This on-device media platform is attractive because of its business model, rapid growth (~115% in FY21), expanding margins, solid free cash flow generation and large market opportunity. Further, the recent share price sell off (it’s still below its all-time highs due to the the recent mini “tech wreck”) has created an attractive entry point for long-term investors. In this report, we review the health of the business, valuation, risks, and then conclude with our opinion on investing.

Digital Turbine (APPS) share price, source: YCharts

Overview:

Digital Turbine Inc. (APPS) is an on-device media platform which works with wireless carriers and device OEMs to pre-install apps on new devices. The app developers pay Digital Turbine for placement on the phone, and this revenue is split with the carriers. In short, Digital Turbine allows app developers to target specific customers across carriers such as AT&T and Verizon. Digital Turbine's technology platform has been adopted by more than 40 mobile operators and OEMs, and has delivered more than 4.8 billion application preloads.

The company’s products primarily fall under two categories – First boot and Every Day or Life-Cycle products. The First boot product revenue is typically dependent on new device sales, while life cycle products revenue is independent of device sales and is more recurring in nature.

Digital Turbine Product Offerings

source: Company Presentation

The First Boot products revenue is powered by Dynamic Installs software solution which is the primary solution that pre-installs apps onto the phones. Dynamic Installs accounted for nearly 80% of APPS’s overall sales in FY 2020 (however the share has fallen to roughly 50% as of Q3:21). Given the low margin nature of the First Boot products, Digital Turbine has been focusing on increasing the mix of life-cycle product revenues which are typically higher margin and recurring in nature. The recent (February 2020) acquisition of AdColony, a mobile advertising platform will further bolster APPS recurring revenue base.

To a great extent, APPS management has been successful (so far) in increasing its share of life-cycle product revenue. As of Q3:21, Digital Turbine’s recurring revenue increased to 50% of total sales versus just 10% a year earlier.

Strong Financial Performance

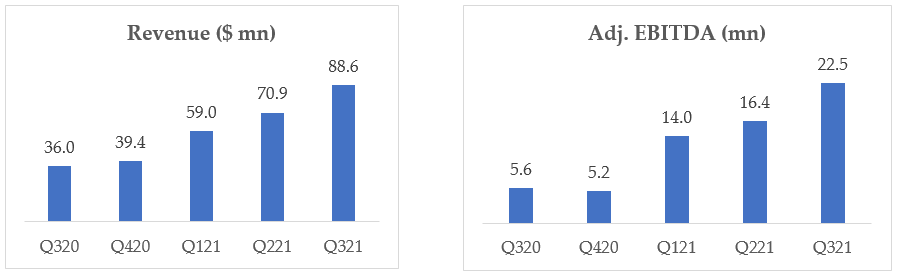

Digital Turbine has been delivering strong growth over the past several quarters. For example, revenue has more than doubled from $36 million in Q320 to ~$89 million in Q321. The company expects growth to continue in Q421 as well and is projecting an overall revenue increase of ~115% for full year fiscal 2021.

The inherent operating leverage of the business led to a 300% growth rate in adjusted EBITDA and a 278% growth rate in adjusted EPS in Q321. Adjusted EBITDA margins expanded to 25.5% in Q3 from 15.5% in the prior year quarter.

source: Company data

On the product front, as noted above, revenues from non-dynamic installed products grew nearly 50% sequentially in Q321 and over 500% year-over-year driven by content products such as SingleTap and Notifications. Specifically, SingleTap has shown great momentum and is already a seven-figure monthly business. The company expects SingleTap to be a growth driver in 2021 and beyond.

Accelerating Secular Tailwinds

The pandemic has led to the explosion in subscriber usage of apps and app-driven spending for entertainment, information, education, retail, and food delivery, to name a few. The mobile app economy is growing in terms of downloads, total sessions, and total time spent within apps. Users are downloading more apps and spending more time engaging with apps. This is evident from the growth in total time spent by users per day on apps to 3.7 hours in 2020, up 35% since 2017. According to eMarketer, US consumers spent $709.78 billion on ecommerce in 2020 (up 18.0%)

We think this trend is likely to continue even post the pandemic, thereby reinforcing the value of APPS’s unique home screen offering for advertisers within these verticals. Given the increasing usage of apps by consumers, advertisers are looking for a platform that can deliver measurable ROI for their ad spending. Digital Turbine’s platforms fits the bill given its ability to allow advertisers’ to fully track the performance of their campaigns including user acquisition costs, conversion rates and ARPUs. According to management in its Q321 earnings call:

“And given the uniqueness of our platform and I think just the macro trend of advertisers are spending dollars right now have to see an ROI of what their spend is. And given every dollar that's spent in our platform we can provide an ROI back to those partners. That makes our platform more sticky, and they can clearly see that return on their investment that they're getting from us.”

Multiple Growth Levers

The company boasts of multiple growth levers revolving around new products, new devices and advertising demand. While the new device trends have been flattish in the US, the international market continues to remain robust. The company added 65 million devices during Q3, 50% YOY growth. And the majority of growth in devices is occurring internationally as the company continues to ramp up international partners (such as Samsung, Xiaomi). Revenue growth from international partners stood at 200% YOY in Q321. The future growth potential is large given that Digital Turbine has <15% penetration the global android smartphone market.

On the product front, APPS is focused on introducing new products to drive growth. For instance, new products such as SingleTap and Notifications continue to ramp up faster than expected. This coupled with robust demand from advertisers is driving an increase in average revenue per device (RPD), which is the core operational health metric of the business. The US RPDs grew 25% YOY and International RPD grew 70% YOY in Q3.

Strong RPD Trajectory

(source: Company Presentation)

Valuation:

Shares of Digital Turbine saw sharp correction earlier this month, with nearly 50% drop in the first week of March 2021. Since then, price has recovered sharply and the stock is trading back to levels close to those seen before the fall. And while some investors find the company’s price-to-sales ratios high, we consider them attractive (and the shares compelling) due to the very high expected sales growth rate.

Perhaps worth noting, the 6 out of the 7 Wall Street analysts covering the shares rate them a buy. However, experience tells us that these analysts are chronically short-sighted in their price targets, meaning the shares are actually a much stronger buy than these analysts suggest.

Also worth noting, and aside from the very high revenue growth rate, Digital Turbine does not have a pure-play direct peer (this makes the company even more attractive). Some of the relevant peers include Google (via its Google Play Store), QuinStreet and Magnite. Overall, we believe these shares are attractively valued given the tremendous long-term growth.

Risks:

Dependent on mobile ecosystem: The company is dependent on the interoperability of its products and services with popular mobile operating systems, such as Android, and any changes in such systems could reduce or eliminate its ability to distribute applications.

M&A: The company relies on M&A as a key ingredient to its growth strategy. APPS has completed significant transactions including the most recent acquisition of AdColony for ~$350 to $375 million. Difficulties with integrating acquisitions could adversely affect operating costs and expected benefits from those acquisitions.

Execution risk: The company has undertaken major investments in new products and media strategies. Delay in execution of these could impact earnings in future years.

Conclusion:

Digital Turbine is a compelling growth story benefitting from the burgeoning mobile app install advertising market. We see multiple catalysts for growth led by new devices, new products and robust advertising demand. The inherent operating level in the business model should continue to support margin expansion and free cash flow growth. The stock offers a compelling long-term investment opportunity for growth investors. We do NOT currently own shares of Digital Turbine, but we are considering a purchase.