Iron Mountain’s 8.6% dividend yield is compelling for some investors but comes with risks. The company remains confident of sustaining the current dividend, but we’ll describe the big risks that investors should consider (such as debt load, lack of growth in its core storage business, and high capital intensity). While the company has taken some measures to counter these risks, it’s prudent for risk-averse investor to understand the risk-reward tradeoff. This report reviews the health of the business, valuation, risks, dividend safety, and concludes with our opinion about investing in Iron Mountain.

Overview:

Iron Mountain Inc. is a REIT operating in the niche area of information storage and retrieval. It provides services such as storing physical records, information management, shredding services and more recently data center space for enterprise-class colocation and hyperscale deployments. IRM operates ~92 million square feet of storage space in nearly 1,450 facilities located in around 50 countries. In total Iron Mountain serves more than 225,000 global customers, including 95% of the Fortune 1000.

IRM boasts of its recurring and durable revenue stream driven primarily by its storage rental business which accounts for a majority ~63% of sales. The rental contracts are typically one to five years which provides revenue visibility. Also, IRM has limited revenue cyclicality given the resilience of the storage rental business during economic downturns. However, with physical storage businesses maturing in developed markets and customers transitioning to digital, IRM is also trying to expand into higher growth geographies and faster growing businesses (such as Data center).

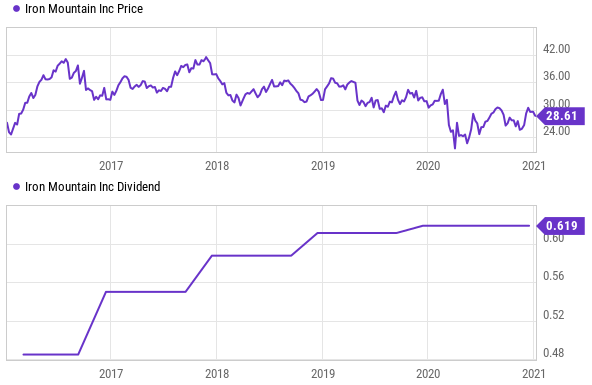

Iron Mountain has made significant progress in shifting its revenue mix to faster growing businesses, including emerging markets, data center, and adjacent business segments (entertainment and fine art storage). The shift in business mix has resulted in higher organic growth and continued improvement in Adjusted EBITDA margins (as shown in figure below).

Business Mix Accelerating Growth:

(source: Company Presentation)

While the progress has been encouraging, we believe the ongoing (and capital intensive) pivot towards more competitive data centers away (and away from core document storage) is difficult. Further, core document storage is experiencing decelerating volumes. Within records management (~55% of total revenue), volumes fell ~1.1 million cubic feet sequentially during Q320, with 2020 expected to fall ~1-1.5% YoY (when the final numbers are released).

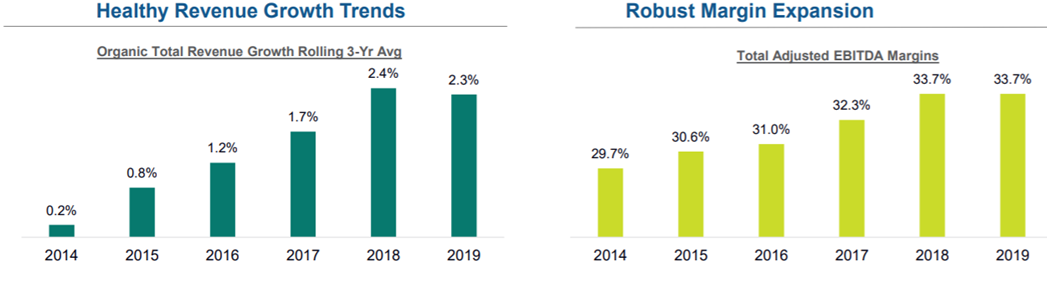

Data center expansion opportunity significant; Execution remains key

Potentially the most important growth driver for IRM is its data center operations, which is estimated to be ~10% of EBITDA for 2020. The company has made several data center acquisitions including Fortrust, I/O, Credit Suisse, and EvoSwitch. It currently operates 15 data centers across 13 global markets with a presence in nine of the top 10 US markets and three of the top 10 international markets. Five of the top 10 global cloud providers are IRM’s Data Center customers.

Iron Mountain also plans to invest heavily in the coming years, nearly tripling its overall data center storage capacity organically (~126 MW to 376 MW). During Q320, data center continued to deliver strong bookings momentum, signing over 12 megawatts of new and expansion leases, bringing year-to-date bookings of 51 megawatts. The management team noted the following in its Q3 earnings call.

“We believe we are growing considerably faster than the broader market. Going into next year, we feel good about the state of our pipeline, both from a hyperscale perspective as well as our core retail co-location business supporting rich ecosystems across our platform. We believe we can lease in excess of 20 megawatts next year, which would result in mid-teens annual bookings growth.”

We think the data center business offers significant opportunity for growth but execution is the key. Also, the capital intensive nature of this business makes the transition risky and the execution even more crucial. Given these moving parts, we think it’s important for investors to be away of the challenges and opportunity.

Data center capacity to become ~3x

(source: Company Presentation)

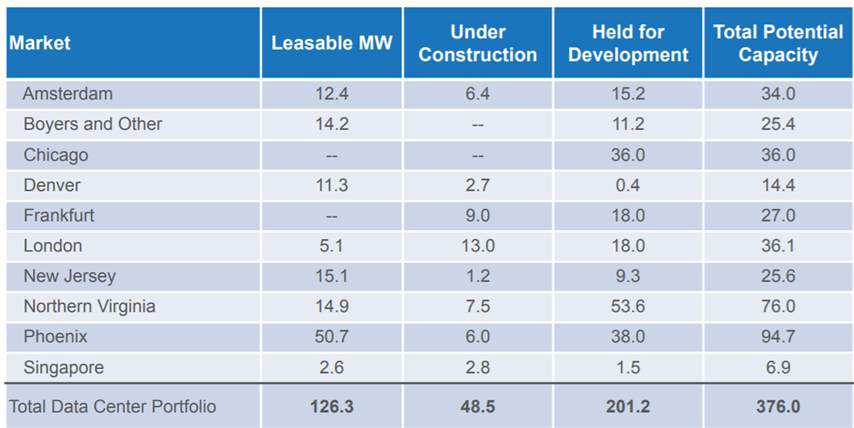

Cautious on dividend sustainability

Iron Mountain has raised its regular dividend in nine out of the last 10 years, and it has increased it by 30% over the last five years to $0.62 quarterly. While the company remains confident of sustaining the current dividend, we are cautious given high debt levels and the capital intensive business model. Also, the payout ratio has been on the higher side which is concerning.

The firm's AFFO was $213 million in Q320 and the payout ratio was 85%, a reasonably safe level in most cases. But given significant amount of capex needed to fund the growth of the business, the high payout ratio puts a lot of stress on the balance sheet.

On top of this, the company has limited financial flexibility given its already high debt. The leverage ratio at the end of Q320 was 5.3x and is expected to remain at this level when Q4 is reported. This is at the higher end of its long-term target of 4.5x-5.5x. The company's leverage profile is riskier than the average REIT's leading to a low credit rating of BB- from Standard & Poor's. This leads to higher cost of capital and difficulty in raising capital. Importantly, a lack of access to capital can significantly impact IRM’s ability to sustain and grow its dividends.

Dividend growth has been slowing in recent years. IRM raised its annual dividend by 11.6% in 2017, 6.1% in 2018, 3.2% in 2019 and only 0.9% in 2020. Also, IRM’s core storage business has been slowing and has limited growth prospects. To counter this, the company has been focusing on aggressive expansion in the data center business. However, this leaves little room for error as failure to achieve expected returns on these investments could eventually put pressure on management to reduce the dividend.

Overall, we remain cautious. Management is aiming to bring its AFFO payout ratio to mid-60s range. If successful, it would make the dividend more sustainable and safer.

Dividend growth slowing down

(source: Company Data)

Valuation:

On a Price to Adjusted Funds from Operations (“AFFO”) basis, IRM is trading at ~9.2x its 2020E AFFO. Since the company has no direct peers, we compared it against data center and industrial REITs. The data center REITs (such as Digital Realty Trust (DLR) and Equinix) are trading in the range of 25x-29x, while industrial REITs (Duke Realty, Eastgroup Properties, Prologis) trade in the range of 25x-26x. Based on this, IRM looks inexpensive but carries the risks mentioned above which are reflected in the valuation. The high dividend yield compared to other similar REITs also suggest higher risk.

Risks:

High debt: The company’s debt remains high which increases the risk given the inherent capital intensive nature of the business. It also increases interest expense putting further pressure on earnings and cash flow. While deleveraging remains a priority for the company, we see limited options to achieve this without putting pressure on the dividen.

Lack of organic growth: The physical storage business (comprising more than 60% of sales) is low growth as clients transition to digital. While the company is trying to transition toward more digital businesses including data center, the fact remains that these are still relatively small in size. Also, these growth businesses require significant capex. If the company fails to achieve the scale and competitive advantages in data centers that it has in physical storage, it will further dampen the long-term growth outlook.

Conclusion:

IRM’s 8.6% dividend yield is attractive but comes with its own set of risks. Heavy debt load, lack of growth in its core storage business, and high capital intensity are risks that an investor should consider. The balance sheet offers limited flexibility given an already high leverage (5.3x). These risks are reflected in the company’s valuation as well as higher yield. We think until the company has improved its leverage profile, conservative income investors may want to focus on dividend payers with stronger balance sheets and long-term growth plans. However, investors with a higher risk appetite may consider Iron Mountain given its high yield and potential for capital gains if it is successful in executing its strategic shift toward digital storage.