If you are looking for a high-income opportunity that is attractive on a risk-versus-reward basis, the BDC we review in this article is worth considering. Not only does it offer regular, supplemental and special dividends, but it stands out versus its BDC peers in terms of strong financial metrics and strong deal flow trajectory going forward. It also has support from a larger parent organization, it has significant interest rate hedging (by virtue of its largely floating rate portfolio and debts) and the recent share price pullback makes for an increasingly attractive entry point. In this report, we review the details and conclude with our opinion on investing.

Overview: Sixth Street Specialty Lending (TSLX)

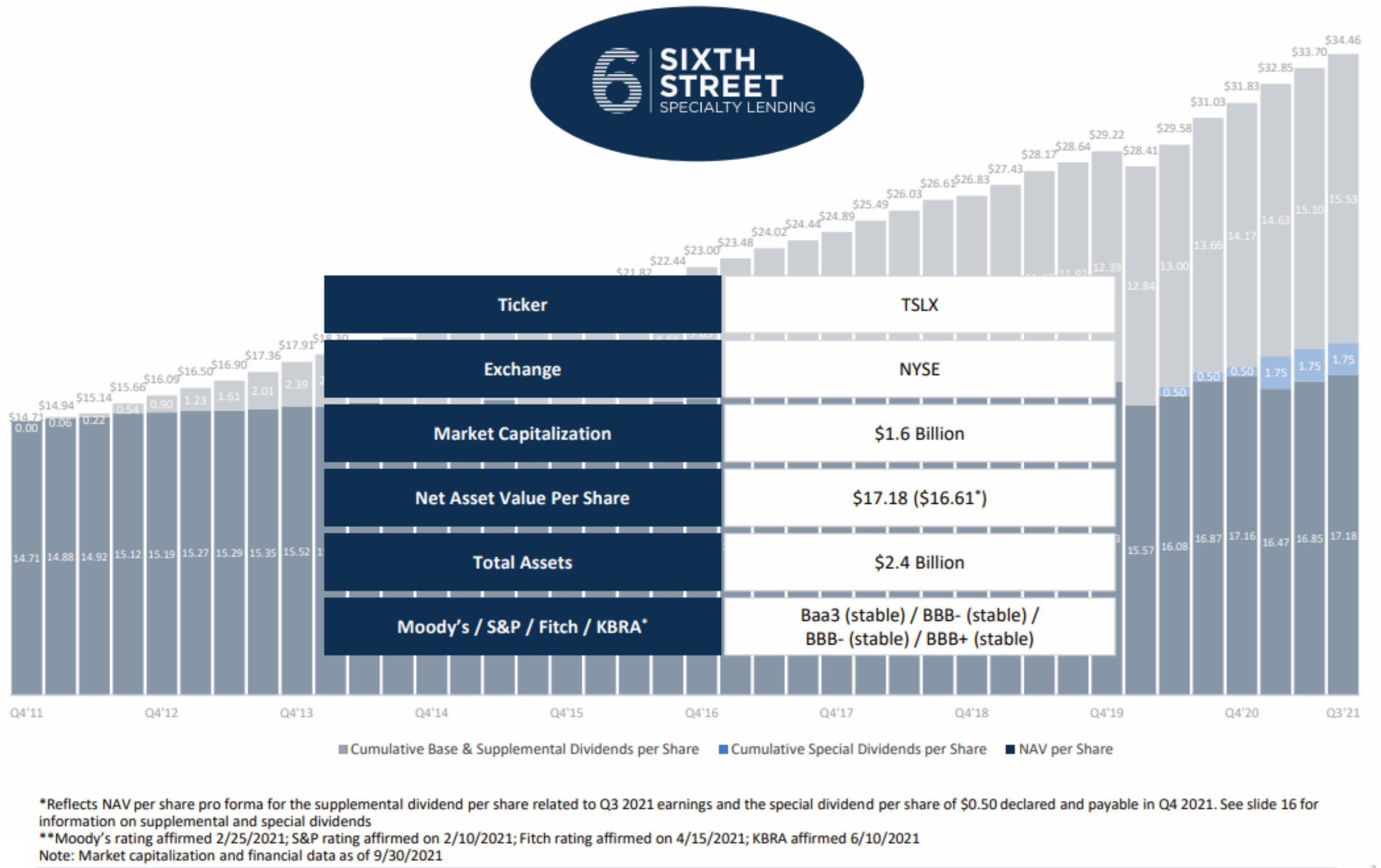

Sixth Street Specialty Lending, Inc. (TSLX) is an externally managed closed-end investment company that was founded in 2010, and that has elected to be regulated as a business development company, or BDC, under the Investment Company Act of 1940 (and treated as a regulated investment company, or RIC, for U.S. federal income tax purposes).

If you don’t know, BDCs were created by Congress in 1980 as a way to provide small and growing companies access to capital. As per regulatory rules, BDCs must invest at least 70% of their assets in non-public companies (with market value less than $250 million), and as long as they pay out 90% (or more) of their income as dividends, they are exempt from paying corporate taxes. And for reference, the dividends you receive from TSLX are non-qualified dividends (meaning they don’t qualify for the special lower tax rate of qualified dividends).

Regarding external management, Sixth Street Specialty Lending, Inc. is managed by Sixth Street Specialty Lending Advisers, LLC (the “Adviser”), an SEC-registered investment adviser. The Adviser sources and manages the portfolio through a team of investment professionals with significant expertise in middle market lending.

Also important, TSLX benefits from being a part of the larger Sixth Street organization. Specifically, Sixth Street is a global investment firm with over $50 billion in assets under management and committed capital. Six Street operates nine diversified, collaborative investment platforms: TAO, Growth, Specialty Lending, Fundamental Strategies, Infrastructure, Opportunities, Insurance, Agriculture, and Credit Market Strategies. Sixth Street was founded in 2009, and has more than 320 team members including over 145 investment professionals in nine locations around the world. This is helpful for sourcing deals.

Worth mentioning, Sixth Street Specialty Lending was founded under the name TPG Specialty Lending. The name of the business was changed following the completion of the agreement for Sixth Street Partners to become independent from TPG in May 2020. Sixth Street Specialty Lending continues to trade on the New York Stock Exchange under the symbol TSLX as it has since becoming a publicly listed company in 2014.

Investment Strategy

The company’s investment objective is to generate current income and, to a lesser extent, capital appreciation primarily in U.S.-domiciled middle-market companies through direct originations of investments. These directly originated investments primarily include senior secured loans and, to a lesser extent, originations of mezzanine loans and investments in corporate bonds, equity securities, and structured products.

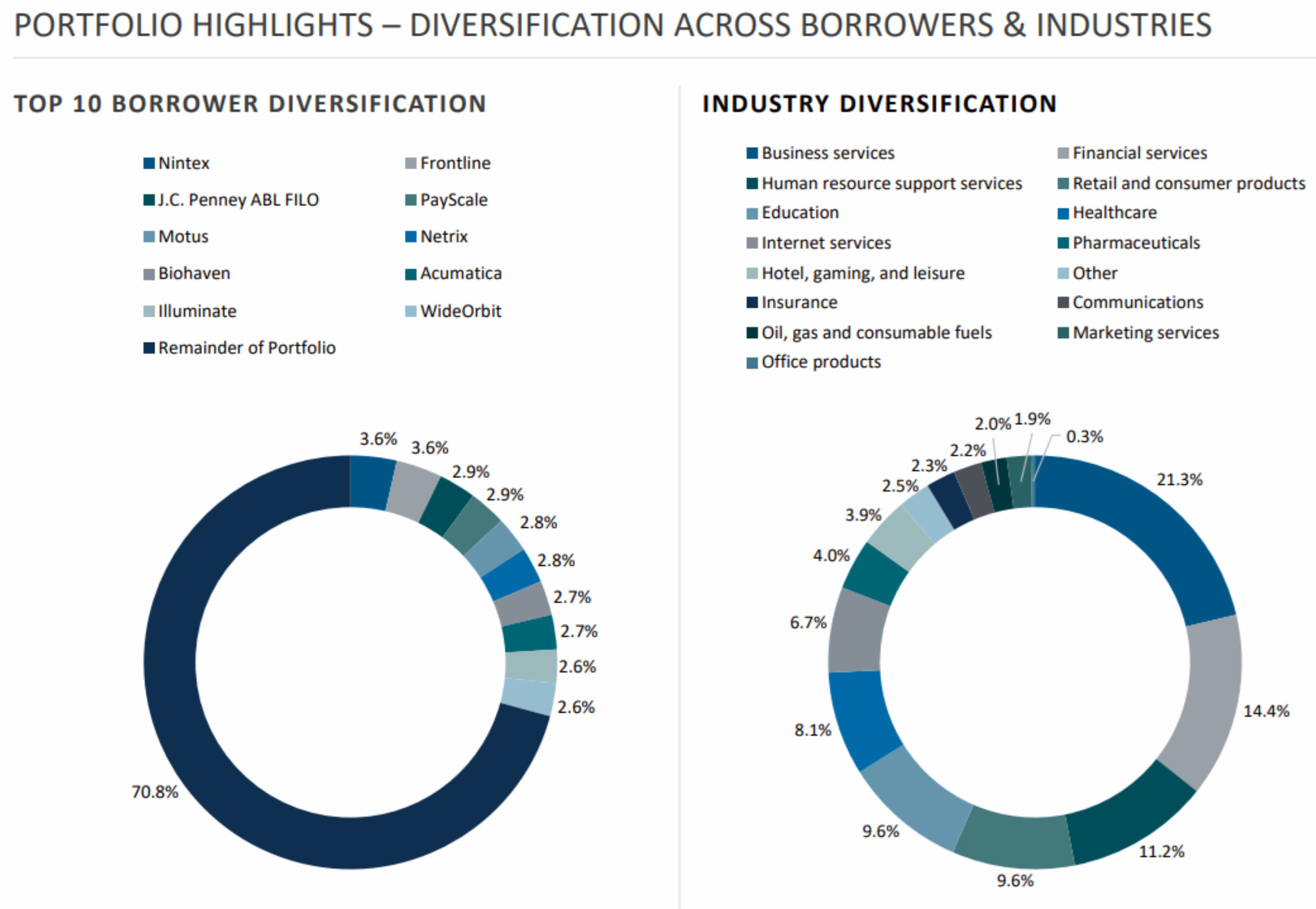

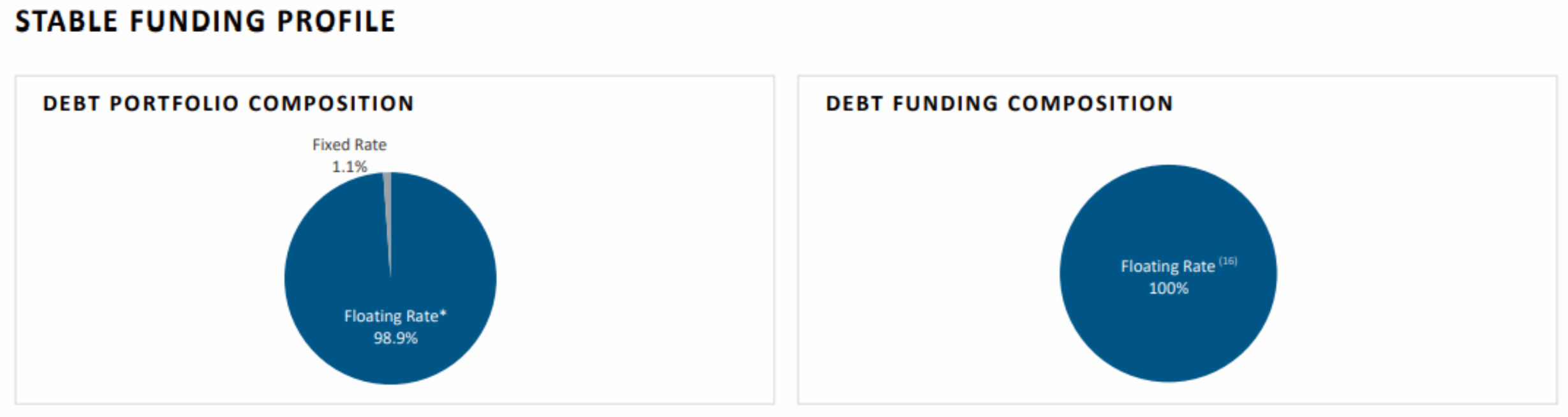

For perspective, the overall investment portfolio is 92.5% secured debt, 92.5% first-lien debt investments and 98.9% floating rate debt investments. Further, the portfolio is diversified across 67 investments with an average investment size of $36 million (and the largest investment represents 3.6% of total investments).

Solid Track Record of NAV, NII and ROE.

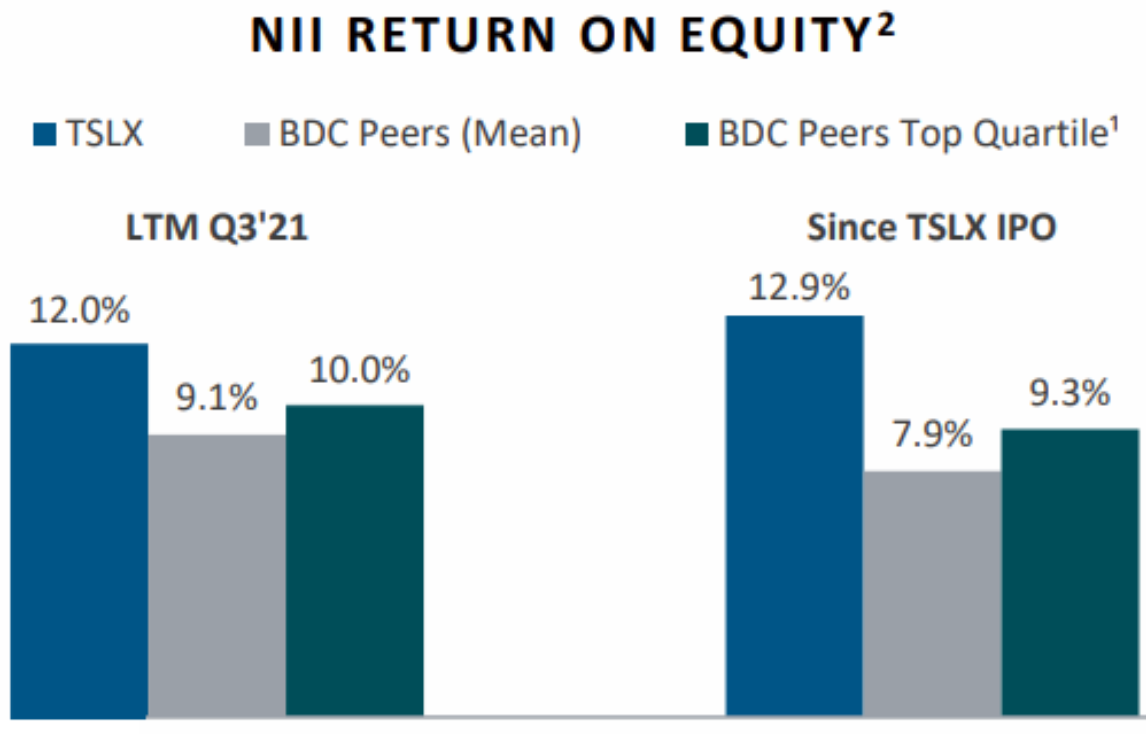

Net Asset Value, or NAV, is essentially a measure of a BDCs book value (or what assets are left over (owners equity) after subtracting out liabilities). And in the case of TSLX, NAV has grown at a healthy clip throughout its history. Similarly, Net Investment Income, or NII, has also grown (NII is a measure of the net income provided by the company’s investments). Further still Return on Equity, or ROE, has also been particularly strong for TSLX throughout its history and especially as compared to peers.

As further evidence of the company’s strong performance, here are additional comparative metrics on returns and performance.

And while we appreciate the strong track record for TSLX on these metrics, we put an even greater value on the company’s continuing strong future business prospects.

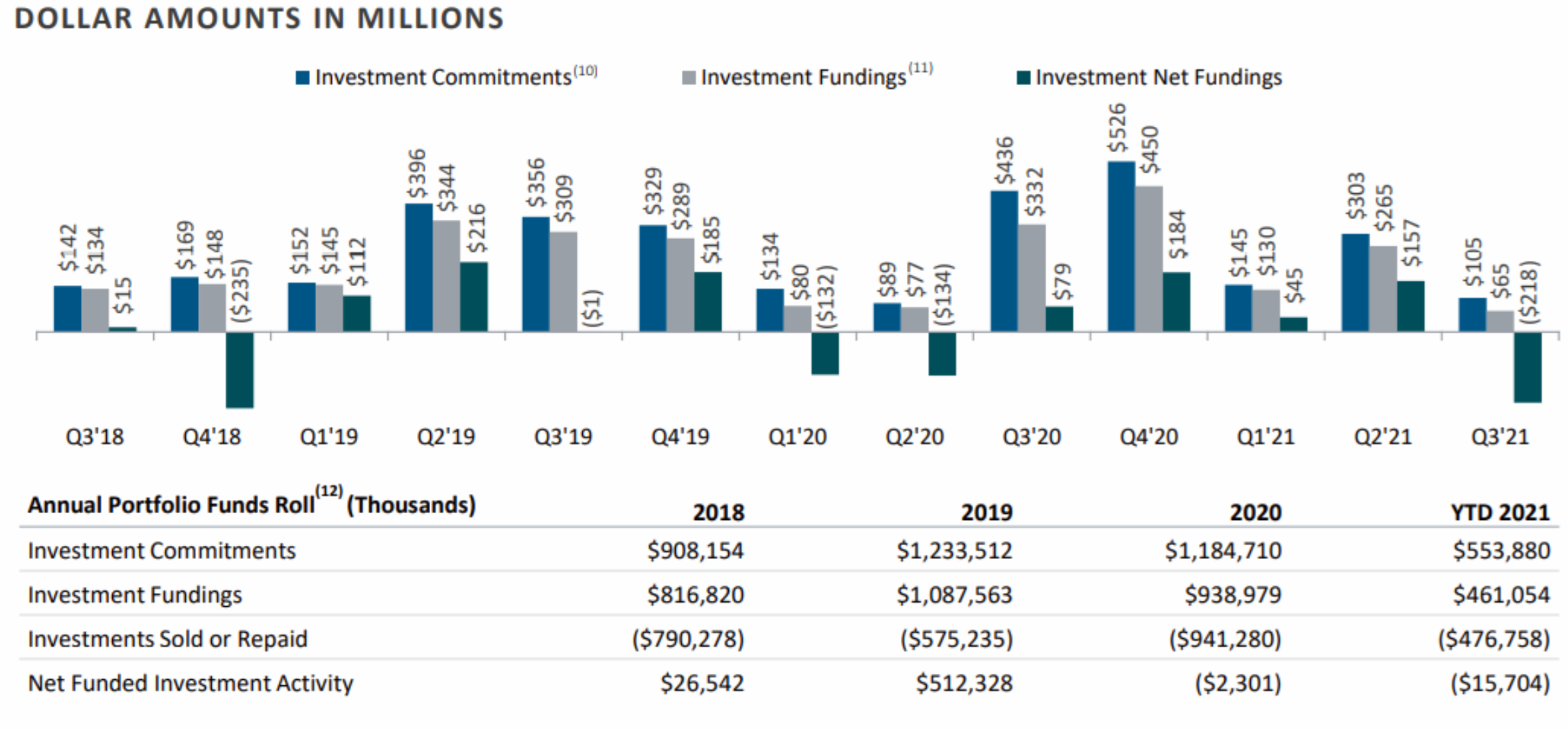

Healthy deal flow and pipeline (new originations)

TSLX continues to demonstrate a strong business trajectory, which bodes well for the future. For example, in Q3 ’21 (the most recently reported quarter), the company had new investment commitments and fundings totaling $105.4 and $65.4, respectively. The fundings were distributed across 1 new portfolio company and 4 upsizes to existing portfolio companies. Further, paydowns and sales totaled $283.8 distributed across 6 full realizations and 1 partial sale. The net payoff investment activity was $218.3, as you can see in the chart below (and as compared to history).

Strong Dividend

Furthermore, TSX has a healthy (and well managed) dividend (consisting of base, supplemental and special dividends). For example, you can view the dividend history here. For a little perspective, and per the latest earnings call, the special dividend:

“also serves to enhance our capital efficiency by eliminating nearly all of the excise tax drag on our spillover income, which is currently estimated to be $0.02 per share on an annualized basis. Given that the combination of these transactions is leverage neutral, the reduction in our excise tax burden will result in approximately 10 basis points of ROE uplift on an annualized basis.”

We view this as a sign of a disciplined management team, and the extra dividends are always nice. Further still, TSLX offers an automatic dividend reinvestment program (or DRIP), whereby dividends are automatically reinvested at an attractive price (read more here).

Interest Rate Risk

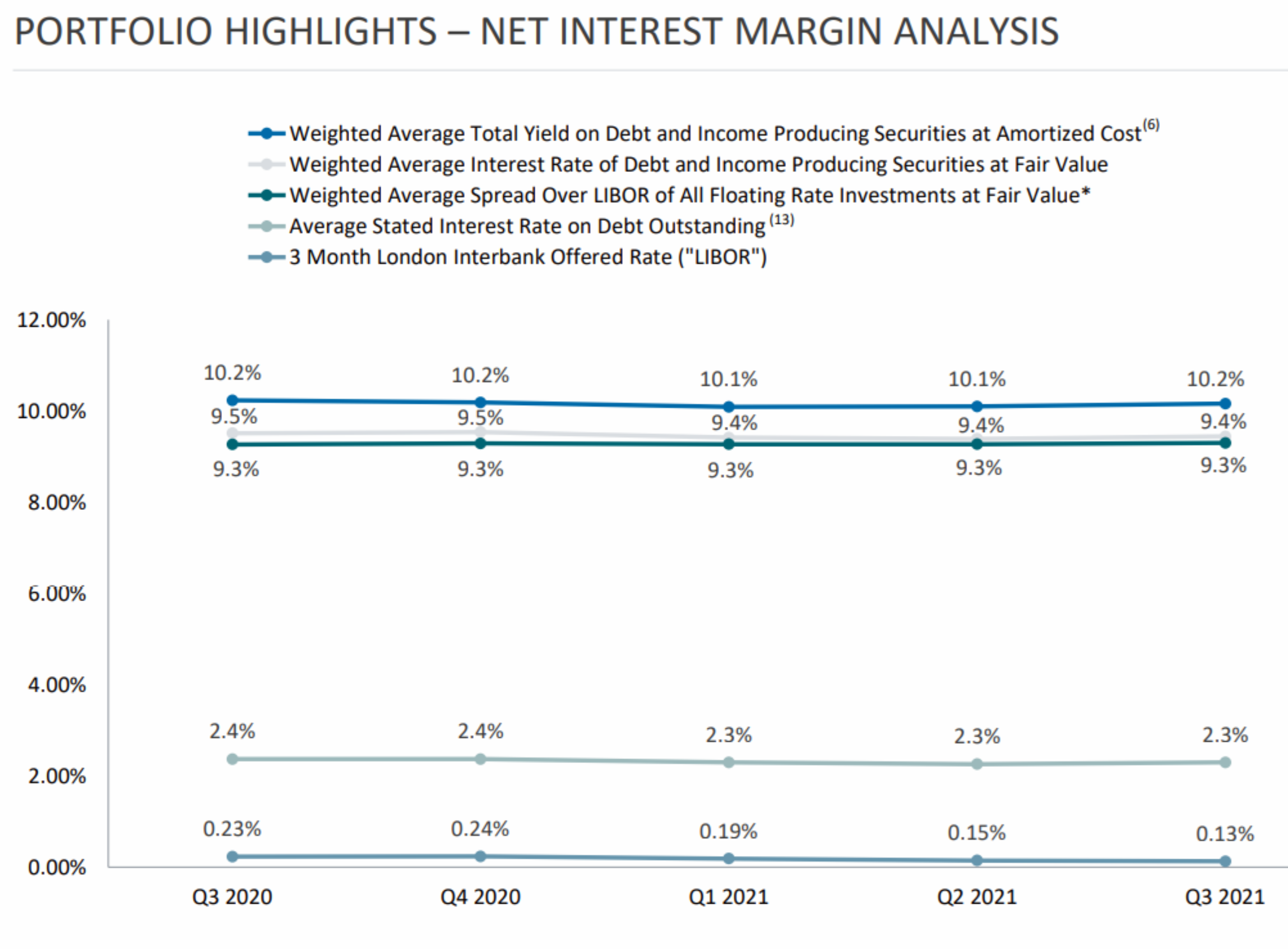

As a financial company, primarily involved in lending, TSLX faces significant risks from interest rates. Afterall, this company basically makes money by borrowing money at a low rate and then reinvesting the borrowings (in portfolio companies) at a higher rate. For perspective, you can see the net interest margin of the company in the graphic below.

Basically, TSLX pays a low 2.3% to borrow money, and then reinvests it at a significantly higher rate, thereby generating income and profits from the net interest margin spread.

Also very important, we mentioned earlier that 98.9% of the company’s debt portfolio is floating rate. This means that as interest rates rise, TSLX has the potential to receive higher interest payments on the money it has loaned. And while essentially 100% of TSLX’s own debt payments are floating rate, the similarity of these two figures provides a significant hedge on rising interest rates.

Valuation: Price to Book

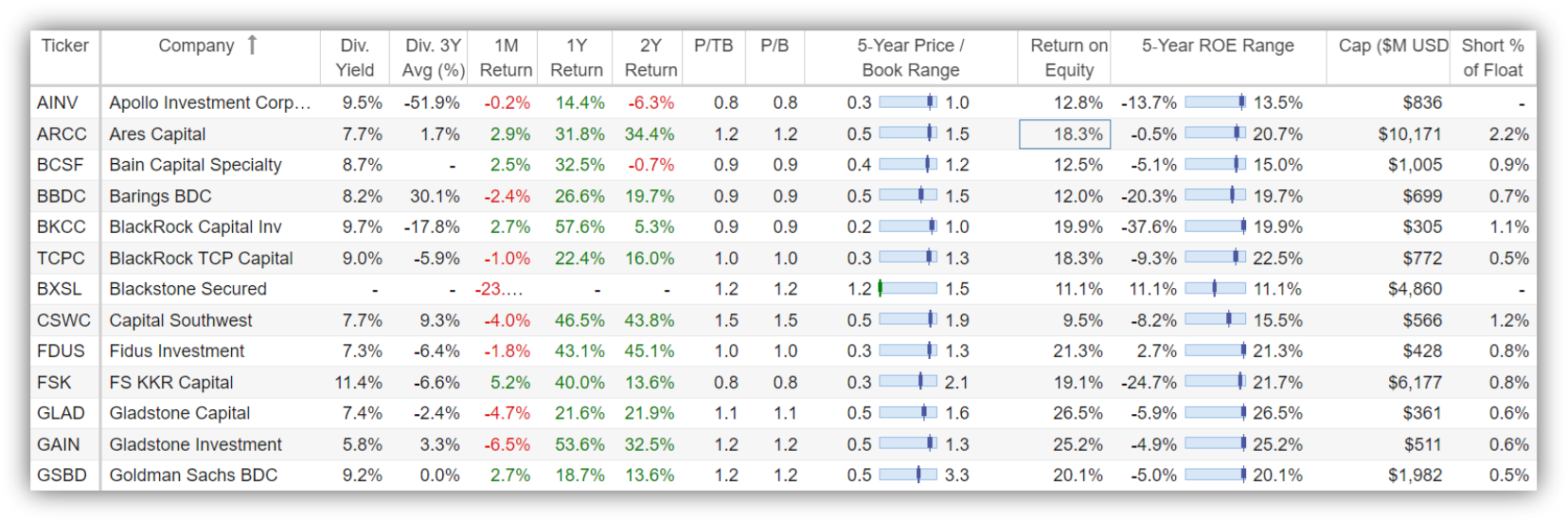

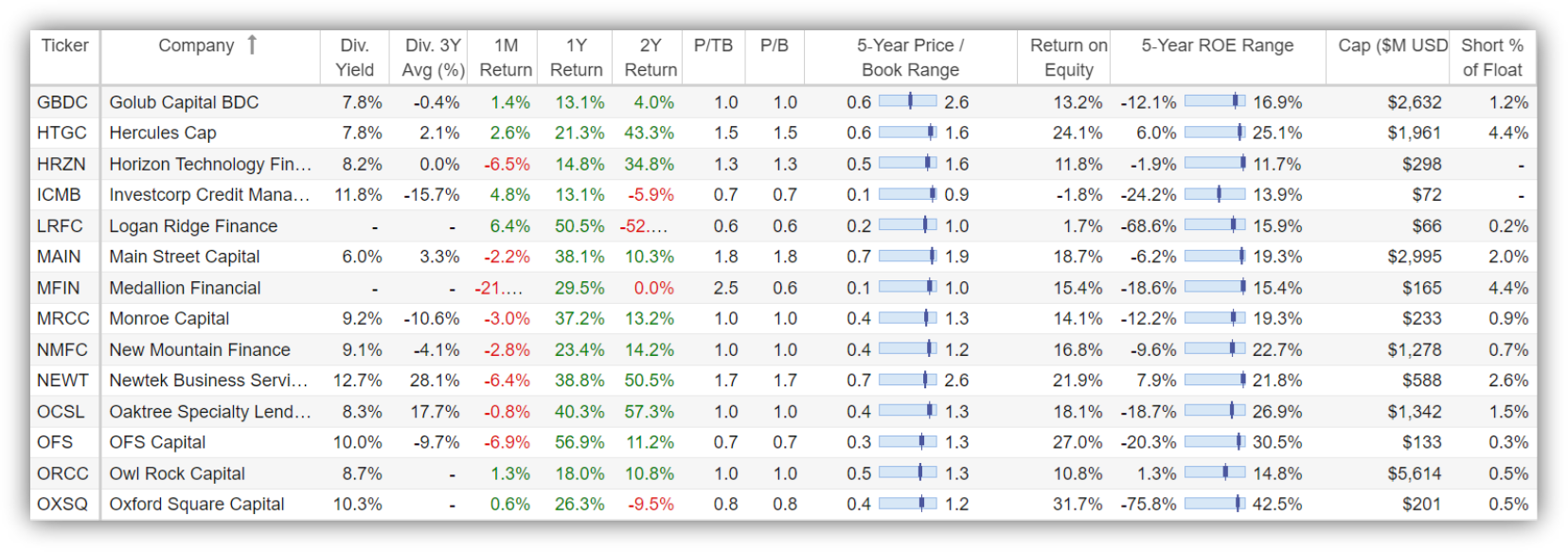

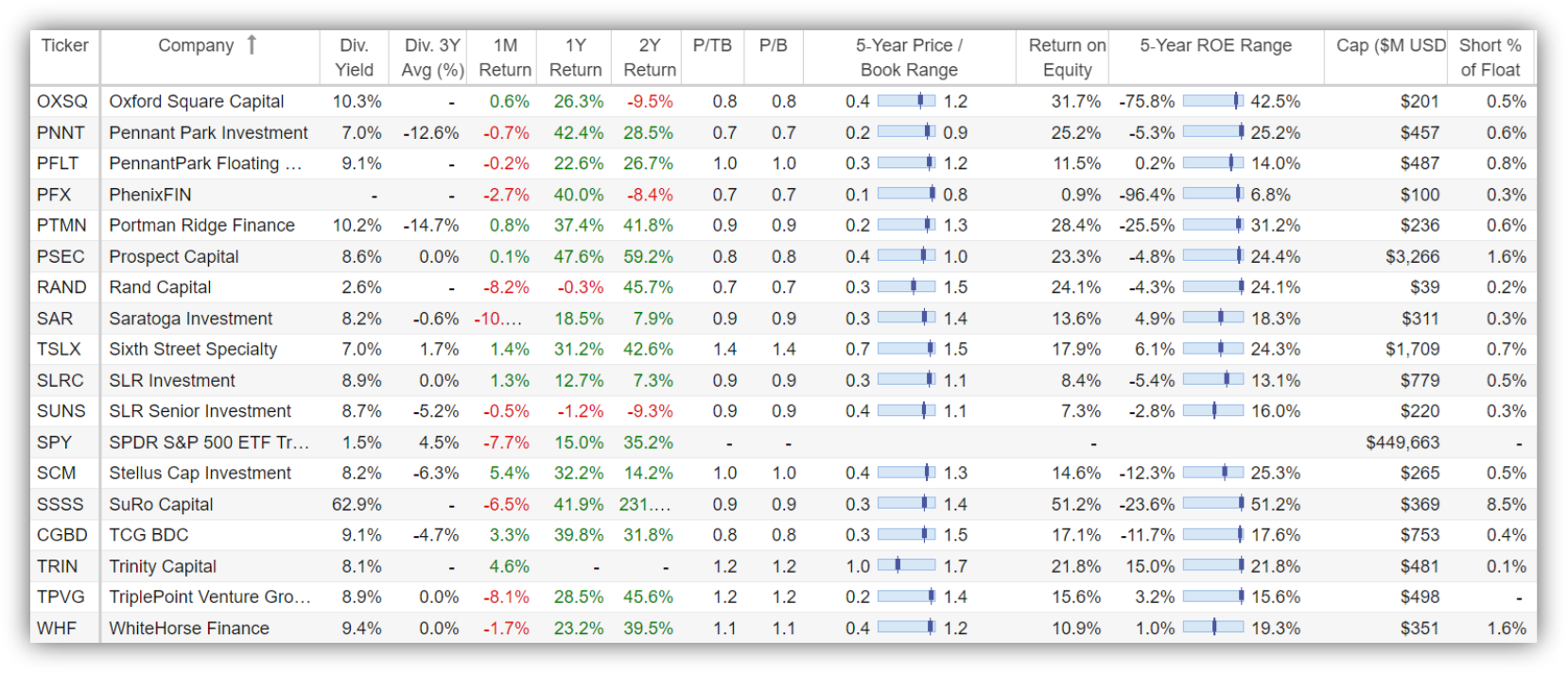

Price to book value is one common metric used to value BDCs, and you can see where TSLX stands on this metric currently, relative to its 5-year history and relative to BDC peers, in the following table.

However, one important caveat is that investors often incorrectly look to buy BDCs trading at a discount to NAV (or book value) as if it were “the holy grail.” It’s not. Rather, BDCs that trade at a lower price to book are generally riskier and the lower valuation is warranted (because of the risk). On the other hand, higher valued BDCs are generally considered less risky. A better metric to consider when valuing BDCs is price-to-book value versus its own history (as you can see in the table above) and weather or not it is generating a strong returns on equity (ROE). And TSLX scores well in both categories.

Other Risks:

As a general rule, BDCs are able to earn higher returns on their investments than traditional banks because BDCs are lending to higher risk companies that banks often avoid (or are excluded from due to post-financial crisis regulations). However, BDCs can reduce some of this risk through diversification (i.e. TSLX invests in many portfolio companies). And also, TSLX invests in mainly first lien and secured debt, further indications of higher safety versus other BDCs that may invest in riskier subordinated debt. Further still, we generally advocate for investing in BDCs as only one part of a prudently diversified high-income portfolio, thereby further reducing risks in aggregate.

The Bottom Line

BDCs can be an important part of a balanced high-income portfolio, and TSLX stands out as a healthier and high-quality BDC opportunity. We like the largely floating rate portfolio loans (because interest rates are expected to rise), we like the history of strong metrics (such as ROE, NII and price-to-book value), and we like the strong and continuing attractive deal flow trajectory (thanks also the benefits of being related to the larger Sixth Street organization, which can help improve deal flow). Overall, if you are looking for high-income that is compelling on a risk-versus-reward basis, Sixth Street Specialty Lending is worth considering for a spot in your prudently diversified high-income portfolio, especially after the recent market-wide price pullbacks.