed fixed-income portfolio with access to a diversified pool of alternative investments and equity strategies. The Fund’s investment philosophy is predicated upon the belief that thorough research and independent thought are rewarded with performance that has the potential to outperform benchmark indexes with both lower volatility and lower correlation of returns as compared to such benchmark indexes.

As of 31-Aug-2022, the fund held approximately 96% fixed-income securities, and your can see a more detailed holdings breakdown below.

GOF is one of the largest CEFs with over $1.4 billion in assets. And many investors have grown to love it over the years because its big monthly distributions to investors have never been reduced (only increased).

For many investors, it’s hard to not love a 13.4% annualized yield (paid monthly) with an impressive track record like GOF!

Big Premium to NAV

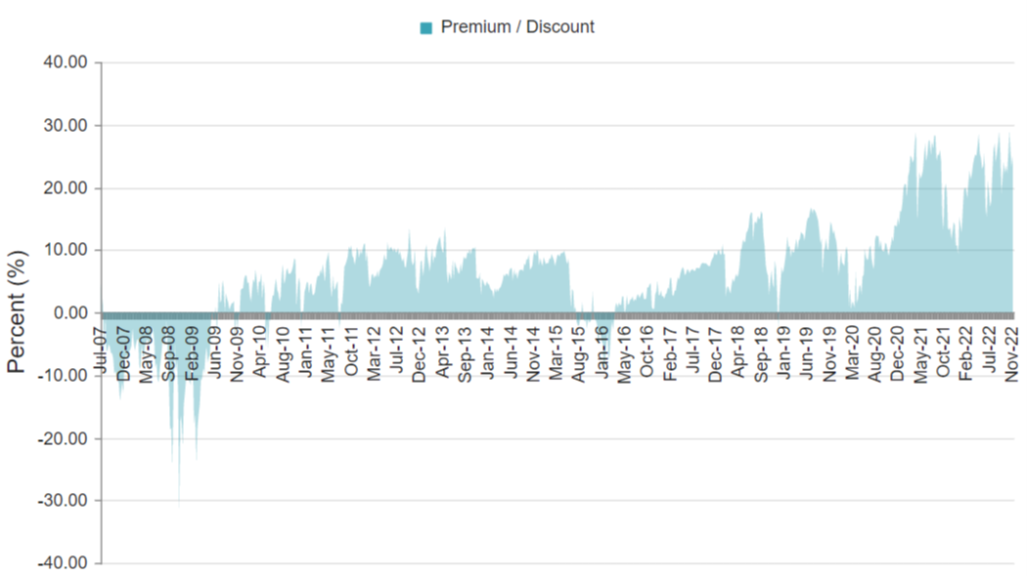

However, one of the most concerning characteristics of GOF is that its shares currently trade at more than a 25% premium to its NAV. That means if you add up the value of all of GOF’s current holdings, they are worth significantly less than the market price of GOF. Here is a look at the historical price premium/discount (versus NAV) for GOF.

CEFs are different than other mutual funds and exchange traded funds because there is no immediate mechanism to bring the market price in-line with the NAV. And as such, big premiums and discounts can exists (thereby creating risks and opportunities) as you can see in the chart above. We generally prefer to purchase attractive CEFs at a discount (not a premium) because it is like buying quality assets on sale. However, GOF has some important “uniquenesses” that should be considered.

GOF Regularly Issues New Shares

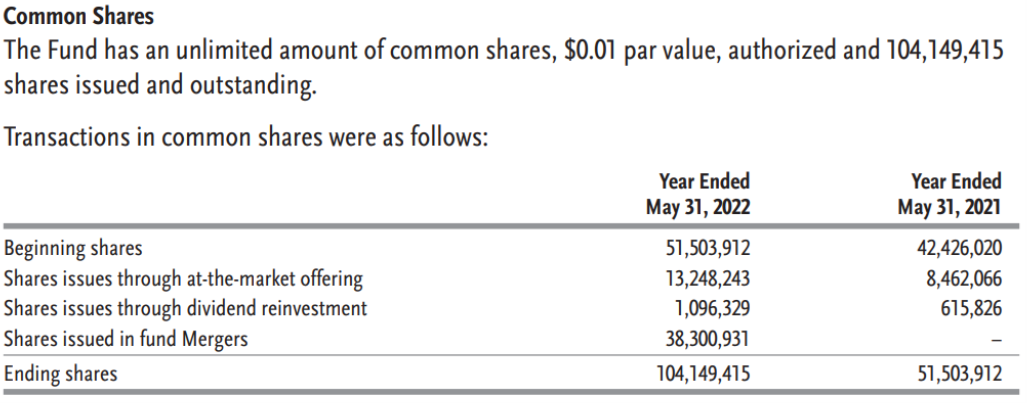

Unlike many CEFs, GOF can somewhat easily issue more shares whenever it wants. And what is particularly amazing is that they have recently been able to issue the shares at the market price (i.e. a big premium to NAV), which means people are actually willing to buy new shares at a premium—thereby instantly creating value for existing shareholders (i.e. the new share issues are NOT dilutive—they’re actually beneficial). Here is a look at GOF shares outstanding at its two most recent year ends (including a breakdown of new shares issued).

To add a little color on the share issuances, some came from shares issued for a recent fund merger (two other Guggenheim funds merged with GOF in late 2021, and investors in the old funds had their shares replaced with new shares of GOF), some came from GOF’s dividend reinvestment program (more on this momentarily) and some came simply from GOF offering new shares in the public market at a price premium (a good thing—almost a bit of an “arbitrage,” some investors might argue).

DRIP Program

GOF offers a dividend reinvestment program (“DRIP”) whereby shareholders receive shares of GOF instead of cash dividends (unless they opt out, and instead actively choose the cash—in most cases). And what is impressive about the DRIP is the “dividend shares” come from the open market when they are trading at a discount (a good thing—buy on sale) or from newly issued shares when they trade at a premium in the market (also a good thing—free premium money as compared to NAV). Here is how Guggenheim describes it in their annual report.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”)… When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly dividend distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ dividends in newly-issued common shares at the greater of NAV per share or 95% of the market price per share. The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. The DRIP effectively provides an income averaging technique which causes shareholders to accumulate a larger number of Fund shares when the market price is depressed than when the price is higher.

This impressive common-sense DRIP program makes the current large price premium a little easier to swallow in our view.

Additional Risk Factors

Of course there are other risk factors investors should consider when investing in CEF’s, such as those described for GOF below:

Leverage

Another risk factor for CEFs is the use of leverage (or borrowed money). CEFs commonly borrow money to help boost returns and income. This can be attractive in the good times (i.e. when the market is up), but painful in the bad times (i.e. when the market is down—like this year).

Leverage is typically limited to 50% for bond funds and 40% for stock funds. GOF’s leverage ratio was recently ~25%, which we view as acceptable (and actually a bit conservative) for a fund like GOF. You can see in the chart below, GOF shares are down ~12.3% this year, which really isn’t that bad as compared to many of its peers (such as PIMCO multi-sector funds which use higher leverage and are down more). And this year’s declines don’t really bother some investors at all considering the big steady monthly distribution payments just keep rolling in.

Sources of Distributions

CEFs can source income for their distributions through a variety of places, such as interest income on the underlying holdings, capital gains and return of capital (“ROC”). You can see the recent breakdown for GOF in the table below.

It would be great if fund’s could source all their income from income on underlying holdings and long-term capital gains, but from time-to-time they recognize short-term gains and ROC in order to maintain the big steady distribution payments that investors love.

If you hold CEFs in taxable accounts, it’s important to know ROC can reduce your cost basis in the fund, which means you could be surprised with a large capital gains tax if/when you do sell your shares.

Overall, we view GOF’s sources of distributions as prudent and attractive given the long-term total return goals and the big steady monthly distribution payments.

Expenses and Fees

Management fees and expenses are another factor investors should keep in mind. GOF’s annual expense ratio was recently 1.83% which may seem high (and it is considering it detracts from your gross returns), but it is reasonable. Keep in mind, the expense ratio includes the fund’s management fees, operating expenses (including interest expense on leverage). GOF’s expense ratio, based on common assets, excluding interest expense was 1.51%.

Also know that GOF invests in bonds that you probably couldn’t get access to on your own (because they trade in massive quantities or require special legal expertise—such as bank loans), and GOF is likely better able to manage leverage (and borrow at a lower rate) than most individual investors could.

Bottom Line

If it is big steady monthly income you seek, GOF remains a decent option. The fund appears well managed and positioned to keep delivering those big steady distributions. And the large market price premium (as compared to NAV) is not as risky as some investors may think (because of GOF’s ongoing “at-the-market” offerings and its well executed DRIP program). We’d prefer to buy at a discount (or at least a smaller premium), but wouldn’t fault anyone too much for buying now, and we also understand those that have owned shares for many years have likely done very well in achieving their goal of big steady monthly income.