Realty Income (O) is nicknamed “The Monthly Dividend Company” for good reason. This Real Estate Investment Trust (or REIT) yields 4.0% and pays dividends monthly. In fact, it has increased its dividend in 95 consecutive quarters (26 consecutive years), and it has made 614 consecutive monthly dividend payments to investors. It has also shown great consistency and resilience throughout market cycles (including covid) thanks to the recession-resistant nature of its properties and its strong management team. In this report, we review the business, the upcoming merger/spin-off, dividend safety, valuation, and risks, and then conclude with our opinion on investing.

Overview:

Founded in 1969, Realty Income Corp (O) began trading publicly in 1994 and is focused on acquiring and managing commercial real estate properties. Its impressive track record of dividend increases has made it part of an elite group of 65 companies that make up the S&P 500 Dividend Aristocrat Index (i.e., S&P 500 companies that have increased their dividends for at least 25 consecutive years). the elite group of 65 companies in the S&P 500 Dividend Aristocrats index. The company’s portfolio consists of 6,761 properties that generate rental revenue from long-term lease agreements with commercial tenants (such as Walgreens, CVS and Dollar Tree, to name a few).

The portfolio is diversified across tenants, industries and geographies. Nearly 96% of its rental revenue comes from tenants with a nondiscretionary service and/or a low price point component to their business. These tenants are resilient to economic downturns and significantly isolated from e-commerce pressures (from the likes of Amazon, for example).

Well Diversified Portfolio - Insulated from Changing Consumer Behavior:

(source: Company Data)

And the company has displayed impressive resiliency during the ongoing covid pandemic. For example, Realty Income actually delivered positive earnings growth in 2020 (+2.1% YOY) versus a negative 5.2% by its net lease REIT peers and negative 6.8% by its S&P 500 REIT peers. Realty Income also delivered a 3.1% YOY increase in its dividend in 2020 (while others were simply maintaining and/or reducing their dividends).

We continue to see growth opportunities for Realty Income ahead, especially considering the large global net lease investable universe (which is estimated at $12 trillion in the US and Europe). Further, Realty Income has been actively pursuing external growth opportunties. For example, so far this year, Realty Income has added $2.2 billion in high-quality real estate assets to its portfolio, including $1.1 billion of new acquisitions in Q2 2021.

Regarding new acquisitions, the UK accounted for nearly 50%, highlighting strong growth in international markets. Year to date, Realty Income has added $1 billion in high-quality real estate in the UK across 41 properties. And of the more than $21 billion in acquisitions opportunity that it has sourced in Q2 2021, nearly 31% were related to international markets.

(source: Company Data)

Further, Realty Income is on track to acquire ~$4.5 billion of properties in 2021. These acquisitions support the company’s increased 2021 AFFO per-share guidance of $3.53 to $3.59, up 2.7% at the midpoint versus the prior range. This represents growth of 5% at the midpoint versus 2020, which is nearly in line with its historical median of 5.1%. This is encouraging considering the company has been able to maintain an earnings growth rate of 5.1% (CAGR) since listing in 1994, regardless of the size of its growing portfolio.

Earnings Growth Remains Strong, Portfolio Size Continues to Increase

(source: Company Data)

Upcoming Vereit Merger and Spin-Co (Orion)

Originally announced back in April, details are increasingly available for Realty Income’s merger and then spin-off of assets with complementary REIT Vereit (VER), expected in this quarter.

In our view, the main reason for this merger and then spin-off is so the two companies can become more operationally efficient as one and also to get rid of their office property assets (considering the future for office properties looks increasingly challenging—thanks to growing “work from home”). Once the merger is complete, the remaining company (Realty Income) will spin-off the combined entities office properties into a new REIT called Orion. The latest details and a summary of the merger/acquisition is available here.

In our view, we like this transaction for exactly the reasons Realty Income is doing it (to acquire Vereit assets at an attractive post-pandemic price, and to get rid of office properties which may well be significantly challenged in the years ahead, due to increasing “work from home”).

We expect to hang on (not sell) our position in Realty Income following the completion of the merger. However, depending on price action, we may look to dispose of the shares of Orion that we will receive automatically as part of the transaction.

Companies often perform this type of deal to separate the “good” assets from the “bad” assets. For example, REIT Simon Property Group (SPG) did something similar a few years back when they spun off Washington Prime Group, and Citigroup did something similar during/following the ‘08-09 financial crisis whereby they separated assets into “good bank” and “bad bank” groups. Again, we like this deal, and we especially like Realty Income shares going forward.

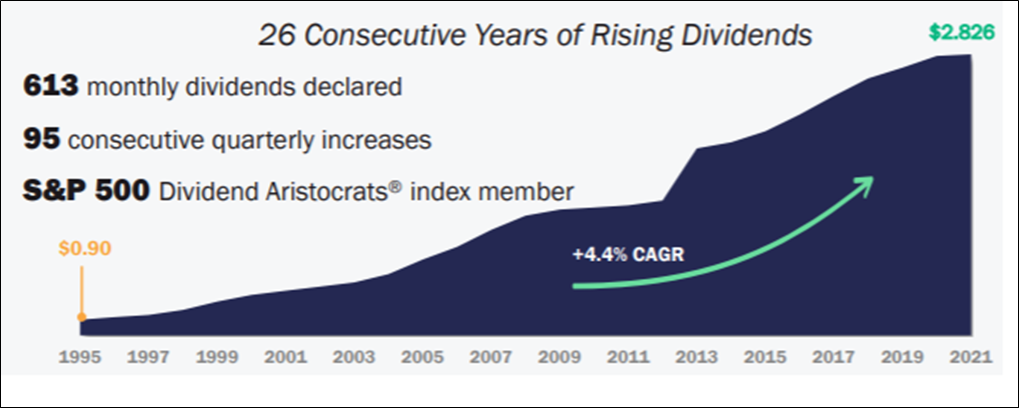

Consistent Dividend Growth

Realty Income is a monthly dividend paying REIT and has a history of raising the dividend every year since 1994. Over this period, it has delivered 95 consecutive quarterly dividend increases (and increased the dividend a total of 111 times). Realty Income increased the dividend three times during 2021 already with the most recent increase coming in September. The current monthly dividend of $0.236 per share represents annualized dividend per share of $2.826 and an annualized yield of ~4.0% based on the current market price of ~$70. We believe the dividend is extremely safe and sustainable given the history of continuous FFO per share growth and the strong outlook going forward (especially following the benefits of the merger).

Additionally, the payout ratio for the company is around 81.4% which further bolsters its ability to continue paying dividends. This means even if Realty Income experiences reduced payments from some tenants, it has extra cushion to not only keep paying the dividend but also to increase it.

Further still, Realty Income boasts of a strong balance sheet with low leverage thereby providing ample flexibility to raise funds in case of any dividend shortfall. It ended Q2 2021 with net debt to adjusted EBITDA of ~5.3x which is well within its target leverage ratio. And the overall debt maturity schedule remains in excellent shape as the weighted average maturity of bonds is 7.1 years, and with only $114 million of debt (excluding commercial paper) due until the end of 2022.

(source: Company Data)

Valuation:

From a valuation standpoint, we compare Realty Income to other retail-focused REITs. Specifically, on a Price to Adjusted Funds from Operations (“AFFO”) basis, Realty Income is trading at ~19.8x TTM AFFO, which is quite reasonable as compared to its peer group. In fact, we believe the ratio should expand (i.e., the share price should increase) considering Realty Income’s large size, strong balance sheet and proven ability to successfully ride through economic downturns and cycles (and especially following the synergies of the merger). Also noteworthy, Realty Income’s superior yield (and stable business) makes it significantly attractive for income seeking investors.

(source: Yahoo Finance)

Risks:

Interest rate risk: As inflation concerns continue to rise—the US Federal Reserve could raise rates sooner than previously expected, which could create challenges for Realty Income. As REITs are often seen as an alternative to bonds, higher interest rates could mean decreased demand for REITs, thereby causing a decline in the share price. Also, higher interest rates put downward pressure on earnings as interest costs rise.

Tenant bankruptcies: Realty Income earnings could be impacted by bankruptcies that continue to hit the retail sector. Though, the company has a diversified tenant base which is weighted towards non-discretionary and low-ticket items, and as such is more immune as compared to many peers.

Inflation: Higher inflation could be a cause of concern. For example, rent increases may not keep up with the rate of inflation which could reduce profitability. Also, substantial inflationary pressures and increased costs may have an adverse impact on clients’ operations, which may adversely affect their ability to pay rent.

M&A risk: The company is highly dependent on acquisitions to fuel its growth. Over the past decade, it has acquired multiple properties. The management team has noted that it will continue to follow its inorganic growth strategy. However, failure to properly underwrite and identify risks and obligations when acquiring properties, could adversely impact its business operations. Also, this strategy could be particularly dilutive for existing shareholders from time to time (given that the company will need to raise capital to fund these acquisitions). Worth mentioning, Realty Income expects the Vereit transaction to be over 10% accretive to AFFO in year one.

Conclusion:

Realty Income is an impressive monthly-dividend company. Not only does it have a long track record of healthy dividend increases, but it has a strong balance sheet, a compelling valuation, and robust earnings growth prospects (the company just raised AFFO guidance again last quarter). Furthermore, we like the Vereit acquisition and then office property spin-off, considering it should achieve significant benefits and reduce risks.

Every investor needs to understand their own individual investment needs and goals, and then structure their investment portfolio accordingly. However, if you are an income-focused investor, shares of Realty Income are absolutely worth considering for a spot in your portfolio.

We currently own shares of Realty Income.