In the last couple weeks we’ve seen many of the top growth stocks take a bit of a healthy breather (i.e. the share prices have pulled back a bit). This not only creates a better entry point for long-term investors, but it also sets up some very attractive opportunities to generate high upfront premium income in the options market. This report reviews a very high-income-generating options trade on an attractive digital advertising stock. The trade not only gives us the chance to pick up shares of this attractive company at a compelling price, but it puts high upfront income in our pocket that we get to keep no matter what. We believe this is an attractive trade to place today—and potentially over the next few days—as long as the share price doesn’t move too dramatically before then.

Magnite (MGNI)

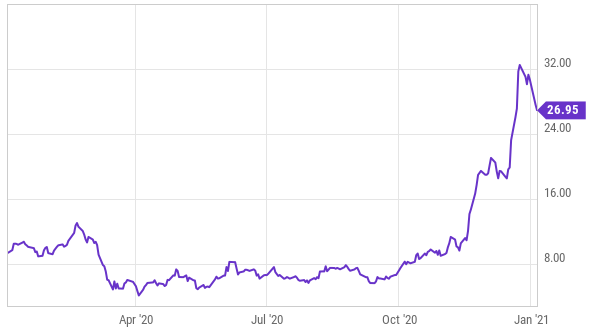

The company we are referring to is Magnite (MGNI). We completed a detailed report on this small digital advertising company back in September explaining why the share price could soar (and the shares have tripled in price since that report). However, the price has pulled back a bit in recent days (as you can see in the chart below), and we still like the company a lot as a long-term investment.

Magnite Share Price:

If you don’t know, Magnite is the largest (and one of the few) omni-channel sell-side platforms for advertising. We believe it will experience significant gains from structural shifts towards SPO (supply path optimization) as well as secular growth in digital advertising (especially connected TVs). As we wrote in our previous report (see link above):

Magnite, previously known as The Rubicon Project, offers a Sell-Side Platform (SSP) or ad exchange where buyers and sellers transact digital advertisement inventory. Thanks to its merger with Telaria in April 2020, Magnite has made in-roads in the fast-growing Connected TV (CTV) digital media industry and has become one of the few omnichannel SSPs in the programmatic advertising space.

You might consider purchasing shares outright, but we particularly like the opportunity that exists in the options market right now (i.e. the upfront premium income available is very high and attractive).

The Trade:

Sell Put Options on MGNI with a strike price of $20 (~25.8% out of the money, it currently trades at ~$26.95), and an expiration date of January 15, 2021, and for a premium of at least $0.15 (or $15 because options contracts trade in lots of 100). This comes out to approximately 0.75% of extra income in less than 2-weeks—which may not sound like a big return—but it is huge for such a short time frame (it’s approximately 27% of extra income on an annualized basis, calculated as ($0.15/$20) x (365/10days)). And this trade not only generates attractive upfront premium income for us now, but it gives us a chance at buying shares of this attractive long-term company at a dramatically lower price ($20—the strike price) if the market price falls below $20 and the shares get put to us before this option contract expires in a matter of days. And we get to keep the upfront premium income no matter what.

Important to note, your broker will require you to keep $2,000 of cash in your account ($20 strike x 100 shares) to secure the trade (assuming you don’t want to use margin).

Also important to note, you can adjust the strike price of this trade (for example to $22.50) depending on how badly (and at what price) you want the shares put to you, and to generate even higher upfront income as shown in the table above).

Your Opportunity:

We believe this is an attractive trade to place today, and potentially over the next few trading days, as long as the price of MGNI doesn't move too dramatically before then and you’re able to generate enough premium income to your liking.

Our Thesis:

Our overall thesis is simply that we consider MGNI to be an attractive long-term business, and it is trading at an attractive near-term price as shares of top growth stocks (such as Magnite) have been volatile in recent trading sessions. Specifically, the shares have sold off in recent trading sessions (as they take a break from their strong recent rally), but still have dramatic long-term price appreciation potential in our view (as we wrote about in our earlier report linked above).

Important Trade Considerations:

Two important considerations when selling put options are ex-dividend dates and earnings announcements because they can both impact your trade. However, in the case of Magnite, they are both largely non-issues. Specifically, Magnite does not pay a dividend, and the company is not expected to announce earnings again until February (well after this trade expires).

Conclusion:

Magnite is the largest (and one of the few) omni-channel sell-side platforms for advertising. We believe it will experience significant gains from structural shifts towards SPO (supply path optimization) as well as secular growth in digital advertising (especially connected TVs).

The shares have dramatic, albeit volatile, upside price appreciation potential, and the recent share price pullback has created an attractive opportunity. Specifically, selling out-of-the-money put options on Magnite generates very attractive upfront premium income (that we get to keep no matter what), and it also gives us a chance to pick up the shares at a significantly lower price (if they fall below our $20 strike price before the options contract expires in just 10 days). Overall, we like the business (as a long-term investment) and we like this high-income-generating options trade.