The tempting Business Development Company (“BDC”) we review in this report offers a 17.4% dividend yield (the shares are down 38% this year) and it trades at a 20% discount to its book value. However, it faces significant risks including industry-wide BDC headwinds (yes—rising rates help net interest margins, but also increase portfolio-company default risks, especially with the economy heading towards recession) and company-specific challenges (the business strategy is somewhat unique). In this report, we review the business, the risks, the dividend and the valuation, and then conclude with our opinion on investing.

Trinity Capital (TRIN)

Based in Phoenix, Arizona, Trinity Capital is a $370 million market cap, internally-managed BDC that provides venture debt and equipment financing to high-growth, venture-backed growth-stage companies. It currently has debt position investments with 85 companies, warrant position investments with 77 companies and equity positions in 25 companies. Overall, Trinity has a BBB credit rating (low investment grade) from Egan Jones. For perspective, here is a look at Trinity’s investment diversification as of September 30th.

Trinity is a unique small cap stock. For some background, Trinity was founded in 2008 when Steve Brown raised $8 million in capital to launch a pooled investment vehicle (Lease Pool 1). The company continued to grow, it became a BDC in 2019, and it IPO’d in 2021.

If you don’t know, there are 40+ publicly-traded BDC is the US. They exist to provide capital to small business (especially the type of businesses that are too small and too risky for most traditional banks), and they can generally avoid corporate taxes if they pay out all their income as dividends.

Trinity’s investment objective is to generate current income and, to a lesser extent, capital appreciation through investments consisting primarily of term debt and equipment financings and, to a lesser extent, working capital loans, equity and equity-related investments. Trinity believes it is one of only a select group of specialty lenders that has the depth of knowledge, experience, and track record in lending to growth stage companies.

Current Valuation

One of the most common ways to value a BDC is via its share price relative to its book value. And on this metric, Trinity trades at a 20% discount to NAV. Such a significant discount can be a sign of both risk and of opportunity.

From purely a financial metrics standpoint, Trintiy’s current discount to book value appears attractive for a variety of reasons. For example, here is a look at some on Trinity’s important financial ratios as compared to other BDCs.

Not only is Trinity’s price-to-book value 0.8x (i.e. a 20% discount), but its debt to equity is reasonable (see table above) and its net investment income remains strong.

Also worth noting, Trinity recent announced a new stock repurchase program, perhaps an indication that management believes its own shares are significantly undervalued.

Dividend Coverage

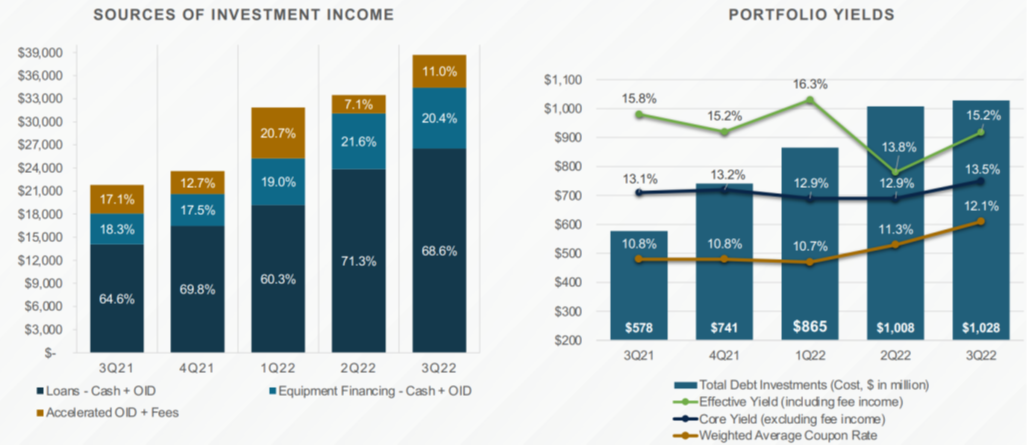

Trinity’s net investment income in Q2 and Q3 was $0.51 and $0.56, respectively. And this compares favorably to its regular dividend payout in those same periods of $0.42 and $0.45, respectively. Plus, Trinity has a track record of paying out special dividends too, as you can see in the chart below.

Risk Factors

You should have already guessed by now, there is a reason why Trinity offers such a big dividend yield and trades at a discount to its book value. And the reason is because it faces a variety of risk factors.

BDCs are Risky: For starters, BDCs are somewhat risky by nature. Specifically, BDCs generally make loans to companies that are too risky, too small and/or too complicated for traditional bank loans. This is why the yields on BDC portfolio investments are so high (they need to charge/pay high yields to offset the risks). However, it is important to understand that Trinity (and other BDCs for that matter) is able to offset a lot of these risks by building a diversified portfolio and through specialized loan underwriting skills.

Venture Finance is Risky: Trinity’s strategy (focusing on venture finance) is particularly risky now as we head into a potentially ugly recession. To some extent, all companies are impacted by the market cycle, but volatility is generally heightened in the venture finance space because venture opportunities are much more plentiful and healthy when the economy is strong, but can weaken and dry up quickly when the economy weakens. It’s important to note, Trinity has navigated market cycles in the past, it has plenty of liquidity and an investment grade credit rating, but it is still particularly sensitive to the market cycle.

Possible Book Value Write Downs: Another reason why Trinity’s share price currently trades below book value is the risk that they company may need to write down (or write off) some of its underlying portfolio holdings (if they enter distress or go bankrupt). For example, on the most recent quarterly call, COO Gerald Harder explained:

I'd like to directly address some recent developments with one of our portfolio companies in the Digital Asset sector. On October 27, Core Scientific, one of the largest publicly-traded crypto mining companies in the U.S., filed an 8-K announcing that its operating performance and liquidity had been severely impacted, and that its Board had made the decision to not make payments coming due in late October and early November with respect to several of its equipment and other financings. The release further went on to state the Core Scientific has been exploring a number of potential strategic alternatives.

Core Scientific was current on its payments to Trinity through October. We have placed the financing to Core Scientific on non-accrual effective November 1, pending the outcome of future developments at the company. As of September 30, Trinity holds an investment in Core Scientific, collateralized by critical computing equipment, with a cost basis of $24 million and a fair value of $19.4 million, which is approximately 81% of cost.

To put that in perspective, Core Logic’s $19.4 million fair value is less than 2.0% of Trinity’s $1.04 billion of total investments at fair value as of Septebmer 30th. So even if Core Scientific goes bankrupt and is totally written off—that still doesn’t warrant the large 20% discount to book value for Trinity. Nonetheless, there could be more write downs coming (especially as we may be heading into an ugly recession), and that may be a big part of the reason Trinity trades at such a large discount to book value.

Also worth noting from the call:

In aggregate, Trinity holds equipment finance facilities with three public companies in the digital asset space: Core Scientific, Hut 8 Mining, and CleanSpark. As of September 30, these financings represent $65 million or less than 6% of our total investments on a cost basis and $60 million on a fair value basis, for an overall fair value to cost ratio of 92.3%.There are certainly challenges being faced by all companies in the digital asset sector, including the prolonged decrease in the price of bitcoin and an increase in electricity costs.

And further still:

In addition to the challenges at Core Scientific, our financing to FemTec Health was placed on nonaccrual in the third quarter.

FemTec Health is a legacy asset, it's not part of our new Life Sciences business. FemTec entered the Trinity portfolio in July of 2021 and they acquired a Trinity portfolio company, which we originally financed in 2017. As of September 30, our loan to FemTec Health carried a cost of $15.7 million and a fair value of $8.9 million, representing 56.5% fair value to cost. Our portfolio team is working closely with the company to obtain the best outcome for our shareholders.

Notwithstanding the issues with Core Scientific and FemTec Health, our overall credit quality remained stable, with 97% of our portfolio performing as of September 30. Our weighted average risk rating of the portfolio was 2.9%, down slightly compared to the 3.0% in the prior quarter, with the change primarily driven by the two credits that we've discussed today.

So basically, 97% of the portfolio is performing, but the market has discounted Trinity’s share price by 20% versus its book value. This seems like an overly negative reaction so far, but the market hates uncertainty and there could be more write downs to come—especially considering where we are in the market cycle (i.e. potentially heading into an ugly recession).

Rising Interest Rates are another risk factor for BDCs in general and for Trinity in particular. On one hand, rising rates are good because it means BDCs can benefit from higher net interest margins (the rate they borrow at versus the rate they lend at), but on the other hand rising rates could create challenges for portfolio investment companies thereby making it more difficult to stay current on their loans (and potentially even fall into delinquency or bankruptcy). For perspective, here is a look at how Trinity is currently positioned to benefit from rising rates.

Basically, a significant portion of Trinity’s investment portfolio will benefit as rates rise, as long as the portfolio companies aren’t pushed into default (which seems unlikely for now based on the information presented earlier).

The Bottom Line

In our view, Trinity’s dividend seems well covered and its discount to book value seems too extreme. We’ll be digging deeper into Trinity’s business in the coming days, but it currently seems like an attractive investment opportunity if you can handle higher risk and volatility, and if you own it in a prudently-diversified goal-focused portfolio. We don’t currently own shares, but it is high on our watchlist.