If you don’t know, preferred stocks are basically like junior (subordinate) bonds, generally with no maturity date. They can pay big-steady dividends (which many investors love), but there are risks, including interest rate risk (when rates rise, preferred stock prices fall) and they’ll never have the same upside potential as common stocks. In this report, we share data on over 100 preferred stocks (sorted by sector then industry) all offering large dividend yields and trading below $25. We then highlight one preferred stock that is particularly attractive and worth considering.

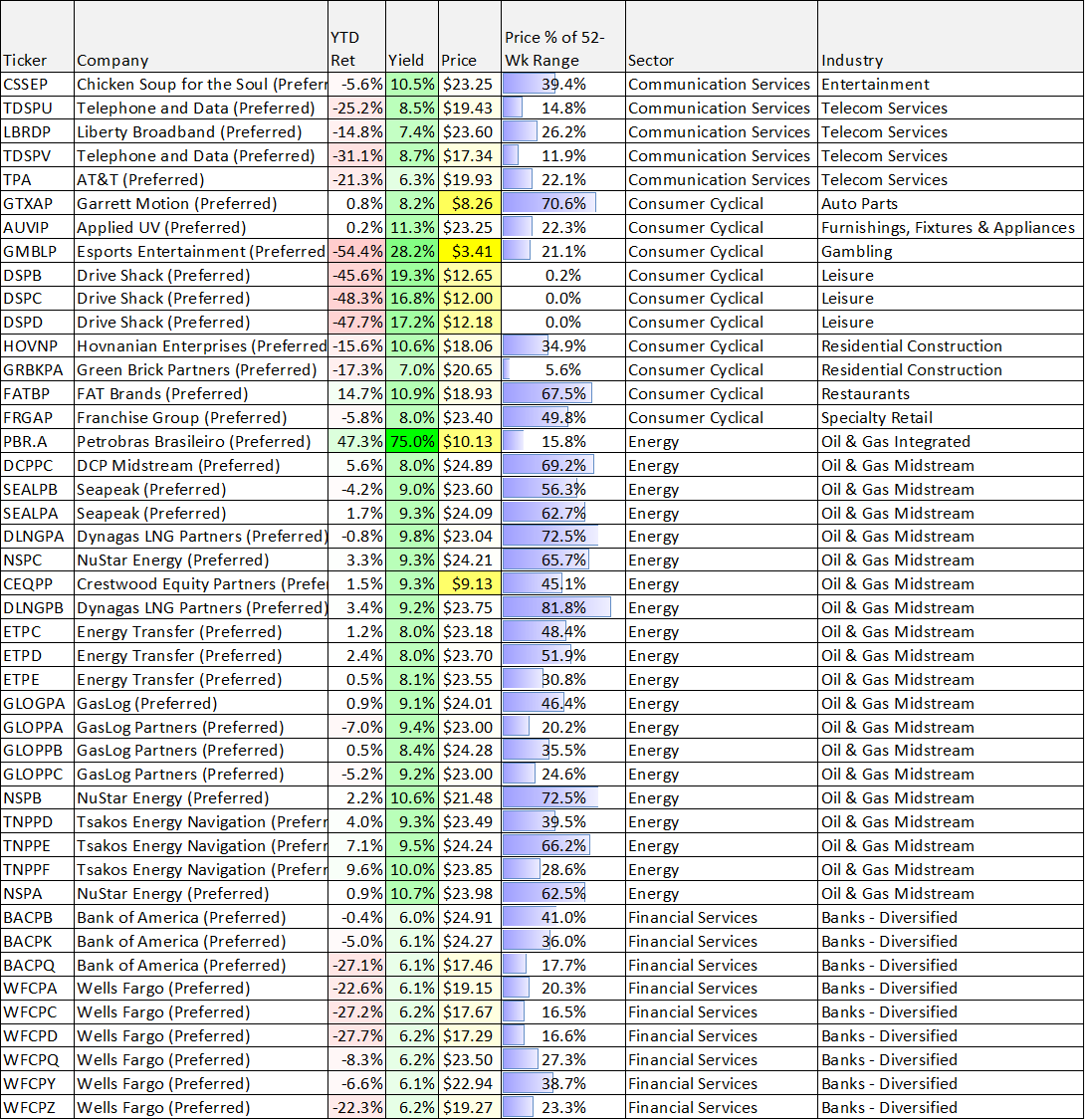

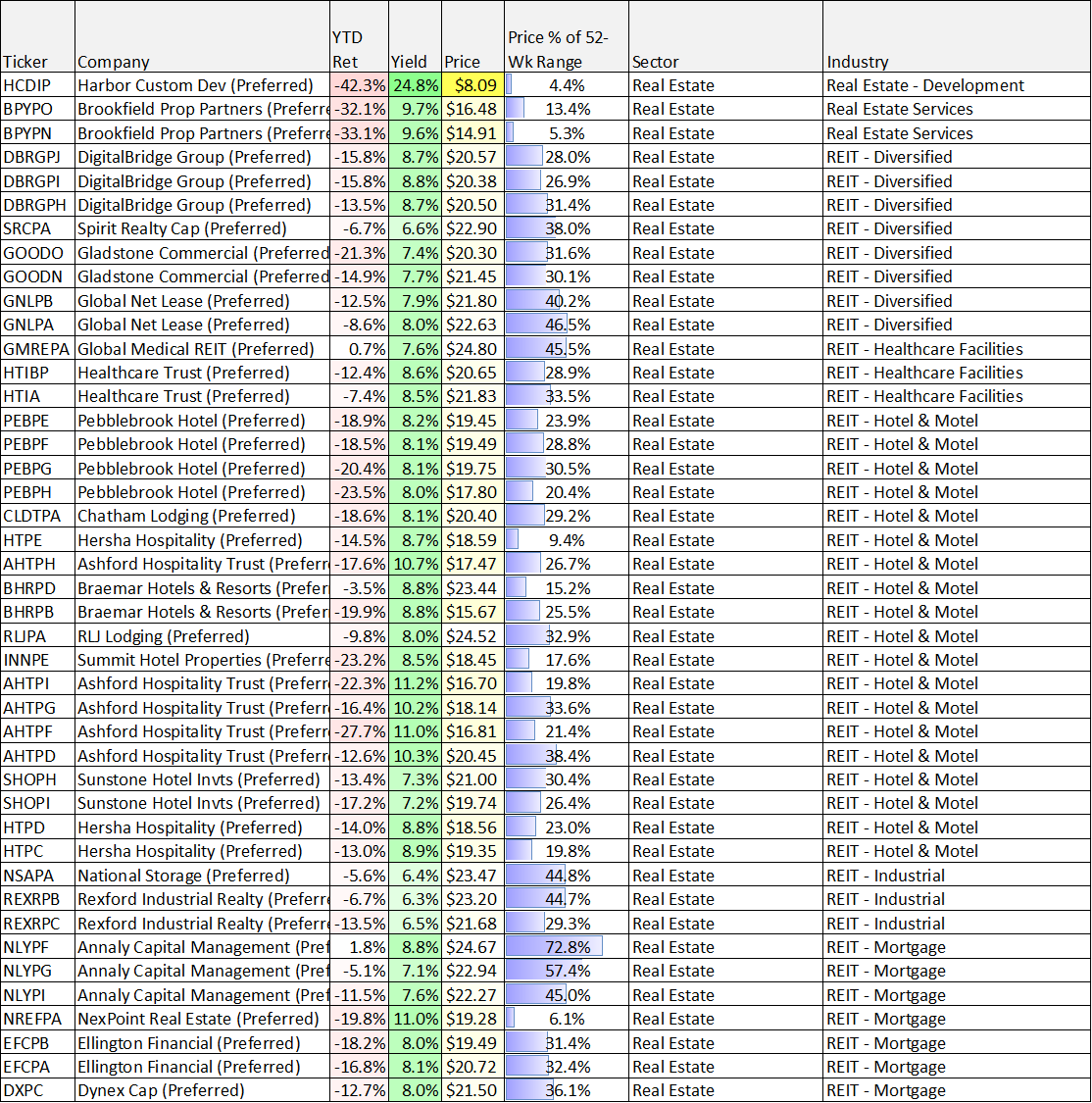

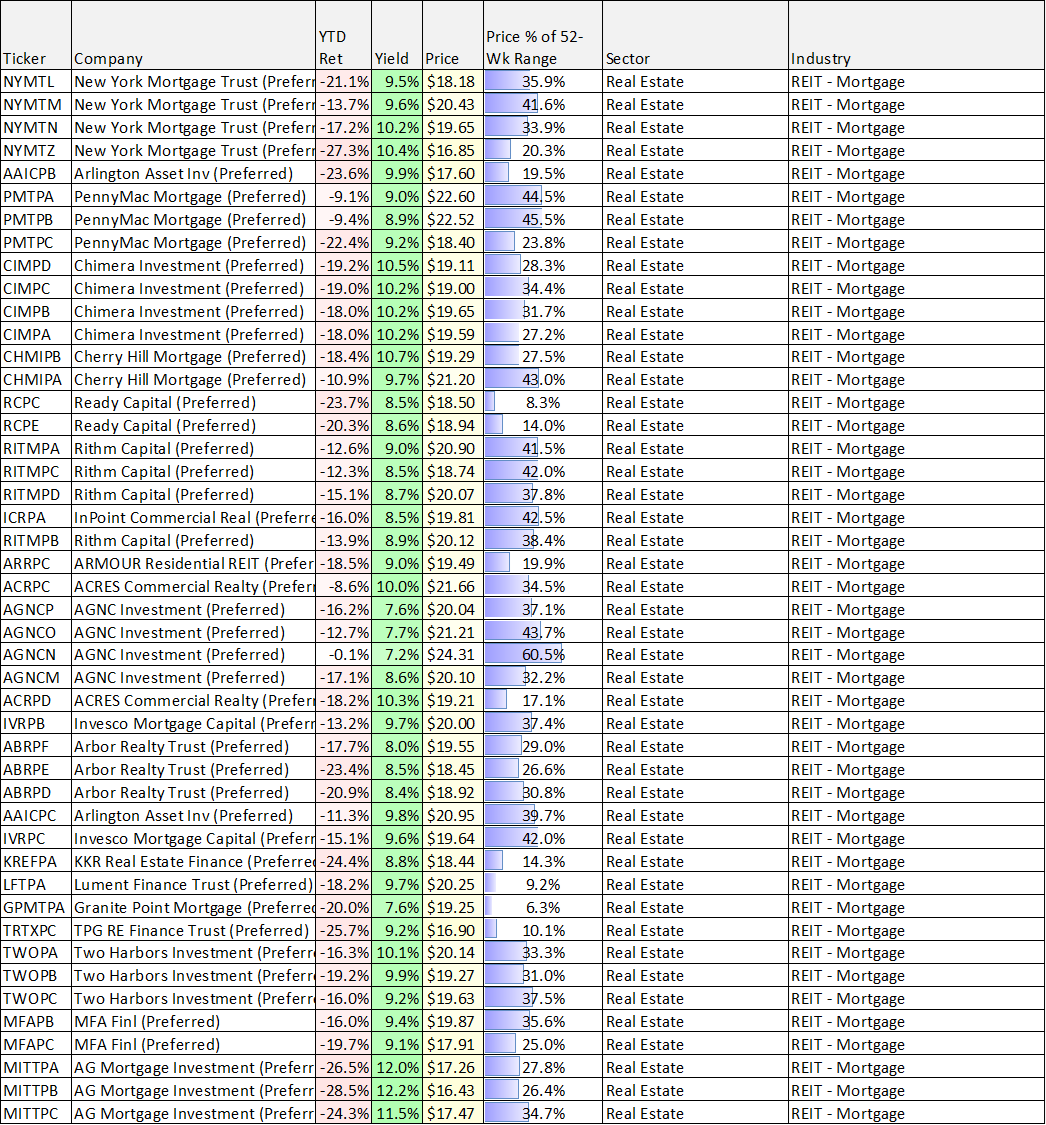

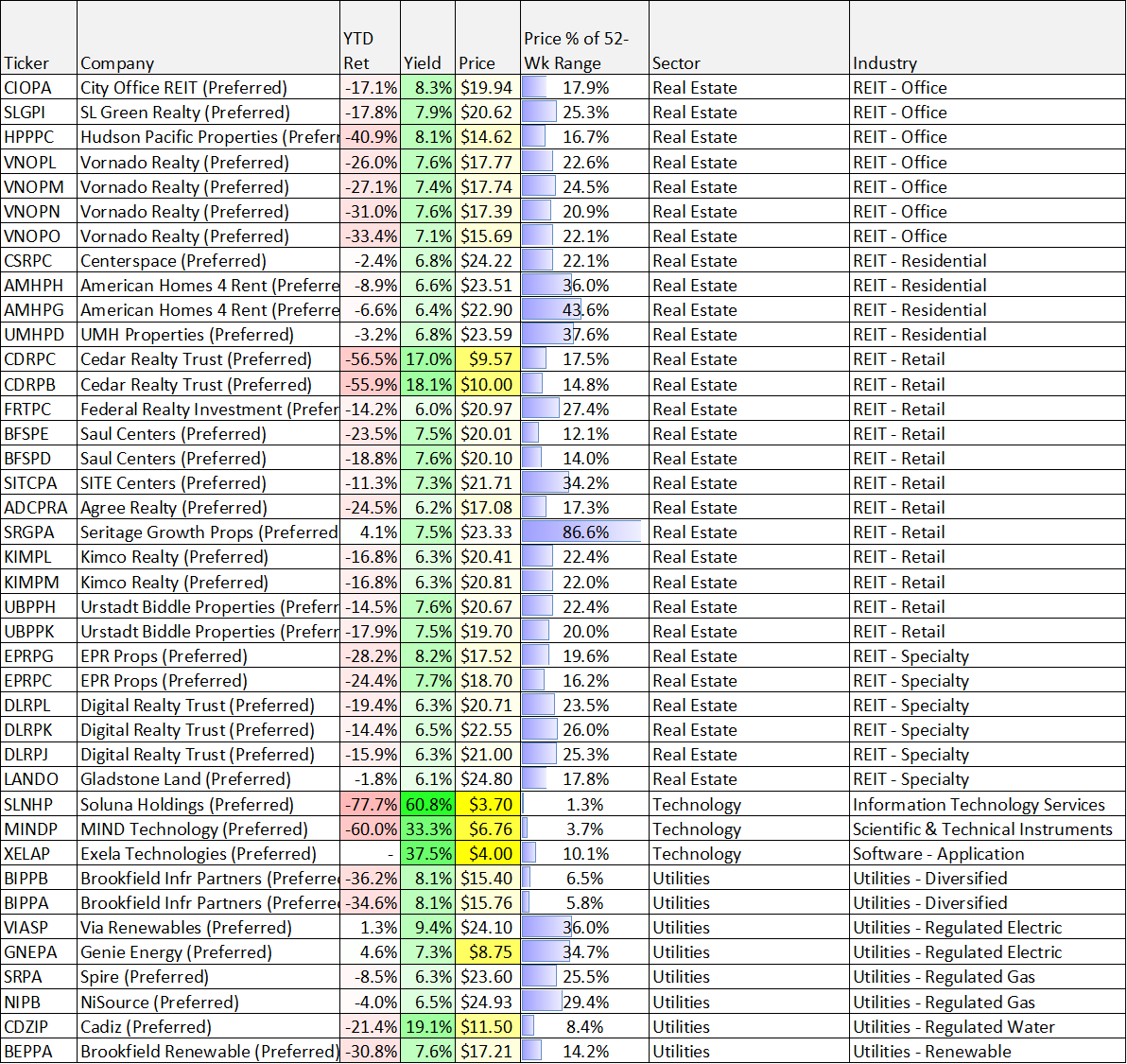

100+ Preferred Stocks

Let’s start with the data. The following list includes over 100 preferred stocks, and as you can see-many of them offer large dividend yields. Generally speaking, preferred stock prices have fallen this year (as you can see in the table below) as interest rates have risen (prices have fallen to make yields commensurate with prevailing market rates).

Preferred stocks are often “callable” at $25 per share, at the issuing company’s discretion. So in the list above, we’ve only included preferred shares trading below $25. You can also see most of the shares are trading much closer to their 52-week lows than highs (which makes sense considering rates are rising and the economy is potentially heading into an ugly recession).

For your information, preferred shares are ahead of common shares but behind bonds in the capital structure. That means in a bankruptcy situation, bond holders are made whole first, and any money left over goes to the preferred stock holders before the common stock holders. Realistically, when companies file bankruptcy, usually bond holders only get paid back a fraction of what they are owed and preferred shares and common shares get wiped out (but not always). The bad news is that bankruptcies do happen; the good news is they don’t happen all that often (usually less than 1% of investment grade companies go bankrupt).

So by including preferred stocks in a prudently-diversified portfolio, you can reduce risks and keep expected income high. Let’s get into the two preferred stock ideas.

AGNC Investment Corp (AGNCP), Yield: 7.6%

AGNC Investment Corp. 6.125% Dep Shares Ser F Fix/Float Cumul Red Preferred Stk

AGNC is a mortgage REIT. It’s strategy is basically to buy really safe Agency Mortgage-Backed Securities (Agency MBS), and then magnify the interest they pay (and the risks) by leveraging their investment (borrowing money) by 5x to 7x or more. In good times, this is a great strategy whereby returns and income are magnifies. In the bad times, losses are magnified.

This year has been rough for AGNC (you can see the shares are down a lot in our earlier table) because as the fed keeps raising rates, the value of the Agency MBS on AGNC’s balance sheet keep falling. And because there are mandated leverage limits, AGNC is forces to sell some of its holdings at lower prices thereby locking in losses to its book value.

The good news for the preferred shares is that if when AGNC is forced to reduce the dividend on the common shares, the preferred shares benefit by becoming safer. They become safer because they’re higher in the capital structure, and any reductions in common share dividends just frees up more capital to support the preferred shares.

For reference, here is how quantum online describes these shares (AGNCP):

AGNC Investment Corp. 6.125% Dep Shares Ser F Fix/Float Cumul Red Preferred Stk: AGNC Investment Corp., 6.125% depositary shares, each representing a 1/1,000th interest in a depositary share of Series F Fixed-To-Floating Rate Cumulative Redeemable Preferred Stock, liquidation preference $25 per depositary share, redeemable at the issuer's option on or after 04/15/2025 at $25 per depositary share plus accrued and unpaid dividends, and with no stated maturity. Cumulative distributions of 6.125% per annum ($1.53125 per annum or $0.3828125 per quarter) will be paid quarterly on 1/15, 4/15, 7/15 & 10/15 to holders of record on the record date that will be the first day of the calendar month in which the dividend payment date falls (NOTE: the ex-dividend date is one business day prior to the record date). From and including 04/15/2025 at a floating rate equal to Three-Month LIBOR plus a spread of 4.697% per annum. Upon the occurrence of a change of control the company will have the option within 120 days to redeem the preferred shares at $25 per share plus accrued and unpaid dividends. If the company has exercised their redemption right, the holders will NOT have the following conversion right. Upon the occurrence of a change of control, and the company has NOT provided notice that they intend to redeem the preferred shares, the holder will have the right to convert the preferred shares into common shares under certain circumstances (see the prospectus for details). Dividends paid by preferreds issued by REITs are NOT eligible for the preferential 15% to 20% tax rate on dividends and are also NOT eligible for the dividend received deduction for corporate holders. This security was not rated by Moody’s or S&P at the time of its IPO. In regard to the payment of dividends and upon liquidation, the preferred shares rank junior to the company's senior debt, equally with other preferreds of the company, and senior to the common shares of the company.

Three key (and attractive) points about AGNCP, include:

Cumulative: If AGNC ever misses a dividend payment, they’re still on the hook to pay it later (so long as they don’t declare bankruptcy). This is an advantage over common shares which are not cumulative.

Fixed-To-Floating Rate: Rising interest rates are a big risk to preferred stocks because preferred share prices fall when interest rates rise. However, beginning on 04/15/2025 these AGNC preferred shares switch to a floating rate (equal to Three-Month LIBOR plus a spread of 4.697% per annum). This eliminates a lot of the interest rate risk.

Redeemable (liquidation preference $25): AGNC can call (retire) these preferred shares at $25 starting pm 4/15/25. But the good news in the shares currently trade at only around $20. So if they get called, that’s an instant profit to you.

The Bottom Line

If you like high income (and price appreciation is your secondary objective) then preferred shares may be particularly attractive to you. Prices have fallen this year (as you can see in our table) and that has created some attractive opportunities, such as AGNC Investment Corps series F preferred shares (AGNCP), as described in this report. Of course there are risks to investing in preferred stocks (such as interest rate risks and the potential for companies to go bankrupt) but a lot of that risk can be eliminated by constructing a prudently diversified portfolio of attractive preferred stocks investments, such as AGNCP.