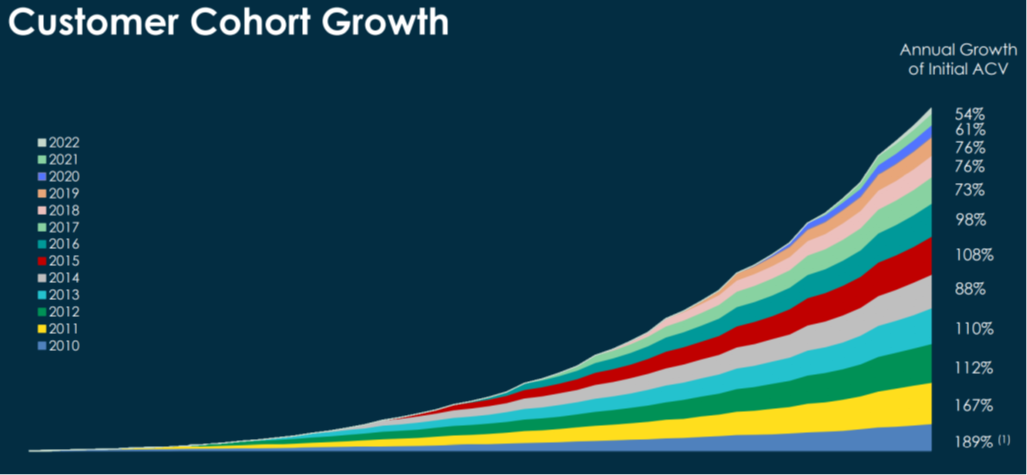

The business of this profitable Software-as-a-Service (SaaS) company is holding up extremely well despite slowing economic growth. The shares are down significantly this year, yet jumped over 13% on Thursday following its latest quarterly earnings announcement, whereby they beat EPS expectations, despite falling slightly short of revenue estimates and modestly lowering full year guidance. Revenue grew at an impressive 21.2% year-over-year, and subscription revenue grew at 28.5%. The magic of this company is two-fold: 1) customers love the solution (the Q3 renewal rate was 98%) and 2) land-and-expand remains firmly intact—a beautiful thing during increasingly challenging economic times (as you can see in the following customer cohort growth chart).

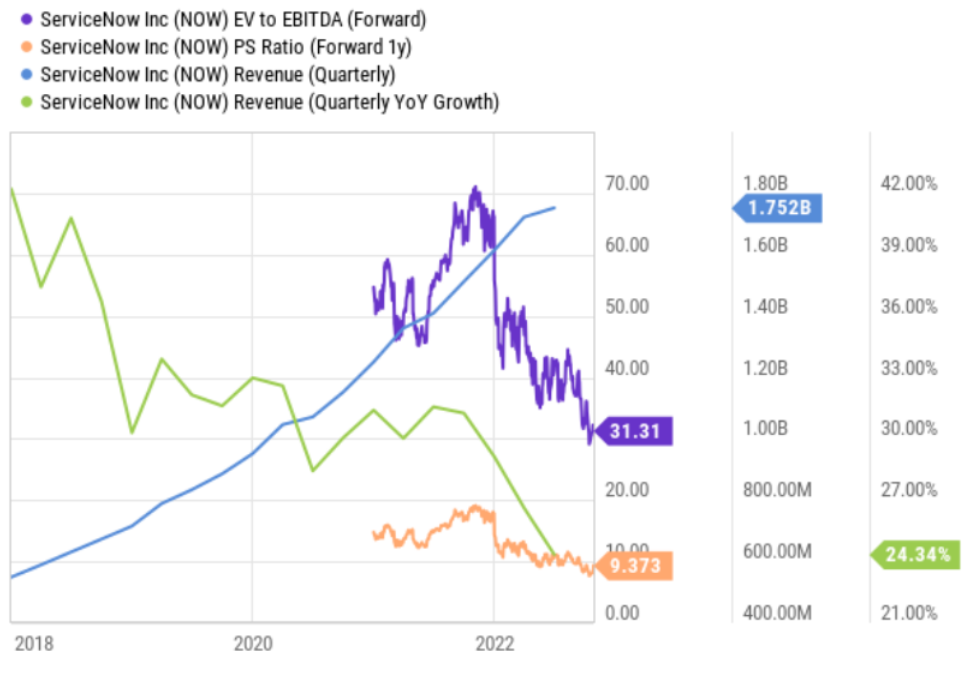

Although valuation multiples are down significantly this year (see below), the shares are not cheap, nor should they be considering the large TAM of this high-growth high margin business.

Here is what ServiceNow Chairman and CEO Bill McDermott had to say about Q3 results.:

“Once again, ServiceNow beat both our top and bottom-line goals… Businesses are leaning into the generational shift from architectures built in the last century to platforms engineered for this one. Through dramatically improved experiences for customers, employees, and creators, ServiceNow is becoming the strategic center of gravity for digital transformation. Our focus on value creation is unmatched.”

We are long these shares in our Disciplined Growth Portfolio, and believe the ongoing digital revolution and migration to the cloud will bring even more profitable growth in the years ahead.