Teladoc shares are up significantly following quarterly earnings, but this once famous (now infamous) “pandemic darling” is down 80% from its recent highs (as post-covid life resumes) and questions remain as to whether there is any legitimate path to profitability. On Wednesday, Teladoc reported a $0.45 loss per share for Q3, it beat on top and bottom lines, but slightly lowered full year guidance.

About Teladoc (TDOC)

There are genuine benefits to Teladoc services for patients, healthcare professionals, healthcare organizations and organizations offering benefits to their employees. Specifically, Teladoc can provide better access to healthcare and deliver better outcomes, all while streamlining operations and lowering costs. Obviously there are those that will always prefer to maintain that one-on-one in personal relationship with their healthcare patients and providers, but there are also wide opportunities for Teladoc. For perspective, here is an example of recent job postings by Teladoc:

Teladoc by the Numbers

To put Teladoc’s busines in perspective, here is a look at the historical share price, revenue growth estimates and actual revenue growth. As you can see, when the pandemic hit, Teladoc shares (and revenue growth) soared!

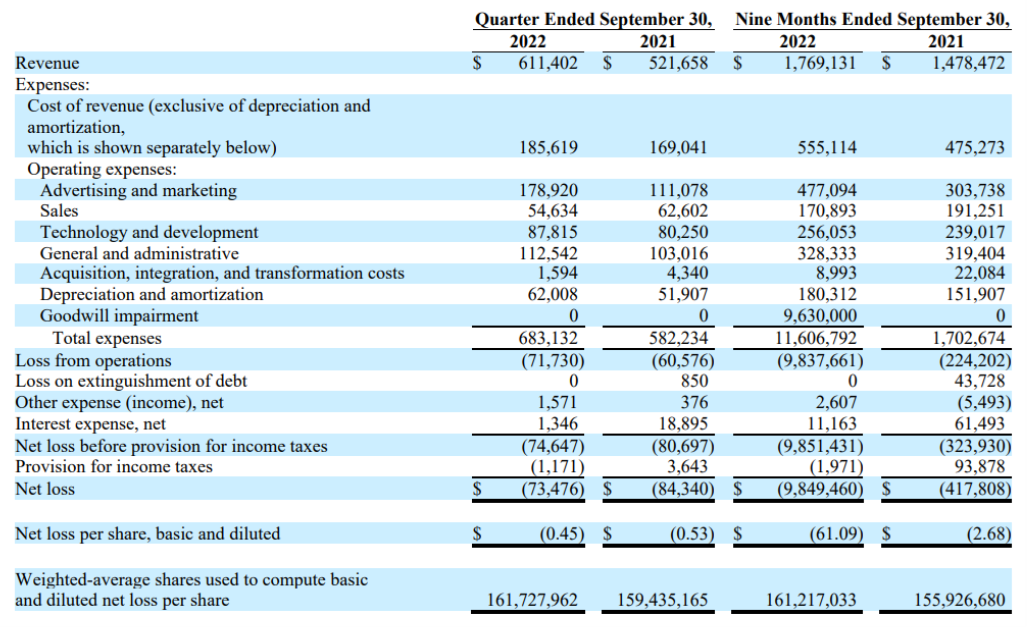

However, the shares have now plummeted as revenue growth expectations have come down dramatically. Further, the company is still not profitable. And as you can see in this next chart, biggest expenses (preventing it from being profitable) include Advertising and Marketing and other general and administrative expenses.

Teladoc’s net loss totaled $73.5 million, or ($0.45) per share, for the third quarter of 2022 (compared to a loss of $84.3 million, or ($0.53) per share, for the third quarter of 2021).

Very important to note, negative results for the third quarter of 2022 primarily included stock-based compensation expense of $55.7 million, or ($0.34) per share, and amortization of acquired intangibles of $48.8 million, or ($0.30) per share. Without these expenses, Teladoc would be very profitable.

The Livongo Acquisition

Teladoc paid around $18.5 billion for complimentary telehealth care provider, Livongo, at the height of the pandemic. Sadly, the combined entity of Teladoc and Livongo, now have a total market cap of around only $4 billion. As a result, Teladoc reported impairment charges of around $6 billion in Q1 and $3 billion in Q2. These were non-cash charges, but still they are the reason why Q1 and Q2 EPS numbers were so much worse

Teladoc Growth:

Despite the negative bottom line earnings, Teladoc continues to report somewhat healthy operational growth. For example, revenues continue to grow (just at a slower pace than during the pandemic). Revenues for the quarter were up 17% year over year. And EBITDA remains positive at $51.2 million for the quarter.

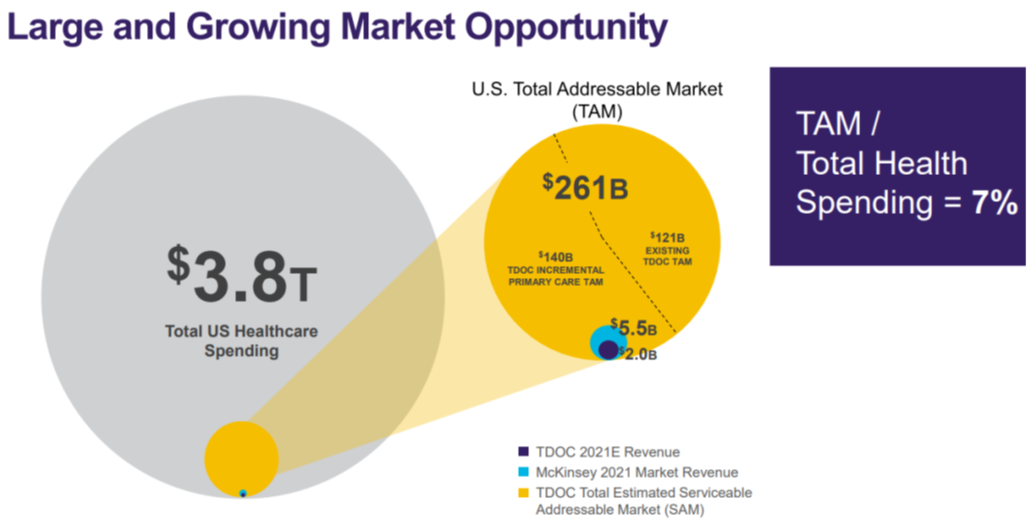

Also, healthcare is a very large industry, and there are massive opportunities for long-term growth, especially considering it has the potential to deliver better outcomes for all constituents (patients, healthcare professionals, healthcare providers and organizations proving healthcare benefits). In 2021, Teladoc estimated the total addressable market opportunity (“TAM”) to be $261 billion in the US alone (that compares to the company’s $611.4 million in Q3 revenues.

Valuation Multiples:

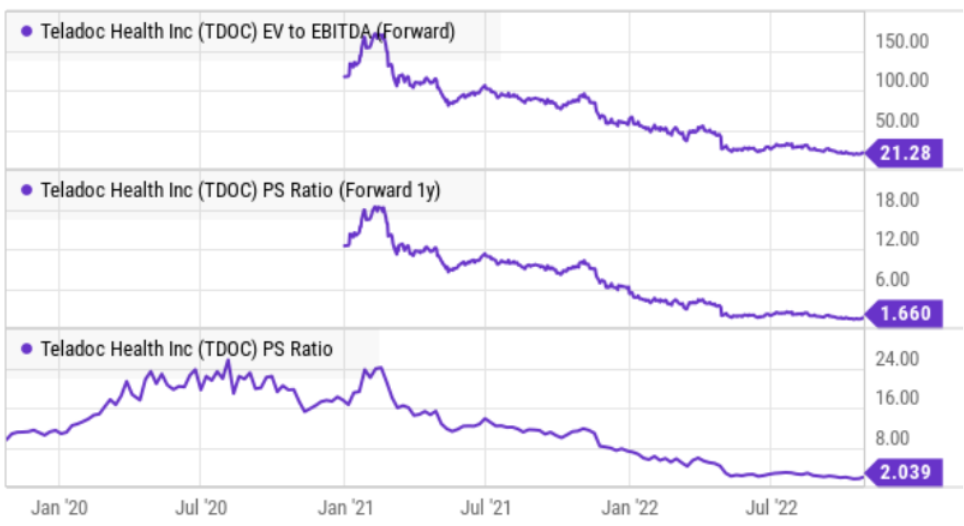

As mentioned, Teladoc shares have fallen dramatically. And the company’s valuation multiples are more reasonable (and some would argue compelling).

However, Teladoc maintains a significant amount of debt relative to its cash and cash flows, and that makes funding growth more expensive, especially in our rising interest rate environment, and more especially for a company that is not profitable. Further, the lower share price makes it harder to raise growth capital through share issuances. And further still, how telehealth will perform in a recession (i.e. we could be entering an ugly one) is unknown, considering the industry remains very new.

The Bottom Line

The question remains, what is the path to profitability for Teladoc? Revenue keeps growing (a good thing) and the market opportunity (“TAM”) is very large (even without pandemic). However, expenses are also high (such as advertising and marketing expenses, and very high stock-based compensation).

The Livongo acquisition was a disaster (Teladoc bought at the wrong time and dramatically overpaid), but the related impairment charges have largely been written off (in Q1 and Q2), and the other amortization expenses will fall in relative size as revenues grow.

The market likes the latest earnings announcement (shares are up more than 8%). And considering the low valuation multiples, it has been argued by some that TDOC may become an acquisition target (by the likes of a Walgreen’s or CVS). We could also see a short squeeze (the shares could rise a lot) considering short interest remains high. And fed interest rate hikes will eventually moderate (hopefully sooner than later), which would be good for growth stocks in general and for Teladoc in particular.

TDOC was a small position in our Disciplined Growth Portfolio, and remains a miniscule one after the price declines. We will continue to own these shares for the time being, but are watching closely. This is an attractive long-term business, that just got way too far ahead of itself during the pandemic. With continuing revenue growth, expenses can fall on a relative basis, and there is a long-term path to profitability. Especially considering the services provided add value for constituents across the healthcare spectrum.