Oak Street Health (OSH) is a recently public company (August 2020) that is on a tremendous growth trajectory as it delivers its highly differentiated, technology-enabled, value-based care model for Medicare. The continuing growth opportunities stem from the rapid shift of patients to value-based care and increasing patient consumerism. This report reviews the business, its growth prospects, valuation and risks, and then concludes with our opinion about investing.

Overview

Oak Street Health, Inc. (OSH) operates a network of primary care centers to deliver value-based care exclusively to Medicare eligible patients in medically-underserved communities. It currently operates over 75 centers in 11 states in the US, serving over 100,000 patients. It also has a pilot collaboration with Walmart (WMT) under which it is assessing expansion opportunities, initially by setting up its centers at 3 Walmart locations. The company was founded in 2012 and has since then witnessed explosive growth. In the most recent TTM period, it generated ~$808 million in revenue, representing a 72% y/y growth. In August 2020, OSH completed the initial public offering of its common shares whereby it raised $351 million and listed on the NYSE.

Technology Platform Supports Differentiated Patient Care Model; Drives Strong Operational and Financial Performance

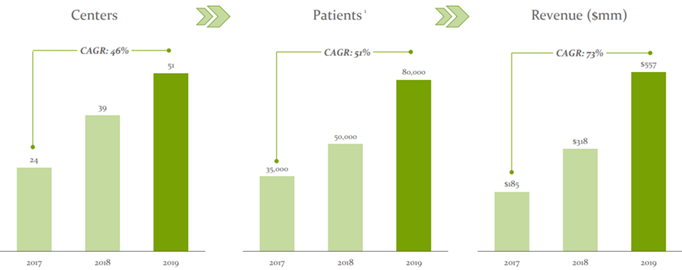

OSH has developed a robust community strategy to engage with Medicare eligible patients. Once the patients are engaged, it leverages its sophisticated technology-enabled platform, called the Oak Street Platform, to integrate health analytics, social support services, chronic care management and primary care into its care model to improve the quality of care and deliver better health outcomes, while significantly lowering the medical costs. As a matter of fact, OSH has been able to reduce the hospital admission rates of its patients by as much as 51%, and the overall positive patient experience has helped it garner a net promoter score (NPS) of 90, which is extremely high for a healthcare provider. As a result, it has been able to drive tremendous patient growth on its platform and expand its presence as a value-based healthcare provider in a very short span of time. The company has recorded a 154% annual growth since establishing its first primary care center in 2013, and over the past three years it has grown its number of patients by 51% and consequently its revenues by 73% annually.

The significant cost savings due to the platform’s efficiency also helps the company align the incentives of payors, which we believe is highly crucial in establishing strategically important payor relationships. As of 30 September, 2020, OSH had contractual relationships with 18 different payors which manage and market Medicare Advantage (MA) plans, including with each of the five largest national MA payors. By leveraging these relationships, the company is able to secure payor contracts even before getting into new markets and this reduces the risks associated with entering into new markets.

Also, most of OSH’s payor contracts are on a capitated or full-risk basis, which means that it receives a percentage of each Medicare eligible patient’s monthly premium from the payor, irrespective of the number of patient visits or the reimbursement levels. This provides it with a guaranteed recurring revenue stream and significant visibility into the financial growth trajectory.

Vast Market Opportunity

Despite spending $3.6 trillion, or ~18% of the national GDP, annually on healthcare, the overall health outcomes in the US are poor, as evidenced by the growing prevalence of chronic disease such as obesity, diabetes, CHF, hypertension, depression, etc., and the lower life expectancy compared to other developed countries. Moreover, these unsustainable levels of healthcare costs are growing at a rapid pace, sometimes even higher than the rate of inflation. This has led to a shift of patients toward more value-based care paradigms, which are often being driven by the payors who are investing heavily in technology enabled integrated care models to generate greater financial efficiency. The poor health outcomes have also led to a high level of dissatisfaction among the patient population in the US, which is substantiated by the very low average primary care physician’s NPS of 3, and has resulted in increasing patient consumerism, whereby they are bypassing anointed physicians to obtain medical information and services. OSH has been at the forefront of implementing its value-based primary care model to address these healthcare trends and has largely benefitted as a result.

OSH’s Market Opportunity: The aging US population is expected to remain a key market driver as it is driving high enrollments under state sponsored Medicare programs. CMS estimates that there are about 60 million Medicare eligible patients in the US and over $700 billion is spent annually on Medicare programs. Of the Medicare eligible population, there are about 27 million older adults that are primarily on MA plans and this population represents OSH’s core market size.

OSH currently has a penetration rate of just about 0.4% in this core market, and this presents it with an extremely large growth runway. We believe the company is extremely well positioned to capture the opportunity with its existing infrastructure, which has the ability to serve over 275,000 patients (based on its potential to serve 3,500 patients per center at full capacity), and also with its expansion plans within existing markets, which it believes have total capacity of up to 450 centers, as well as into new geographies in the US. And, as mentioned earlier, the expansion in new markets will mostly be risk-free from a revenue perspective as the company generally tends to get into payor contracts before entering new markets by leveraging its strong payor relationships. Additionally, the success of its pilot collaboration with Walmart will further enhance its market positioning to capture the vast opportunity.

COVID-19 Moderated Patient Growth in 3Q20, but Capitated Contracts Ensured Top-line Strength

COVID-19 pandemic related headwinds restricted OSH’s community outreach, marketing efforts and centers expansion from early spring through midsummer of 2020, and thus continued to moderate its historically high patient growth trajectory during the third quarter of 2020. Total patients in 3Q20 grew ~28% y/y to ~89,500, while the at-risk patient base (patients for whom OSH is financially responsible for their total healthcare costs), which drives most of OSH’s financial performance, grew by 38% y/y to ~59,500. This resulted in a 59% y/y growth in capitated (or recurring) revenue, which continued to form over 97% of the total revenues of $217.9 million (up 57% y/y). For the full year 2020, OSH expects its at-risk patient count to be in the range of 61,500-63,000 and its total revenue to be between $854 million and $858 million, which represents a 54% y/y growth at the mid-point.

Medical claims related expenses increased 58% y/y, but the claims ratio on capitated revenue declined by 67 bps to 73%, leading to improved patient contribution (measured as capitated revenue minus medical claims expense), which increased 63% y/y to $57.2 million. The cost of care also continued to increase (+17% y/y to $43.2 million) with the growth in patients, but the rate of growth of the cost of care was slower than the rate of growth of patients. This, coupled with the improved medical claims ratio, resulted in a 387% y/y higher platform contribution (measured as total revenue minus the sum of medical claims expense and cost of care) of $20.1 million. However, the operating losses during the quarter continued to remain high at $55.3 million or ~25% of total revenues, partly due to y/y higher stock-based compensation awarded in connection with its IPO, the fixed costs associated with its care centers and as the company continued to invest in its sales and marketing efforts and increased its head count to support its growth.

Going forward, owing to the value proposition OSH offers to its patients, we expect more at-risk patients to stick to the platform for a longer period of time, and thus result in better patient economics. And with the fixed cost leverage that the company will be able to generate as its centers mature with time and the number of patients grow, we believe the company will be able to further expand its patient and platform contribution margins. We also expect the high recurring revenues will provide operating expenditure leverage to the company, which will help it in driving improved operating profitability in the longer term.

CMS Direct Contracting Provides Additional Upside

In October 2020, OSH began enrolling traditional Medicare patients in the CMS (Centers for Medicare and Medicaid Services) Direct Contracting (DC) program (set to begin in April 2021), under which the company will contract directly with CMS in a similar fashion to how it contracts with MA plans. Beneficiaries will be aligned to DC entities such as OSH, either under a claims-based alignment method, whereby CMS will sign beneficiaries to providers based on historical claims data, or under voluntary alignment method, where beneficiaries will choose to align with a DC entity by designating a specific provider.

It is well-known that the company’s care model operates in a similar fashion for both traditional Medicare patients and at-risk MA patients, and this helps the company convert a lot of its traditional Medicare patients to MA plans. However, the overall patient economics takes a hit as the fee-for-service payments it receives for its over 30,000 traditional Medicare patients is comparatively much lower for the benefits it provides. It is expected that the economics under DC (both for claims-aligned and voluntarily-aligned patients) will be much superior to what is being paid in traditional Medicare. In fact, for voluntarily-aligned patients, the company expects to generate higher revenue per-patient than what it generates from at-risk MA patients. According to CEO Mike Pykosz during the Q3 earnings call:

“We would expect per-patient revenue for voluntarily-aligned patients to be greater in Direct Contracting than it is in MA, assuming the same documented patient risk level, primarily because there are no supplemental benefits provided as there are in MA and we do not have to share a larger portion of surplus with CMS as with we do with MA plan. For claims-aligned patients, we expect the per-patient revenue to be lower than voluntarily-aligned patients as our historical work with these patients results in lower health care expenditures. We expect the net profitability of voluntarily-aligned patients to be roughly comparable to our MA economics, assuming comparable risk in the population. We expect claims-aligned patients to have worse economics than voluntarily-aligned patients, driven by lower revenue and comparable medical costs, although still significantly better than what will be our reimbursement fee-for-service today to care for our traditional Medicare patients.”

While it is still a little too early to estimate the number of patients that will flow through to DC (the company estimates the number will be much higher than the required minimum of 5,000 patients in the program’s first year), and also the alignment method of the patients in order to gauge the impact of the program on OSH’s future financial profile, we believe the program will certainly add incremental numbers to its top-line, given the higher per-patient revenue expectation, and allow it to capture patient economics on traditional Medicare patients that are at least similar to its at-risk MA patients. This will improve the company’s overall patient economics and profitability, going forward.

Purpose Driven Leadership Team and Top-Notch Board

Mike Pykosz, Geoff Price and Griffin Myers, three friends from Harvard who later worked together at Boston Consulting Group, co-founded OSH in 2012 and since then have been at the center of its rapid expansion by successfully leading the company in the capacity of its Chairman and CEO, COO and CMO, respectively.

As Chairman and CEO, Mike oversees the company’s mission to rebuild healthcare that is personable, equitable and accountable for Medicare patients, while simultaneously driving down costs. He has been instrumental in building the company’s highly successful clinical model from ground up that has significantly lowered unnecessary hospitalizations. Mike had earlier served as Principal at Boston Consulting Group for over 5 years. He holds a B.S. in Biochemistry from the University of Notre Dame and a law degree from the Harvard Law School.

Geoff Price, OSH’s COO, is responsible for coordination among physicians and clinical leadership, regional managers, its population health team and other parts to create a seamless patient experience among different parts. He was named among “Top 25 Emerging Leaders” by Modern Healthcare in 2019. Geoff had previously worked at the Boston Consulting Group on various healthcare projects. He holds a B.S. in Engineering from the University of Illinois Urbana-Champaign and an MBA from Harvard Business School.

Griffin Myers, M.D., the company’s CMO, is a board-certified physician who has played a key role in the development of its innovative care model. He is responsible for maintaining healthcare delivery excellence and building and supporting the medical groups at OSH. Griffin is also a thought leader for the New England journal of medicine catalyst, a 2017 presidential leadership scholar, an Aspen health innovators fellow, and a member of the Aspen global leadership network. Prior to OSH, he was a Clinical Fellow at Harvard Medical School, and had previously worked as Project Leader at Boston Consulting Group. Griffin is B.S. graduate of Davidson College, has an MBA from the University of Chicago Booth School of Business and has an M.D. from the University of Chicago Pritzker School of Medicine.

Apart from the strong founder led leadership team, the company also boasts of a top-notch board, which includes renowned healthcare veterans and senior level executives at various investment firms.

Valuation

OSH’s stock has garnered significant investor interest since its IPO in August last year due to its highly differentiated health platform which provides the rare ability to simultaneously align the interests of patients, providers and payors to drive both patient and revenue growth. As a result, the stock has already generated about 157% returns on its initial offering price of $21. From a valuation perspective, the stock currently trades at a TTM price-to-sales of 14.4x, which looks rich, but seems justified given the company’s high growth trajectory, the management team’s solid execution on its market opportunities and its future growth opportunities.

Also, the street has a positive outlook on the stock, as 90% of the Wall Street analysts covering it are bullish and have a consensus price target of $64.50, representing ~20% upside potential from the current price.

Source: Factset

Risks

Regulatory Risks: As a Medicare only focused provider, OSH is highly exposed to risks related to changes in the rules and regulations related to the Medicare program. A changing political landscape could also have a significant negative impact on OSH’s business. However, this risk is arguably somewhat mitigated as the newly elected administration has articulated a strong interest in expanding coverage for state sponsored healthcare programs such as Medicare.

Revenue Concentration: A limited number of payors with which the company contracts account for a substantial portion of its revenues. If the company fails to renew its contracts with any of its top payors, there can be a large negative impacts on revenue. However, this risk is significantly reduced as the company generally enters into long-term contracts with payors.

Patients Seeking Costly Care: OSH’s care model focuses on leveraging the primary care setting as a means of avoiding costly downstream healthcare costs, such as acute hospital admissions, to benefit from the capitated nature of its contracts with payors. However, patients can seek care at hospitals should the company not be able to effectively manage patients’ health. This could entail potentially large medical claims, which can make a dent on its profitability.

Competition: While the market for value-based care is vast and largely unpenetrated, there are no real barriers to entry, apart from the ability to get into payor contracts. As a result, a number of innovative start-up companies are trying to get a foothold into the market. Also, certain cash rich MA payors are establishing their own value-based provider groups to serve the rapidly growing demand for value-based care, thus intensifying the competition for OSH.

Conclusion

Oak Street Health has been at the forefront of implementing a highly differentiated technology enabled value-based primary care model that aligns the incentives of all the stakeholders in the provider ecosystem to capture the market opportunities that are being generated from the poor health outcomes, which are primarily a result of flaws in the US healthcare system. As a result, OSH has been able to deliver tremendous top-line performance over the years and has been able to rapidly grow into a scaled value-based healthcare provider for Medicare eligible population. The lack of operational profitability is a concern at the moment, but we remain confident that this young company will be able to drive better patient economics in future to eventually be operationally profitable. The stock’s current valuation looks rich, but the immense market opportunities and its positioning to capture those opportunities justifies it. In our view, if you have a long-term investment horizon, picking up a few shares now is worth considering. We do not currently own shares of OSH, but it is high on our watchlist.