The BDC we review in this report offers a stable 9.3% dividend yield. It also has a strong liquidity position and a relatively defensive portfolio (attractive given current macro uncertainty). In this report, we review the business, valuation, dividend safety and risks. We conclude with our opinion on who might want to invest.

Overview: Goldman Sachs BDC (GSBD), Yield 9.3%

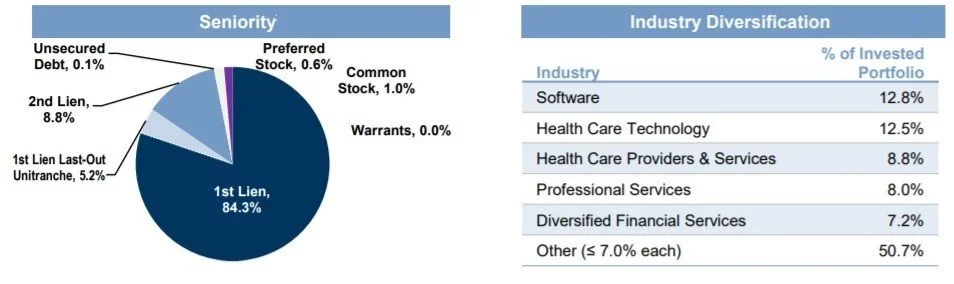

Goldman Sachs BDC Inc. (GSBD) is an externally-managed business development company (BDC) primarily focused on providing debt and equity financing to middle market companies (EBITDA between $5 million-$200 million) in the US. The company makes investments that have a maturity between three and ten years and size between $10 million to $75 million. GSBD’s portfolio is highly diversified across 111 companies with senior secured (first & second lien) accounting for nearly 98% of total investments. Importantly, Goldman Sachs BDC continues to reduce its exposure to subordinated loans. The first-lien investments made up 76% of the portfolio at the beginning of 2020. As of the end of Q3 2021, 84% of the portfolio is higher-quality first lien debt. This is a big advantage especially in the current Covid-19 crisis as it increases safety given that these instruments rank ahead of the subordinated debt of a given portfolio company.

The portfolio is well diversified by industry as well, with the top 5 industries representing 50% of the portfolio, and the single largest industry accounting for just 12.8% of total portfolio fair value. The largest industries in the portfolio, based on fair value as of September 31, 2021, were Software (12.8%), Health Care Technology (12.5%), Health Care Providers & Services (8.8%) and Professional Services (8.0%).

(source: Company Presentation)

We note that investors are concerned about supply chain disruptions and inflationary pressures impacting the economy as well as the performance of companies in certain sectors. GSBD has avoided lending to sectors such as manufacturing and retail which are most susceptible to rising costs and supply chain shortages. The main themes in GSBD’s portfolio continue to be software, professional services, healthcare, and financial services, all of which are considered defensive and should hold up better than many other sectors. That said, these sectors could see margin pressure from wage inflation.

Given the current environment, we are impressed with GSBD’s overall credit quality of portfolio. Non-accrual investments are just 0.7% of the portfolio at cost and 0.1% at fair value as of the end of Q3 2021.

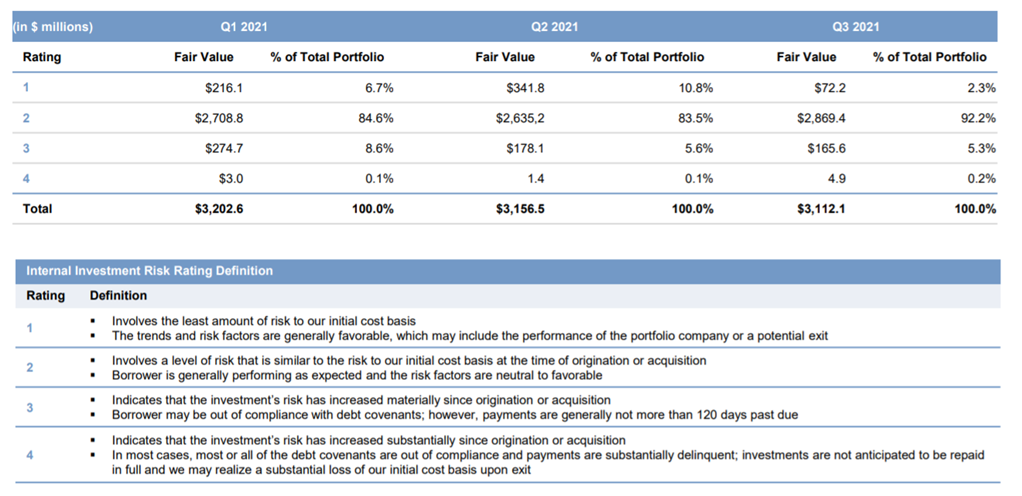

While the COVID-19 crisis is affecting businesses across industries, GSBD noted that so far (through the end of Q321), the impact on its portfolio companies has been low. GSBD has downgraded only 0.1% of its total loans to its high-risk category (internal rating of 4). GSBD defines a rating of 4 as a loan where the risk has increased materially since origination. Approximately 91% of its holdings were in the top two tiers (Rating 1 and 2), meaning the loans are performing as per or better than expectations.

(source: Company Presentation)

Further, GSBD remains active on new originations. Specifically, new investment commitments remain focused on first lien senior secured loans in covenanted structures. During Q321, GSBD made 27 new investment commitments amounting to $670 million (10 of which were to new portfolio companies), while the remaining were to existing portfolio companies. Sales and repayment activity totaled $672 million in Q3 2021 driven by the full repayment of investments in 16 portfolio companies. Turning to portfolio composition, at the end of Q3, total investments in the portfolio were $3.1 billion at fair value. Additionally, GSBD had $402 million of unfunded commitments as of the end of the Q3, which brought total investments and commitments to just over $3.5 billion. And the management team sees a strong pipeline of new opportunities which should further add to portfolio growth in the coming quarters.

Stable Dividend, Compelling 9.3% Yield

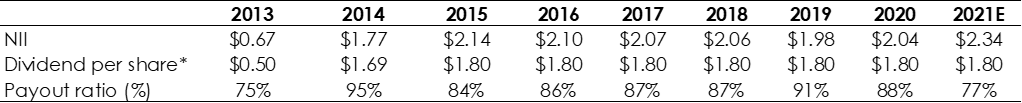

Goldman Sachs BDC has maintained a solid dividend payout since is IPO in 2015. For example, the company declared a Q421 dividend of $0.45 per share, bringing the total distribution for 2021 (including special dividends) to $1.95 per share.

Further, GSBD has covered its dividend comfortably over the last 8 years and we estimate that the net investment income (NII) coverage of dividends declared (excluding special dividends) in 2021 will again be comfortable at 111%. This is significant given that GSBD has very little exposure to equity investments and therefore does not generate any meaningful extraordinary gains that could temporarily cover any shortfall in net investment income.

*Excluding special dividends; 2021E is our forecast. (source: Company Data)

In our view, GSBD’s low leverage provides compelling cushion if the coverage ratio were to decline. The company’s leverage as of the end of Q321 was 0.91x (see debt/equity, below), well below its target and offers flexibility to raise cash to fund dividend shortfall.

Valuation:

From a valuation standpoint, GSBC trades at a premium to book value (1.2x), but this is not unreasonable given its strengthened and relatively defensive portfolio. Specifically, the increasing number of first lien secured debt investments and its defensive industry exposures are attractive. Furthermore, the yield remains higher than peers and is well covered as per our earlier data. GSBD also has relatively low debt to equity, another indication of strength.

(source: Yahoo Finance)

Risks:

GSBD faces similar risks to the BDC industry in general, such as underwriting risk, recessionary risk and interest rate risk:

Underwriting risk: GSBD primarily invests in debt instruments of middle-market companies which makes its inherently risky (as evident from the high yield these investments offer). Thus, it is exposed to underwriting risk. Poor underwriting on its part could lead to heavy losses in the portfolio. However, given the highly-diversified nature of the portfolio (and its defensive exposures), we are comfortable that any underwriting miscalculations will be largely offset by the large and diversified aggregate portfolio.

Recession risk: BDC are often vulnerable to recessions considering that they provide financing to middle market companies which are less established and prone to recessionary challenges. Any economic downturn could negatively impact GSBD’s business.

Floating interest rates: are a risk factor for GSBD. Nearly 99% of its debt portfolio investments are floating rate. On one hand, this can be a risk considering rising interest rates could lead to increased defaults. However, this also gives GSBD a chance to collect higher income on its debt investments as rates rise.

Management change: Worth mentioning, GSBD has an upcoming management change, as Brendan McGovern will retire in March and be replaced by Goldman Sachs veterans Alex Chi and David Mille as co-CEOs. We don’t view this event as out of the ordinary, and get reassurance from the fact that this change was announced many months ahead of time.

Conclusion:

Overall, we are impressed by GSBD’s portfolio which has defensive characteristics and is likely more resilient to the ongoing supply chain challenges and inflationary pressures. The company’s conservative capital structure with low overall leverage (0.9x) and limited near-term debt maturities offers ample flexibility to raise liquidity, if needed. The dividend is well covered by net investment income and is quite healthy. While the shares trade at a slight premium to book value, we view that as warranted (given the portfolio strength), and the 9.3% dividend yield makes the shares particularly compelling. If you are a long-term income-focused investor, Goldman Sachs BDC (GSBD) is worth considering for a spot in your prudently diversified long-term portfolio.